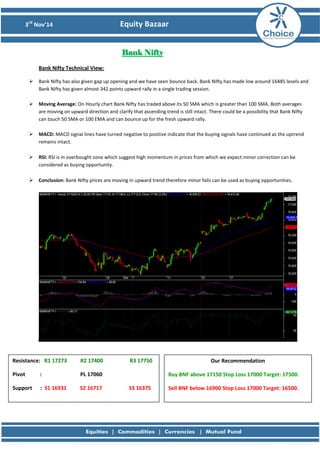

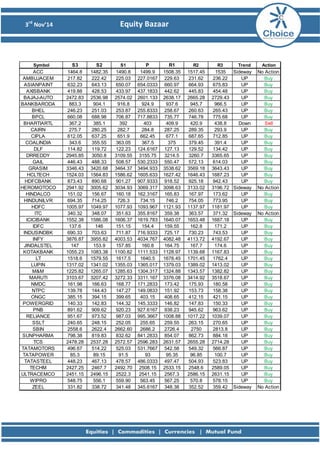

The document provides a technical analysis of the Nifty, Bank Nifty, and stock SRTEANSFIN from November 3rd, 2014. It notes that the indexes opened with gaps and gained throughout the day, with technical indicators like moving averages and MACD signaling continued uptrends. For Nifty, support is seen at 8225 and resistance at 8400. For Bank Nifty, support is at 16931 and resistance at 17273. SRTEANSFIN broke resistance and is recommended as a buy above 948 with a target of 980.