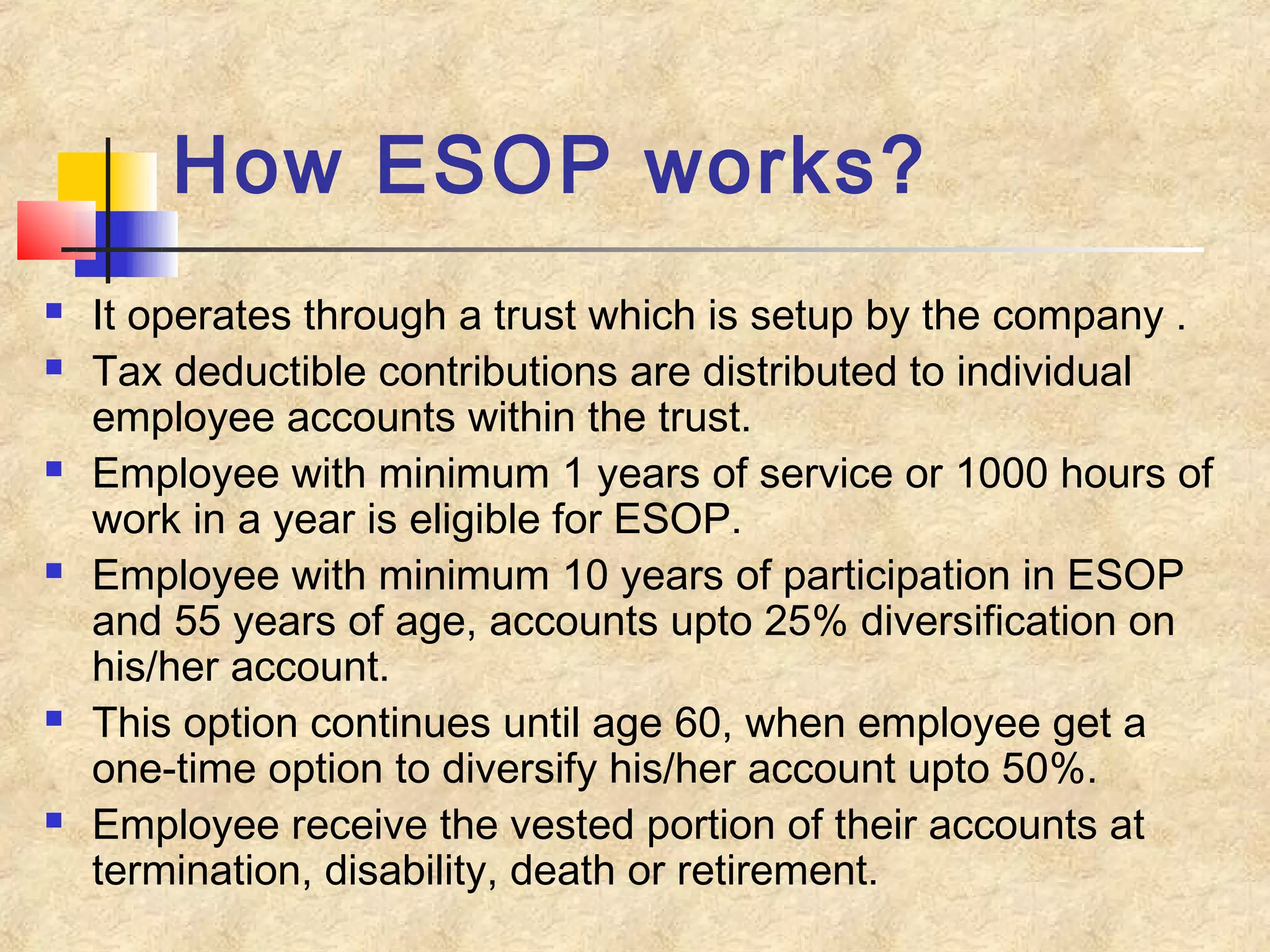

ESOP (Employee Stock Ownership Plan) allows employees to buy company stock at fair value, making them owners. Introduced in the 1950s, ESOP trusts established by companies distribute tax-deductible contributions to employee accounts. Employees must work 1 year or 1000 hours to be eligible. After 10 years and age 55, employees can diversify up to 25% of their account. While building employee ownership and retention, ESOPs also face challenges like share dilution and decreased attractiveness if stock value declines. Overall, ESOPs are seen as beneficial for rewarding, retaining, and attracting talent through ownership.