This document provides a market summary and outlook for the global shipping industry in mid-2015. It discusses trends in key shipping segments including containerships, tankers, bulk carriers and offshore vessels. For containerships, demand is expected to remain high for large vessels above 12,000 TEU due to cost savings. Newbuilding contracting is forecast to reach 1.9 million TEU in 2015 with a focus on vessels over 16,000 TEU. Overall containership fleet growth is projected to be around 7% in 2015 and 5.5% in 2016.

![DNV GL © 2013

15

11

15

1717

0%

5%

10%

15%

20%

VLCC Suezmax Aframax Panamax Handysize

300

100

200

0

700

600

500

400

20202019201820162015 201720142013201220112010

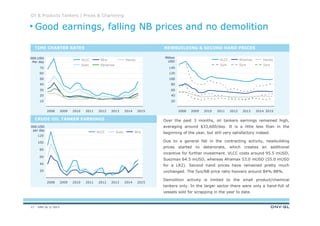

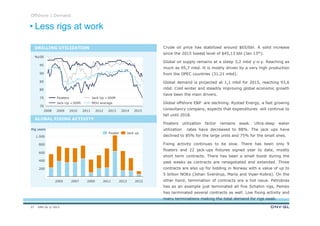

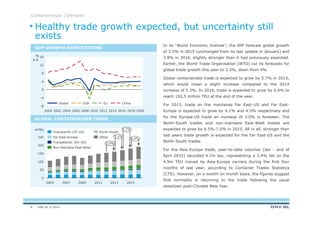

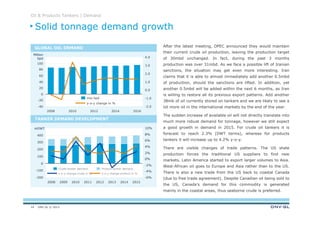

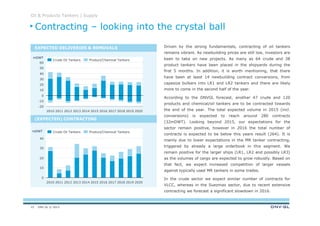

If we look at the demand/supply ratio, it seems like most of the

oil tanker segments are well balanced. On the crude side, the

demand for tonnage is a notch ahead of the expected fleet

growth, providing an extra boost for freight rates. When we look

beyond the current year, we must not underappreciate coming

deliveries, which in 2016 will be much higher than in 2014 and

2015. This will certainly bring a cooling effect to the earnings.

On the product side, the balance is slightly worse although yet

not alarming. The fleet is going to grow 1% faster than demand

for tonnage. As already mentioned before, we are particularly

worried about 245 vessels strong MR orderbook. Many of those

ships were contracted on a speculative basis and thus may

struggle to find employment once being delivered. In addition,

on the longer hauls, LR1 tankers will gradually try to squeeze

their smaller brothers out of business, by providing better

economies of scale.

The oil tanker orderbook contains 841 ships corresponding to

75.6 mDWT. It represents 8% and 14% of the existing fleet

respectively. The current fleet consists of 11,026 ships, which

have an accumulated tonnage of 526.9 mDWT.

In 2015, the crude fleet is expected to grow by 1.1% (vs.

demand of 2.3%) whereas the products tanker fleet will grow by

5.6% (vs demand of 4.2%).

mDWT

Oil & Products Tankers | Supply

FLEET DEVELOPMENT

Order book versus fleet [in %]

Product/Chemical TankersCrude Oil Tankers

Fleet in balance

16](https://image.slidesharecdn.com/dnvgltrendreportjune2015-150827073323-lva1-app6891/85/DNV-GL-Trend-Report-June-2015-16-320.jpg)