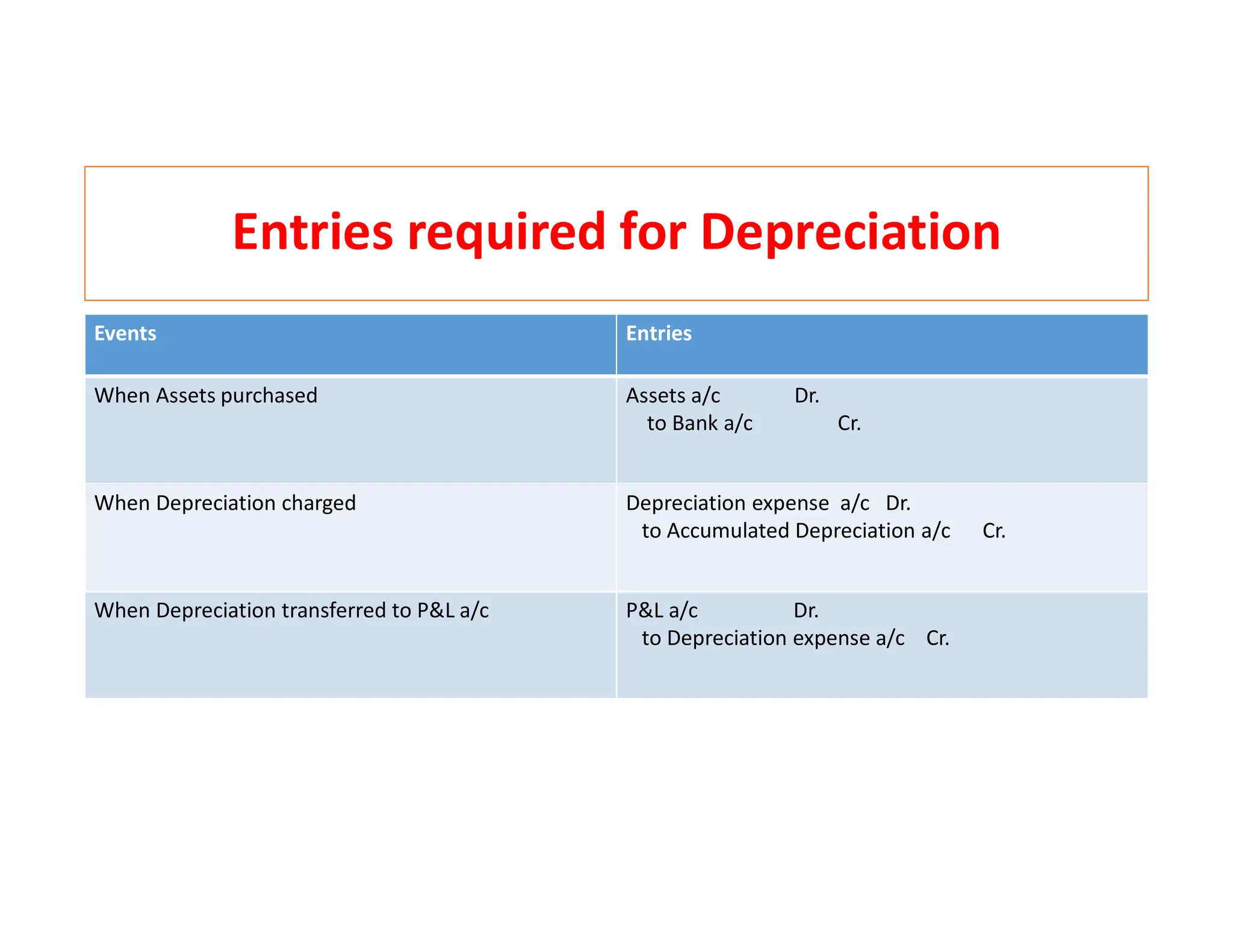

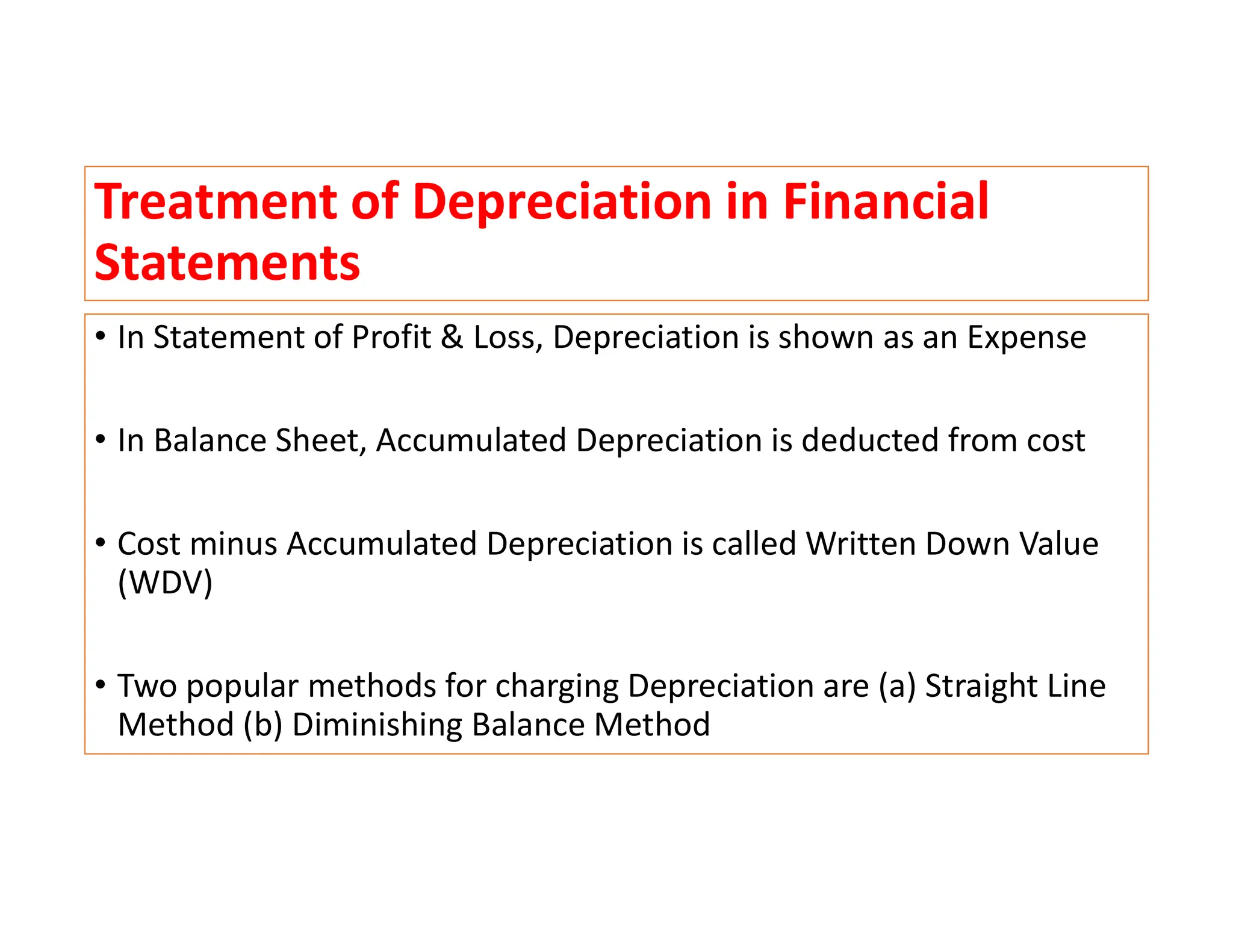

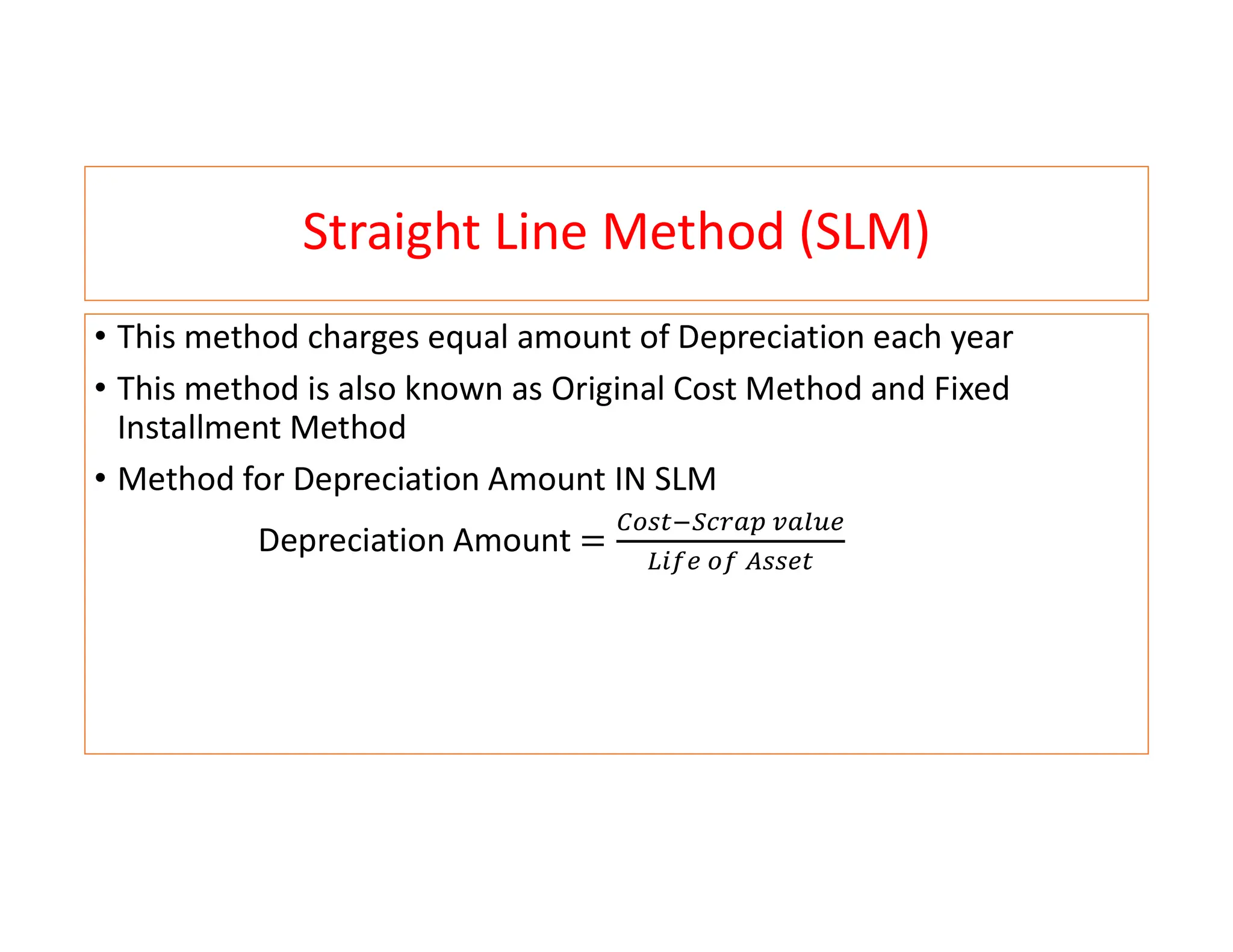

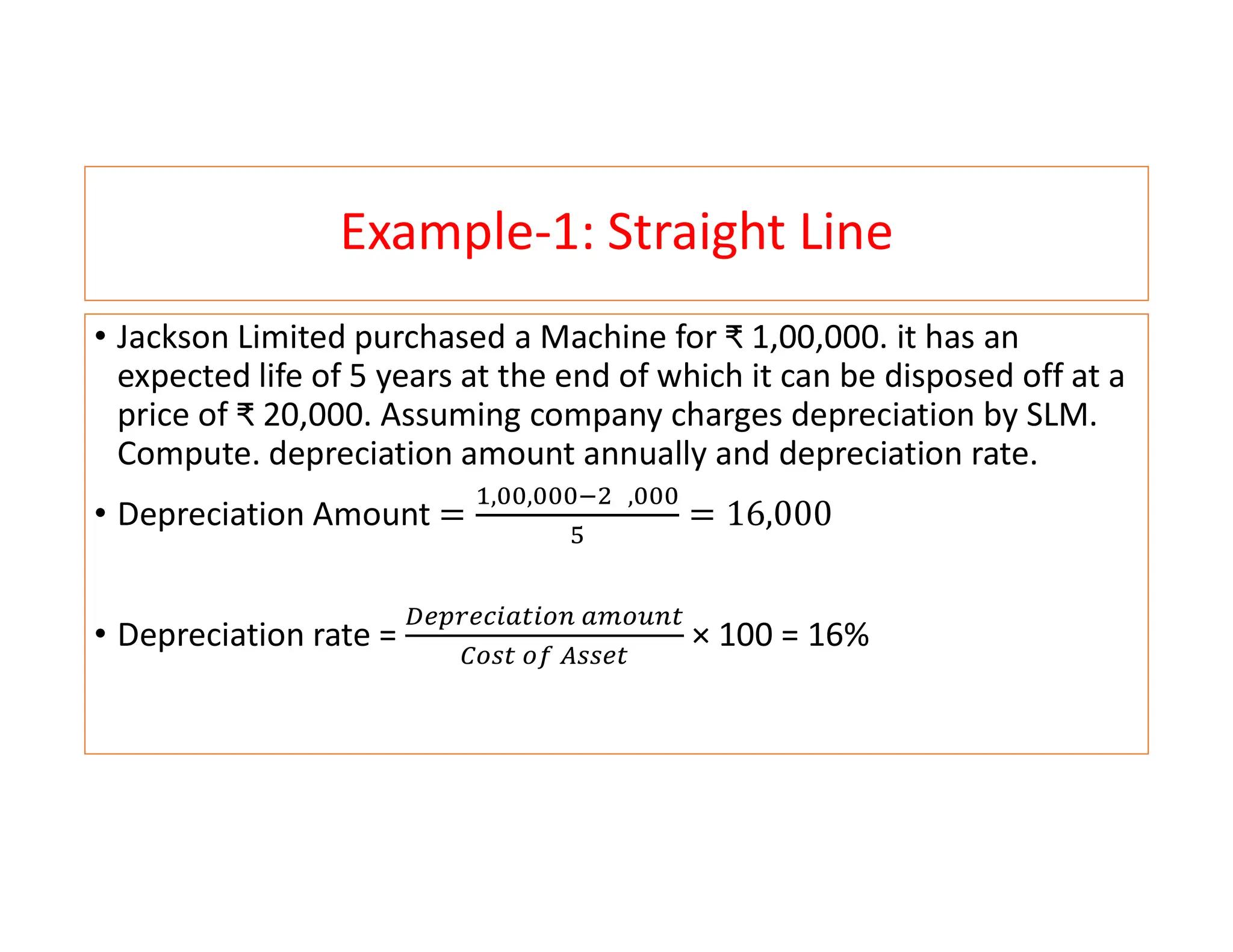

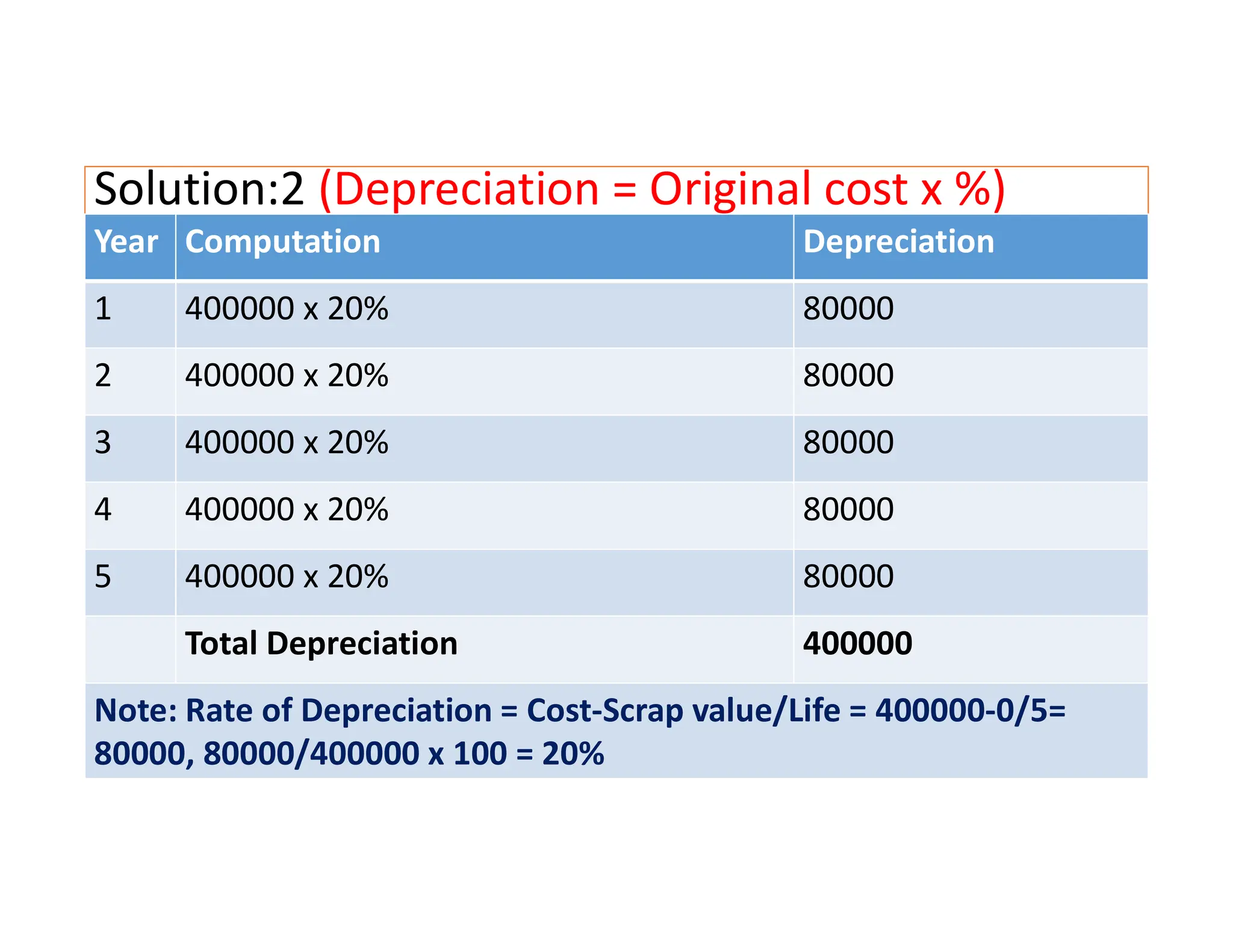

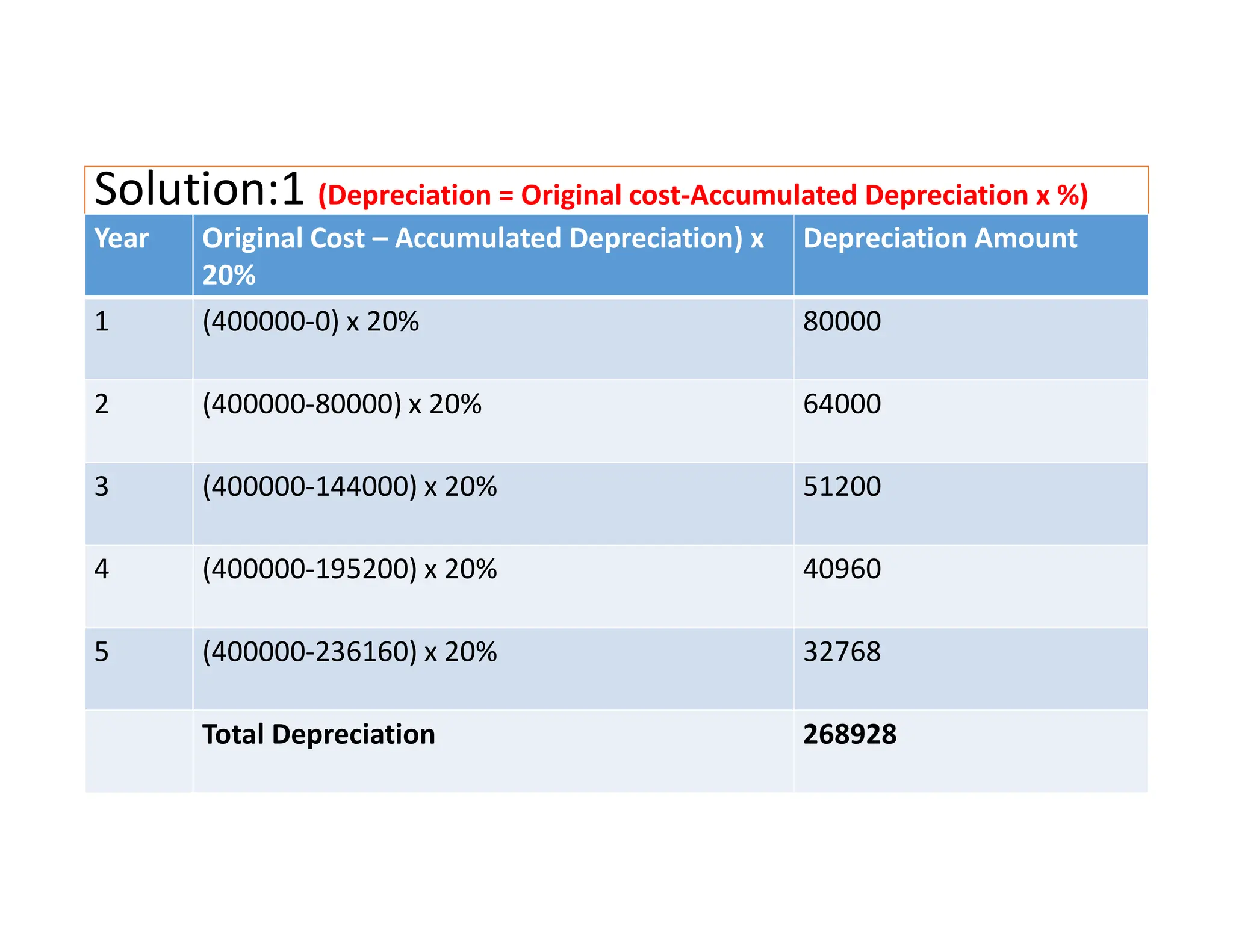

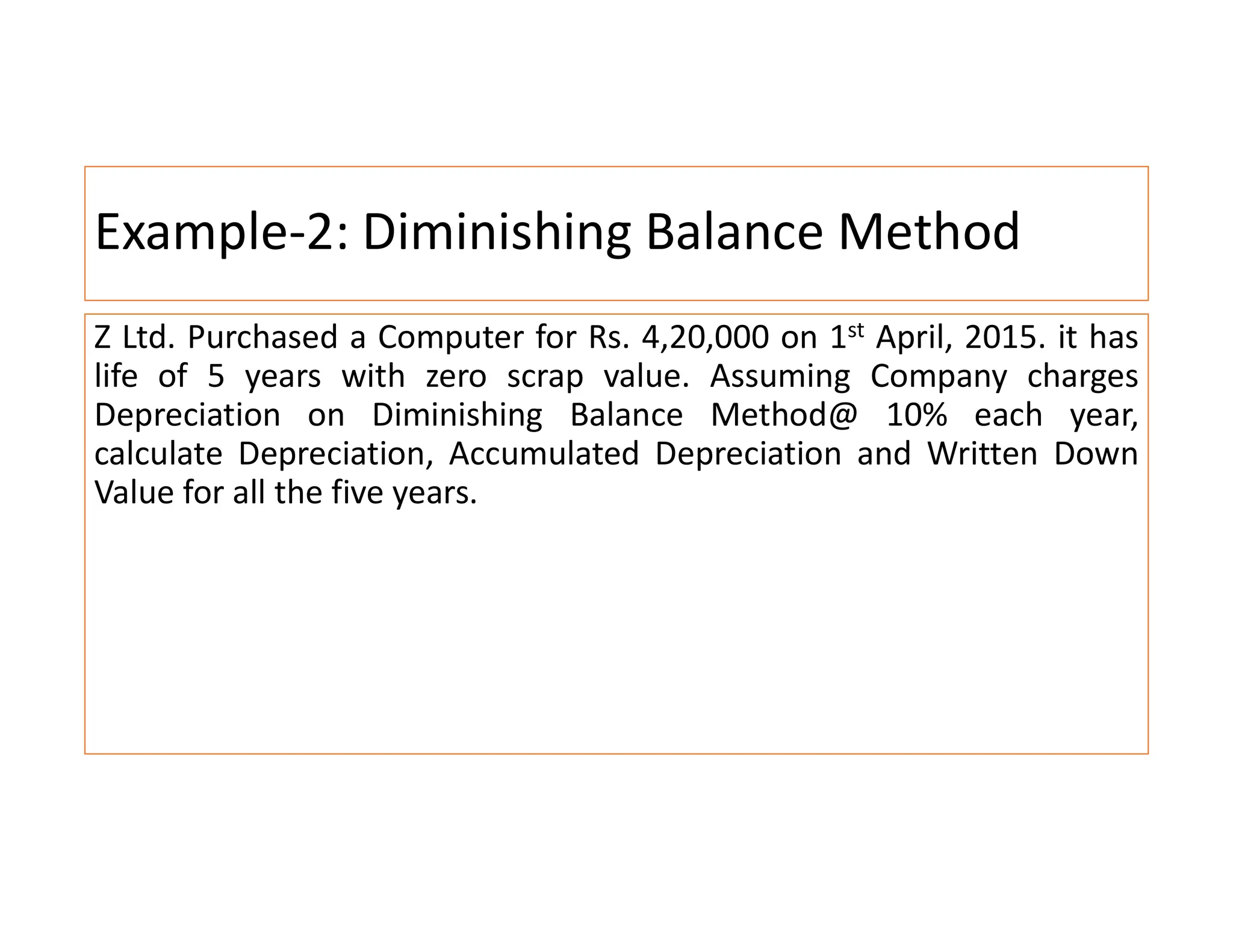

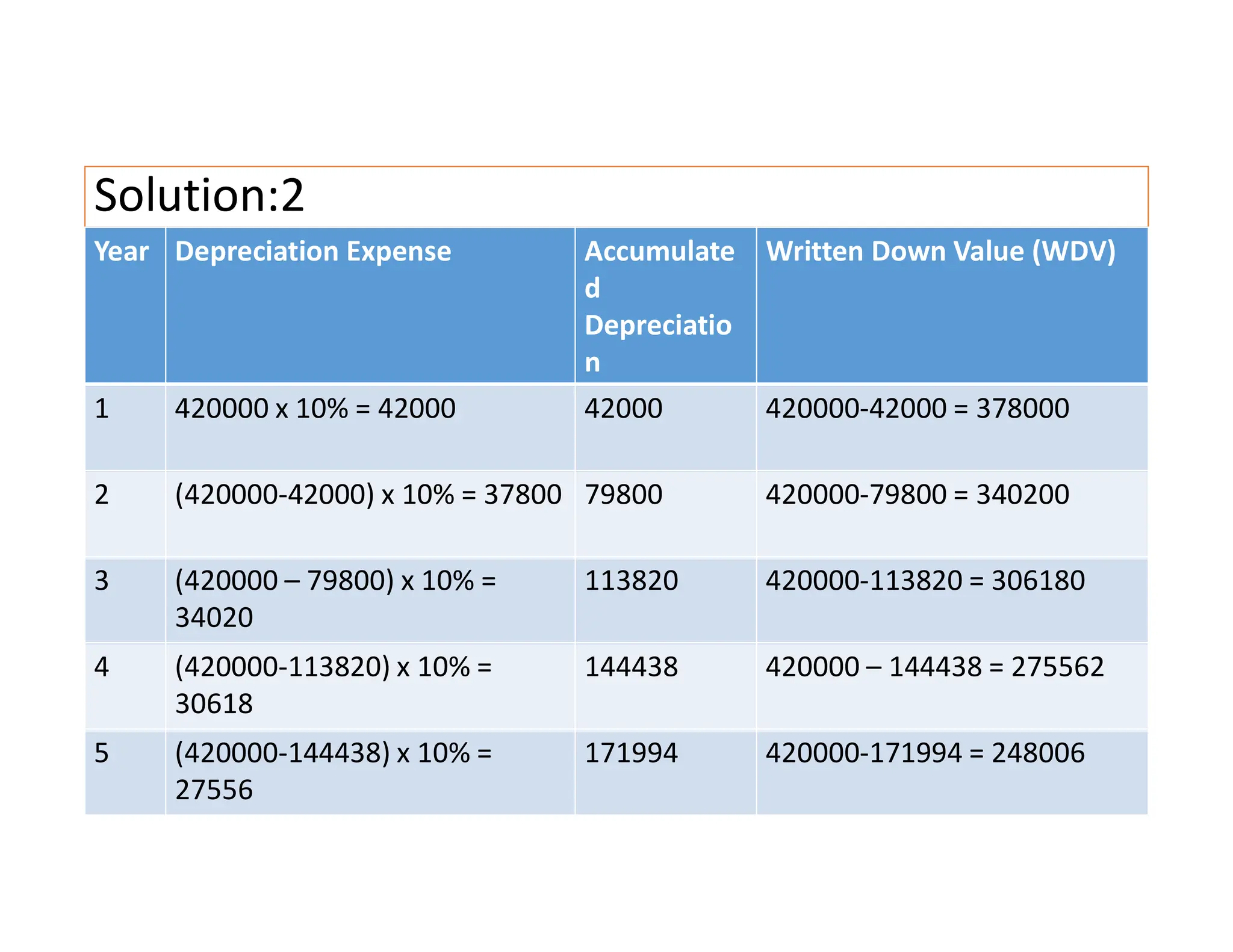

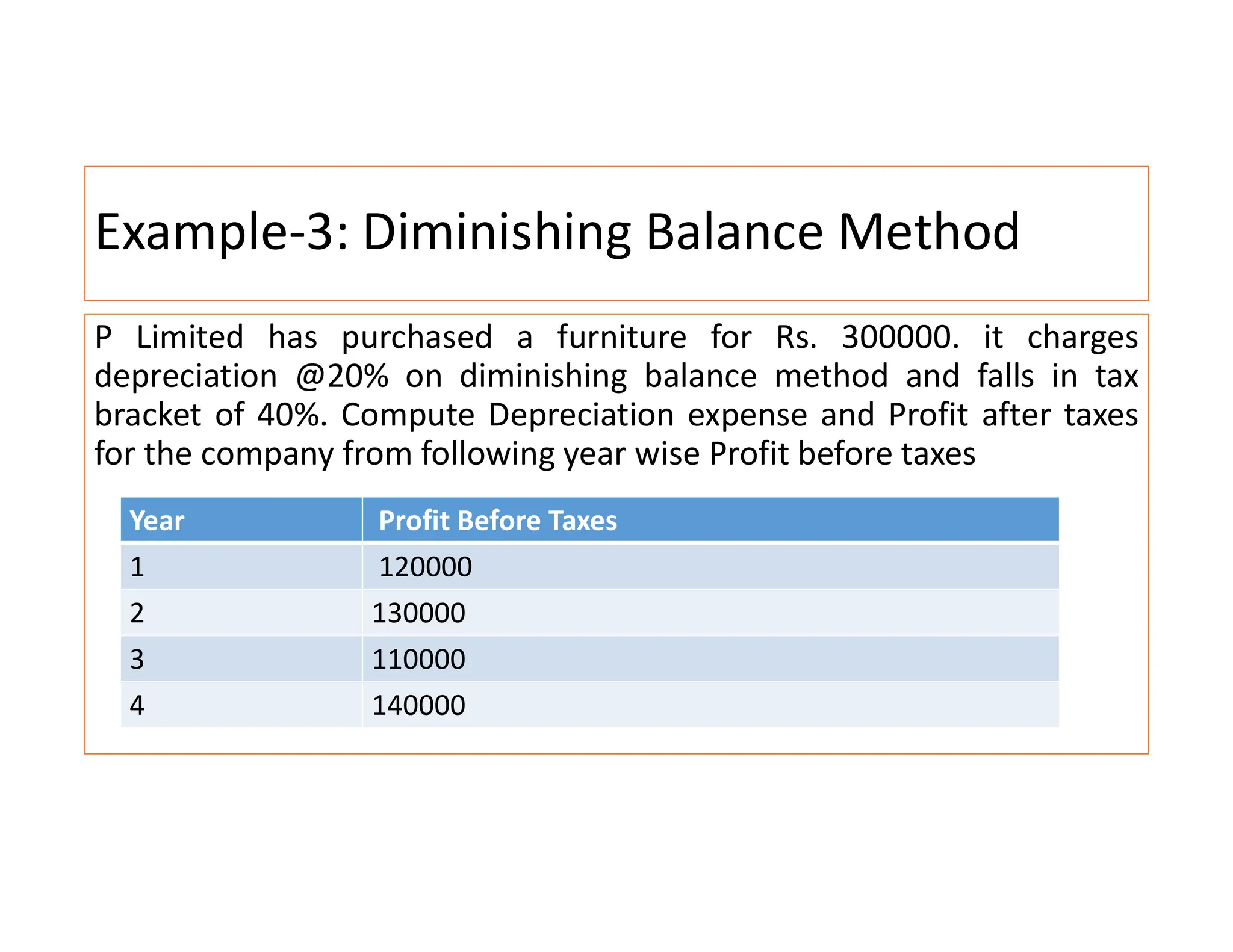

