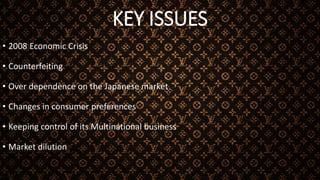

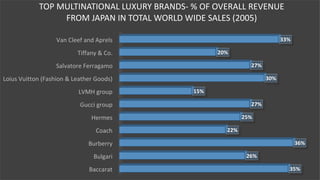

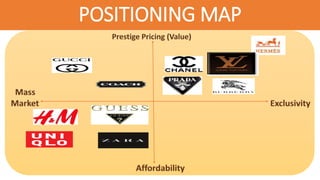

Louis Vuitton entered the Japanese market in 1977 and by 2007 controlled 54 stores in Japan, with 55% of revenue coming from Japanese consumers. However, declining sales since 2002 forced Louis Vuitton to adjust its strategy. A collaboration with Japanese artist Takashi Murakami in 2003 increased profits by 10%. While price reductions and market dilution strategies were implemented in Japan in 2009 due to the economic crisis, Louis Vuitton still faces threats of counterfeiting and competition in the saturated Japanese luxury market.