1. Salary is remuneration received periodically for services rendered as a result of an employment contract. TDS or tax deducted at source is income tax deducted from salary payments.

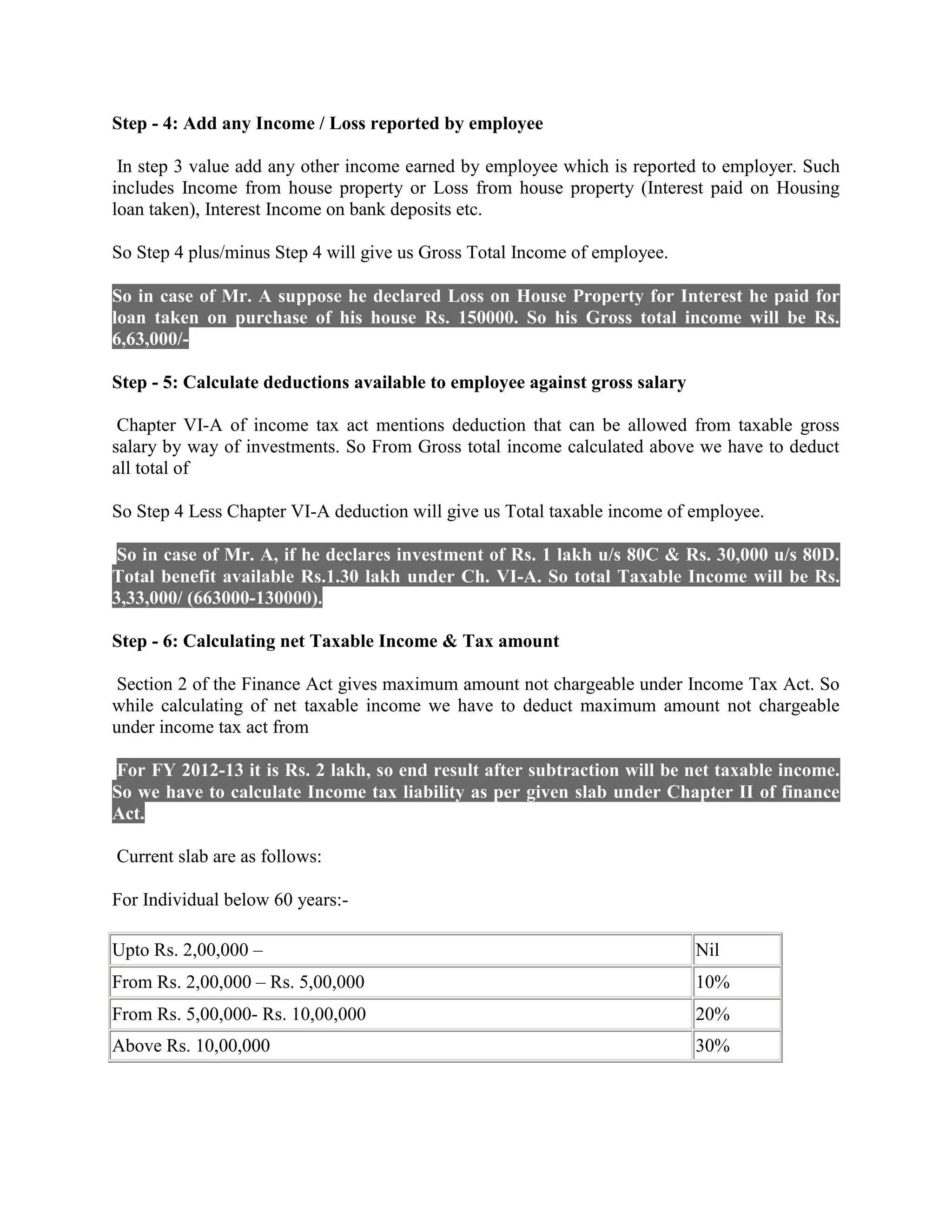

2. To calculate TDS, the total gross salary is determined, exemptions are subtracted to get the taxable salary, and annual taxable income is projected. Deductions are then subtracted to get the total taxable income.