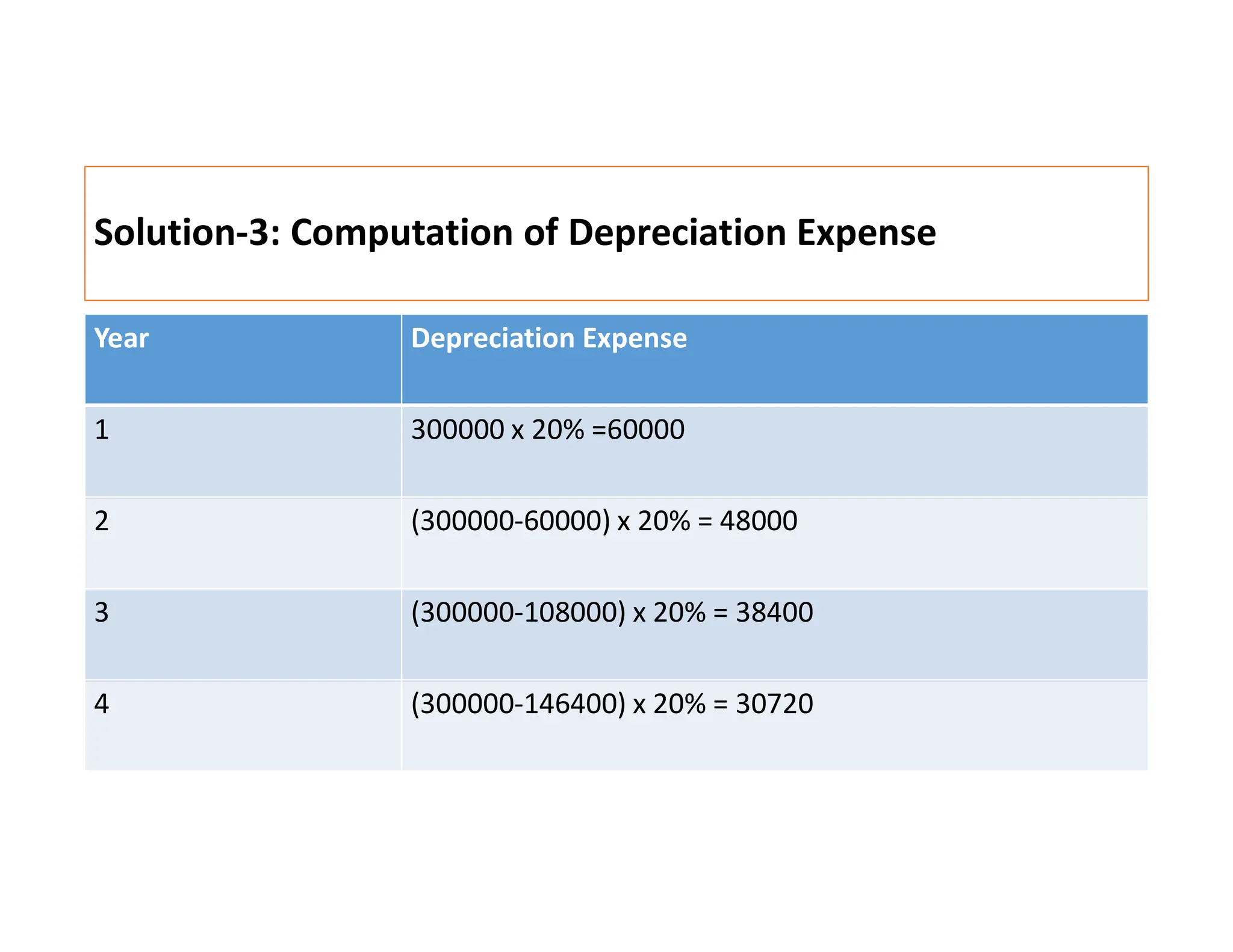

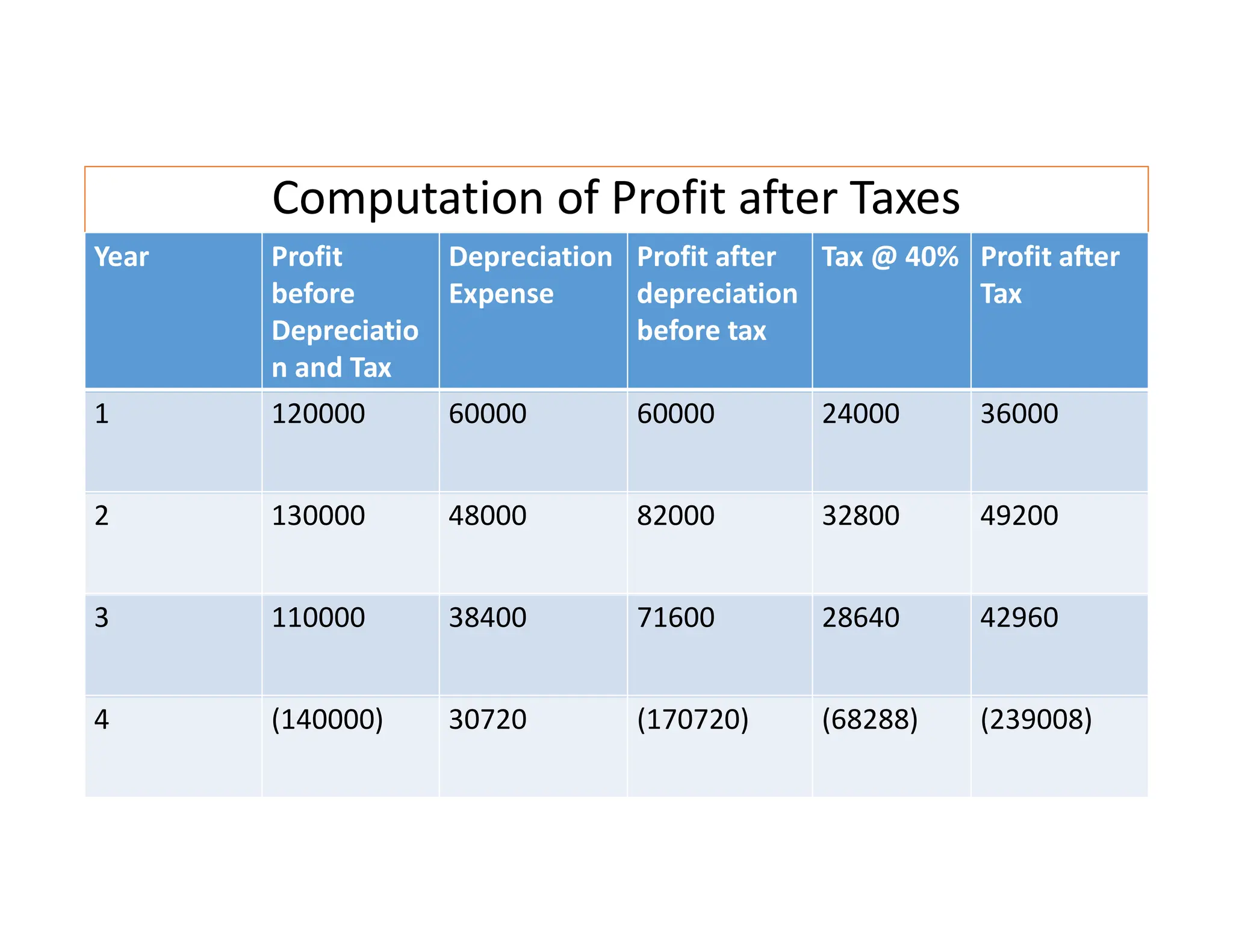

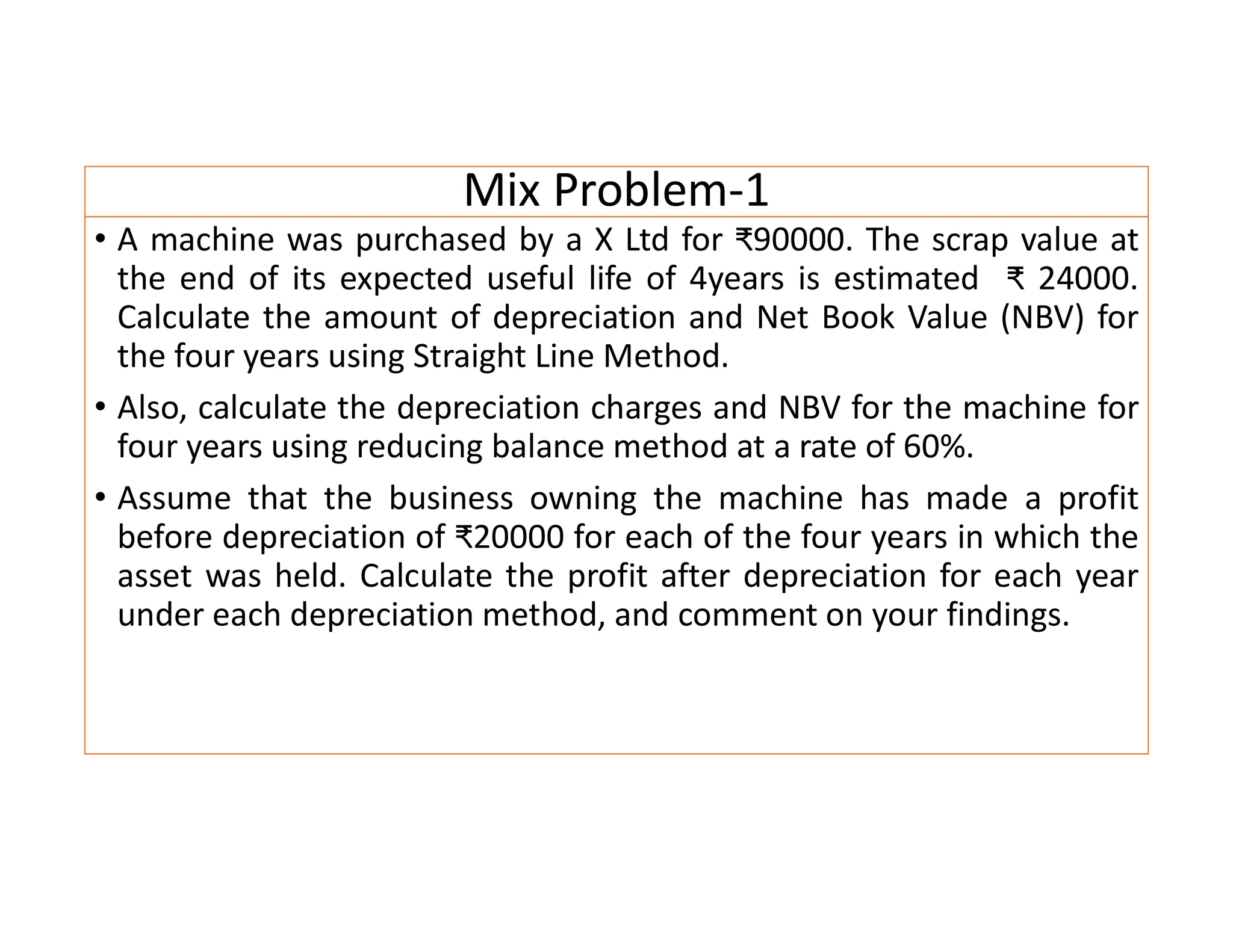

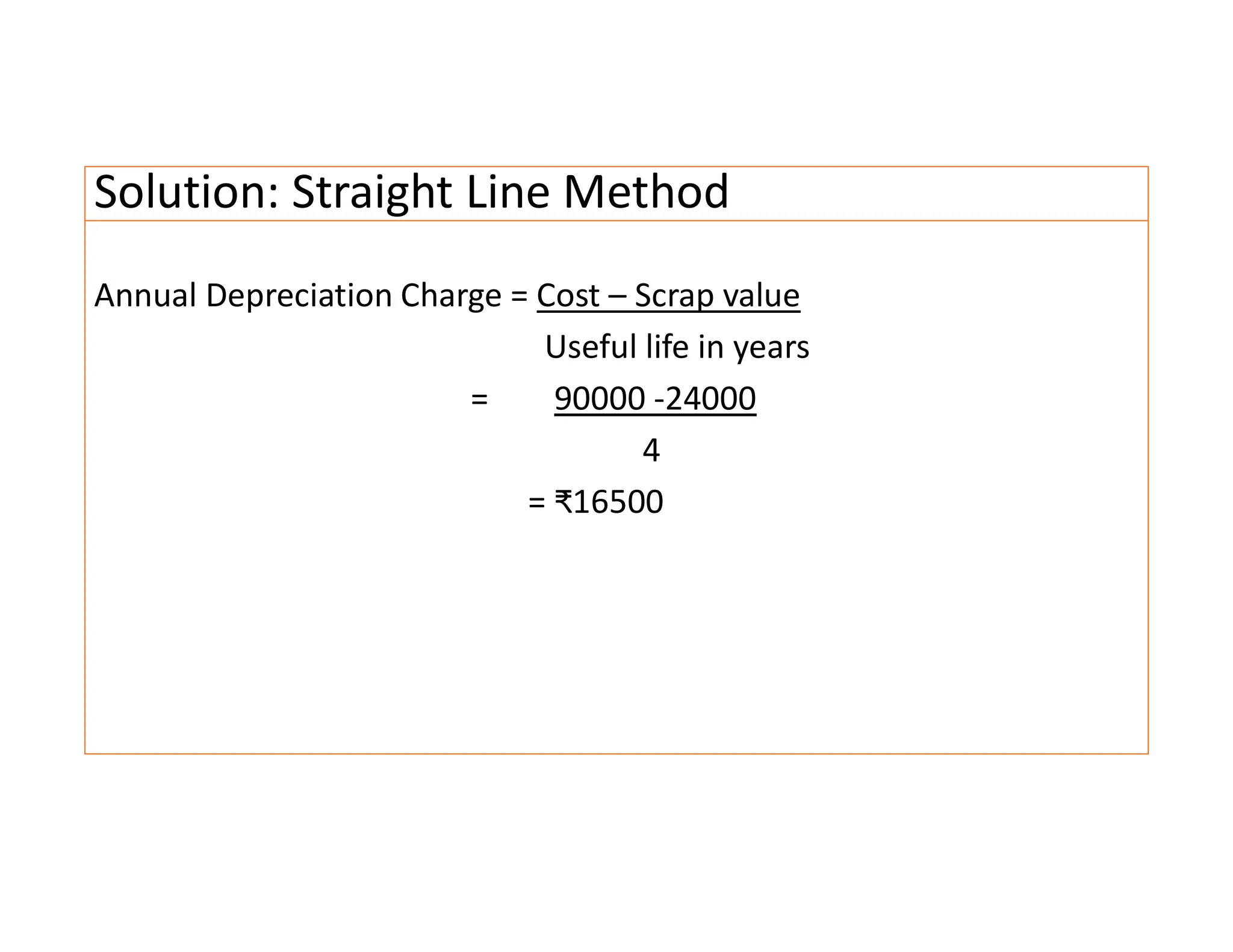

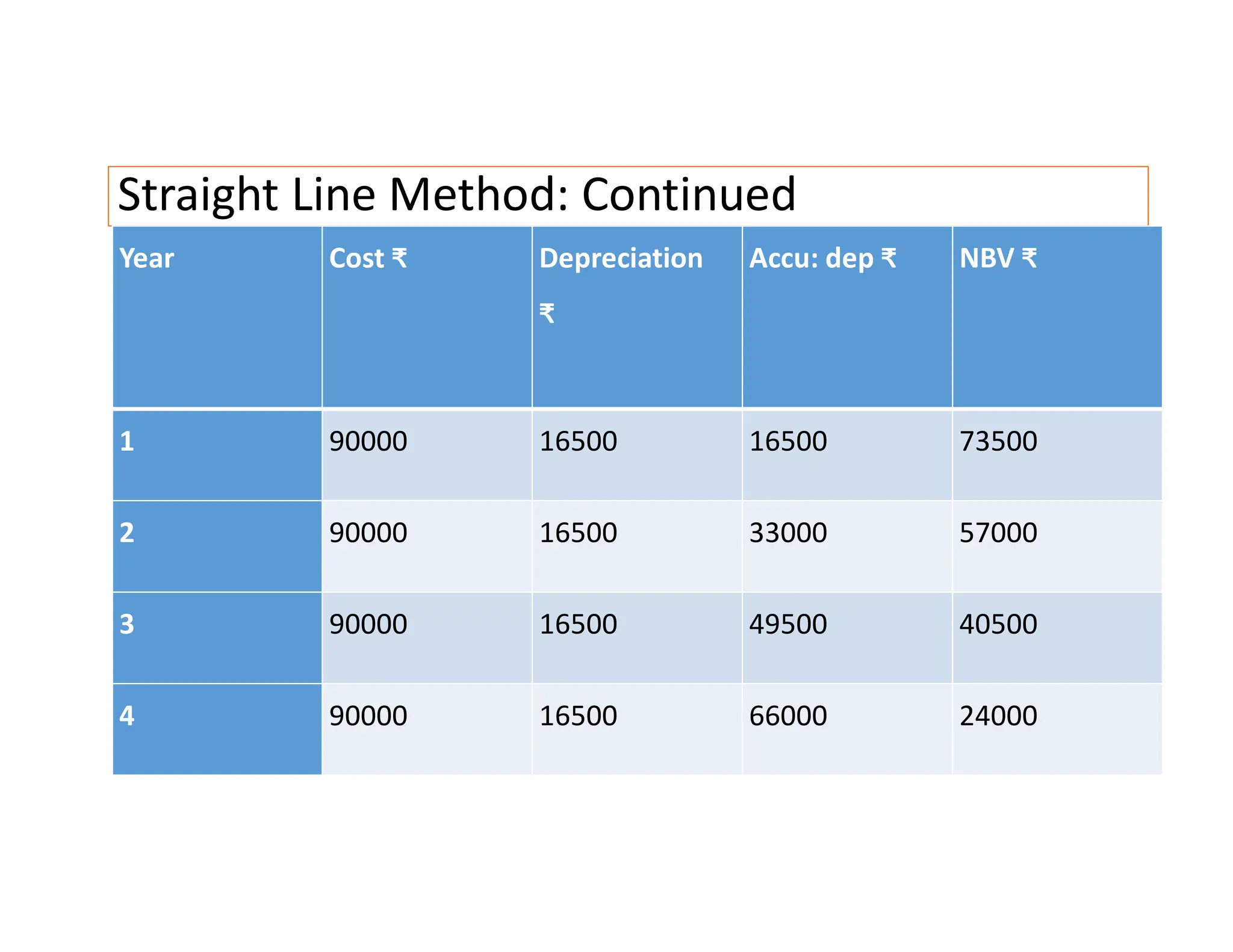

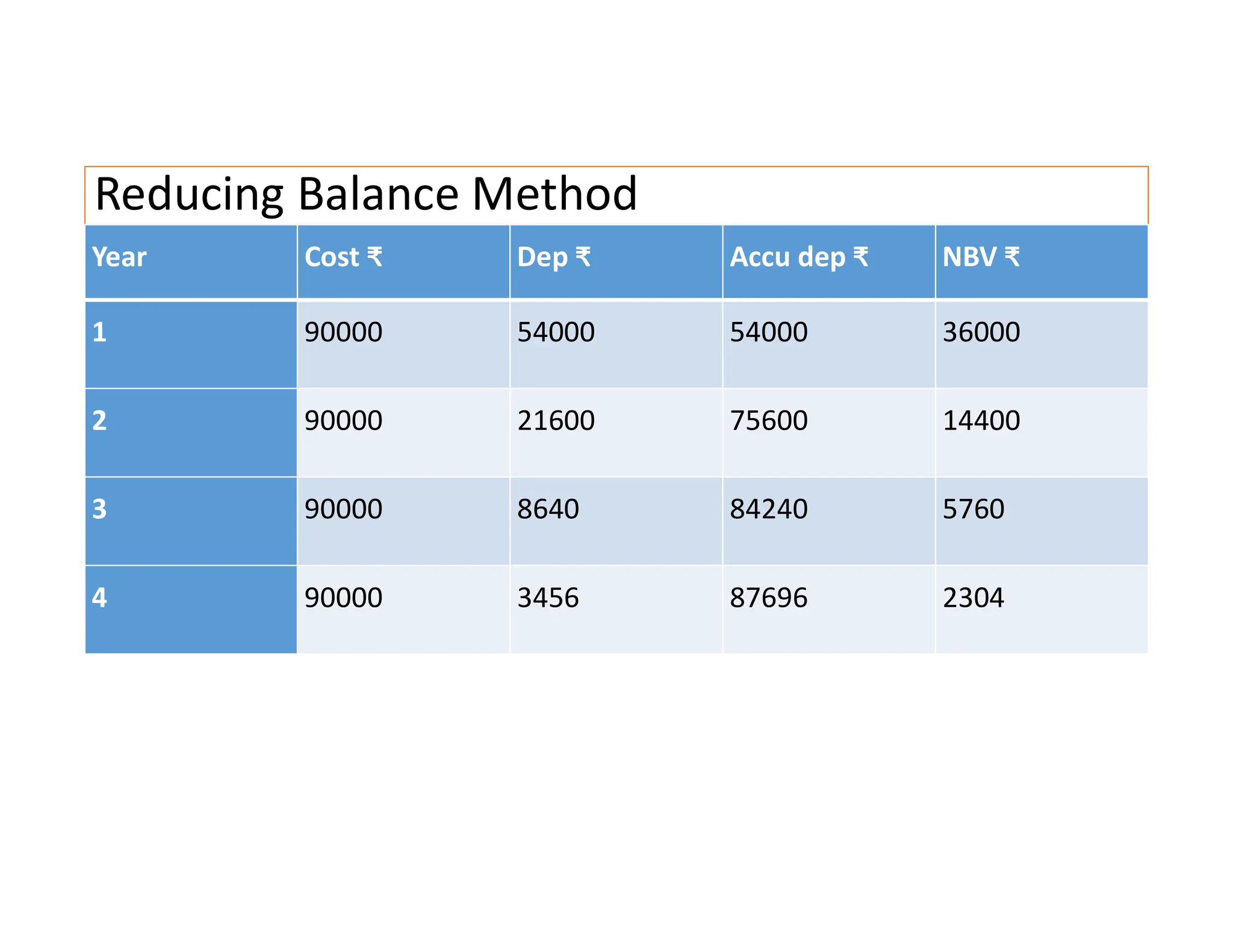

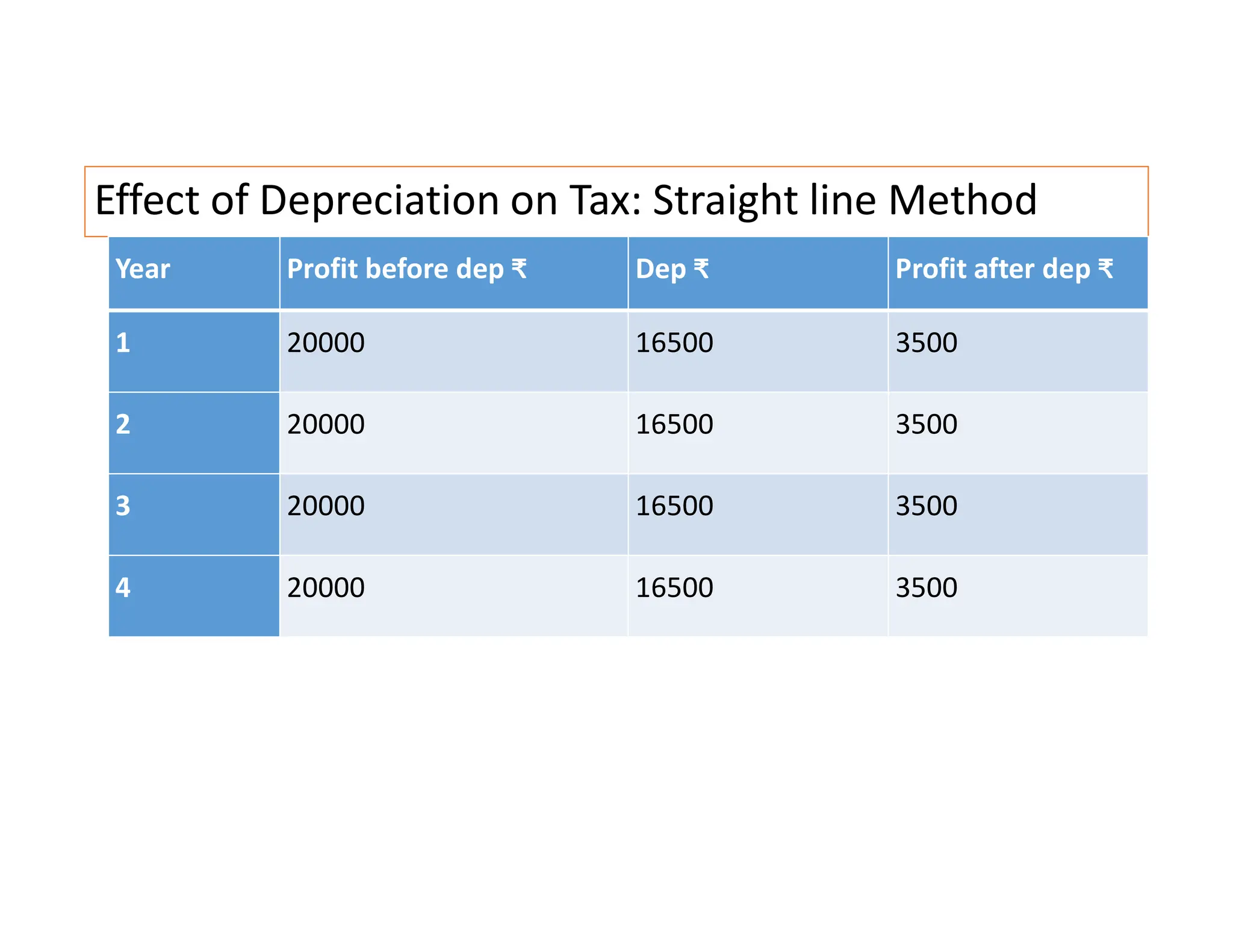

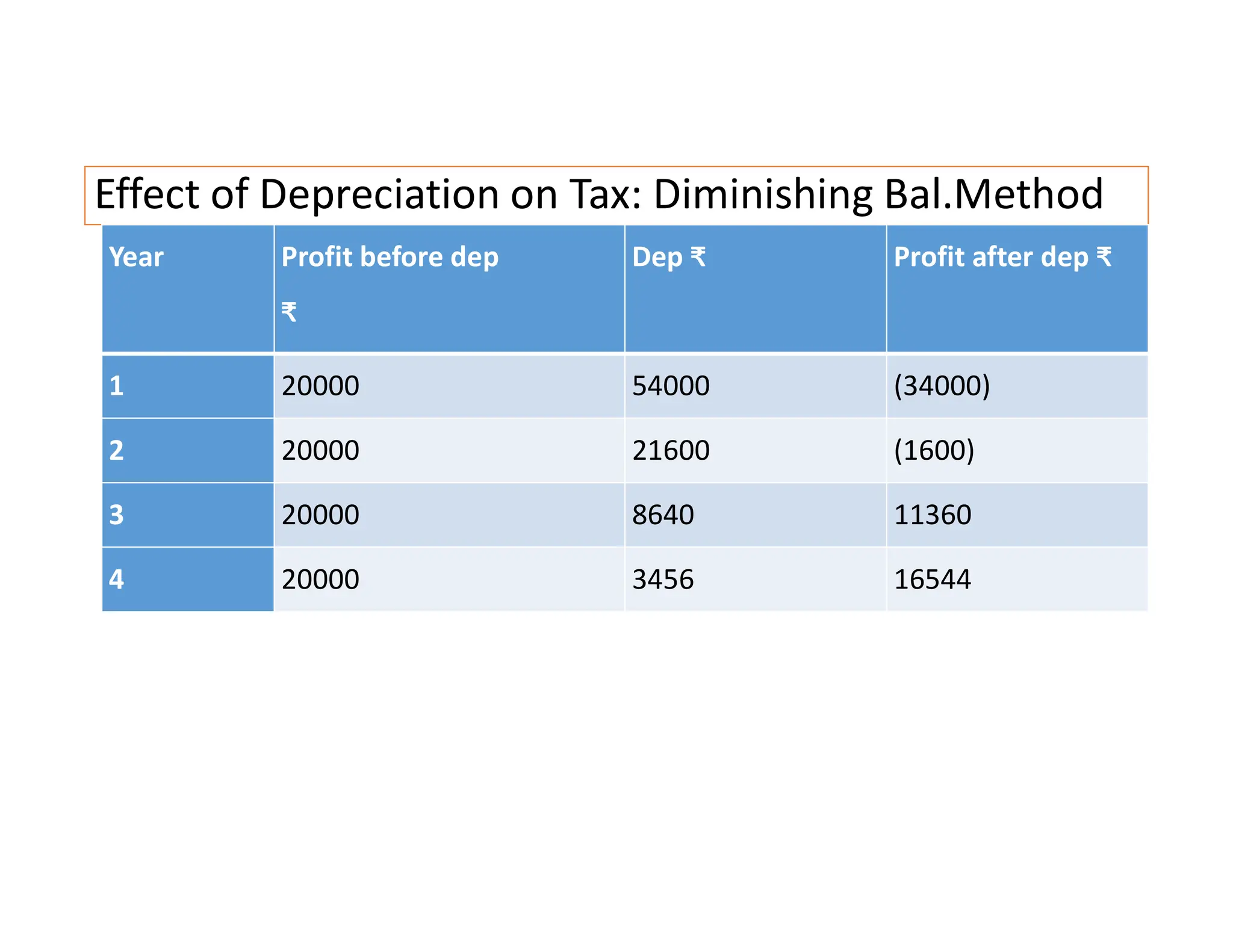

