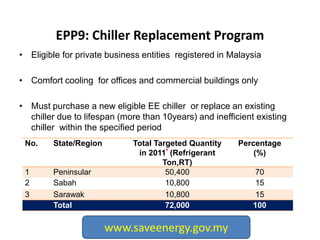

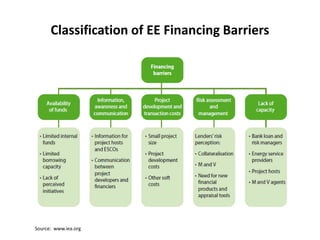

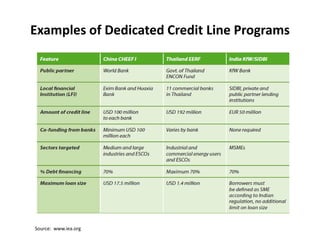

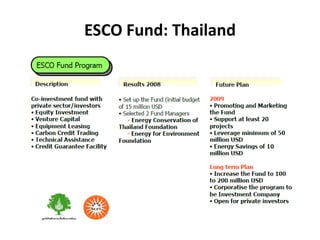

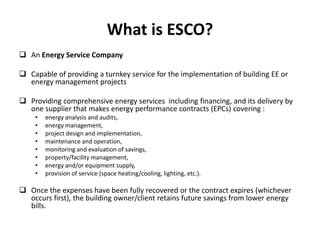

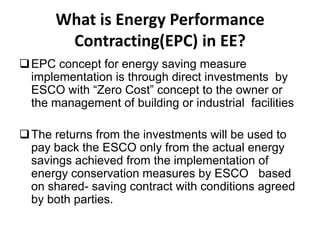

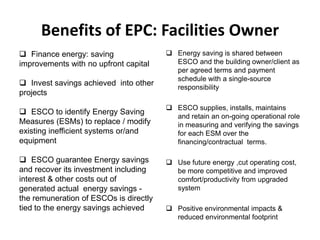

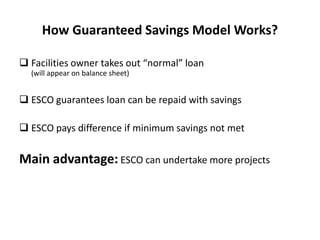

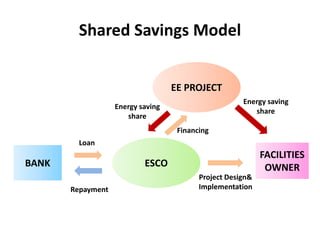

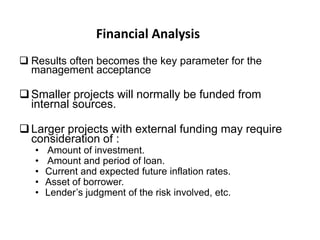

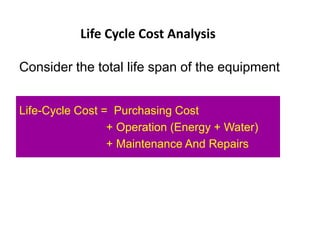

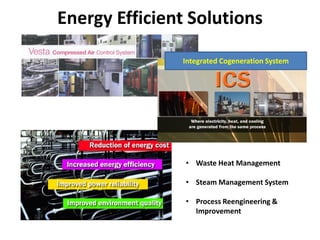

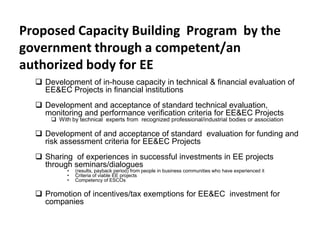

The document presents a technical talk on financing and evaluation criteria for energy efficiency projects in Malaysia, organized by Zaini Abdul Wahab, covering existing funds, financing options, and evaluation methods. It highlights the Green Technology Fund Scheme and various fiscal incentives introduced by the government to encourage energy efficiency initiatives across sectors. The talk also discusses barriers to financing and the role of Energy Service Companies (ESCOs) in implementing energy-saving measures through Energy Performance Contracting (EPC).