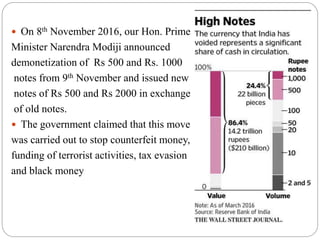

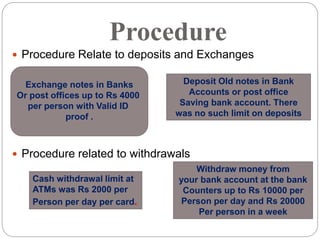

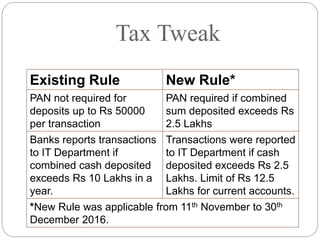

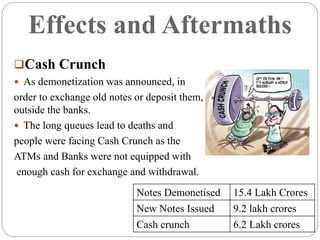

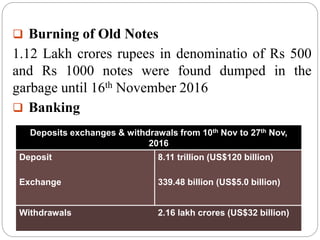

The document discusses India's demonetization of 500 and 1000 rupee banknotes in November 2016. It provides background on the meaning of demonetization, India's history with it in 1946 and 1978. It then outlines the key aspects of the 2016 policy including exchanging old notes for new ones, deposit procedures, tax implications for deposited cash, initial reactions from support and criticism, effects like cash shortages and increased e-payments, and evasion attempts through gold, salaries, and donations. In conclusion, it argues the long-term benefits of reducing corruption and black money outweigh short-term costs, and the government must ensure a smooth transition to the new currency.