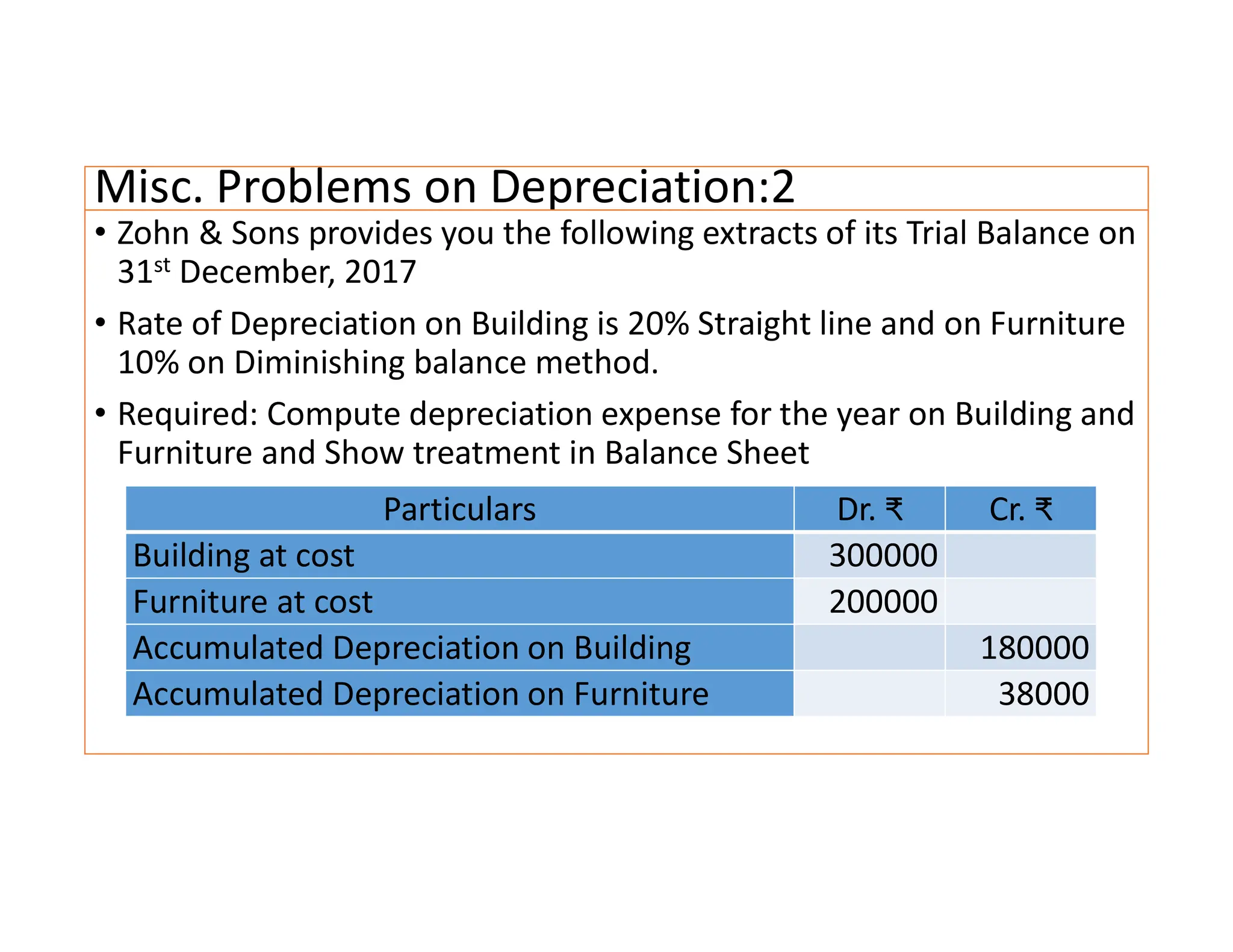

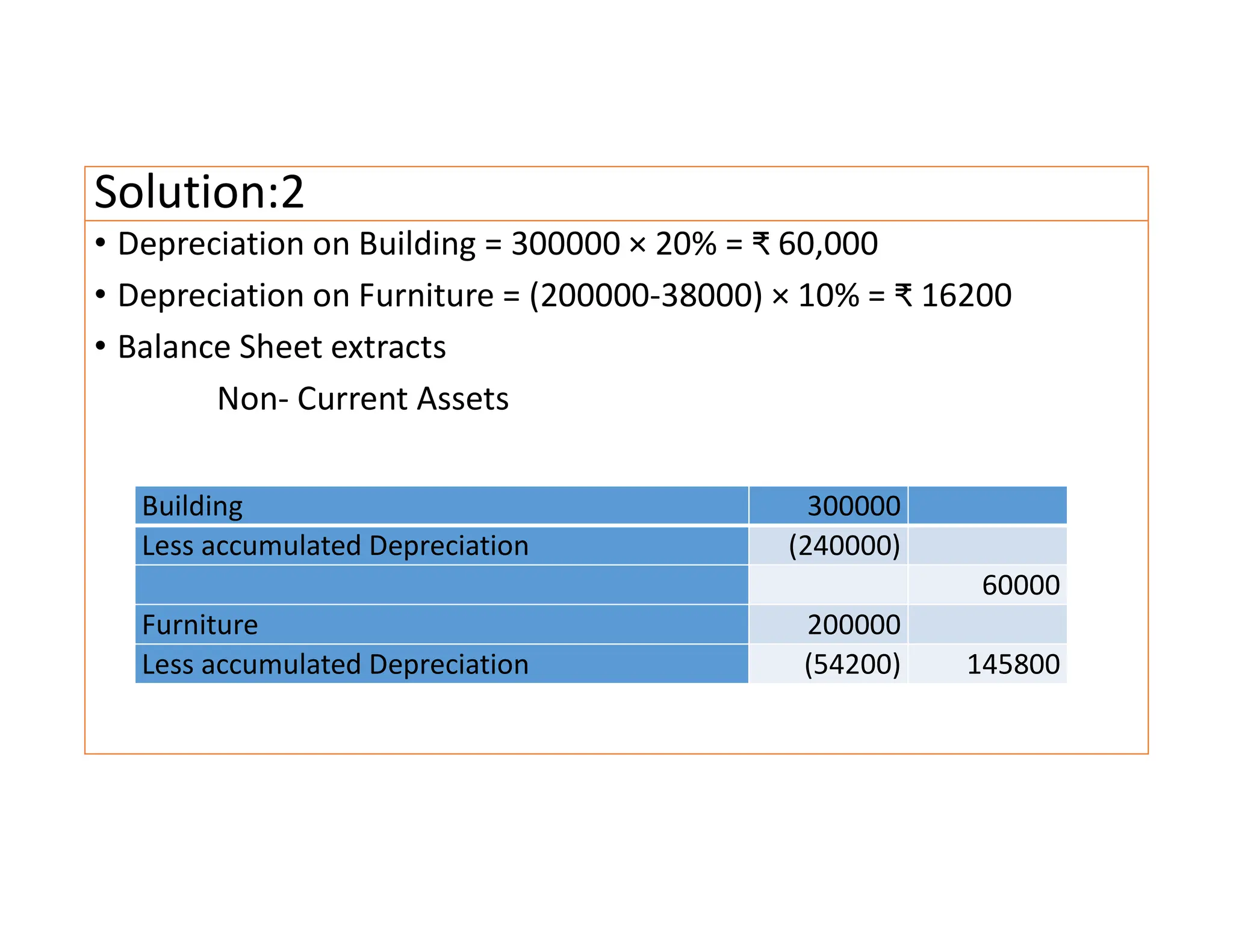

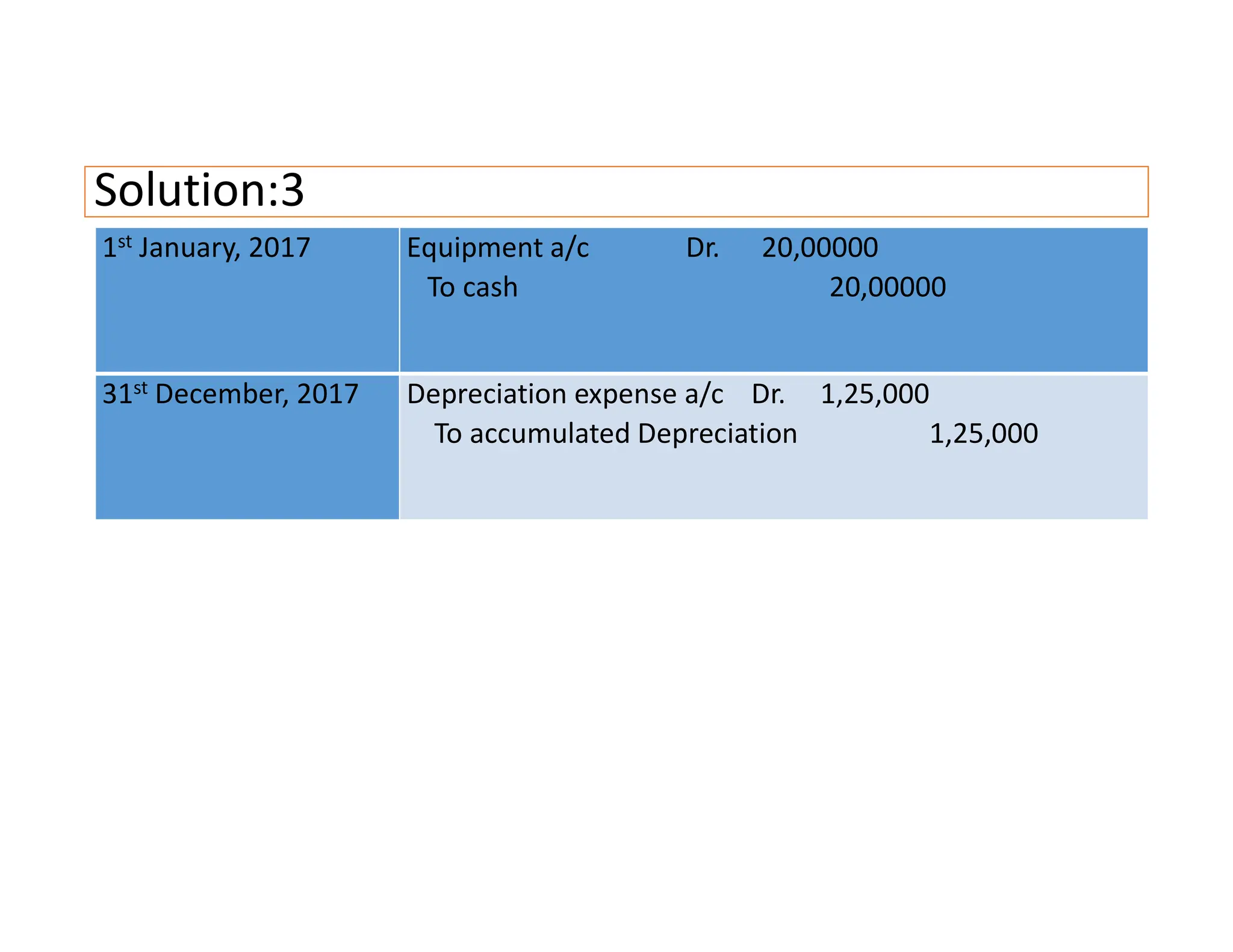

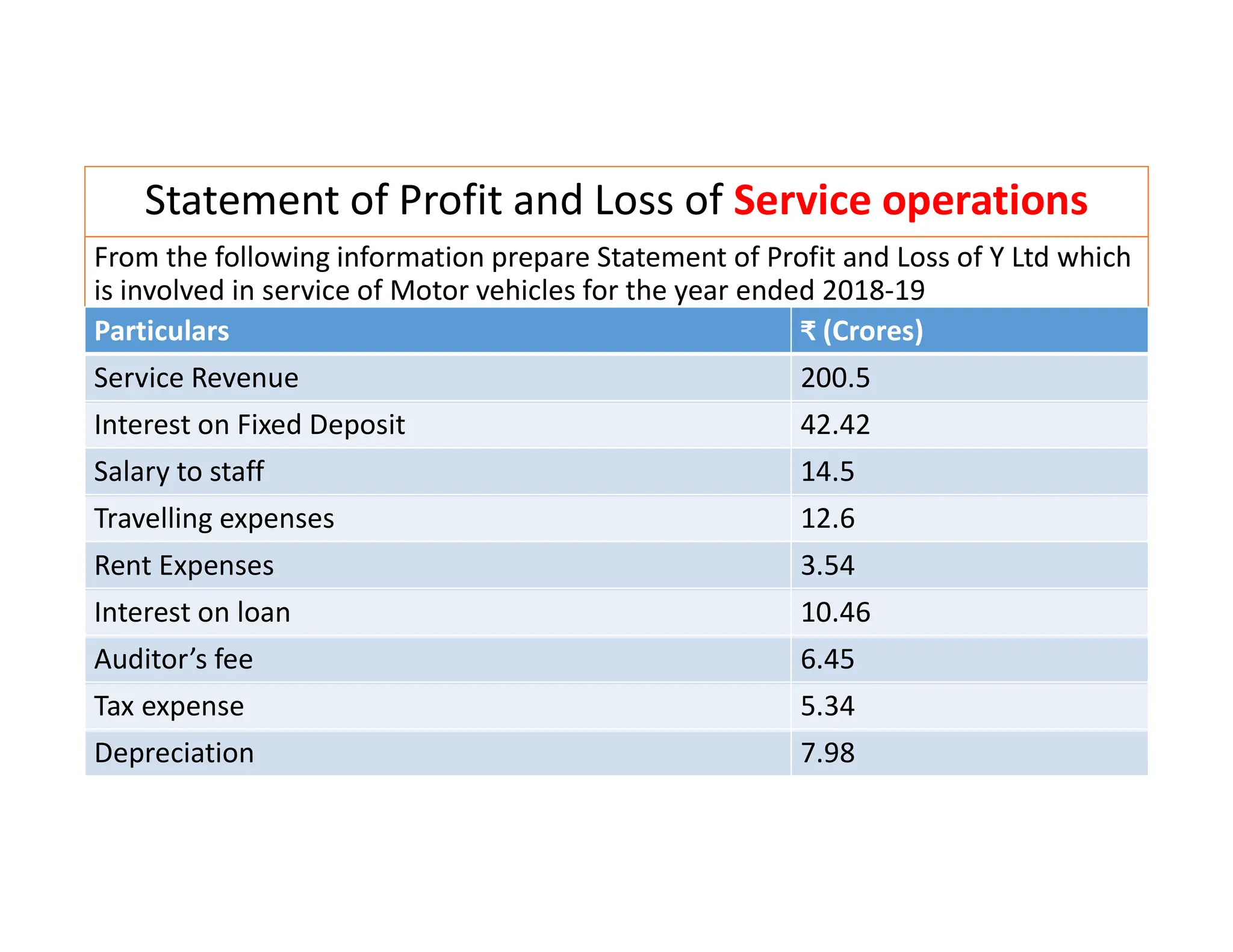

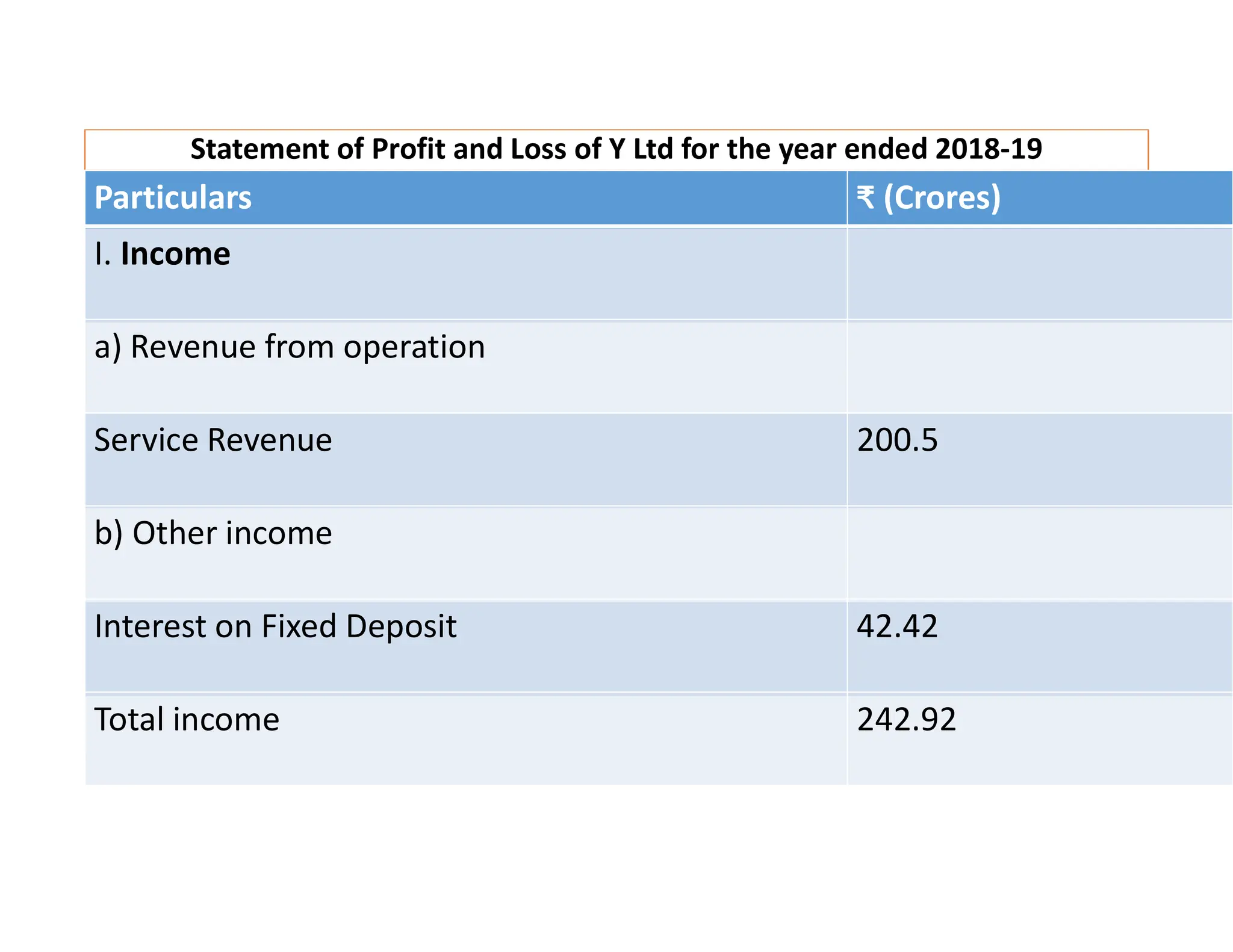

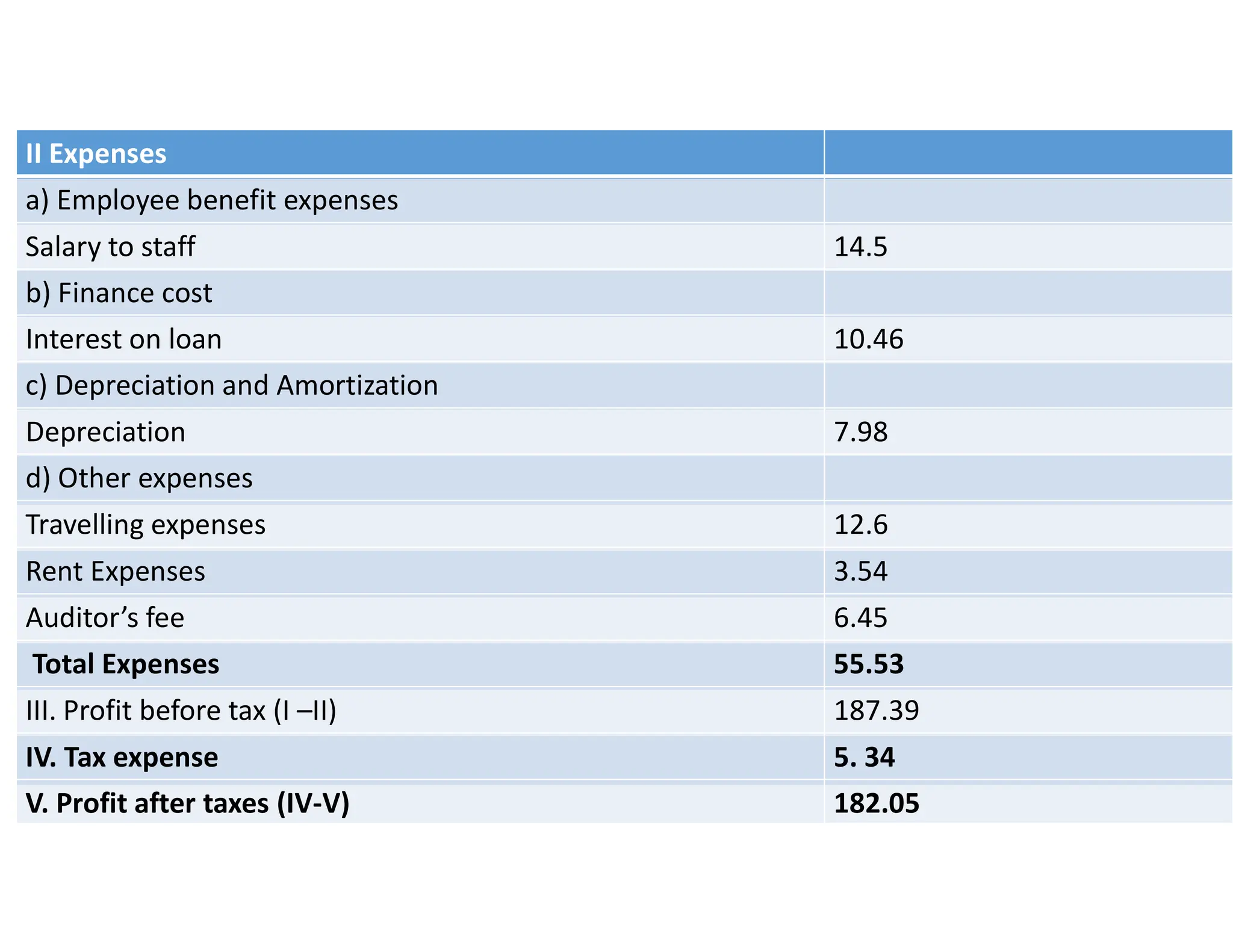

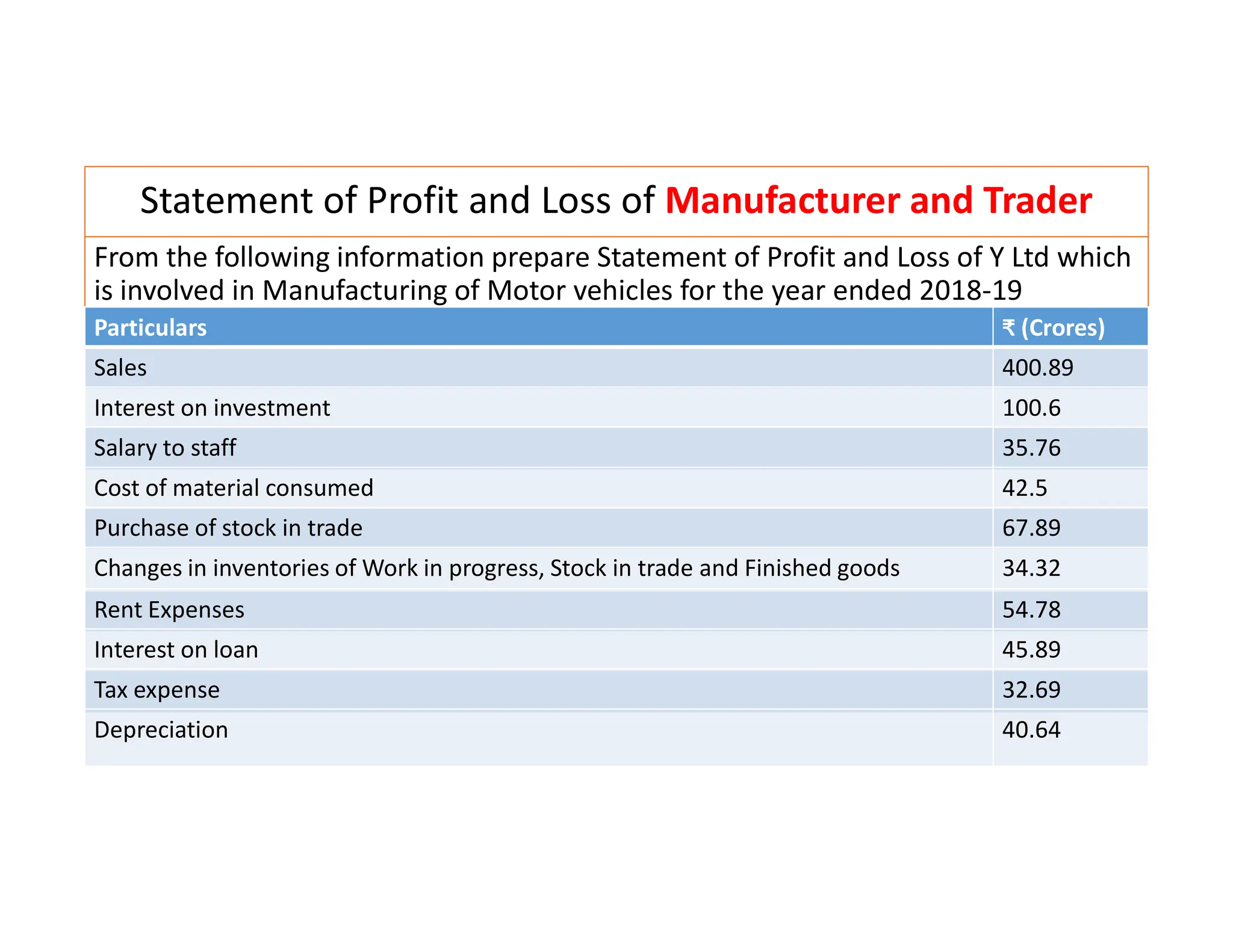

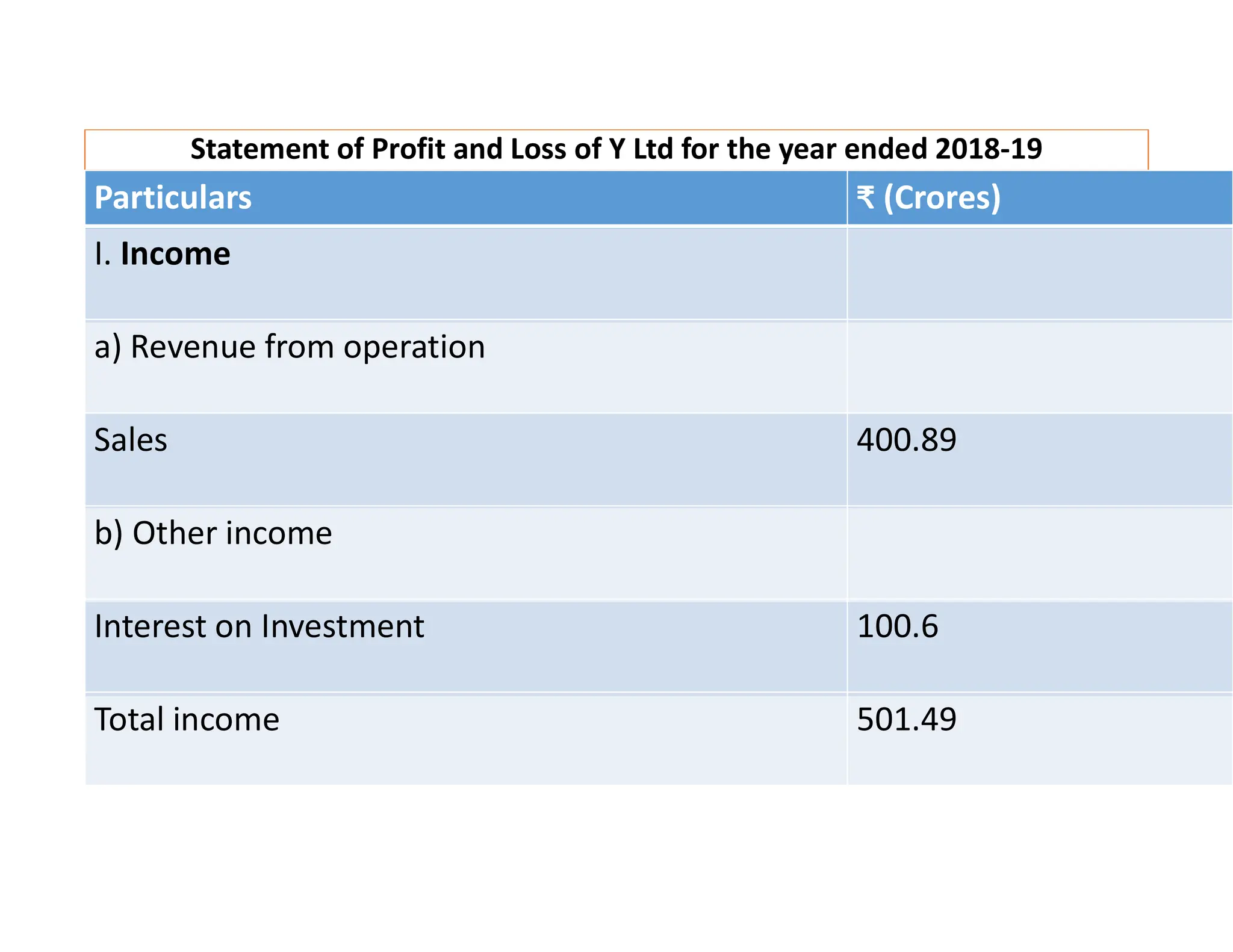

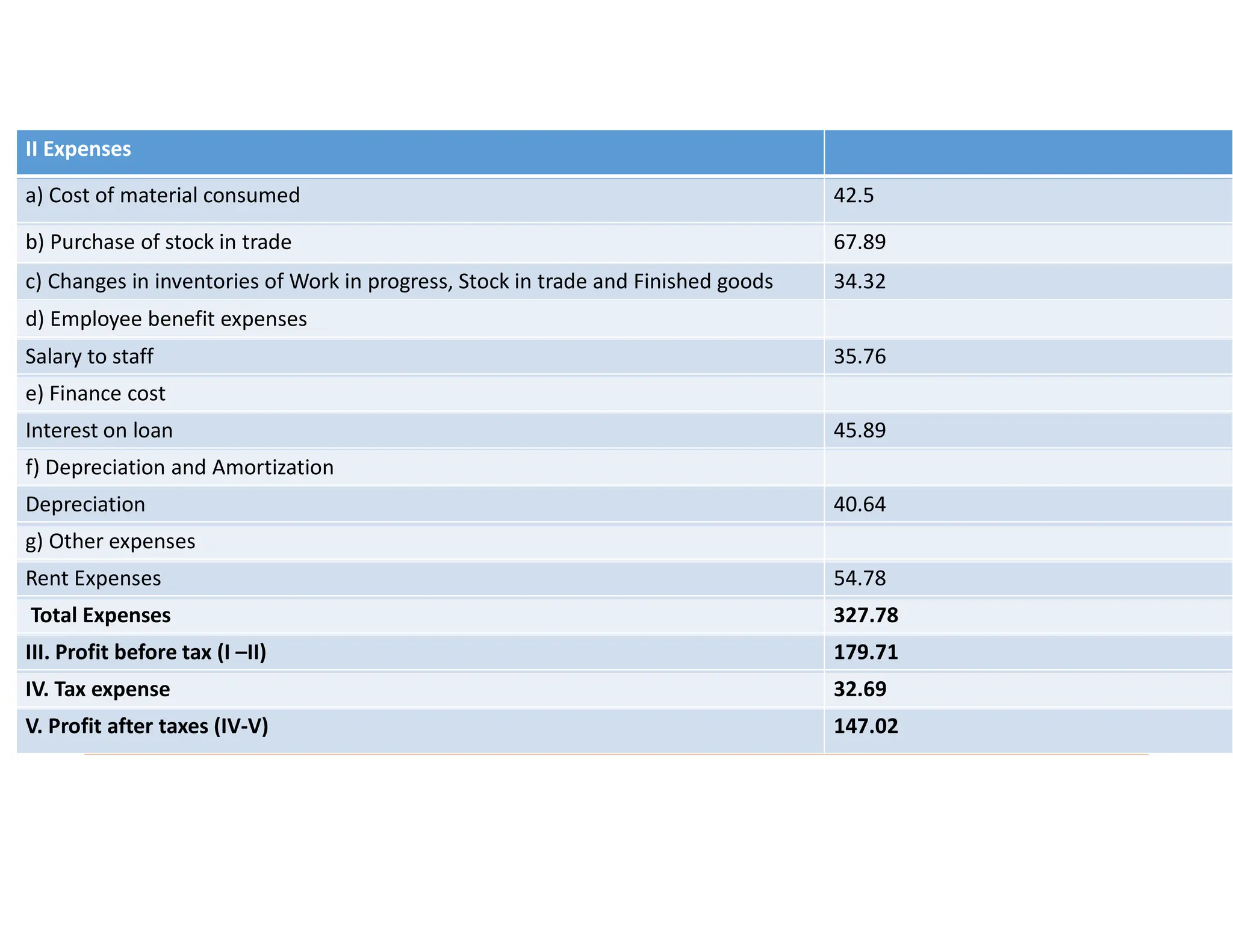

