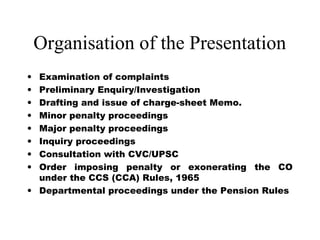

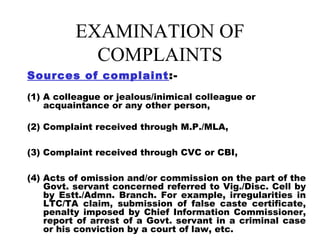

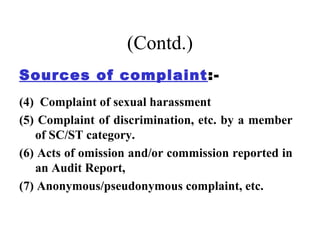

1) The document outlines the steps for conducting a departmental inquiry into employee misconduct, including examining complaints, preliminary investigation, drafting charge sheets, minor and major penalty proceedings, inquiry proceedings, and issuing final orders.

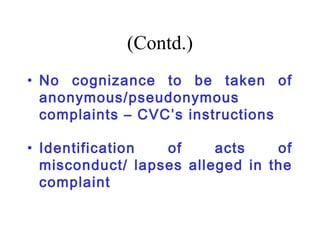

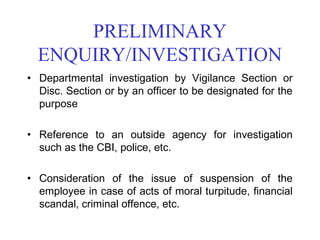

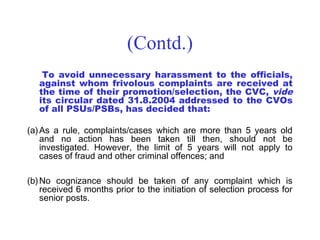

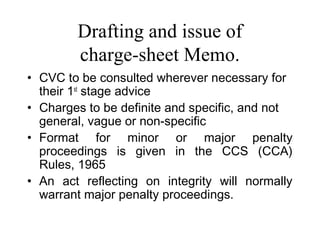

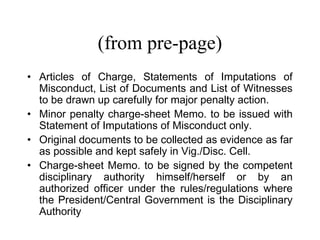

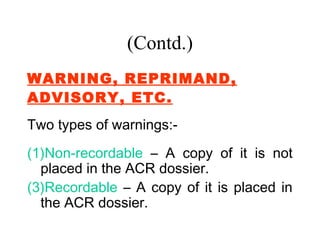

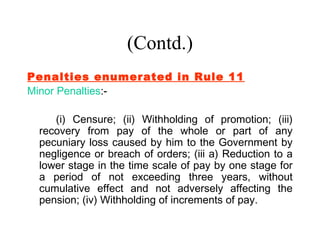

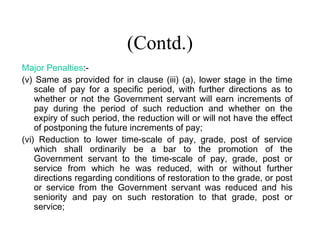

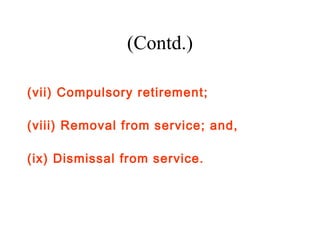

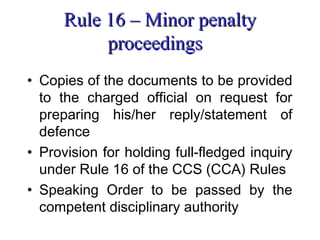

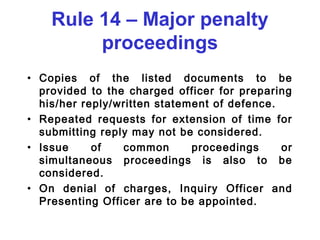

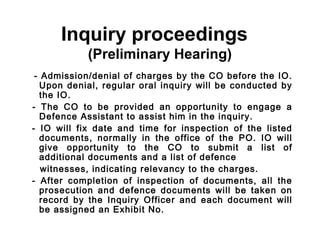

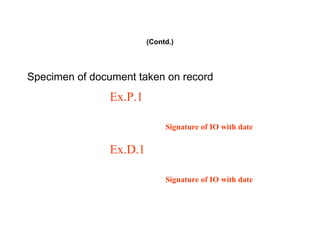

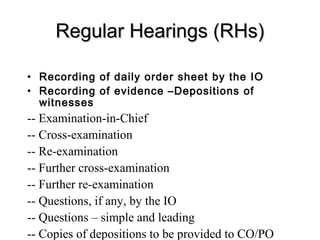

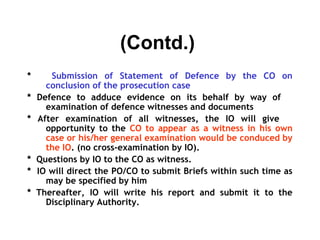

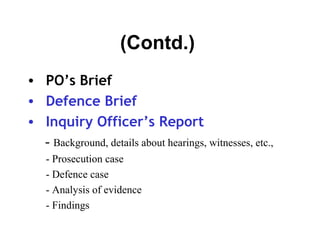

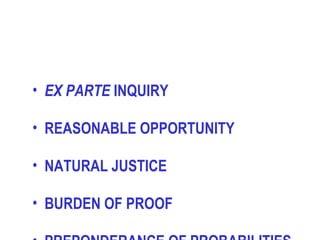

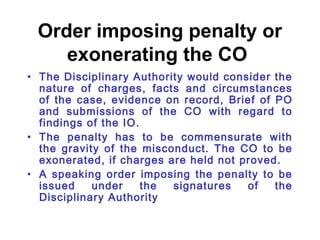

2) Key parts of the process include identifying the alleged misconduct, investigating the complaints, drafting specific charges, providing employees opportunities to respond to charges, conducting inquiries where employees deny charges, and imposing penalties or exoneration based on evidence.

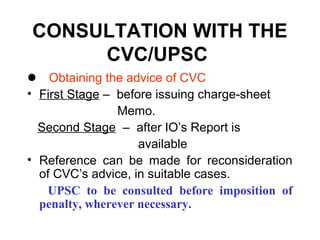

3) Consultation with oversight agencies like the Central Vigilance Commission and Union Public Service Commission is also required at various stages of the process.