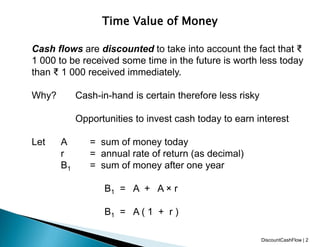

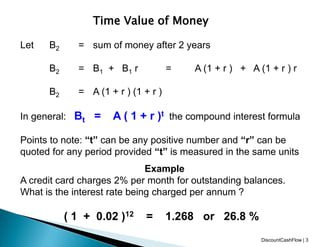

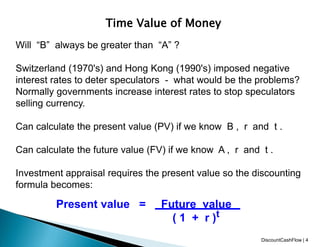

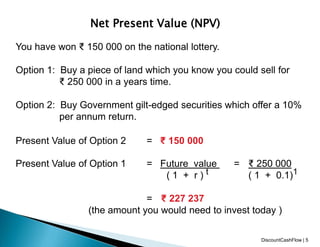

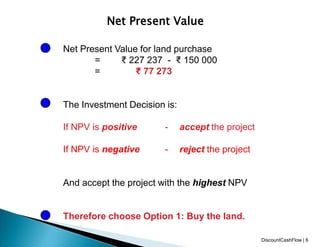

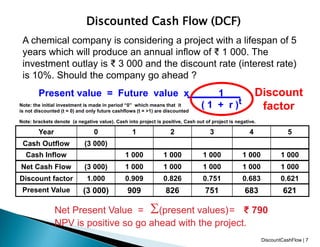

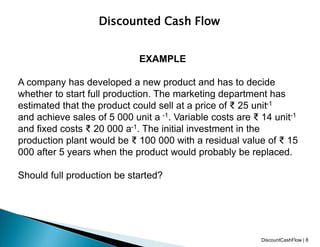

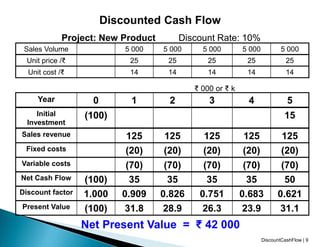

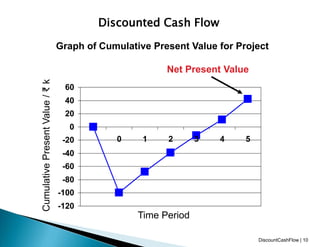

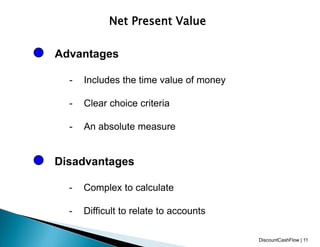

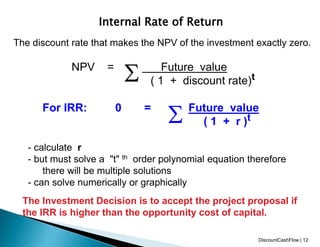

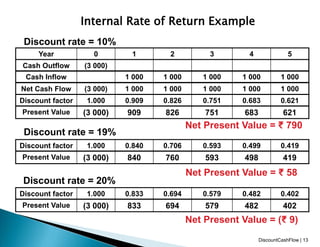

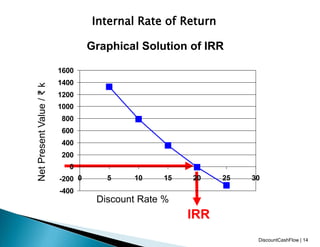

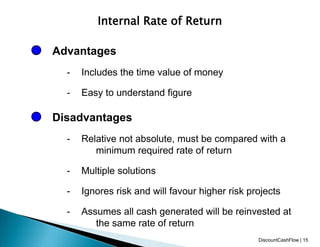

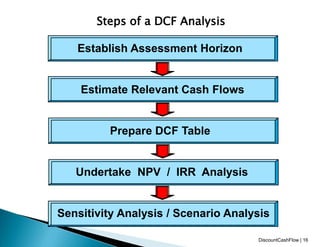

This document discusses techniques for discounted cash flow analysis including net present value (NPV), internal rate of return (IRR), and time value of money. It provides examples of calculating NPV and IRR for projects and investment decisions. It also compares the advantages and disadvantages of NPV and IRR as metrics for investment evaluation.