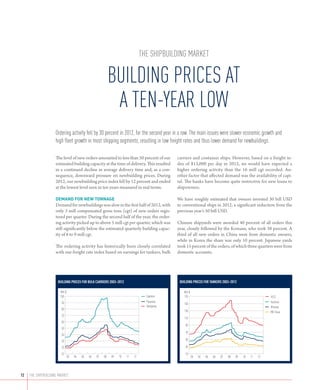

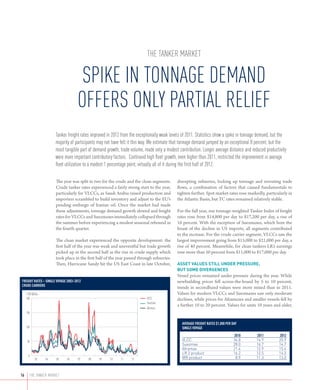

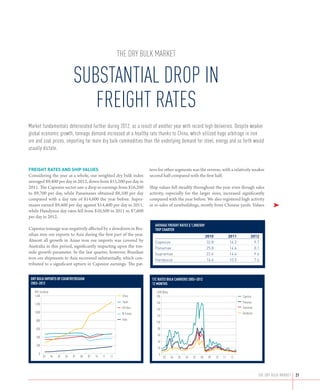

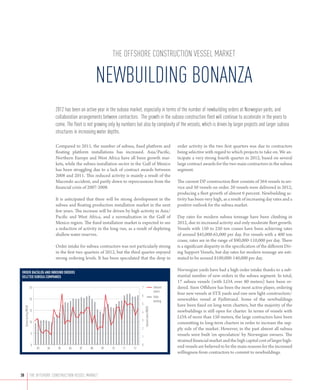

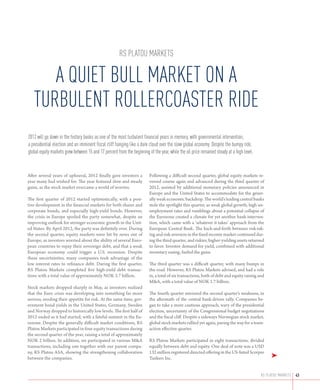

The document provides an overview of the global shipping and offshore markets in 2013. It discusses trends in various shipping segments including tankers, dry bulk carriers, container ships, car carriers, and LNG carriers. The offshore section covers mobile offshore drilling units, offshore support vessels, and offshore construction vessels. Key points include another year of high fleet growth outpacing tonnage demand growth, declining freight rates and asset values across most shipping segments, and signs of recovery in the LNG and offshore markets. Overall, the markets remained challenging in 2013 but showed potential for recovery in 2014-2015 as the global economy improves and fleet growth moderates.