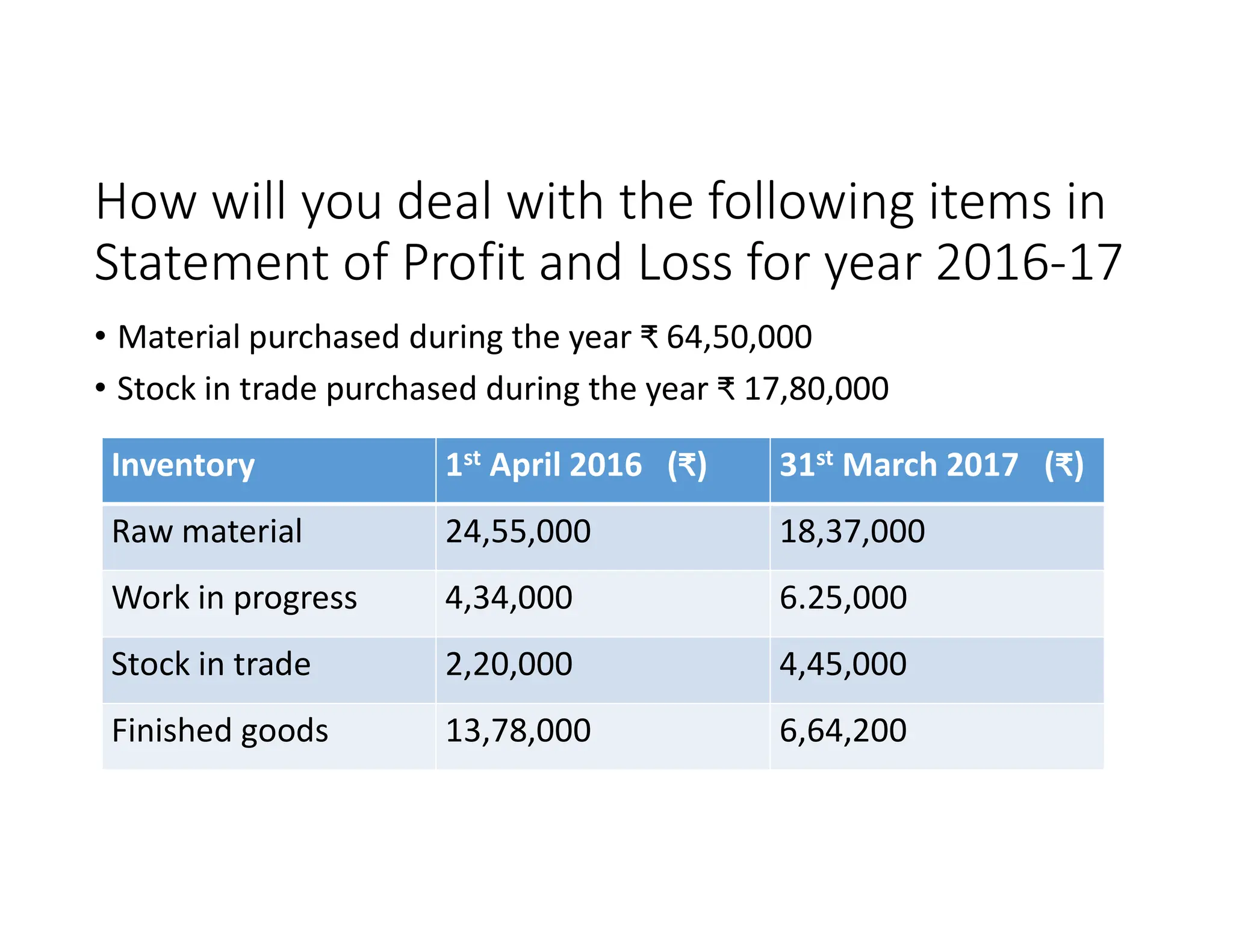

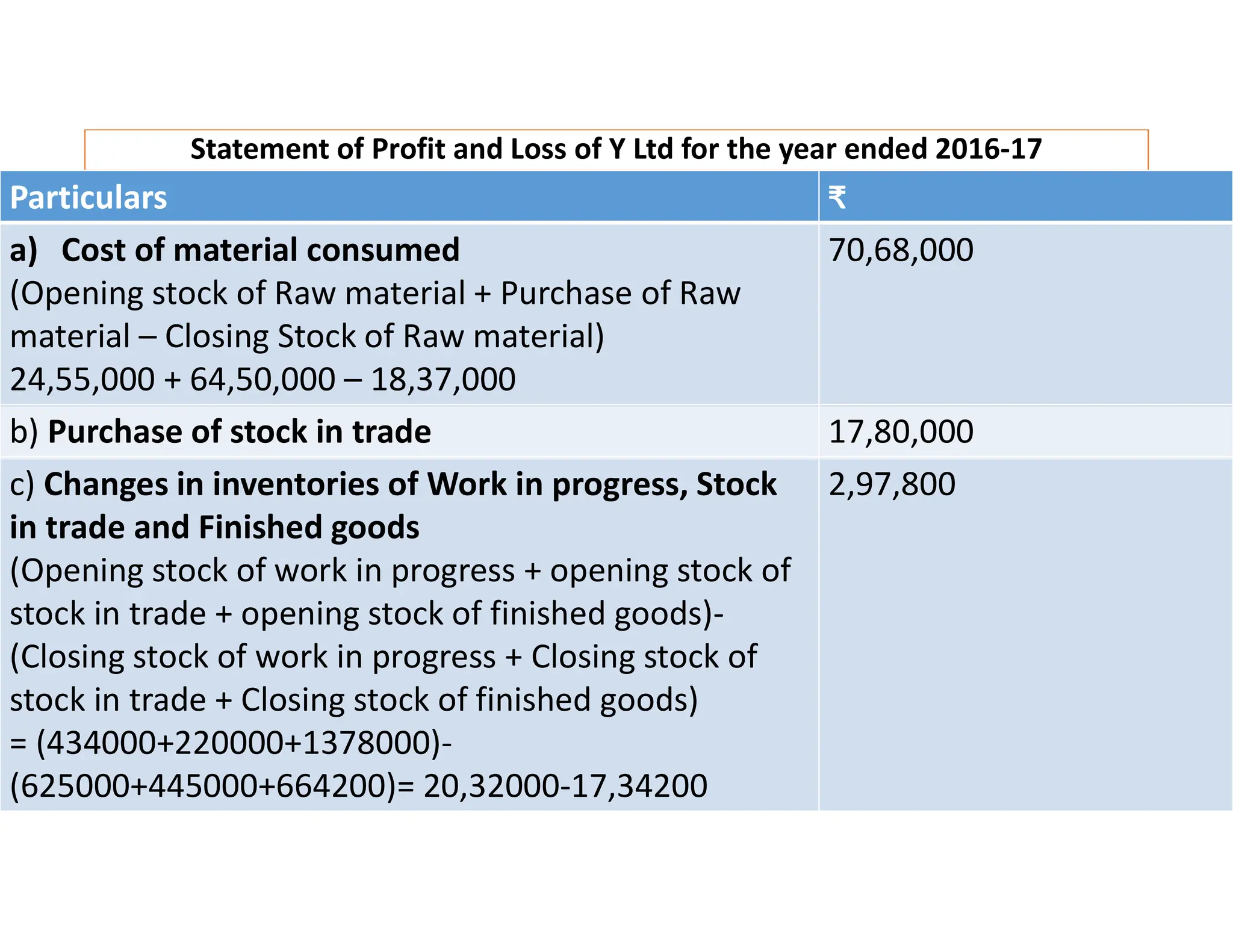

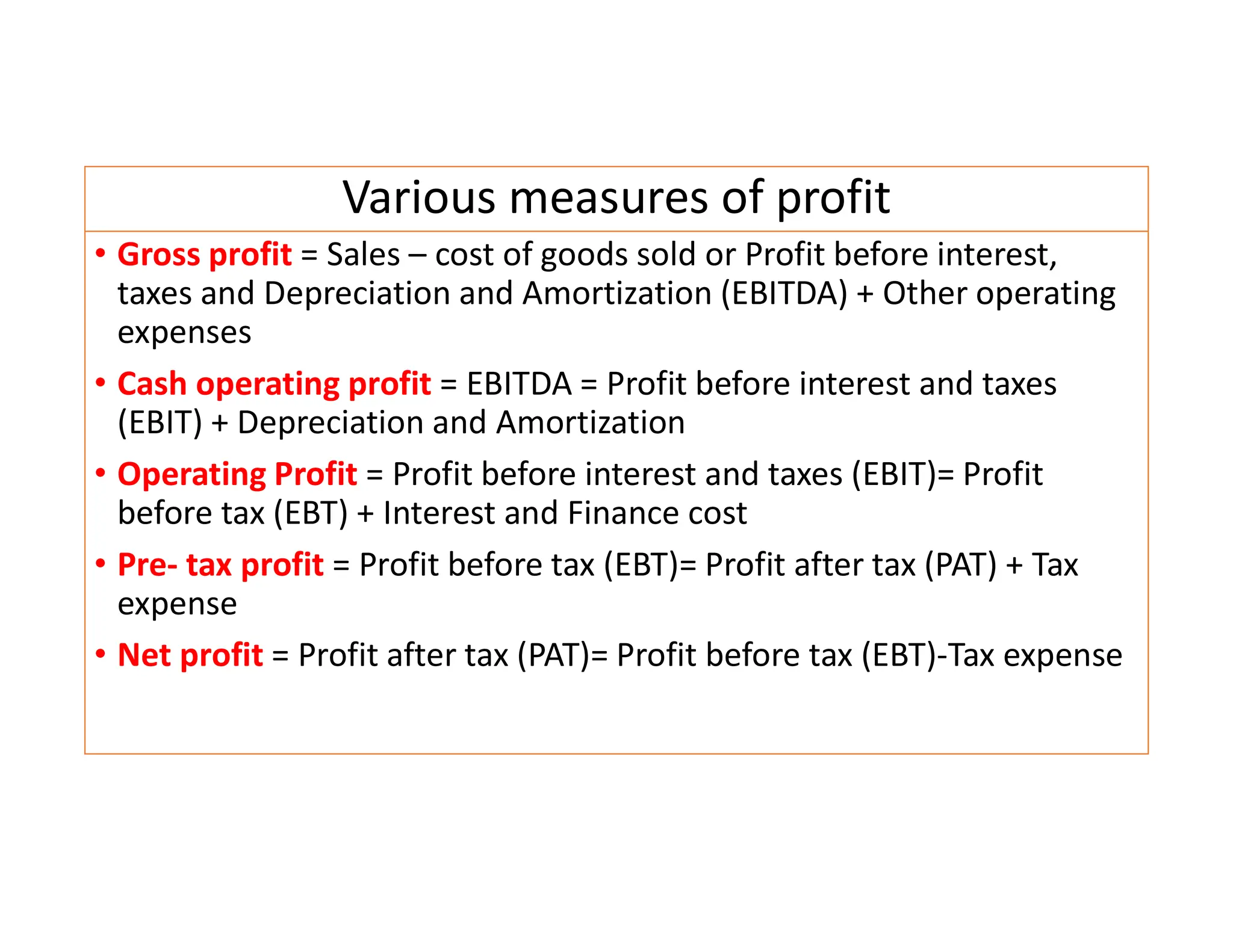

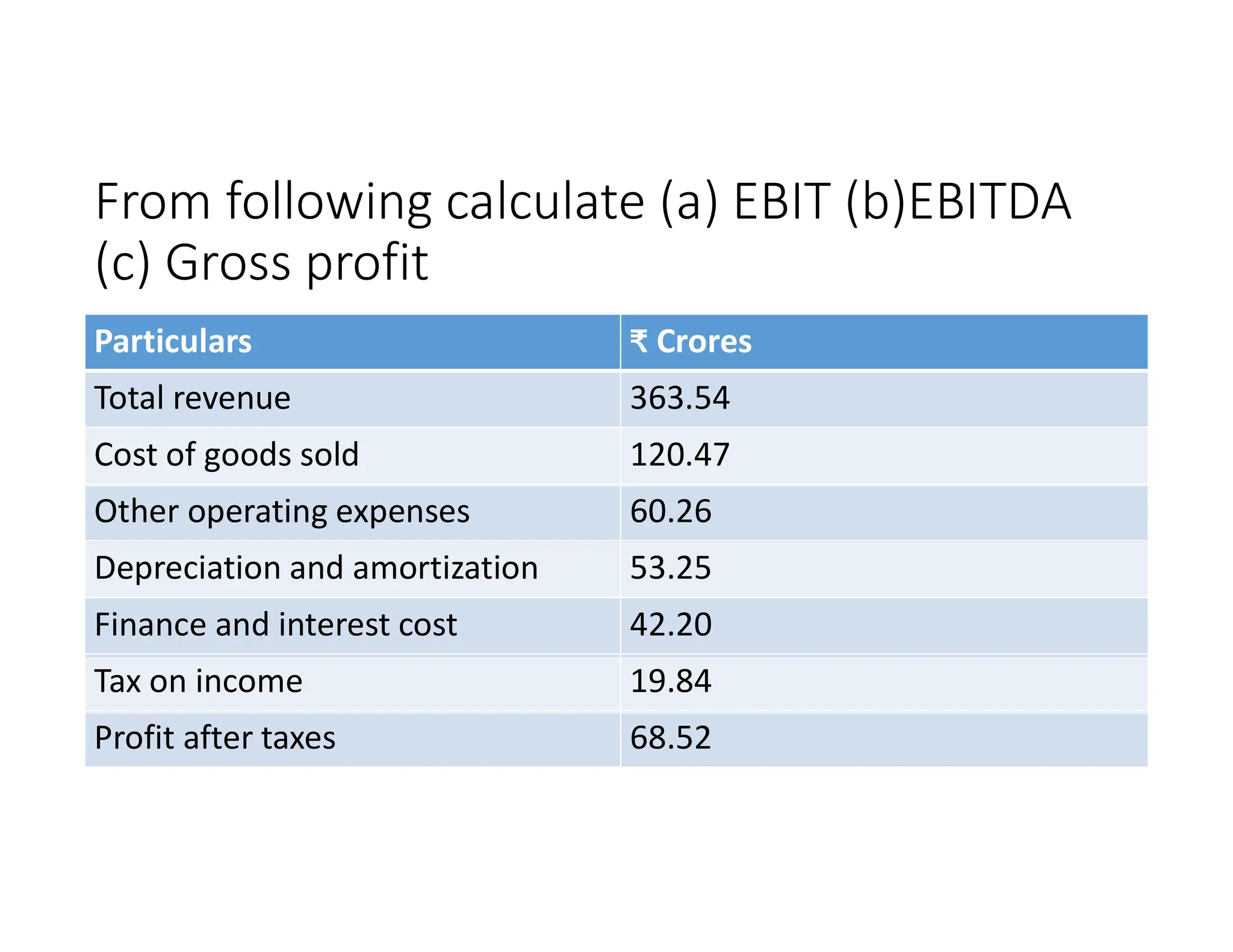

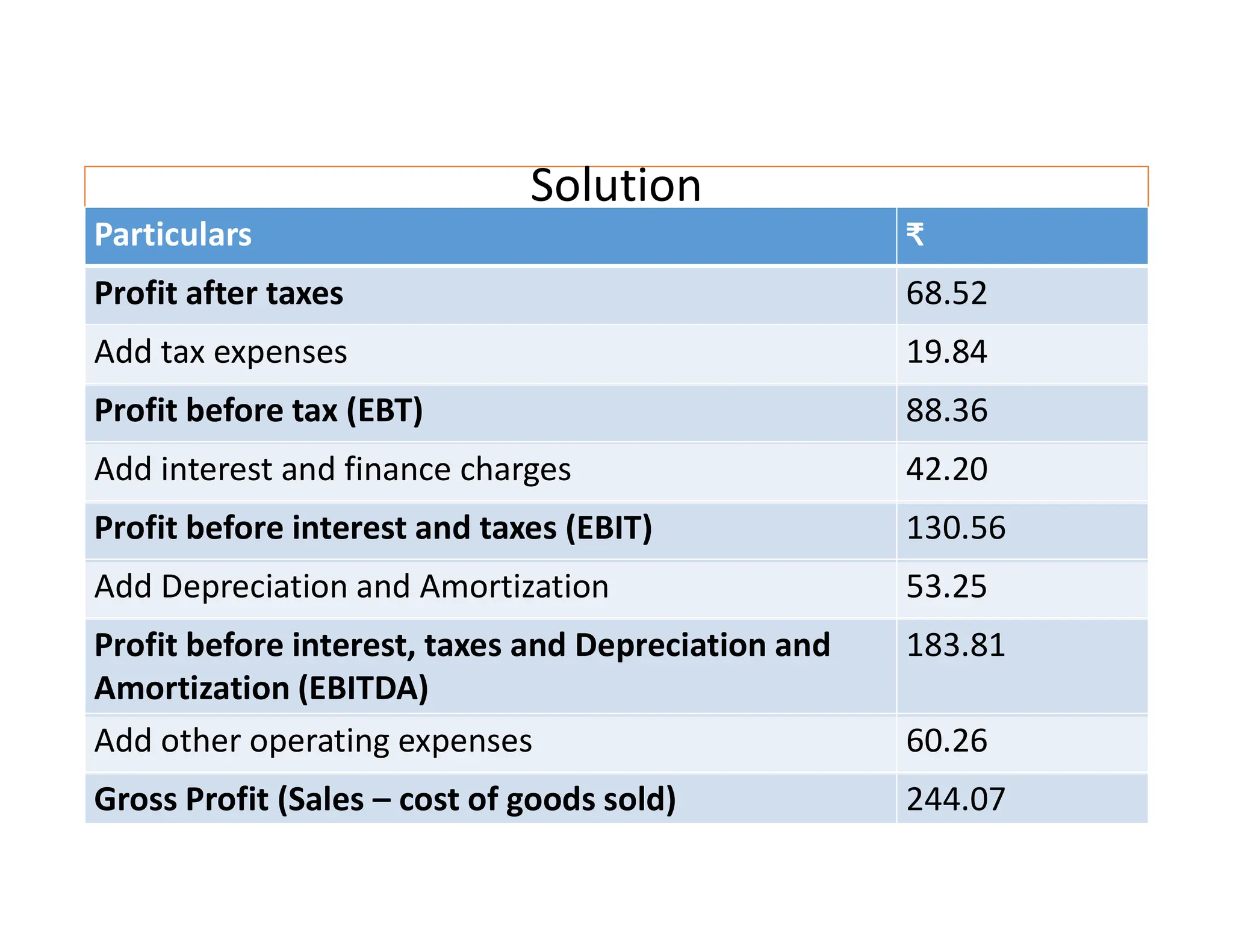

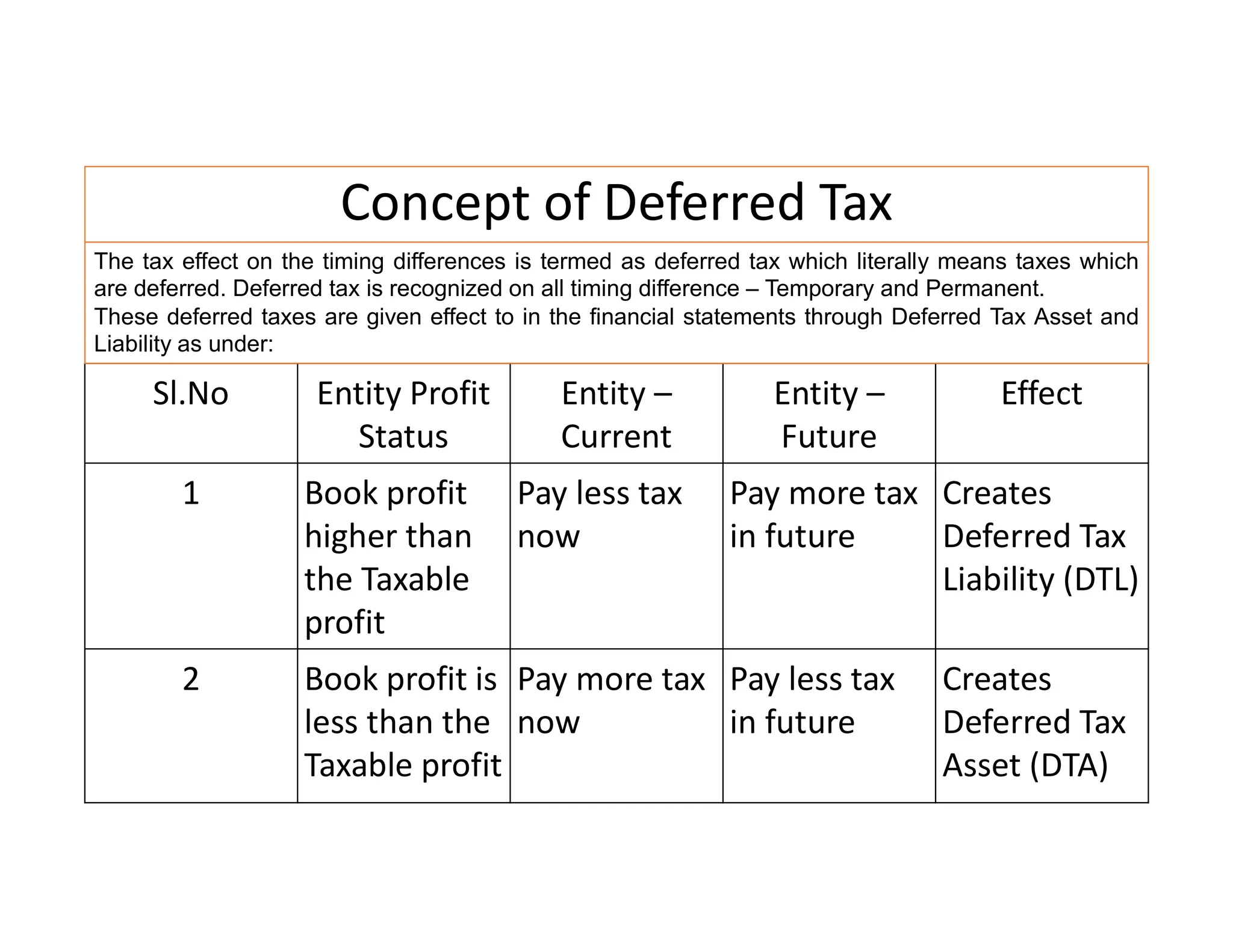

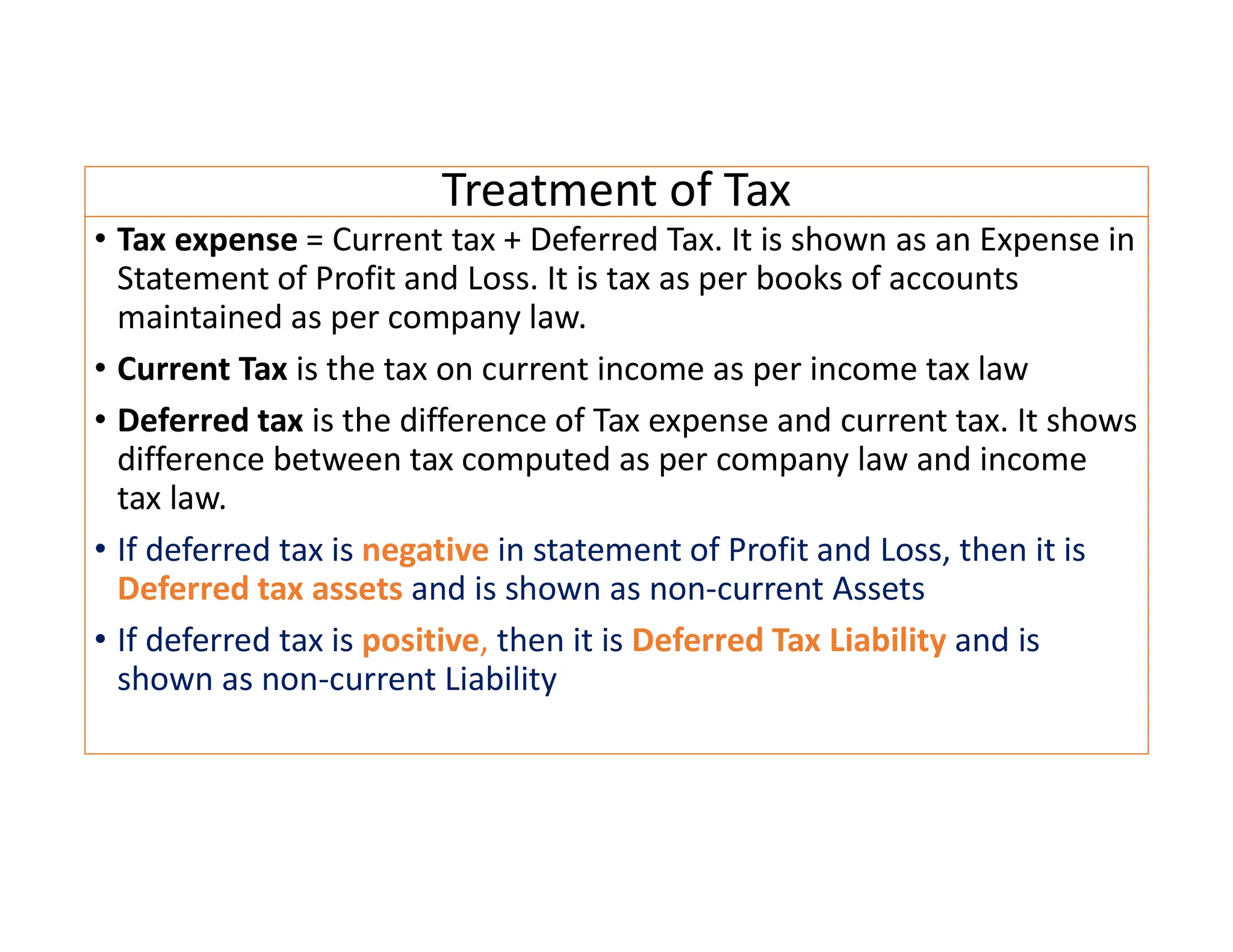

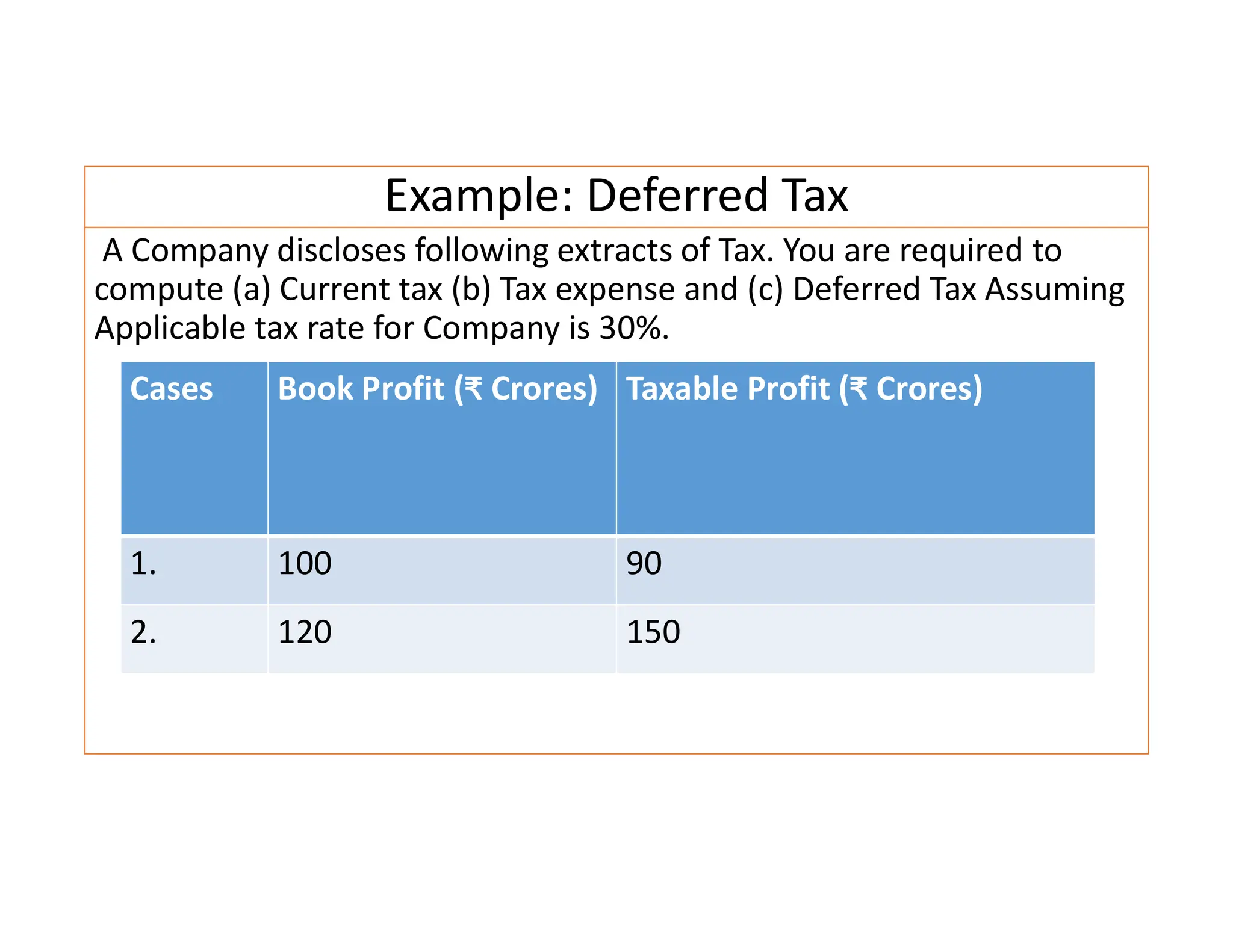

