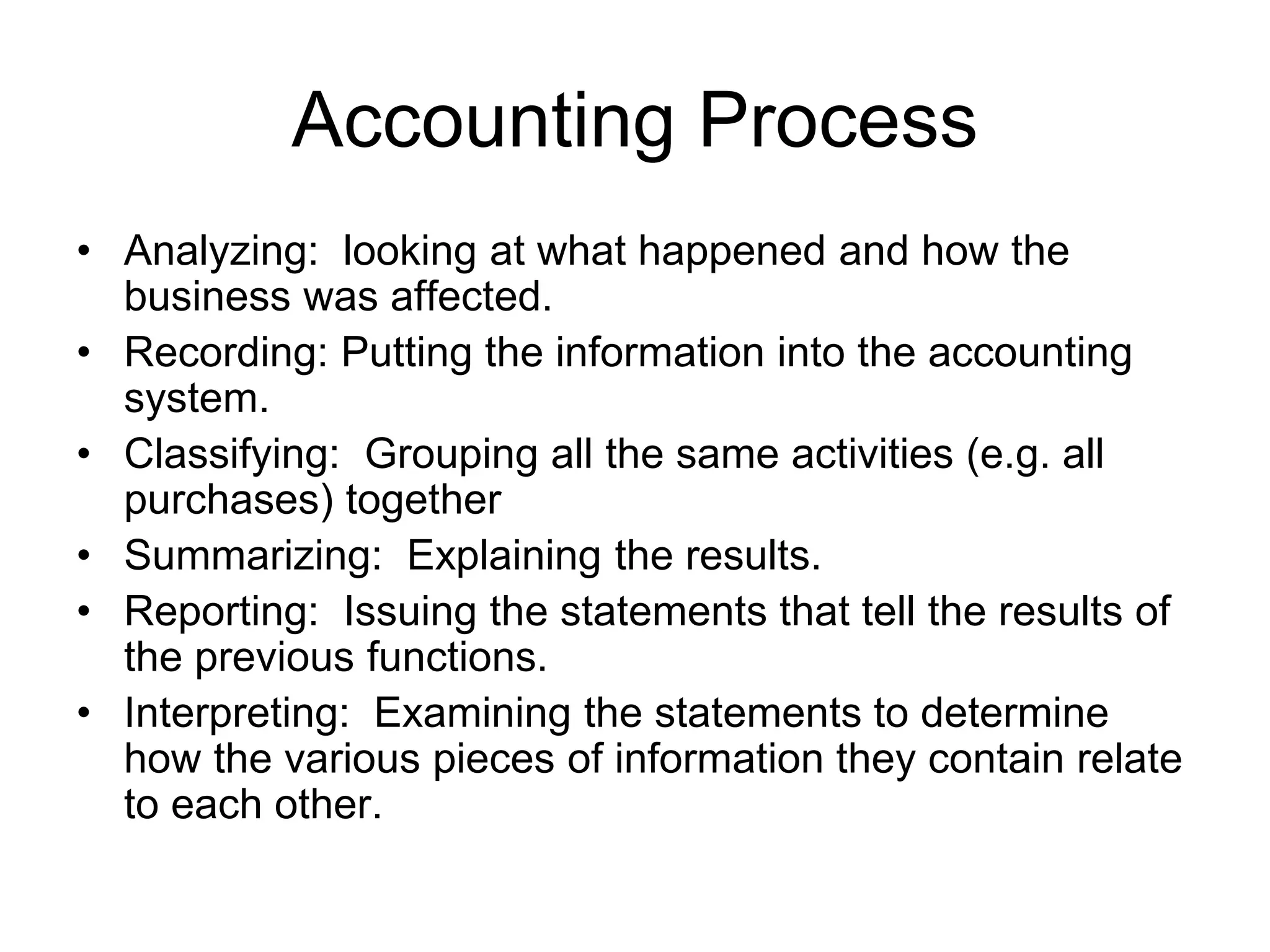

This document provides an introduction to financial management for pharmacists. It discusses the importance of financial management skills for pharmacy managers. The document outlines the objectives of understanding financial statements, goals of financial management, accounting and bookkeeping processes, and limitations of financial information. It also describes different types of business organizations like sole proprietorships, partnerships, and corporations.