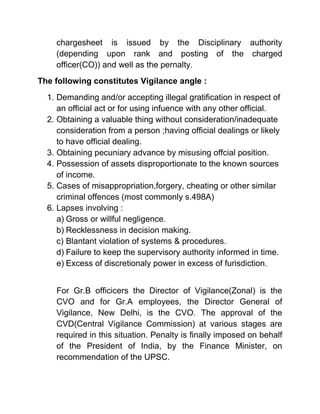

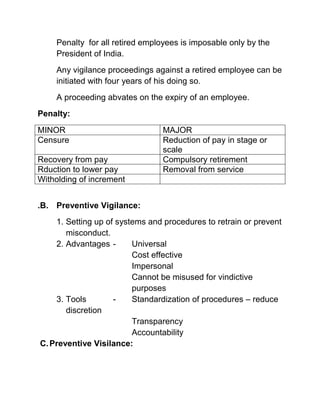

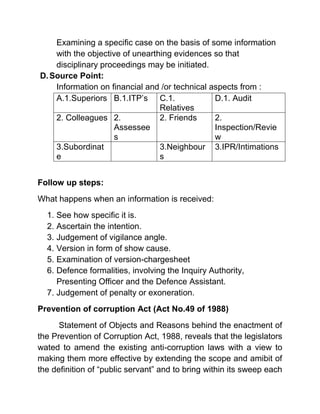

The document outlines the Central Civil Service Conduct Rules that impose restrictions on government employees in India. It provides a list of dos and don'ts for employees, which include maintaining integrity, devotion to duty, political neutrality, and prohibitions against accepting gifts or hospitality. It also describes aspects of vigilance for enforcing standards of conduct, including the structure for investigating cases, what constitutes a vigilance angle, penalties for misconduct, and preventative vigilance through transparency and accountability measures.