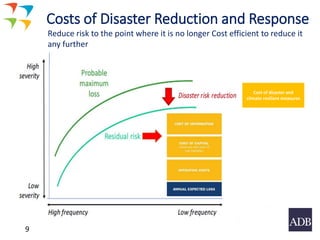

The document summarizes gaps in disaster risk reduction (DRR) financing and efforts to address them. Key points include:

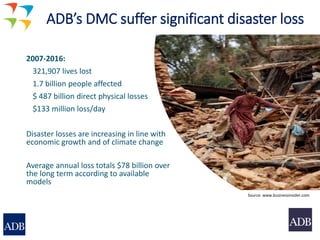

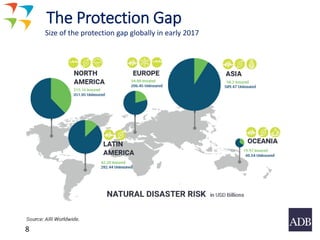

- 321,907 lives lost and $487 billion in direct losses from 2007-2016 due to disasters, with costs increasing from climate change.

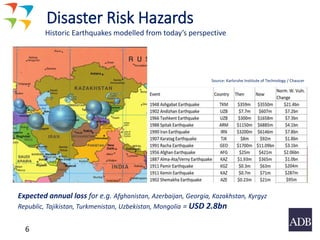

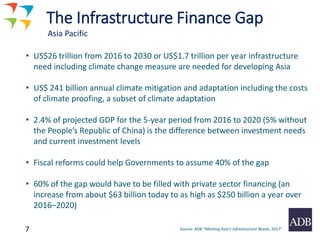

- Developing Asian countries face an annual average loss of $78 billion and infrastructure financing gap of $1.7 trillion per year.

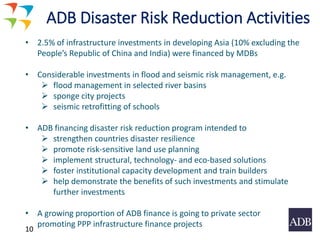

- The Asian Development Bank finances DRR programs and investments in areas like flood management and seismic retrofitting, but these make up only 2.5% of infrastructure spending excluding large countries.

- Efforts are needed to strengthen DRR strategies, assessments, knowledge, insurance programs, and leverage more public and private funding