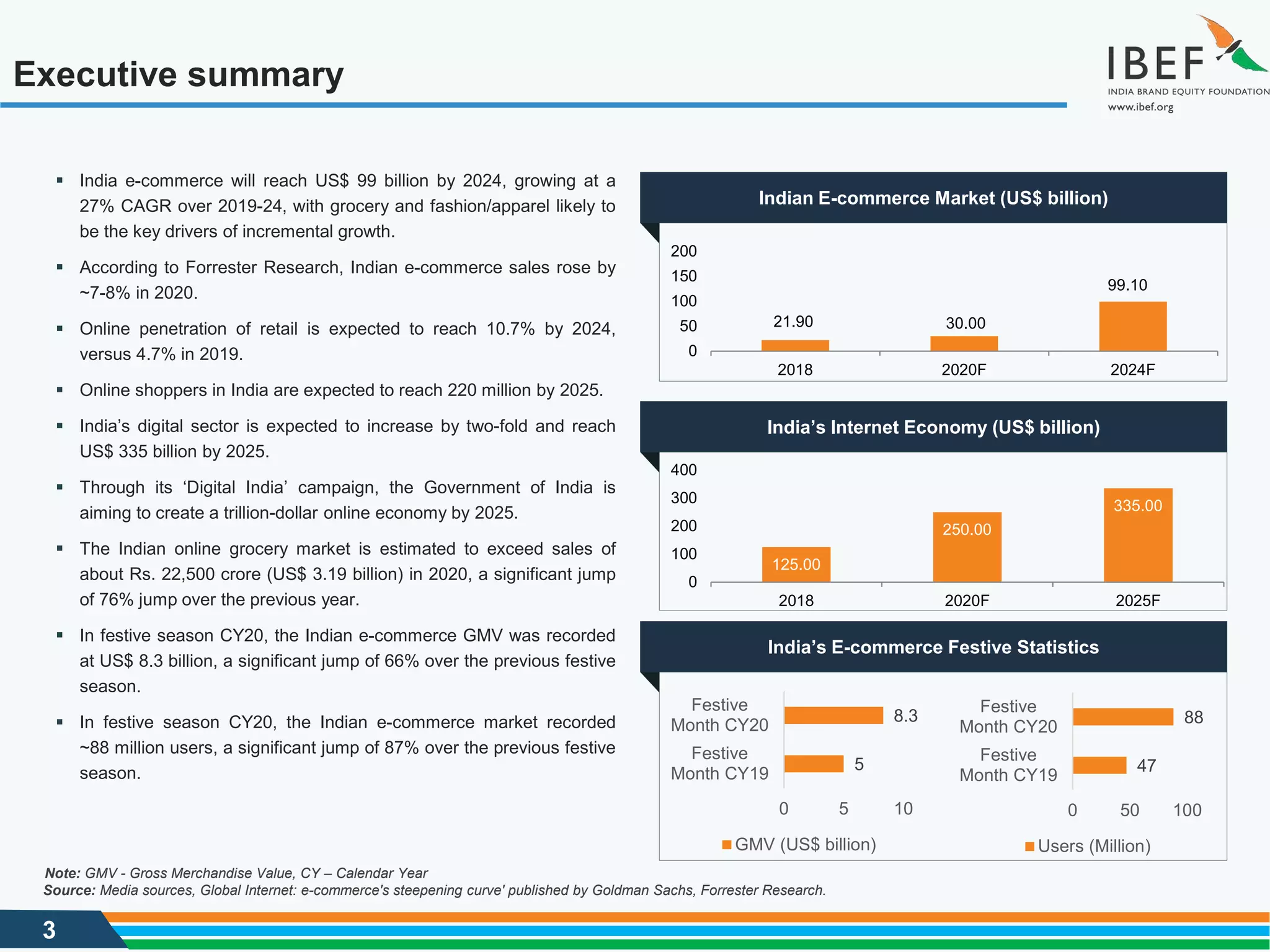

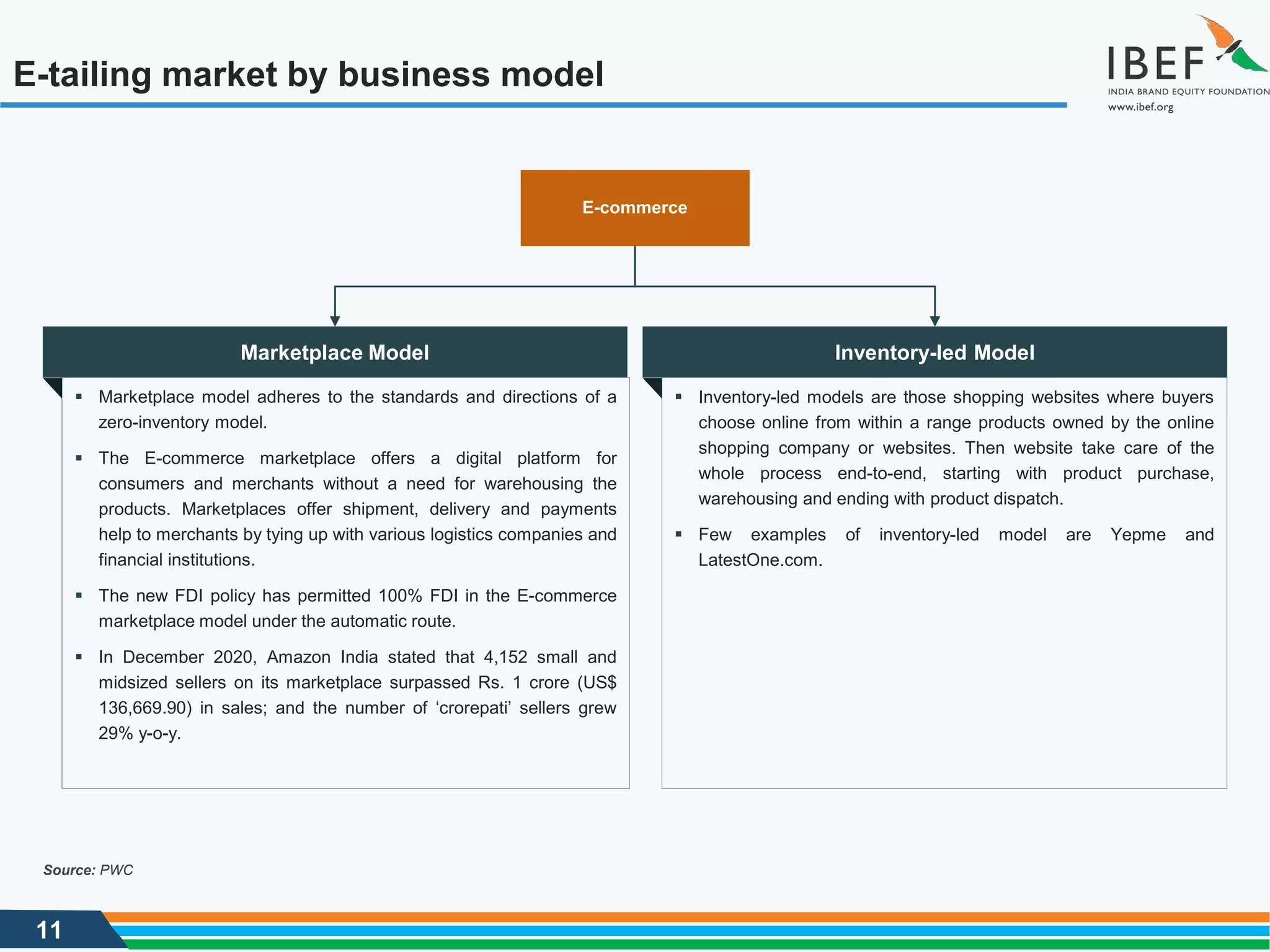

The document summarizes recent trends in India's e-commerce sector. Key trends include major players expanding ancillary services like training programs and product categories. E-commerce giants are also expanding into new areas through acquisitions and partnerships. The government is supporting industry growth through new e-commerce initiatives promoting sectors like artisans and local manufacturing. Overall the document outlines how major policy moves and strategies by industry players are fueling growth in India's booming e-commerce market.