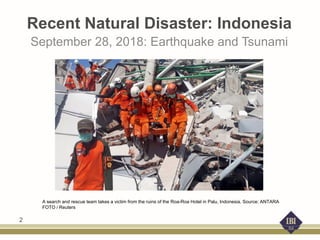

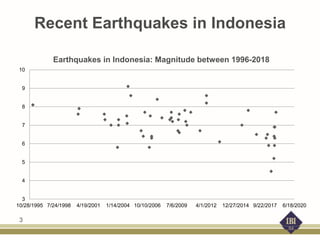

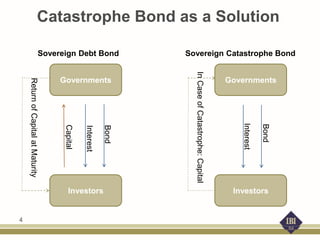

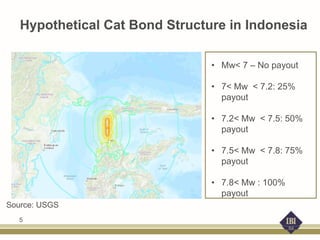

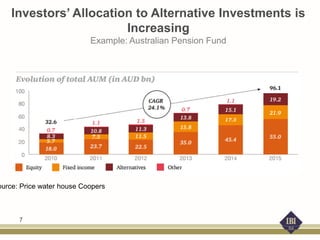

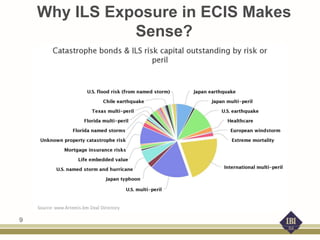

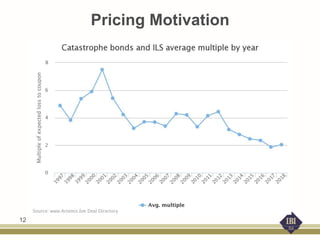

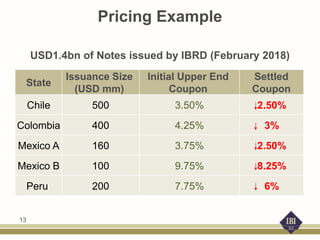

This document discusses catastrophe bonds as a "win-win" solution for governments and investors. Catastrophe bonds allow governments to access capital rapidly after natural disasters to fund relief and reconstruction. The bond principal is returned unless a triggering event, such as an earthquake above a specific magnitude, occurs. This transfers some disaster risk from governments to investors. The document outlines the advantages for both parties and provides examples of catastrophe bond structures and pricing. It promotes catastrophe bonds as an attractive asset class for investors seeking diversification and argues they are an effective risk mitigation tool for governments facing climate change risks.