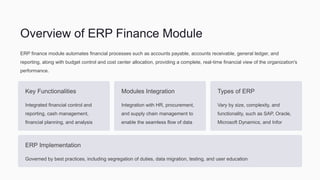

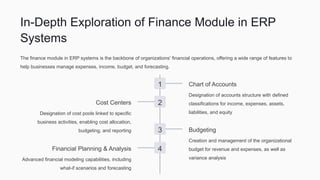

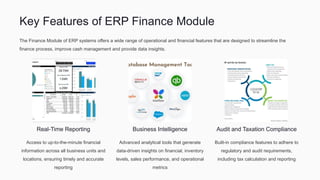

The document discusses the capabilities and functionalities of the finance module in ERP systems, which automates financial processes and enhances reporting and compliance. It highlights the benefits of implementing such a module for improved productivity, better decision-making, and cost control, while also noting the challenges related to integration and organizational change. Real-world examples of successful implementations illustrate the efficacy of ERP finance modules in enhancing financial management and operational efficiency.