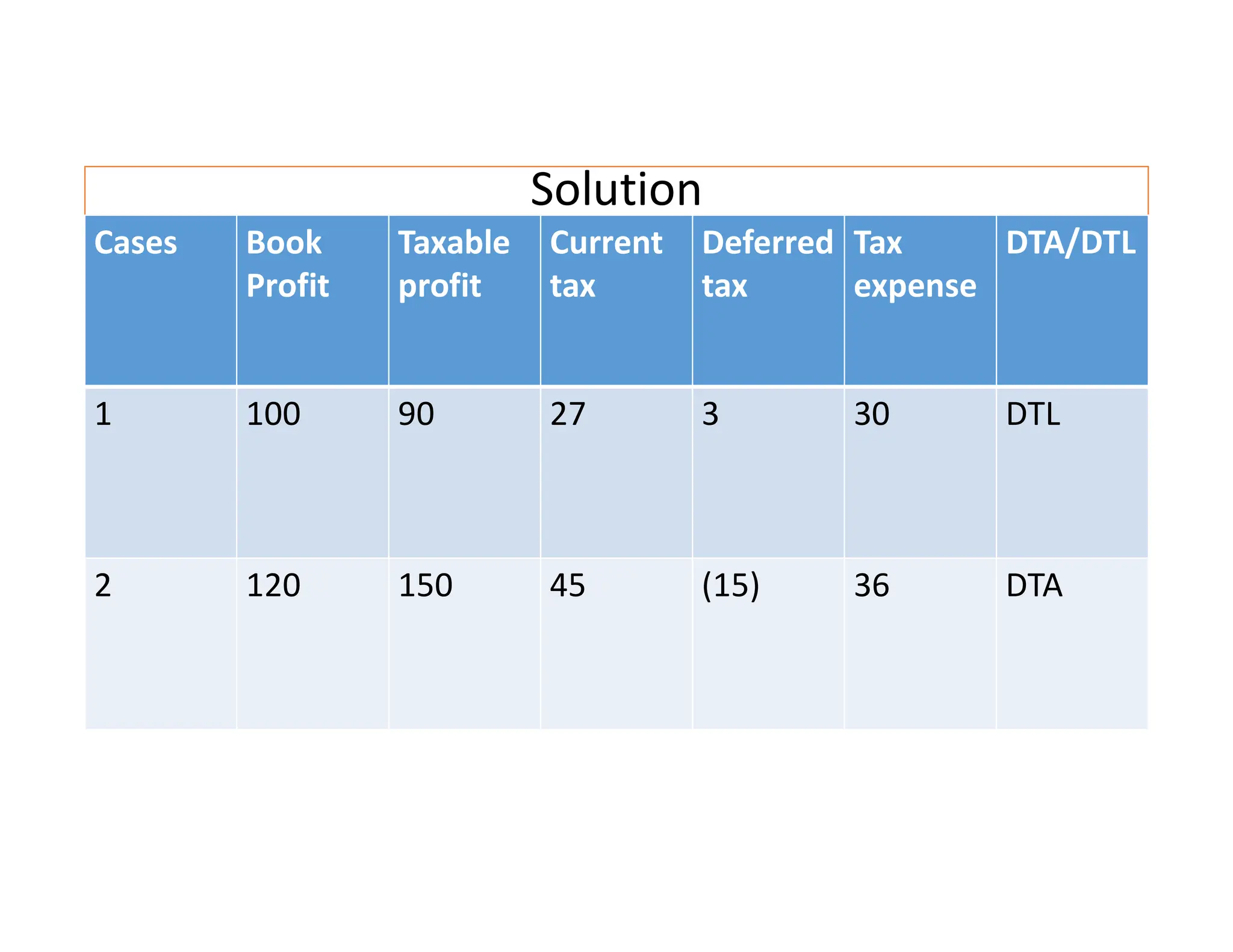

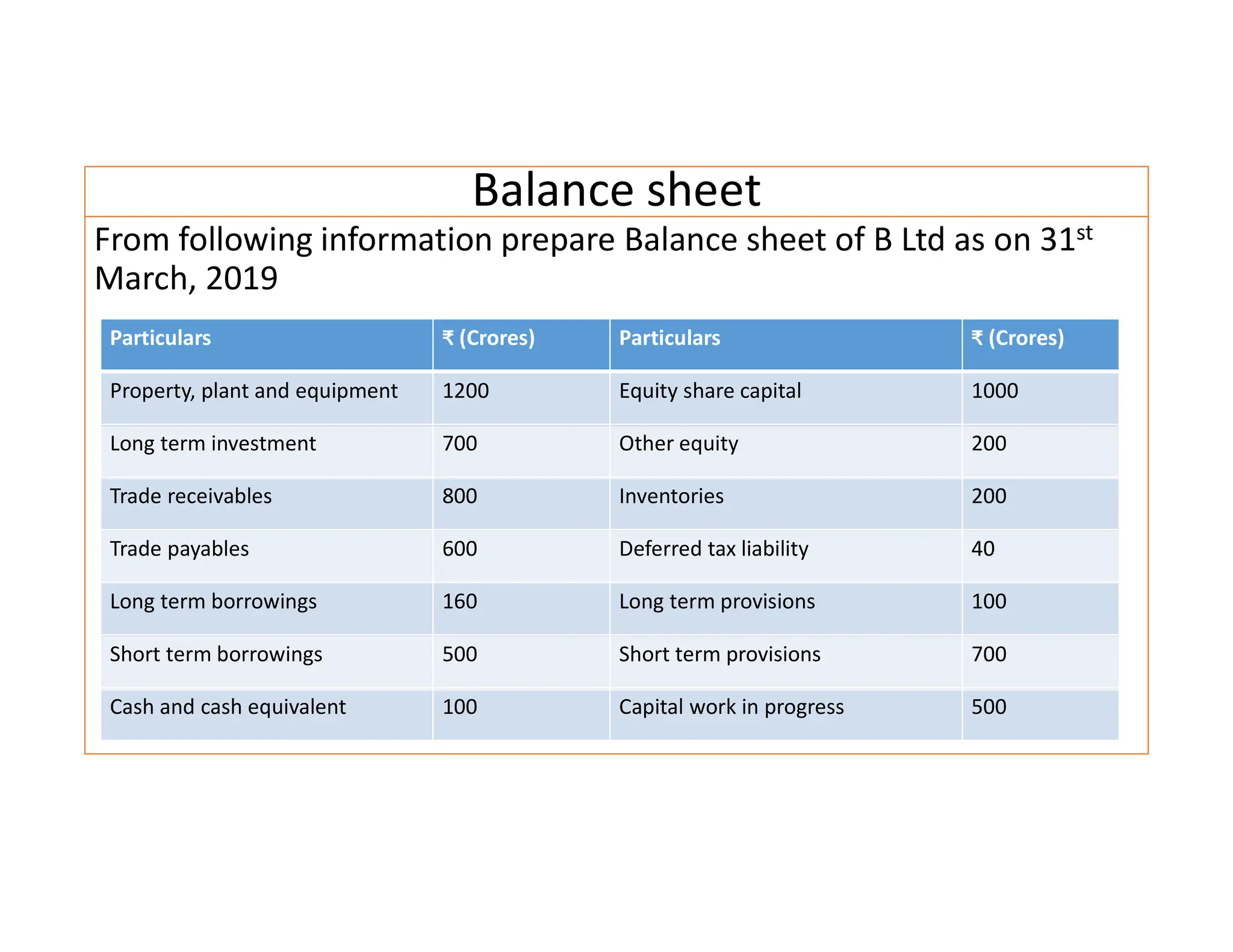

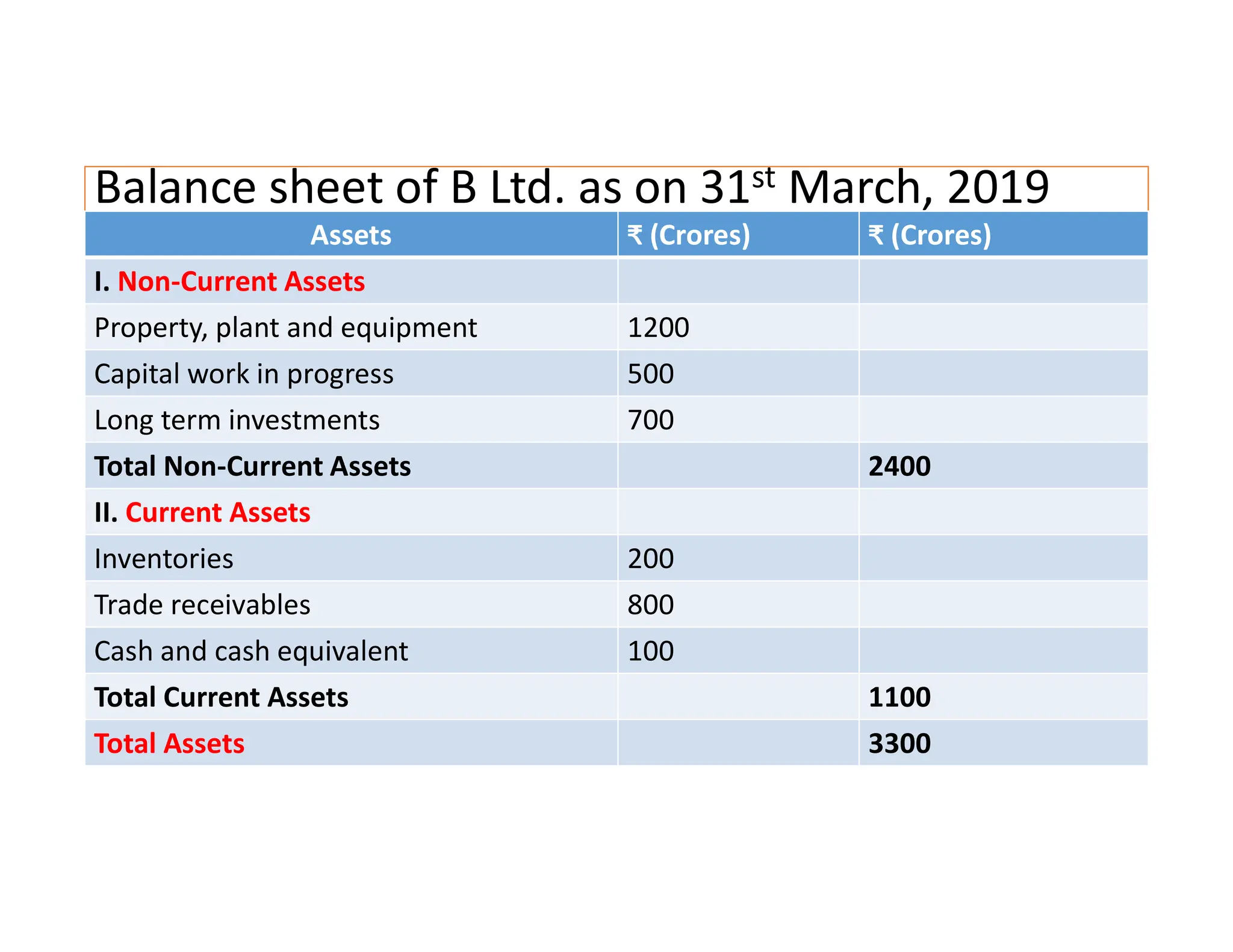

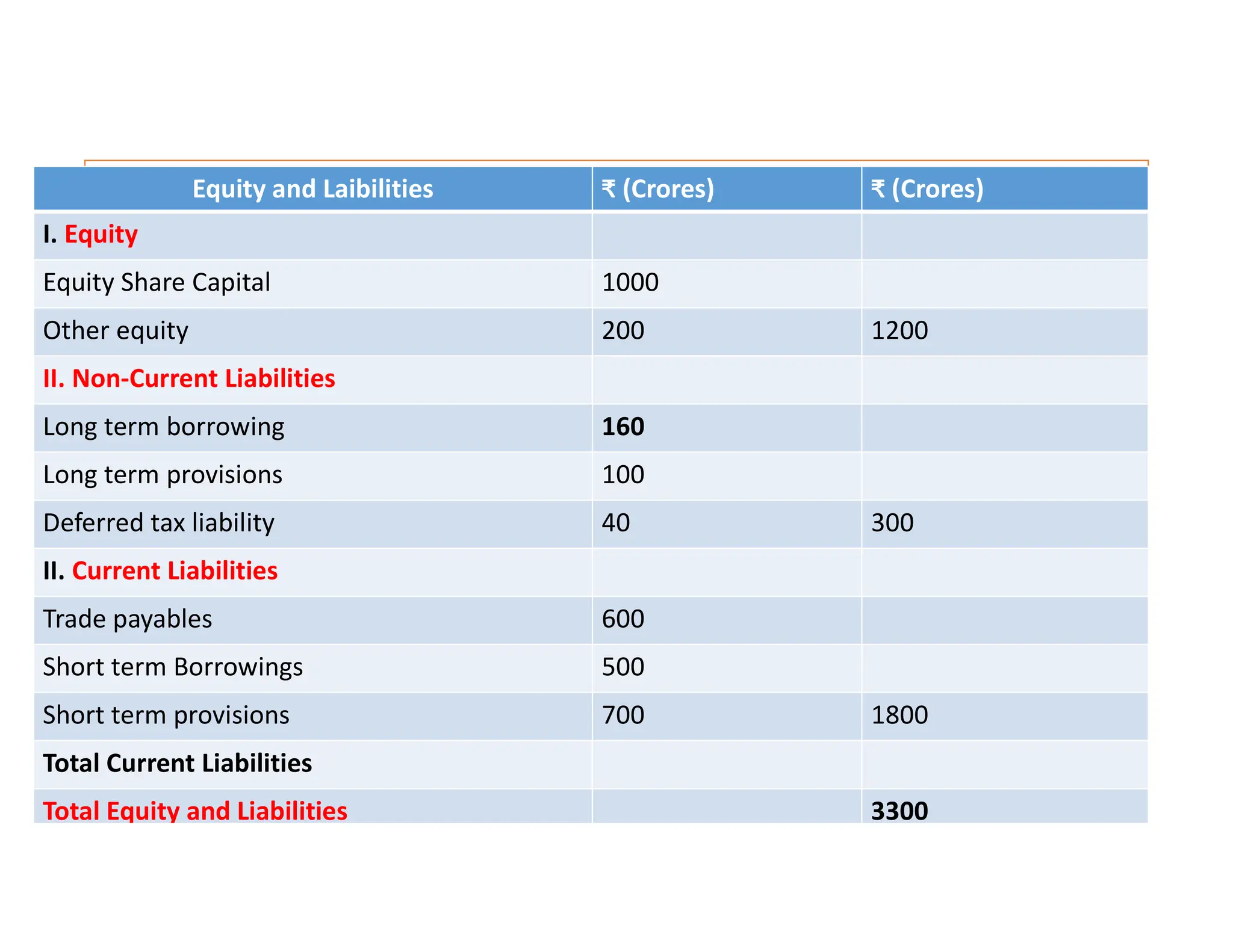

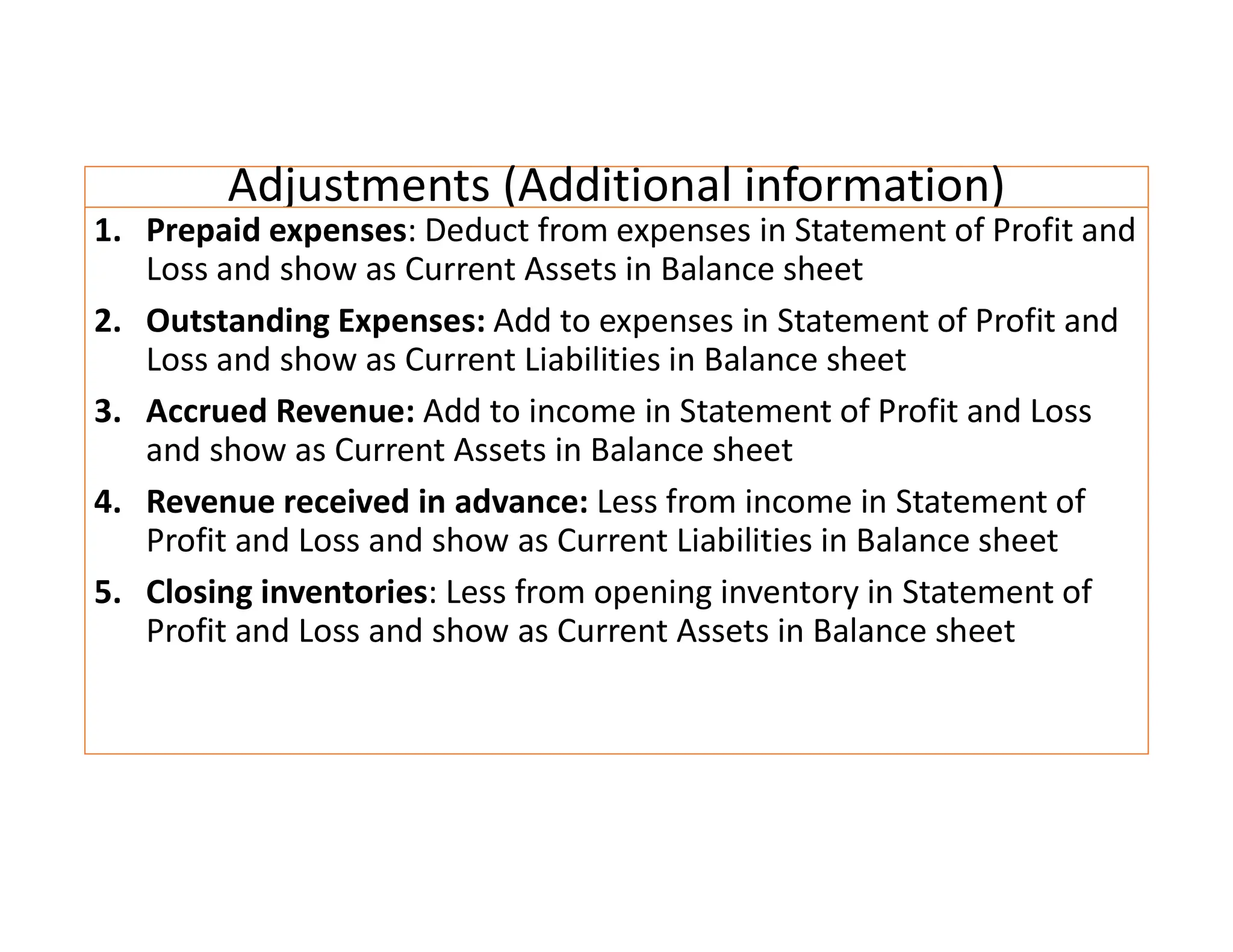

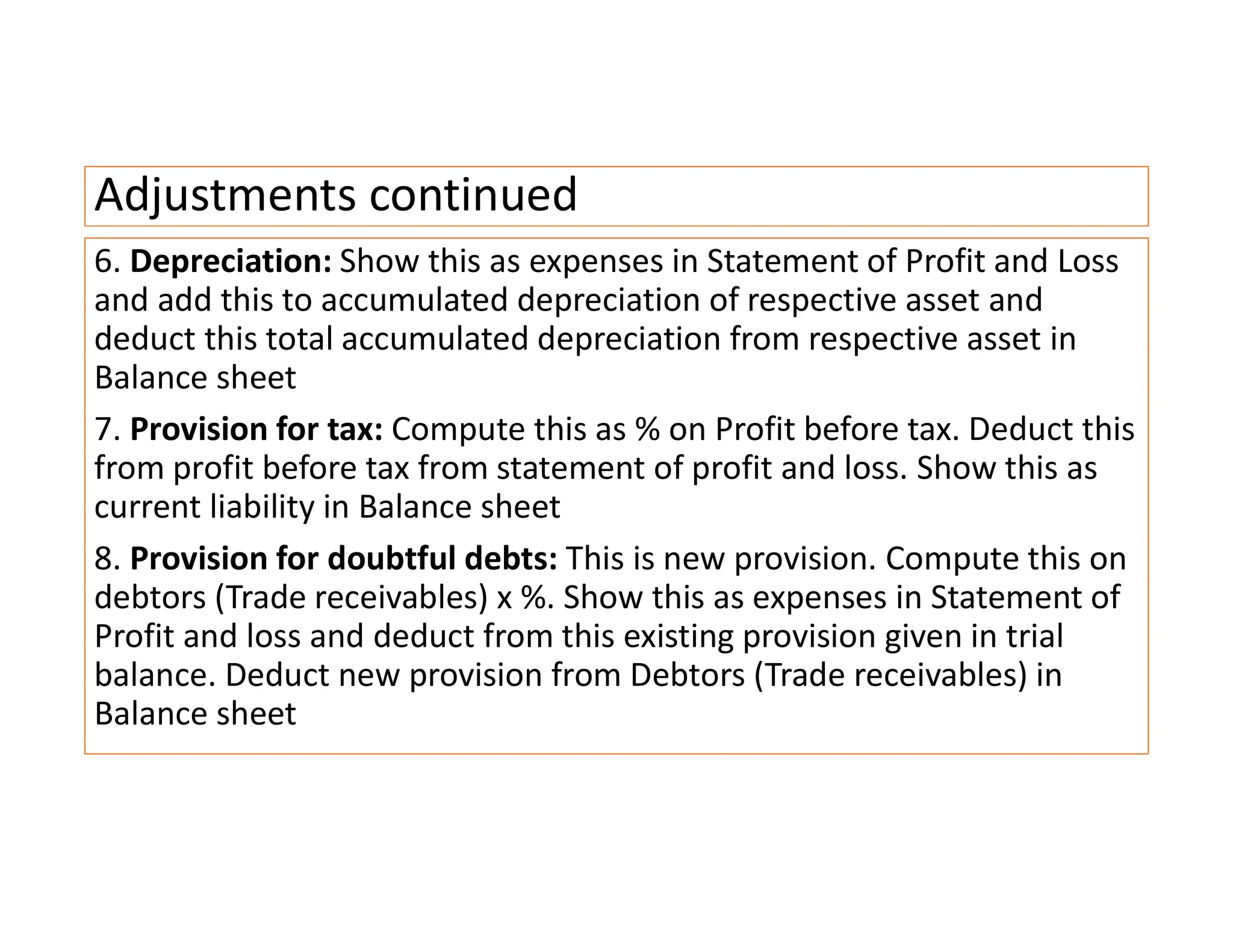

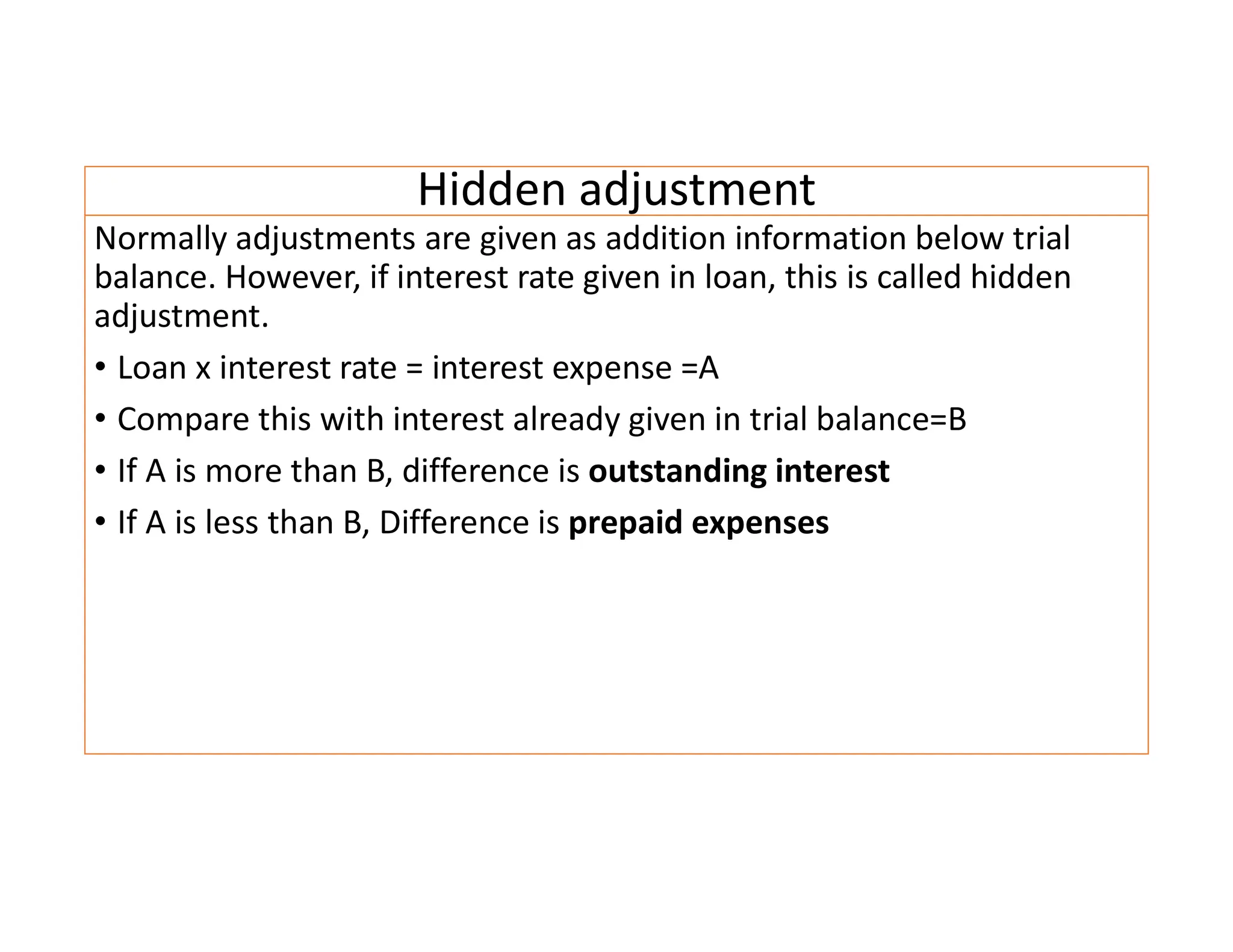

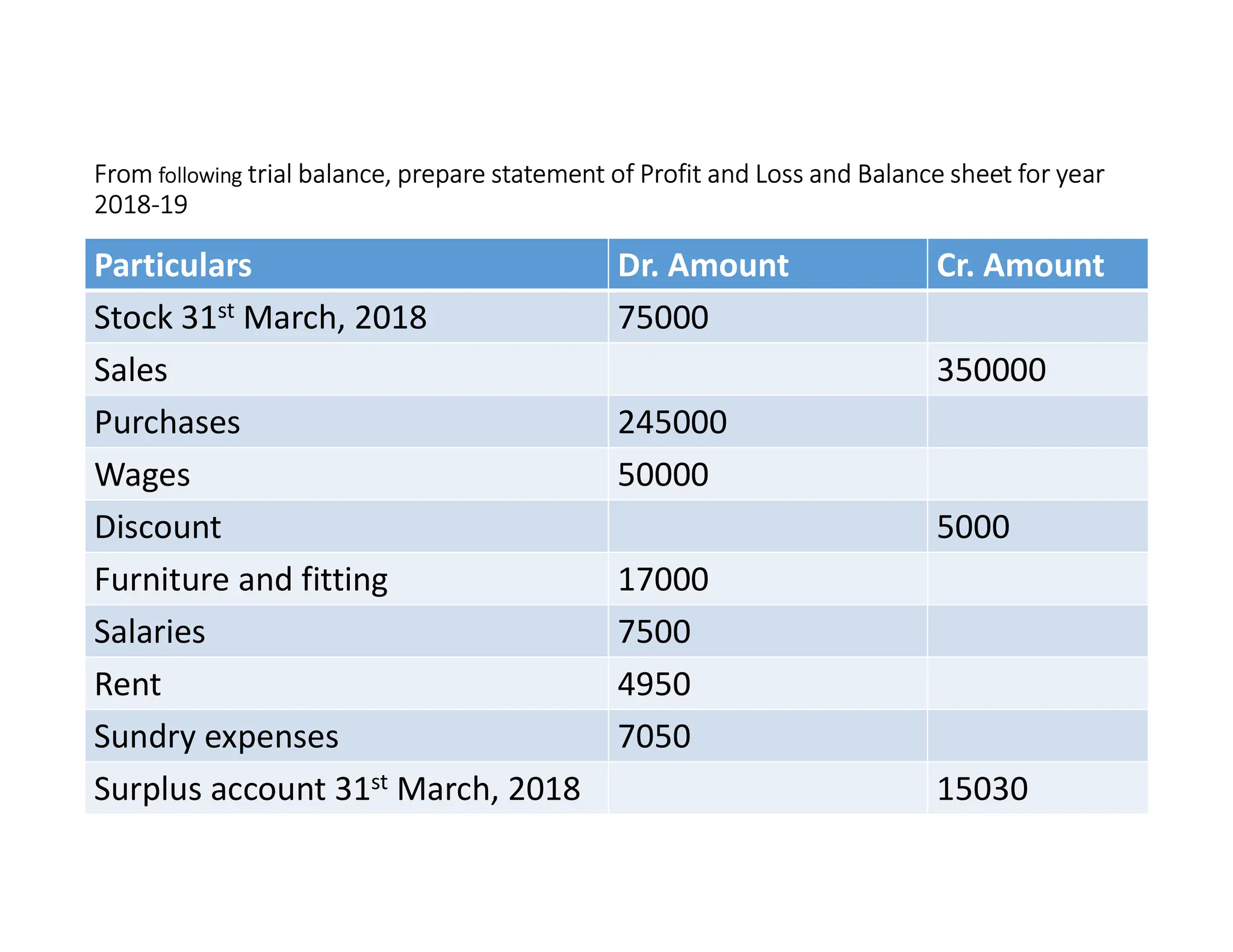

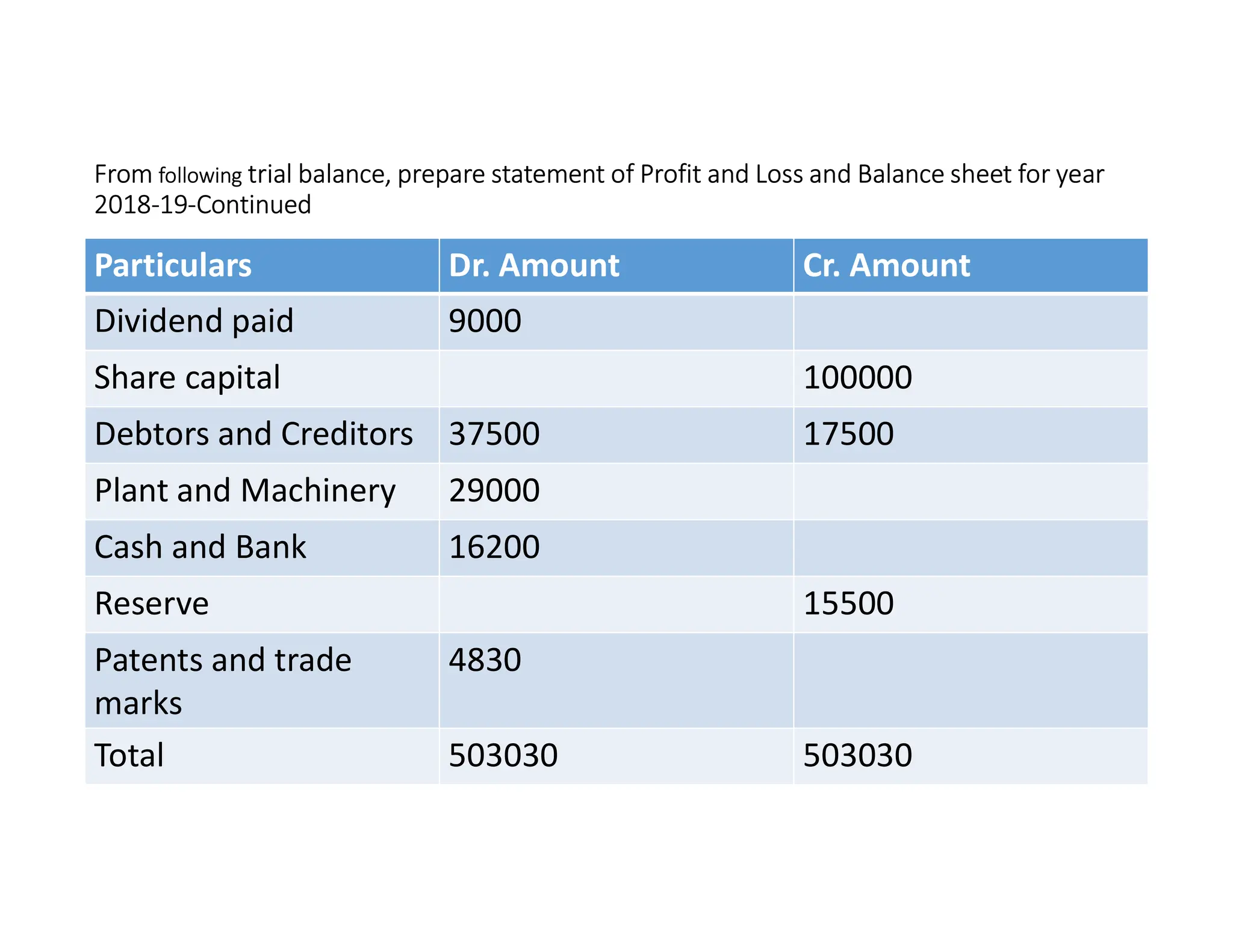

