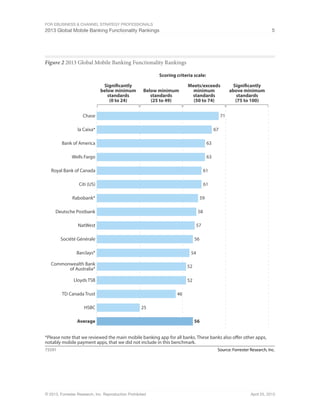

The document evaluates the mobile banking offerings of 15 large banks worldwide using Forrester Research's Mobile Banking Functionality Benchmark methodology. Chase ranked highest overall for its robust functionality, especially in transaction features. While every bank demonstrated strengths, opportunities for improvement exist across all banks. Banks need to better leverage mobile context and cross-sell products. The UK banks in particular still lag behind peers in other regions.