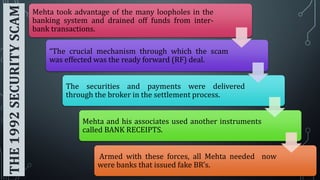

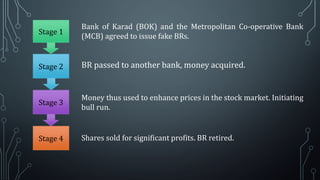

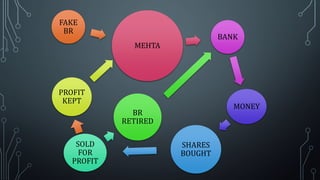

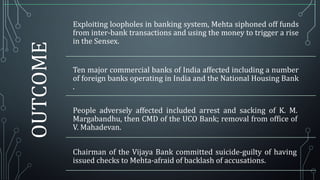

Harshad Mehta exploited loopholes in the banking system in 1992 to siphon off funds from inter-bank transactions and use the money to trigger a rise in stock prices. He did this through fake bank receipts issued by complicit banks that allowed him to acquire money, which he used to purchase shares and drive up prices. When the scheme was exposed by a journalist, banks demanded repayment, causing banks and individuals to lose money. Mehta was later charged with multiple criminal offenses and civil suits, and although he raised further controversy by claiming to bribe politicians, he ultimately died in prison in 2001 while serving time for financial crimes.