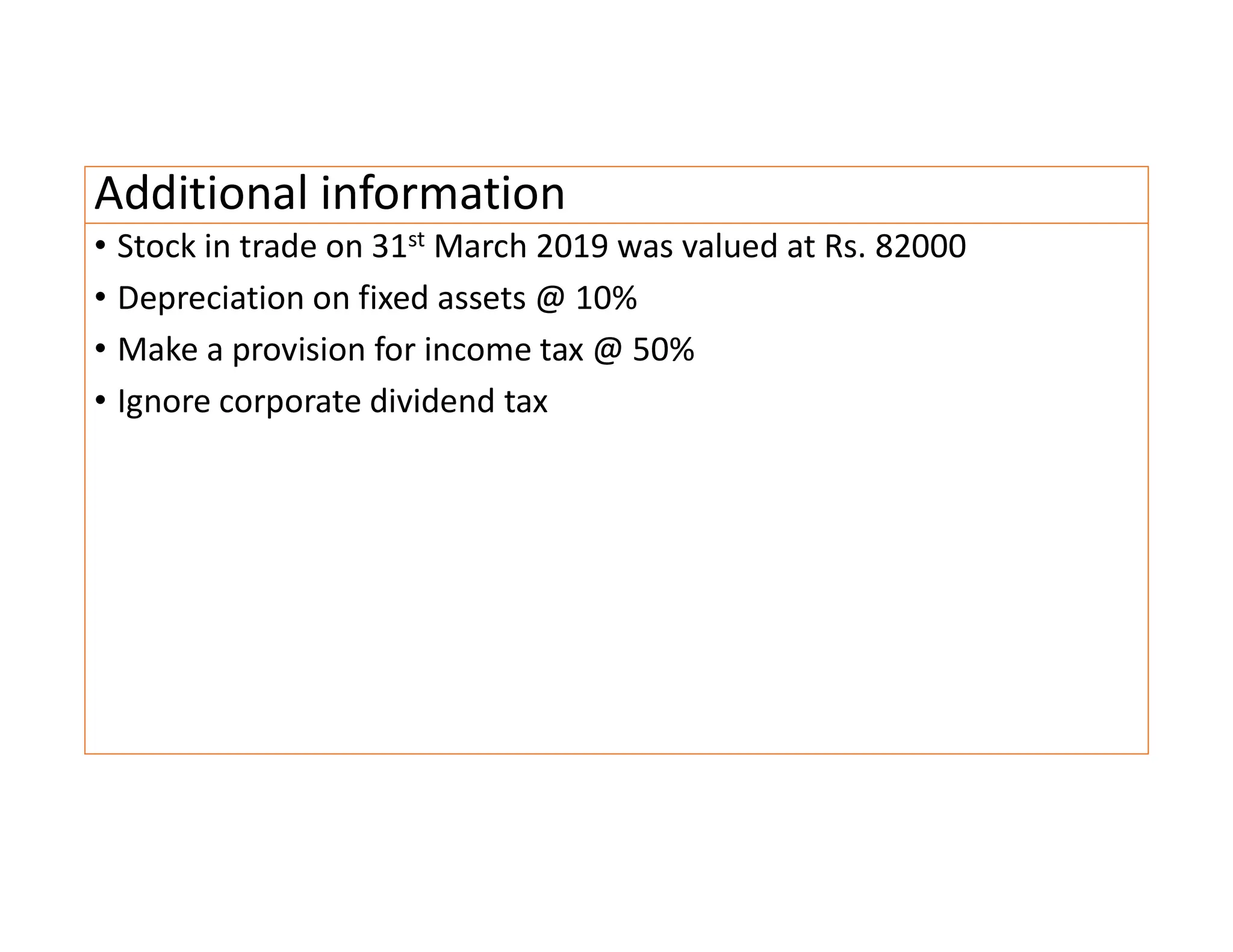

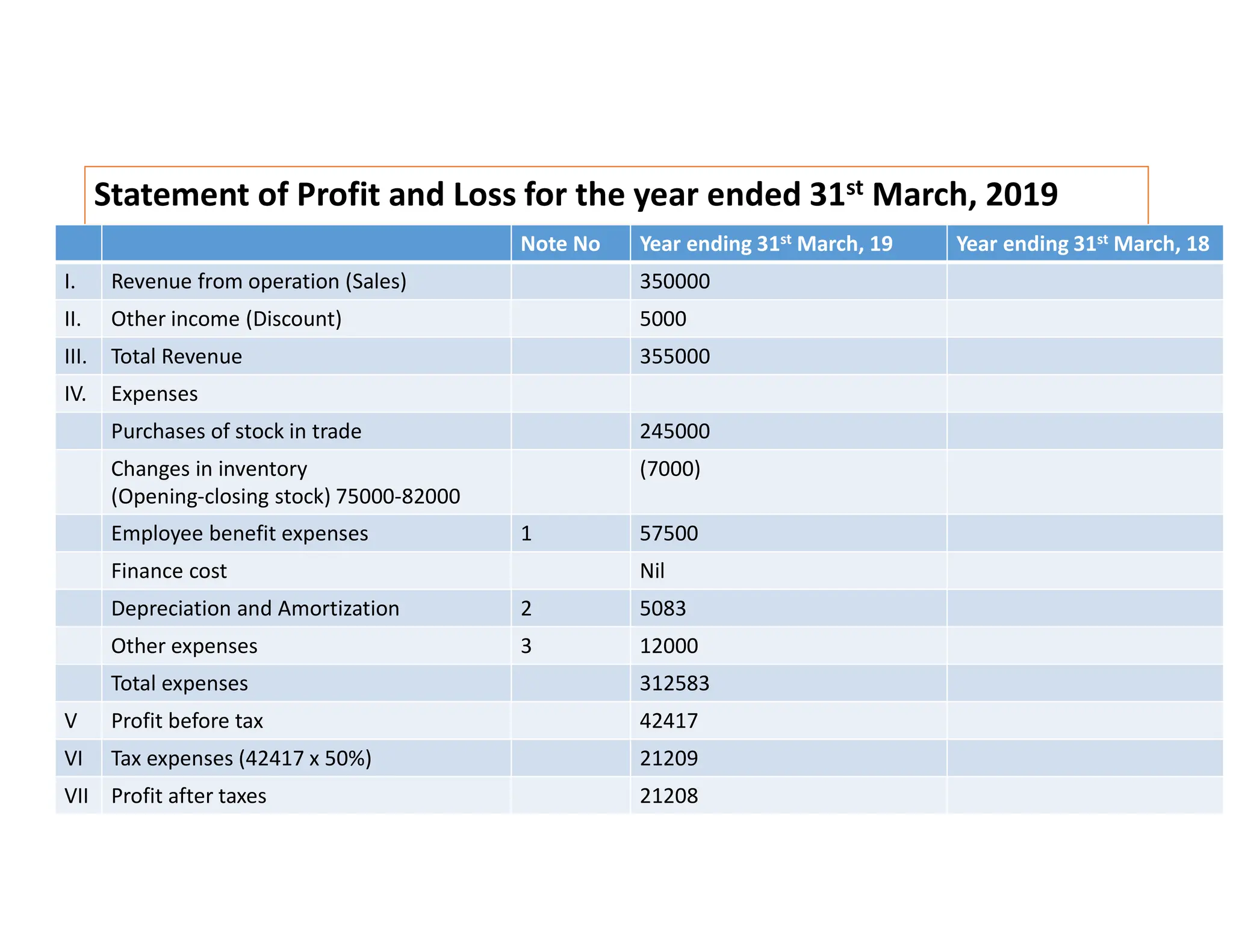

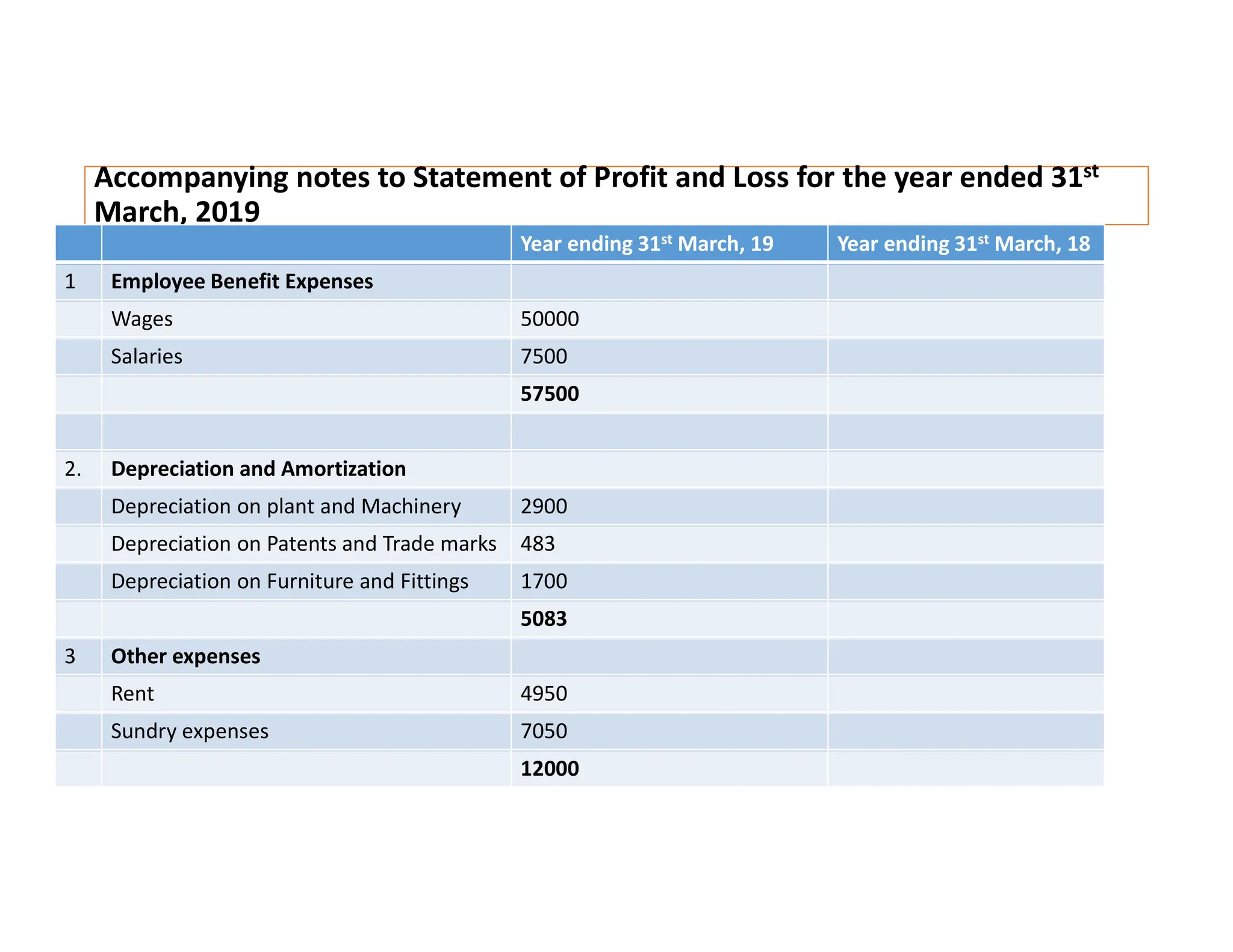

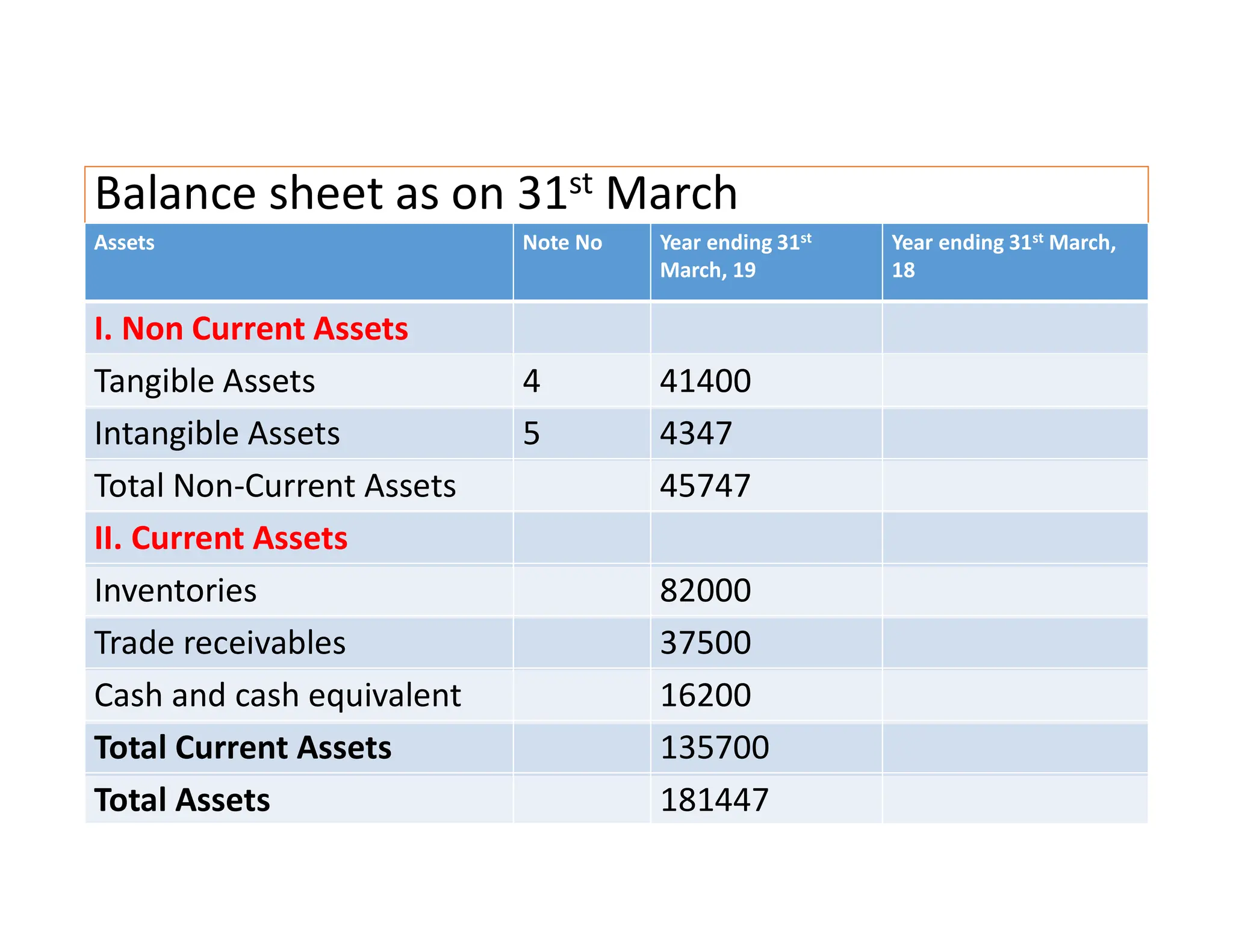

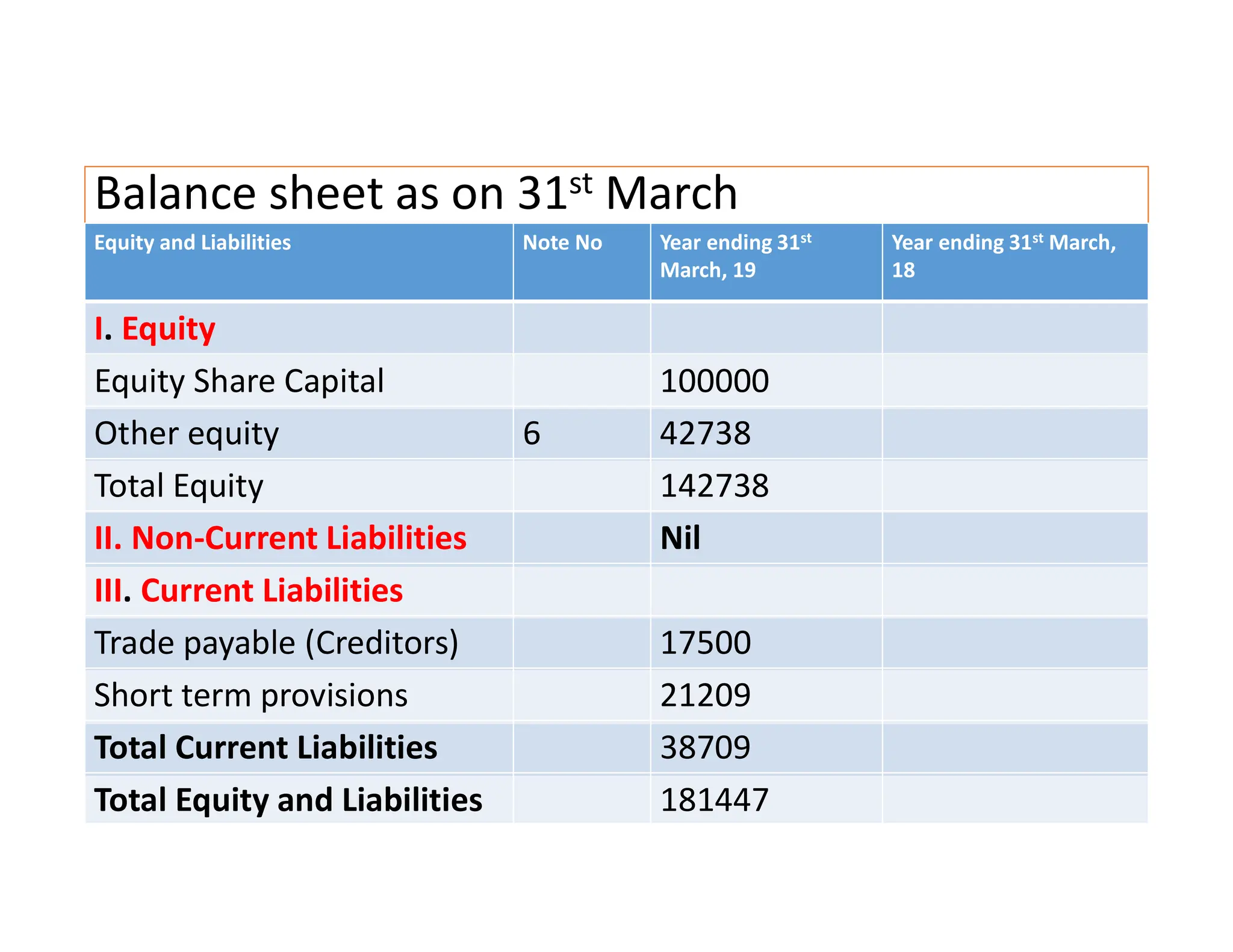

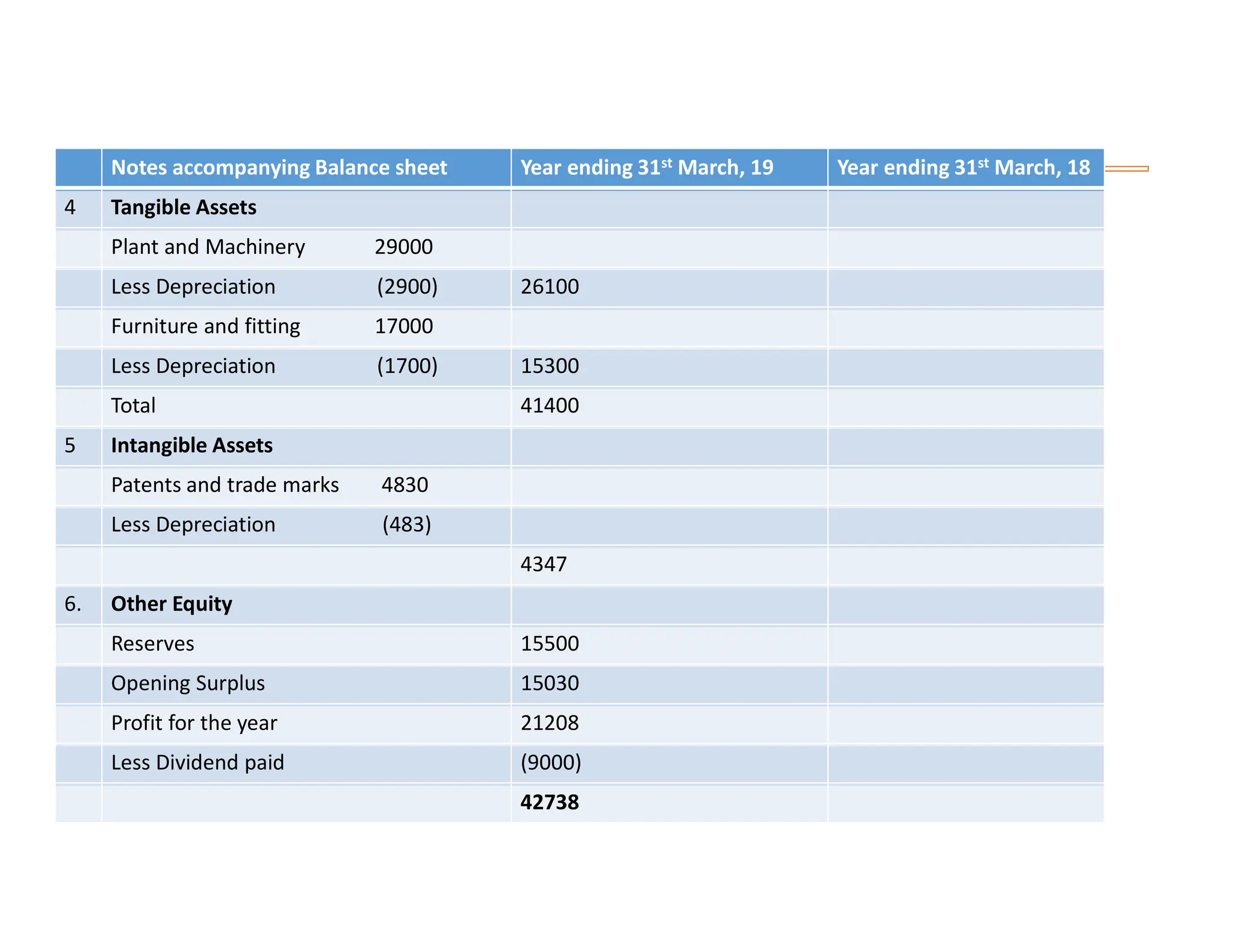

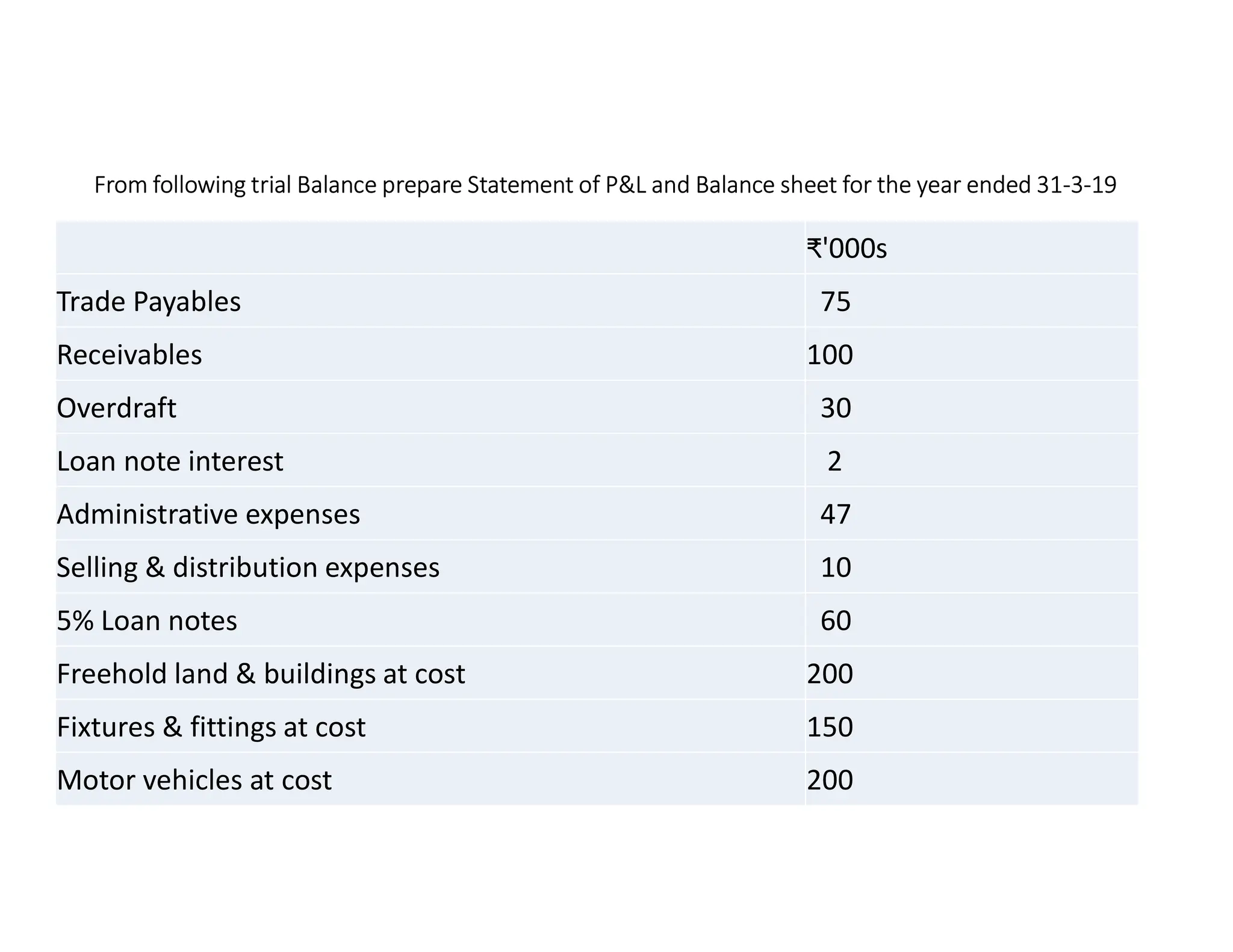

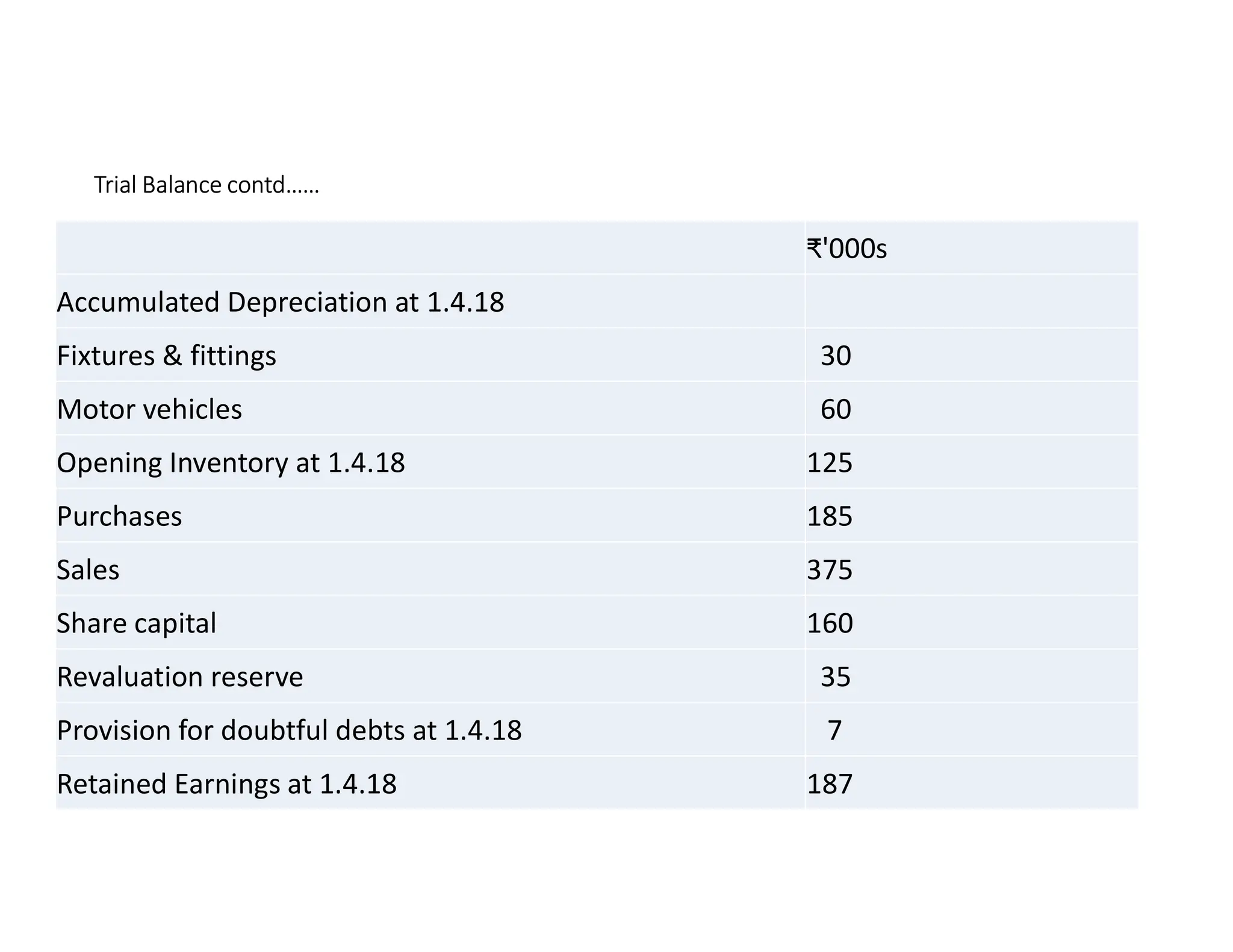

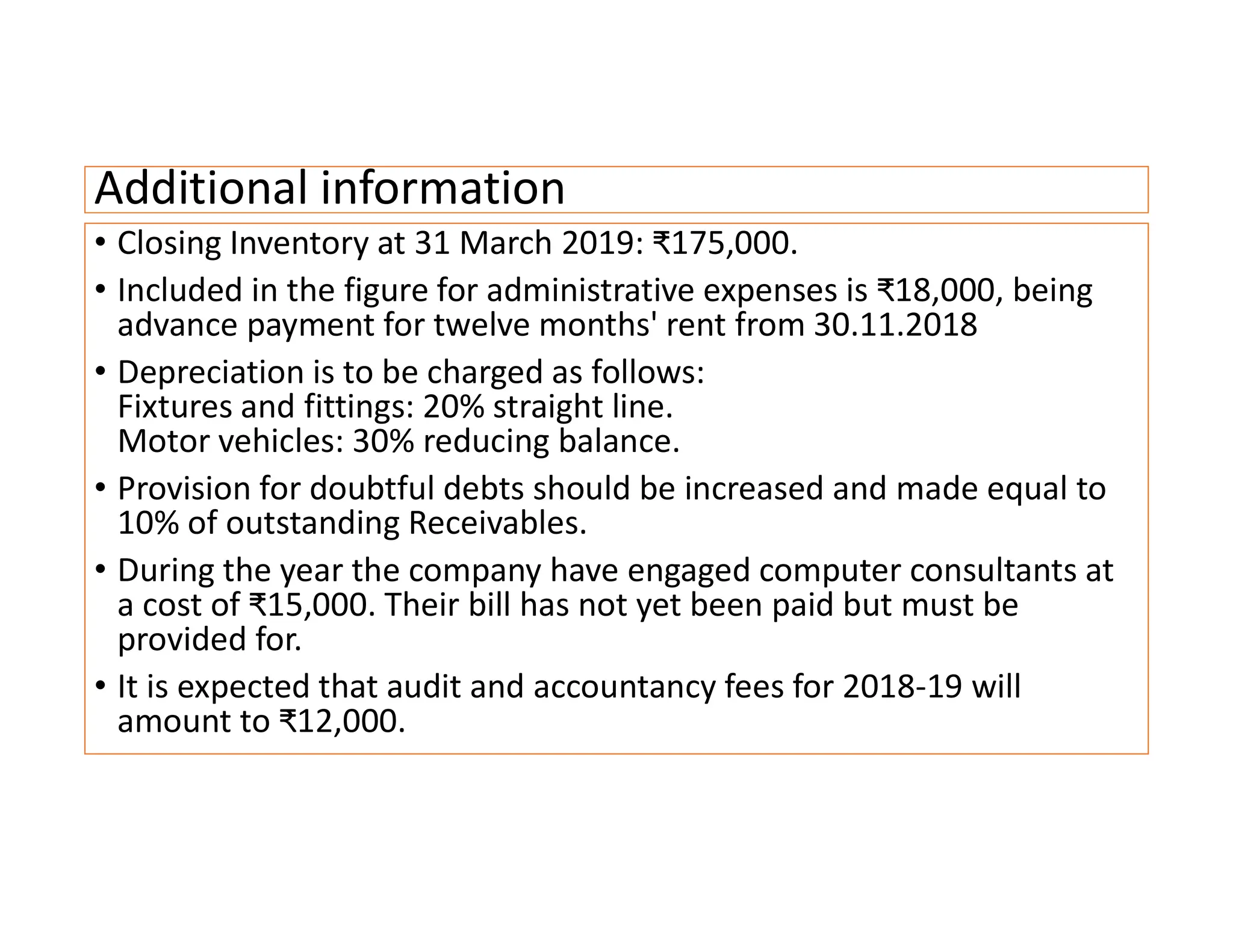

