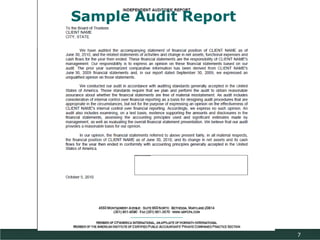

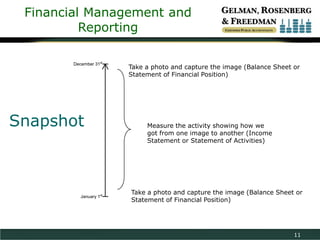

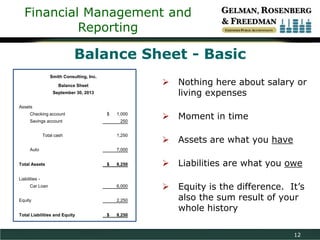

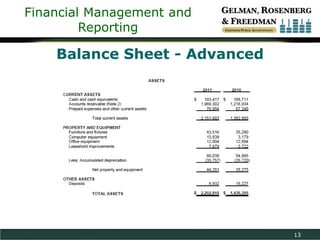

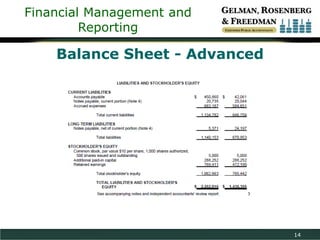

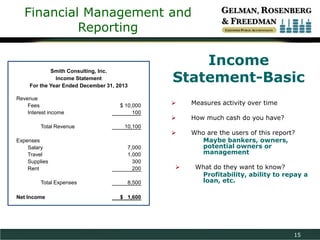

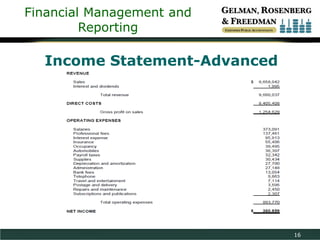

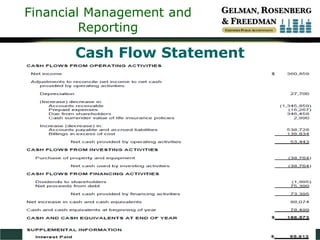

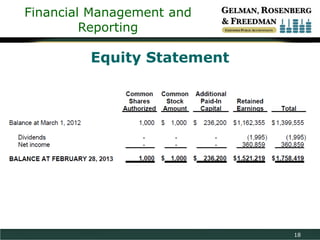

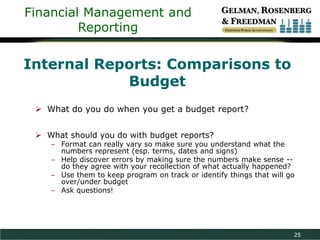

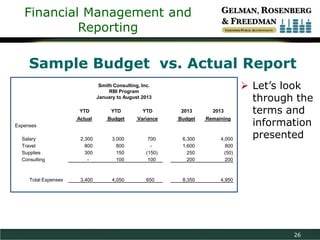

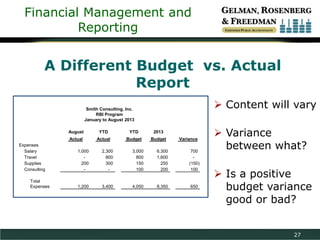

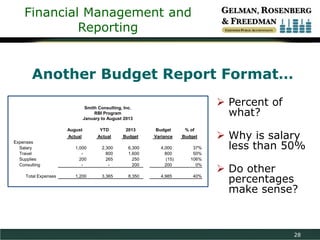

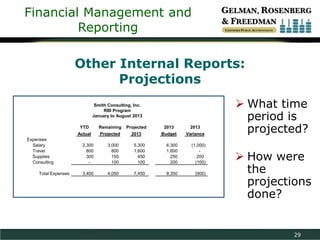

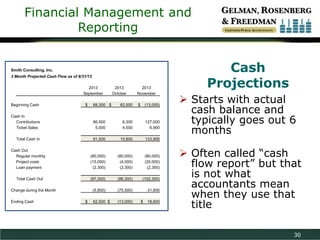

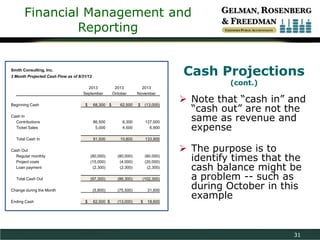

This document provides an introduction to financial management and reporting presented by John Pace and Steven Lyons of Gelman, Rosenberg & Freedman CPAs. It discusses key financial statements including the balance sheet, income statement, cash flow statement, and equity statement. It also covers common internal reports such as budgets and cash flow projections. The presentation provides examples and explanations of financial reporting concepts and terminology.