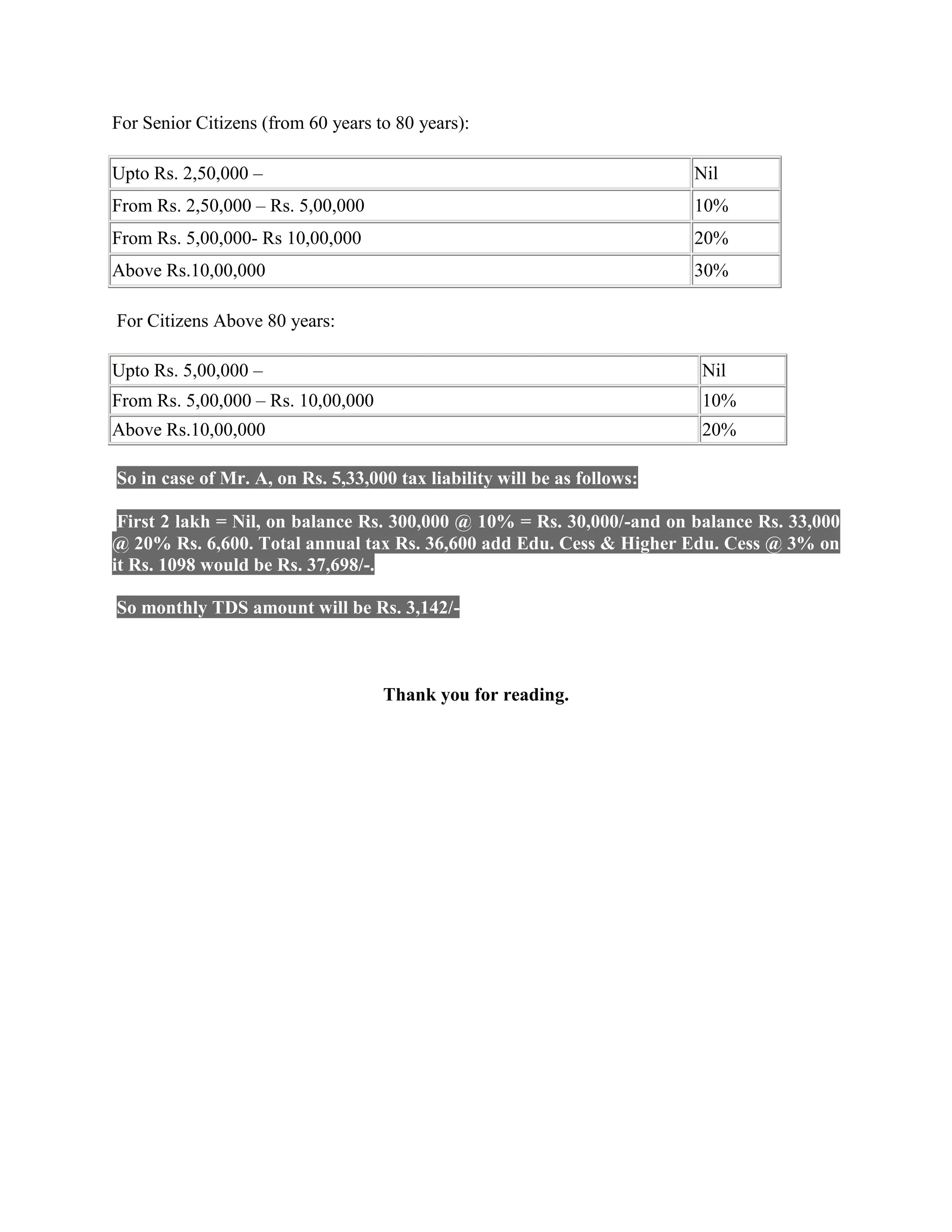

3. Based on the tax slabs, the annual tax liability is calculated. The monthly TDS amount is the annual tax divided by 12 months.