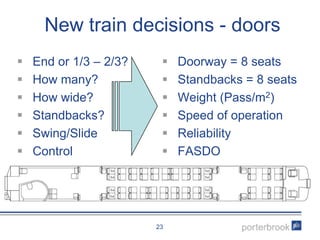

The document discusses the design and specifications of a new train by Porterbrook, emphasizing the importance of reliability, comfort, energy efficiency, and adaptability for various services. It outlines the challenges and considerations in the UK rolling stock market, including compliance with regulations and market demands. The design process involves balancing various factors such as speed, capacity, maintenance options, and financial implications for operators.