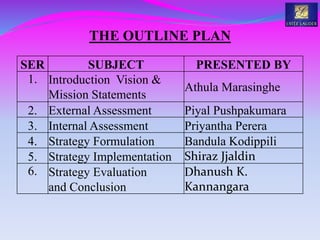

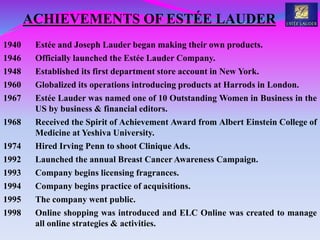

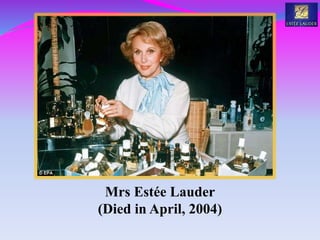

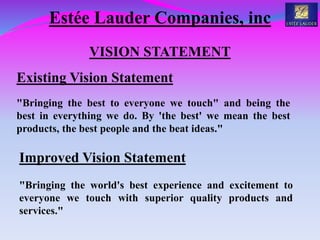

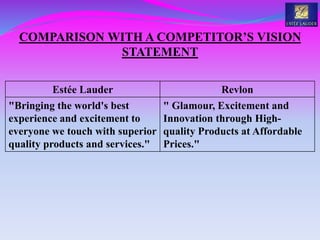

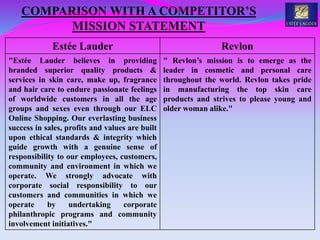

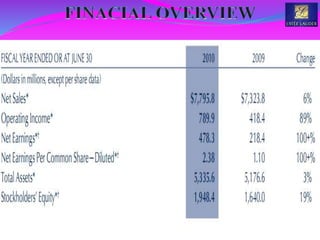

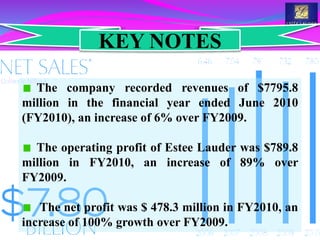

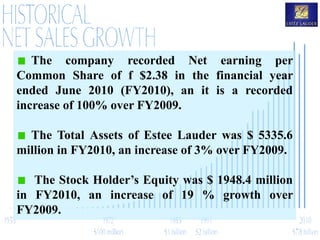

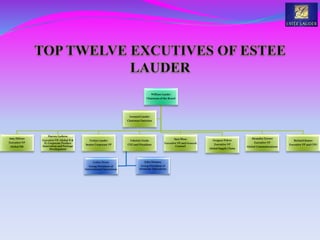

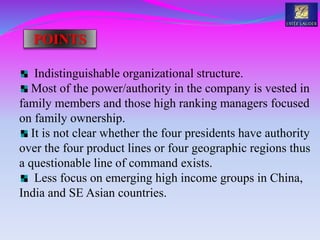

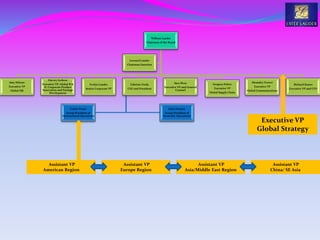

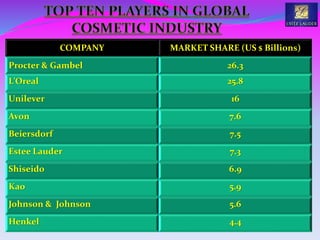

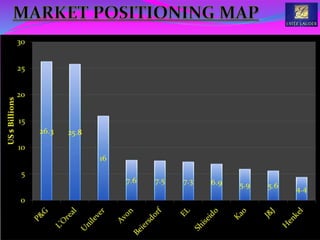

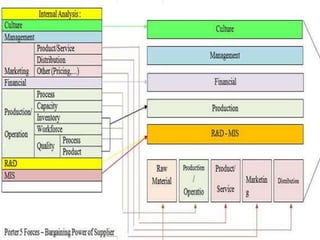

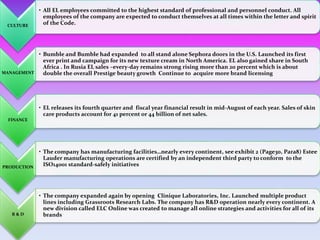

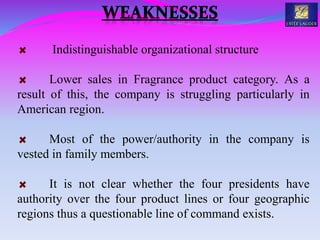

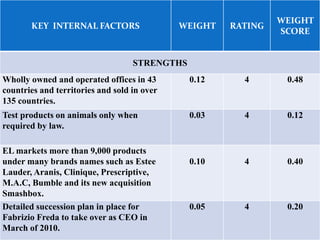

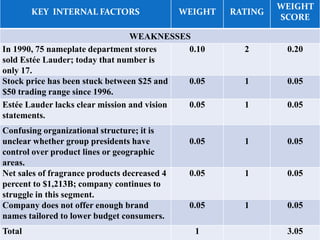

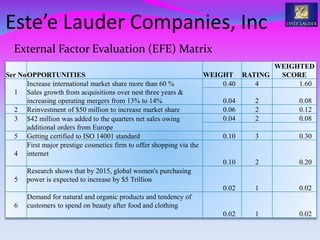

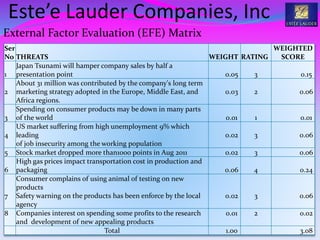

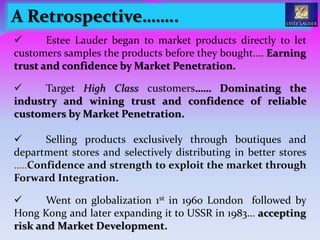

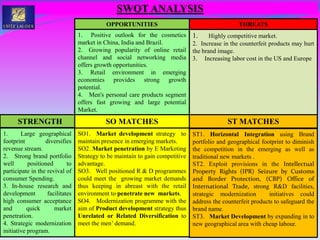

