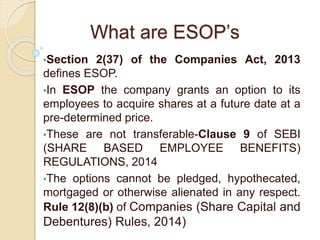

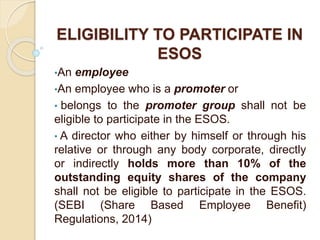

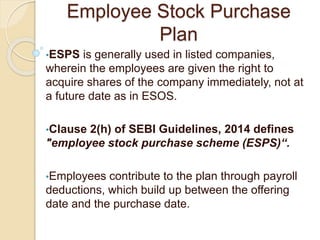

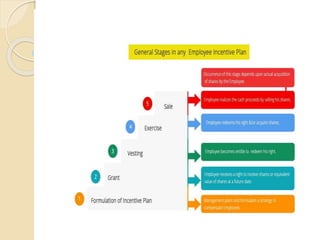

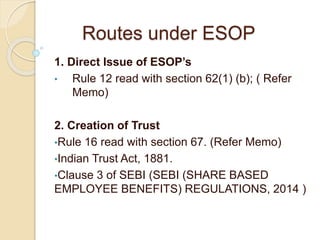

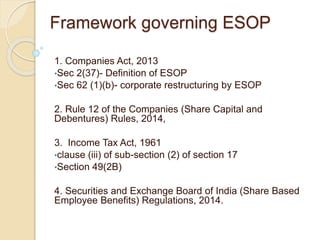

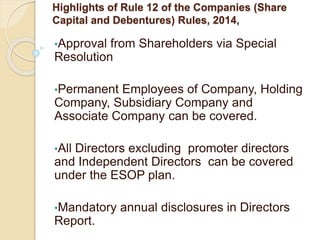

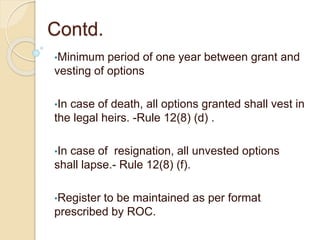

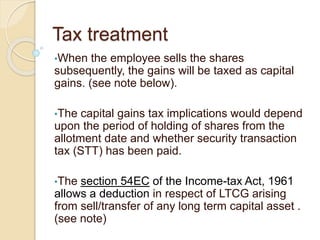

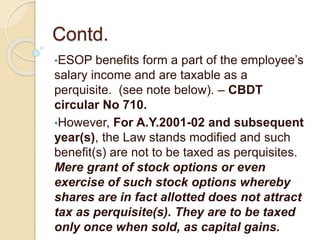

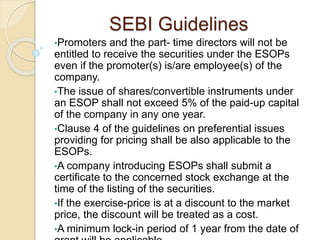

The document discusses Employee Stock Option Plans (ESOPs) and Employee Stock Purchase Plans (ESPs), outlining their definitions, eligibility criteria, and regulatory frameworks under Indian law. ESOPs grant employees options to acquire shares at a predetermined price, while ESPs allow immediate share acquisition through payroll deductions. It also addresses tax implications and SEBI guidelines regarding the issuance of shares under ESOPs.