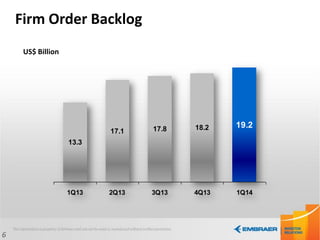

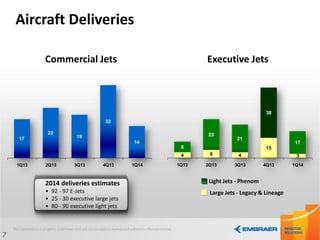

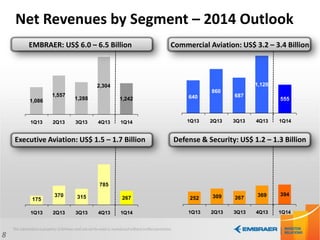

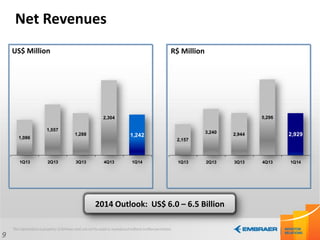

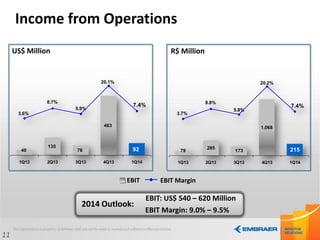

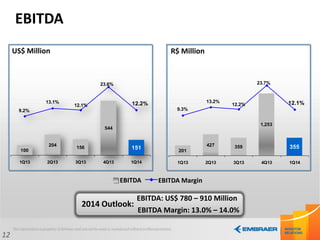

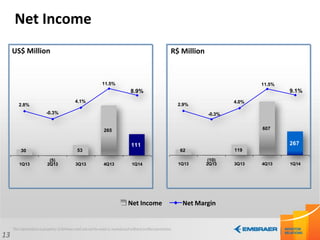

Embraer reported its first quarter 2014 earnings results, with net revenues of $2.3 billion and net income of $267 million. The company delivered 14 commercial jets, 20 executive jets, and saw continued growth in its order backlog which reached $19.2 billion. Embraer expects full year 2014 net revenues between $6.0-6.5 billion and net income margin of around 9%.