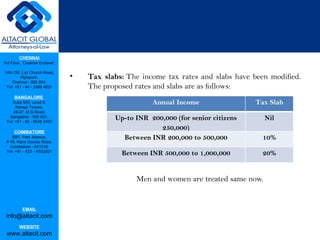

The document summarizes key aspects of India's proposed Direct Tax Code (DTC) which intends to replace the country's 50-year old Income Tax Act. Some key changes proposed in the DTC include removing most tax saving schemes, introducing a new EET system for taxing retirement savings instead of the current EEE system, modifying income tax slabs, and reducing the corporate tax rate from 34% to 30%. The DTC has faced criticism for potentially resulting in increased tax liability and litigation as well as not introducing significant simplifications to the tax system.