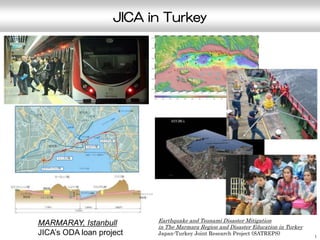

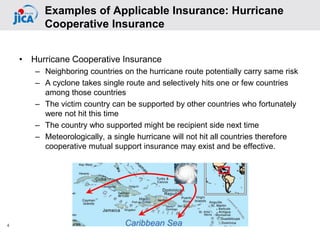

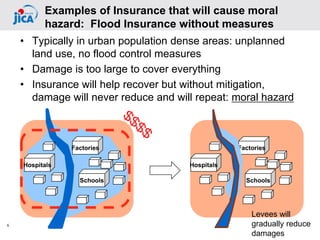

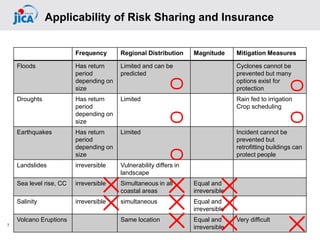

The document discusses Japan's experience in disaster risk reduction and the role of insurance in mitigating risks, emphasizing the necessity of tailored structural and non-structural measures. It illustrates various insurance models, such as cooperative insurance during hurricanes, and highlights the importance of investments in disaster risk reduction for long-term damage prevention and recovery efficiency. Key lessons include shifting focus from post-disaster responses to proactive prevention and the necessity of government support for sustainable risk management.