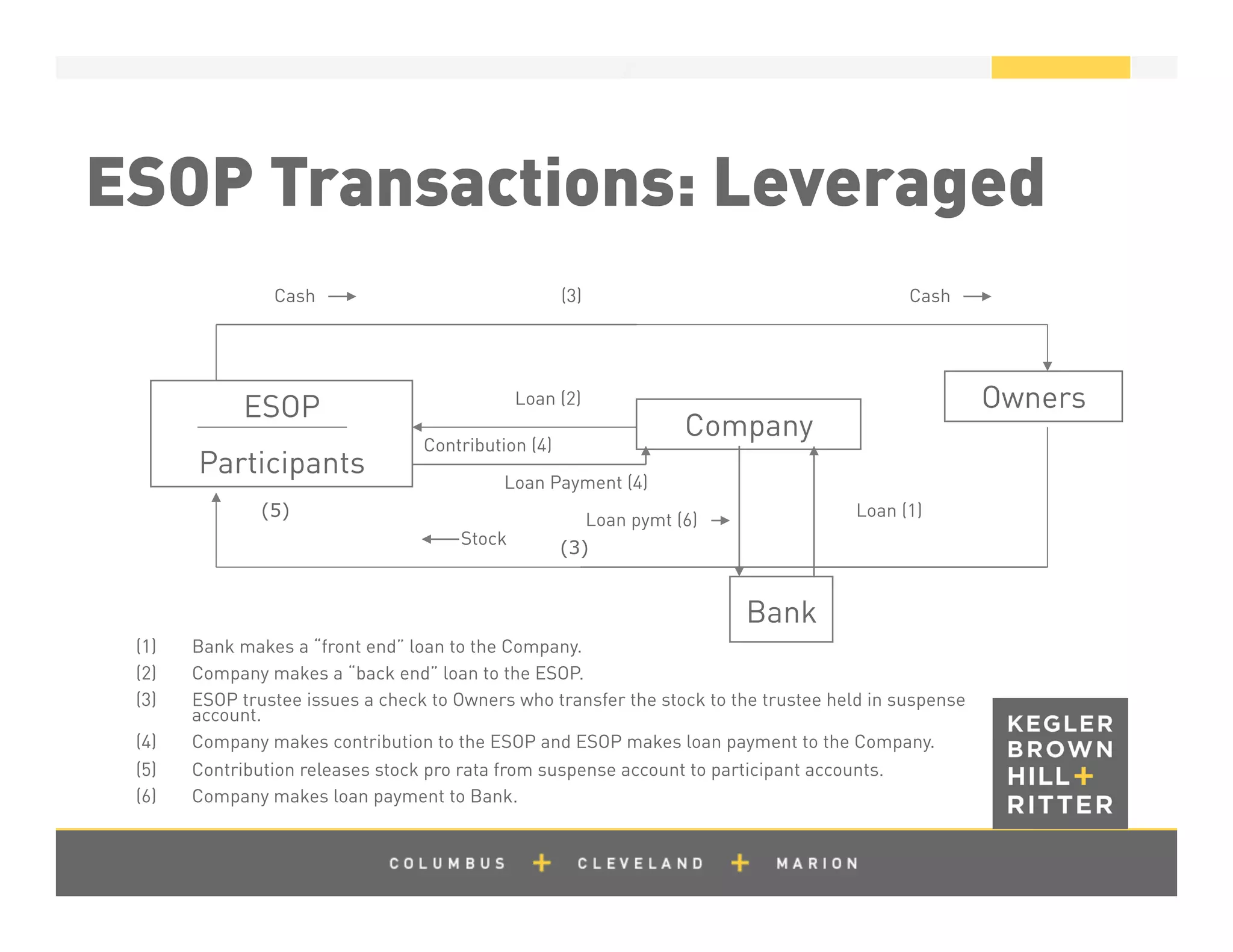

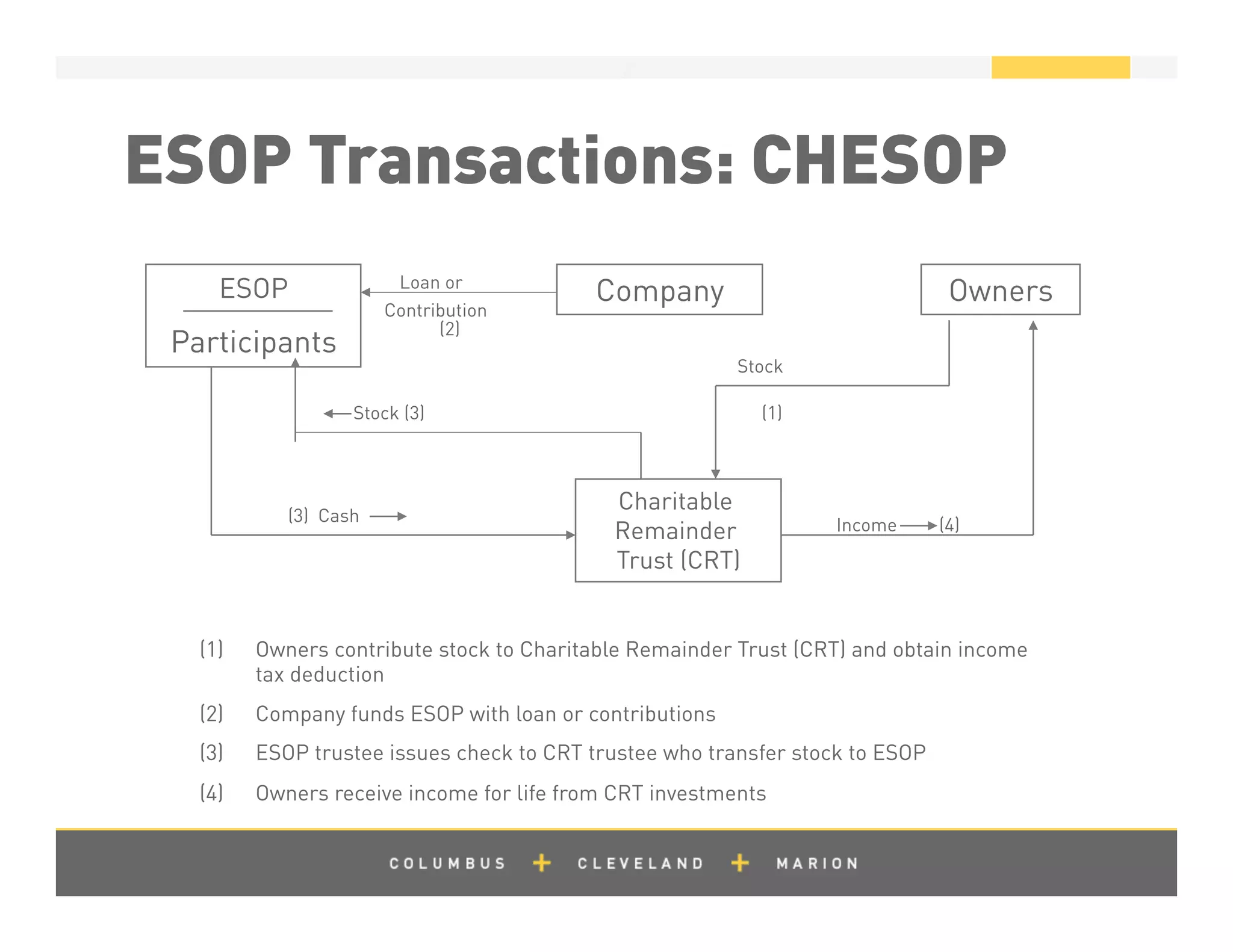

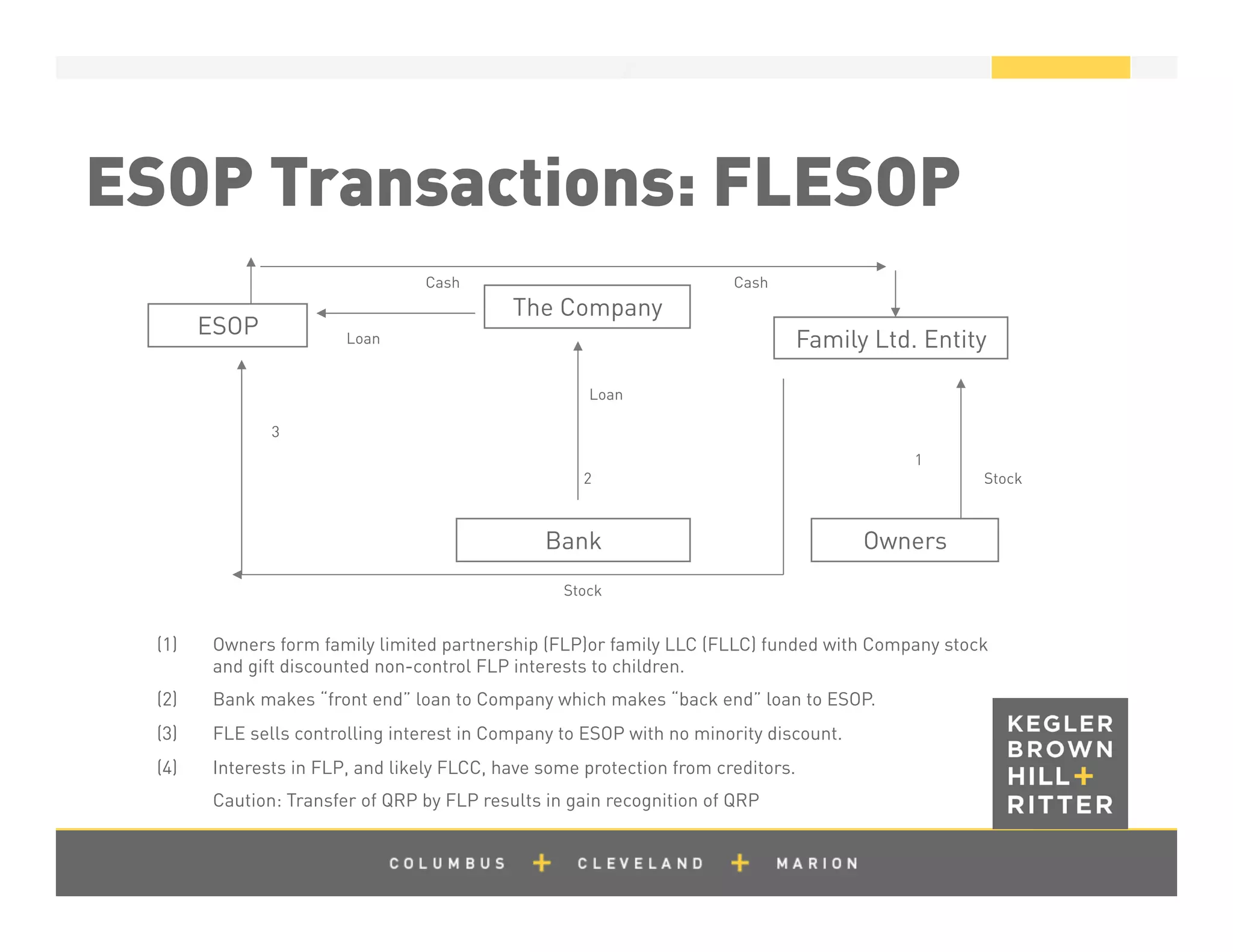

The document discusses the Employee Stock Ownership Plan (ESOP) business model, covering its purpose, regulatory environment, associated tax benefits, and the structure of ESOP transactions including leveraged and non-leveraged financing. It highlights the advantages of ESOPs for companies and employees, such as improved performance and tax exemptions, while also addressing potential problem areas including valuation issues and fiduciary conflicts. Additionally, it outlines business valuation standards and accounting rules applicable to ESOPs.