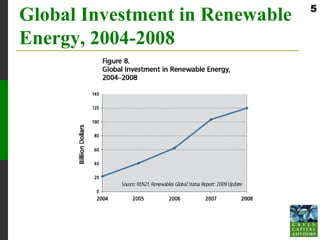

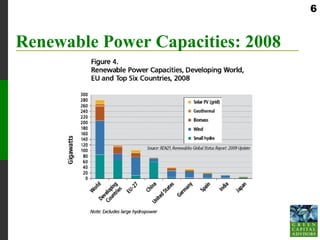

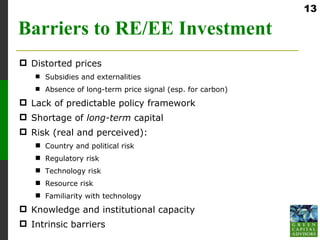

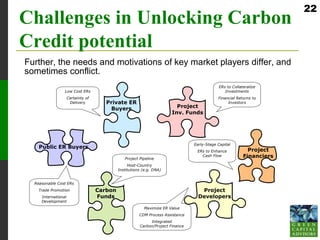

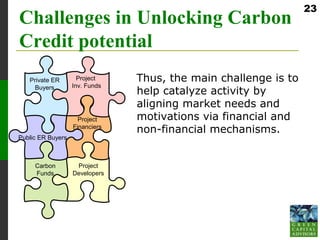

This document discusses innovative financing for green projects and a greener economy. It outlines opportunities in renewable energy but also challenges in financing green projects due to issues like risk, lack of long-term capital and policy uncertainty. It proposes best practice solutions like bundling small projects, using carbon credit revenues to derisk projects, and implementing green taxes. It discusses the role of development finance institutions and export credit agencies in mitigating risk and catalyzing projects. Finally, it introduces Green Capital Advisors, a firm that provides advisory services around sustainable financing policies, programs and projects.