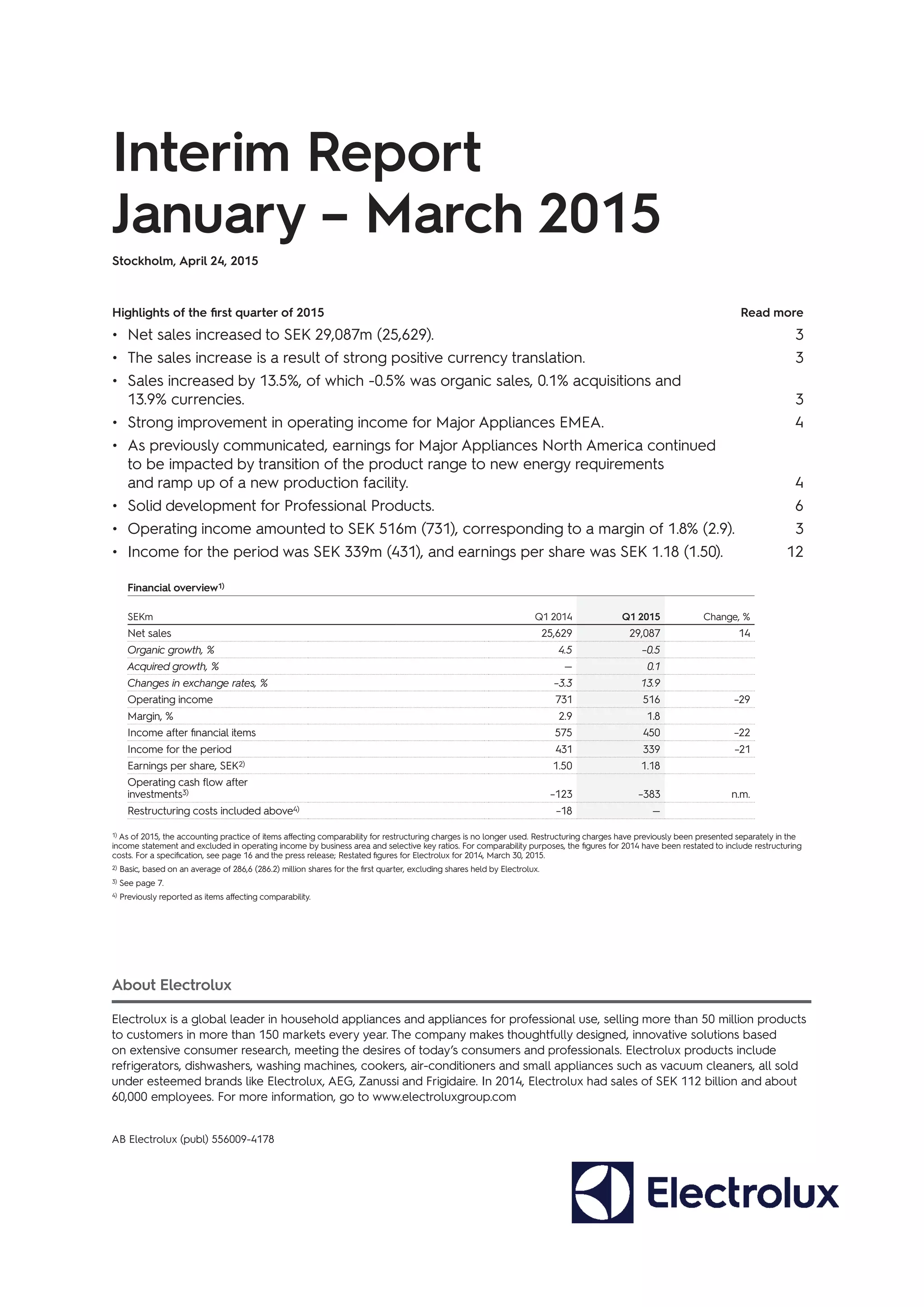

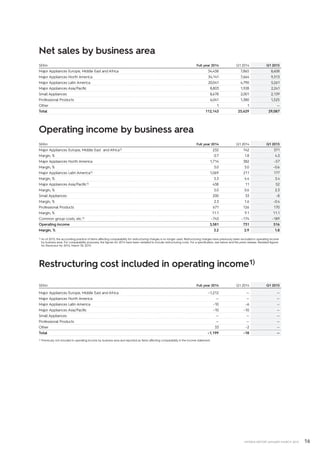

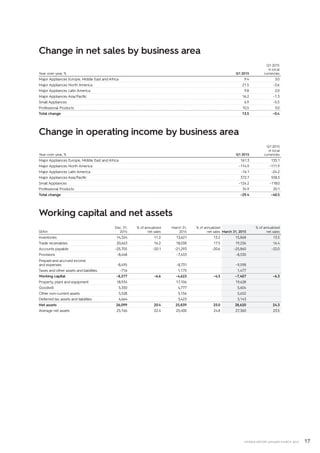

In the first quarter of 2015, Electrolux reported a 13.5% increase in net sales to SEK 29,087 million, largely attributed to positive currency effects, although organic sales fell by 0.5%. Operating income dropped to SEK 516 million with a margin of 1.8%, impacted by restructuring costs and a slow ramp-up of a new production facility in North America. The company experienced mixed market performances, with significant growth in EMEA but challenges in North America and Latin America due to market conditions and transition costs.