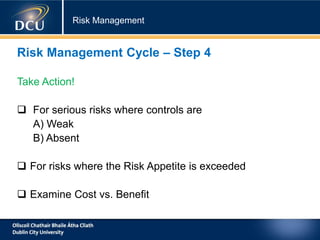

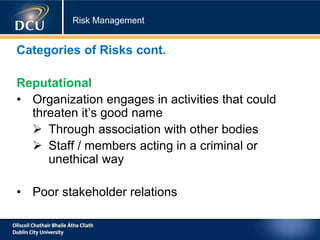

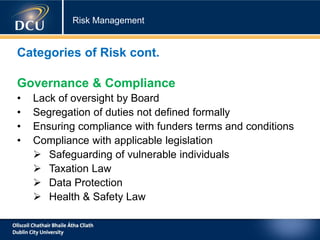

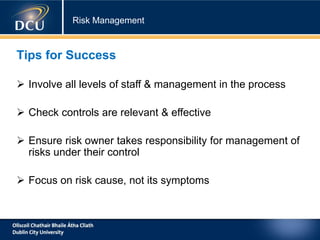

This document provides an introduction to risk management. It outlines the aims to explain why risk management is relevant and its components. It describes the risk management cycle as a 5 step process: 1) define objectives and strategy, 2) identify risks, 3) evaluate controls, 4) take action, and 5) monitor and report. It also discusses categorizing risks, creating a risk register to record risk details, and tips for effective risk management.