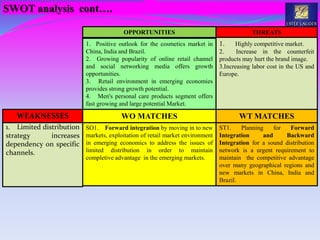

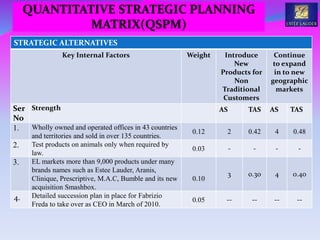

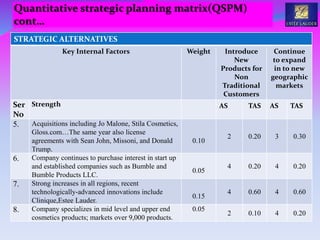

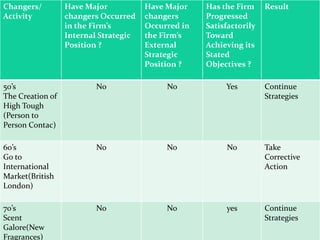

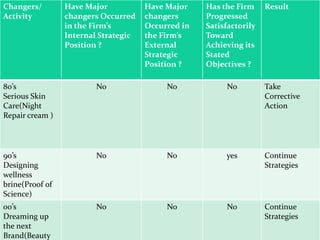

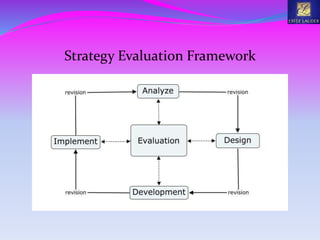

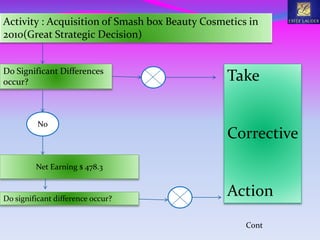

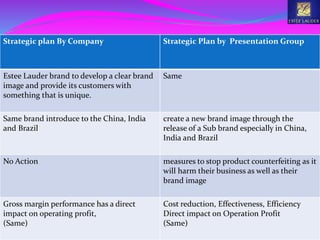

This document provides an outline for a strategic audit of Estée Lauder Companies, Inc. It begins with an introduction that lists the company's production divisions and key facts. It then lists the company's achievements and competitors. The document discusses the company's vision and mission statements and compares them to a competitor. It provides an internal assessment of the company's strengths, weaknesses, business model, and financial ratios. It analyzes the company's organizational structure and provides recommendations to improve it. The document aims to conduct a thorough strategic audit of Estée Lauder.