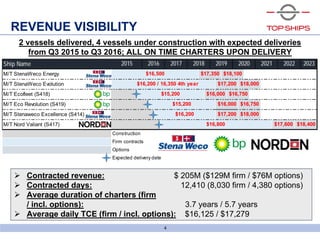

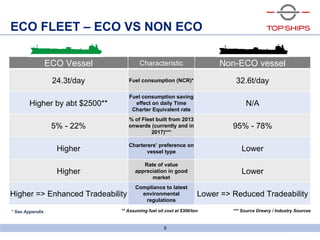

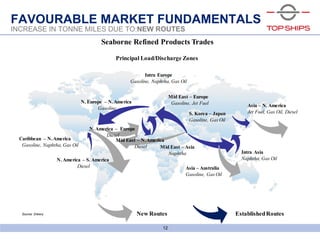

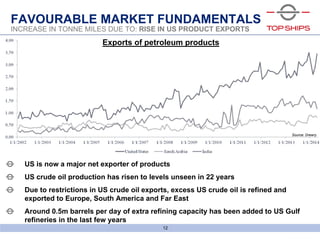

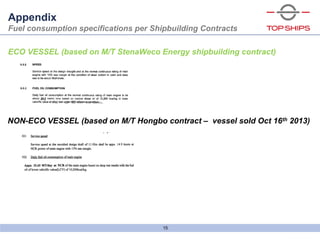

This presentation provides an overview of Top Ships Inc., including its history and fleet, revenue visibility through existing contracts, growth strategy, management team, and favorable market fundamentals in the petroleum shipping industry. The company has acquired 6 newbuild, eco-designed product tankers with long-term charters in place. It sees opportunities to grow its fleet through additional newbuild orders or secondhand vessel acquisitions.