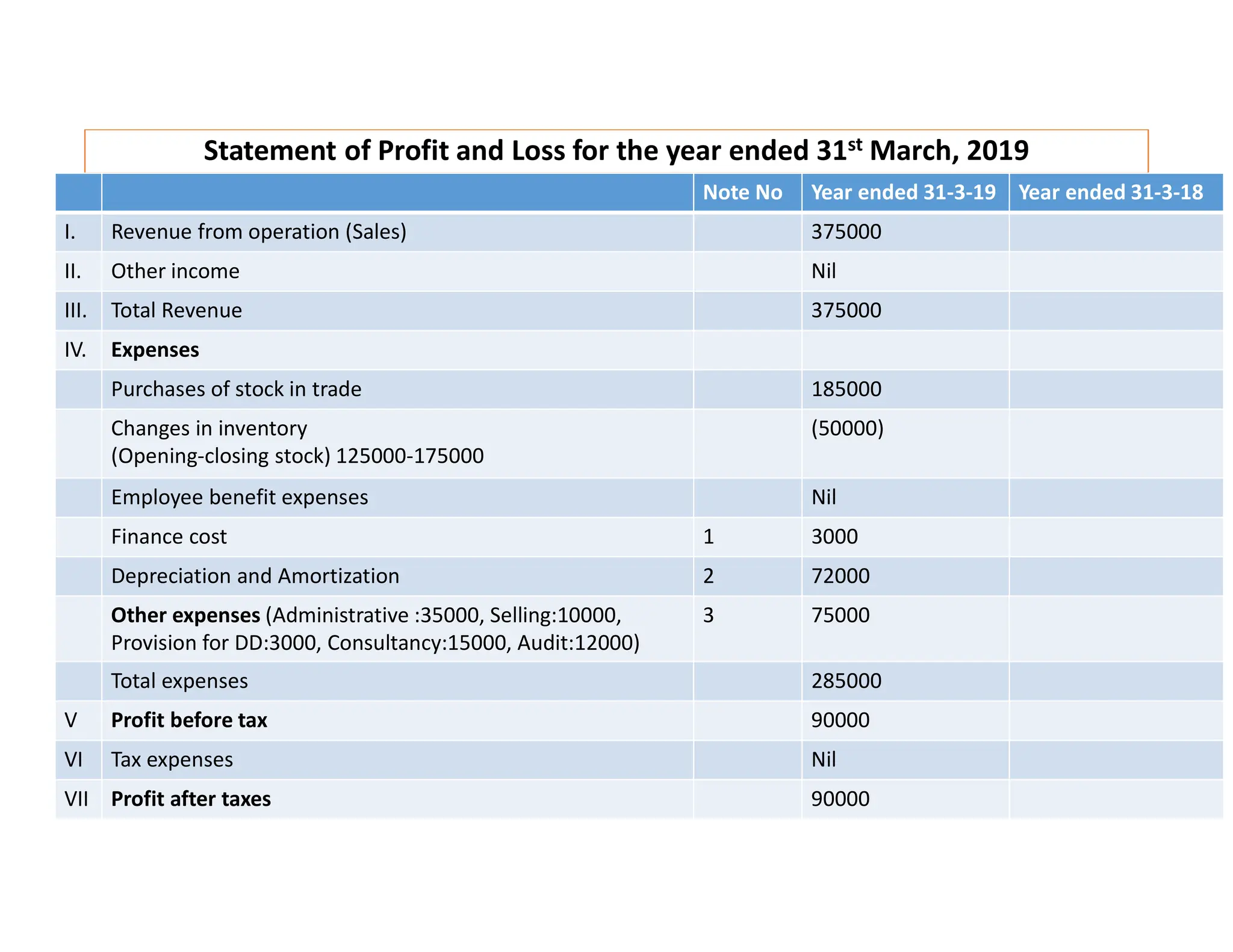

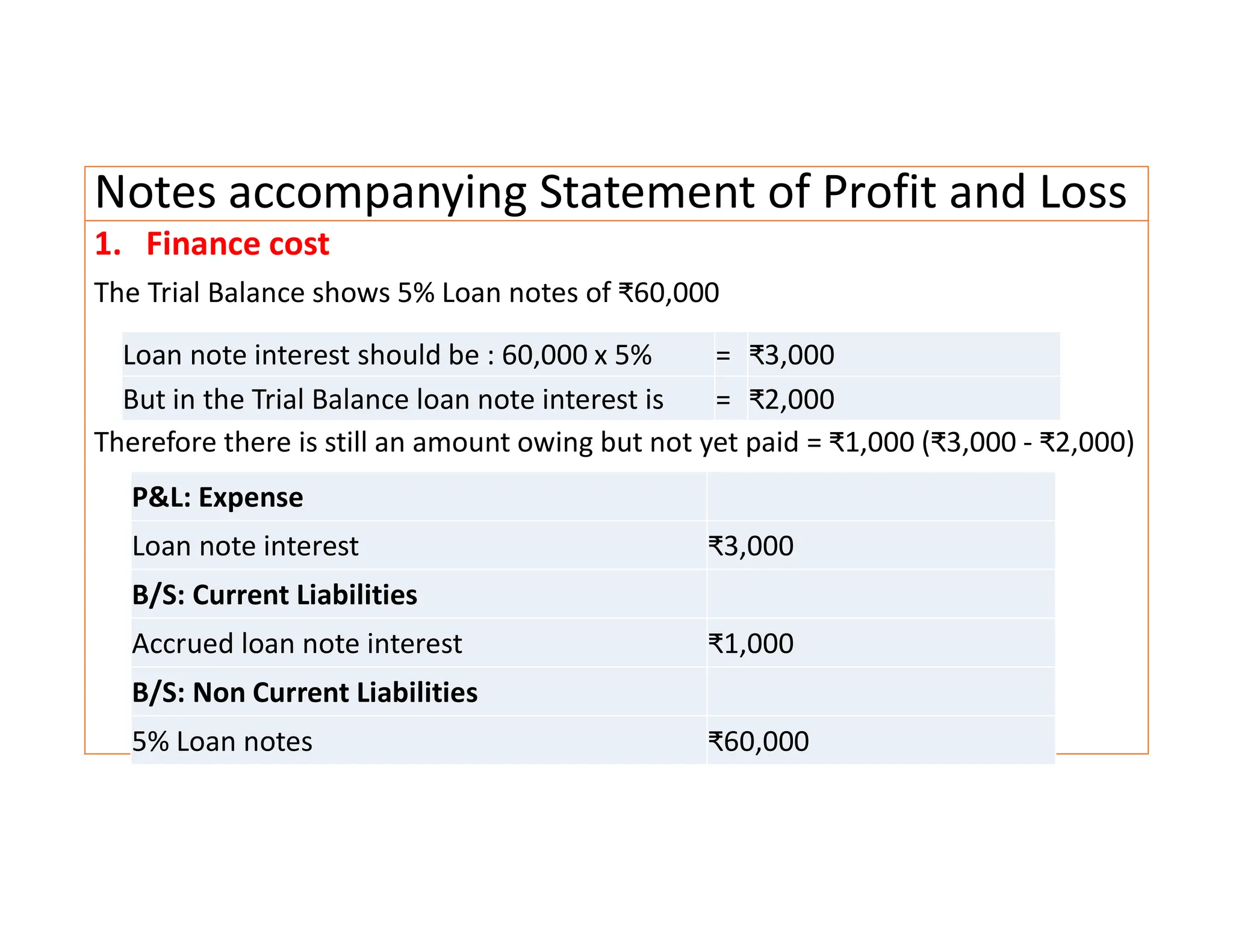

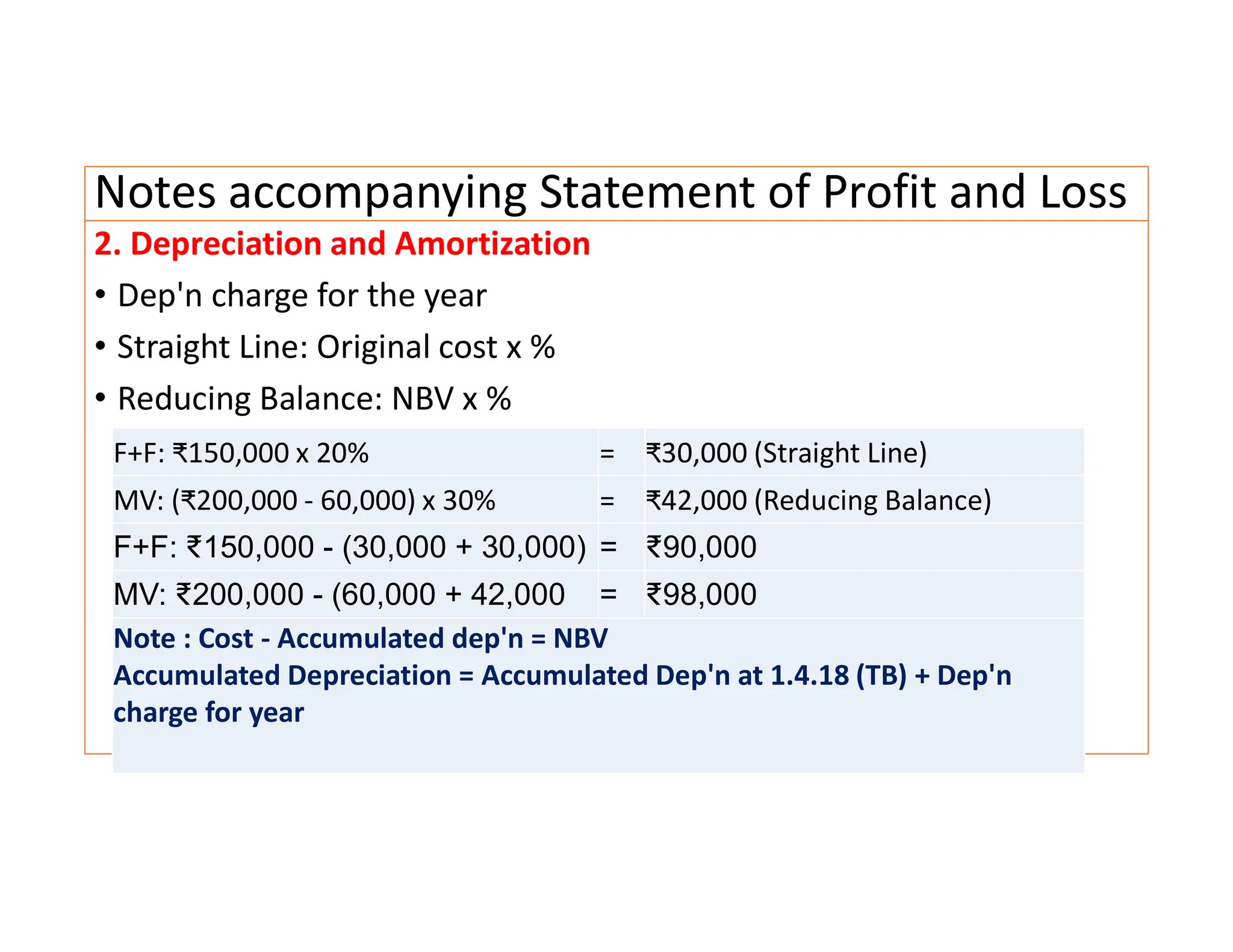

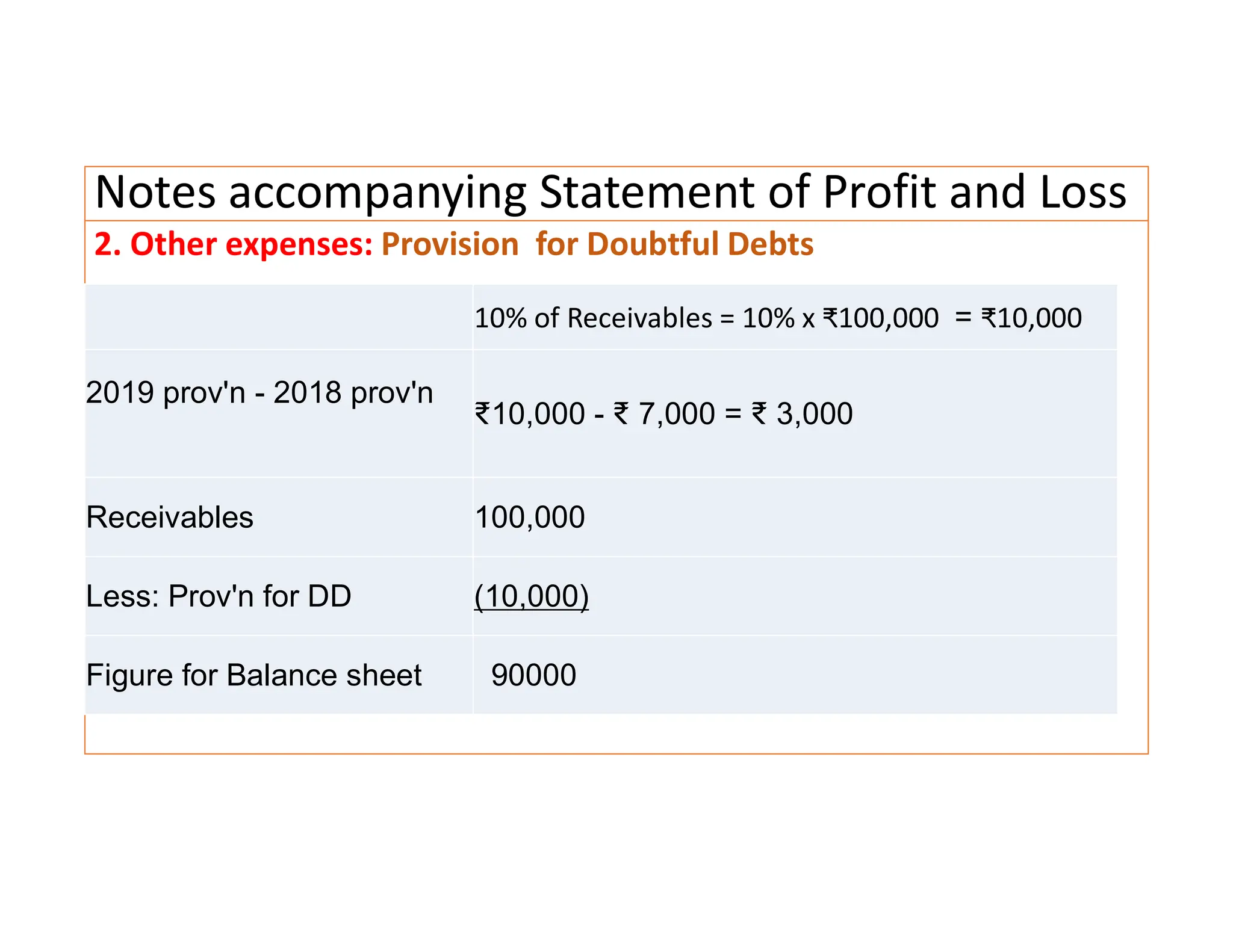

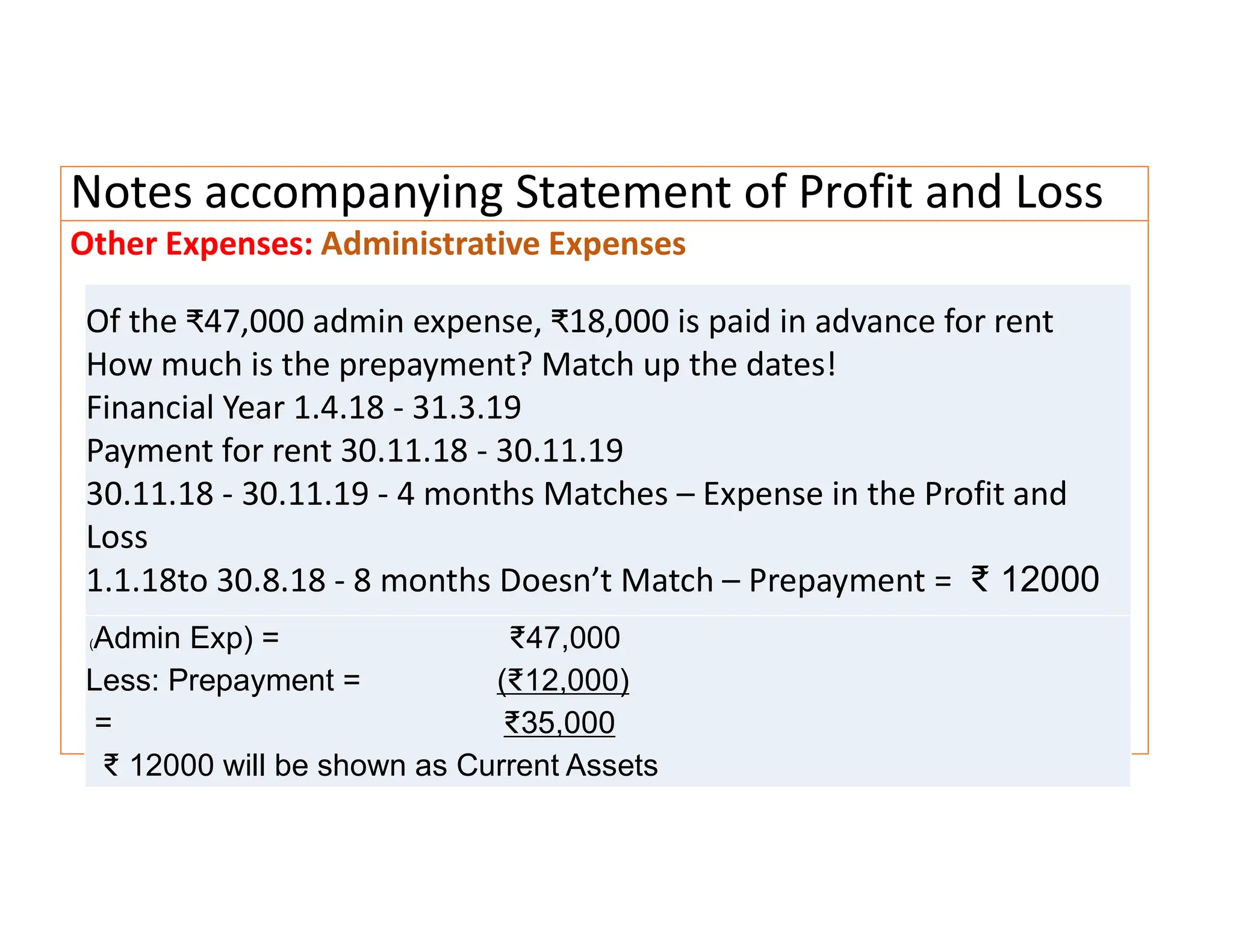

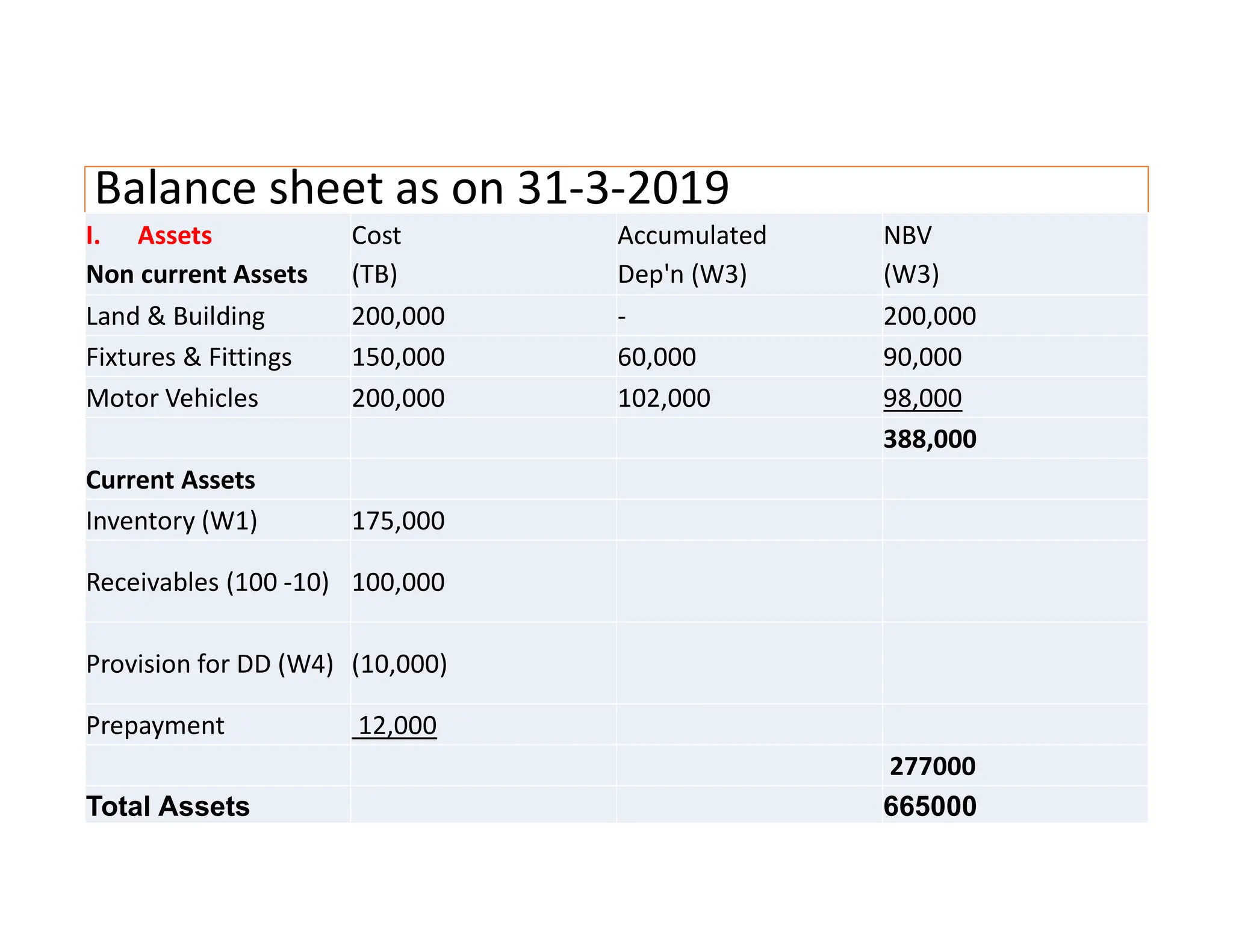

The document outlines financial accounting principles related to depreciation, including its definition, causes, and effects on financial statements. It's divided into methods of depreciation such as straight line and diminishing balance, providing examples and calculations for each. Additionally, it discusses the treatment of depreciation in profit and loss statements, and introduces concepts like deferred tax, current tax, and various measures of profit.