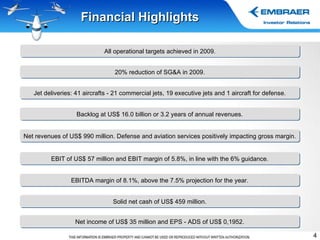

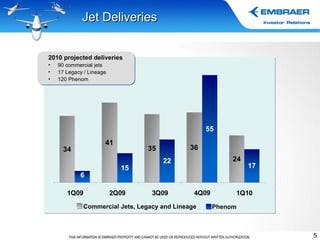

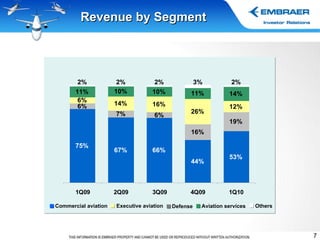

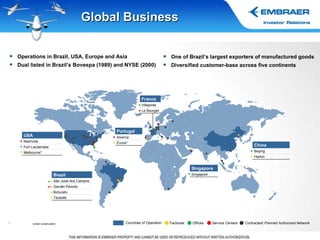

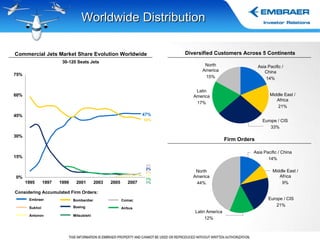

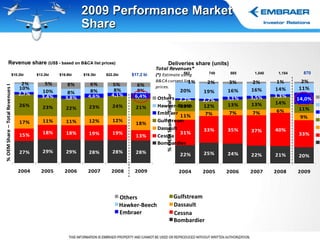

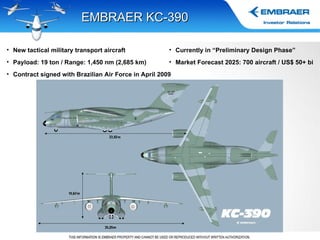

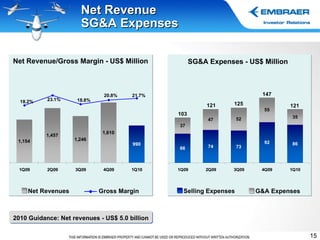

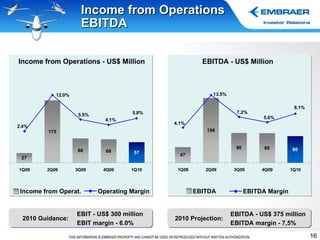

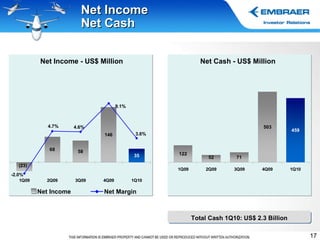

The document provides an overview of Embraer's business highlights and financial results. It discusses forward-looking projections including expected jet deliveries and revenue growth in 2010. It also summarizes Embraer's product portfolio, global operations, and market leadership in commercial and executive aviation.