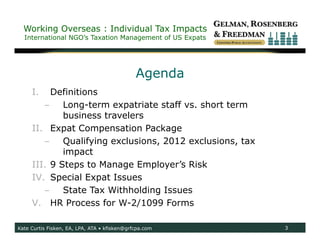

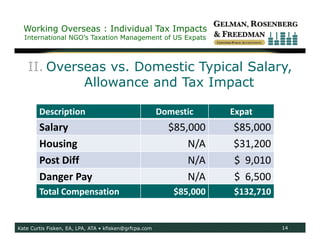

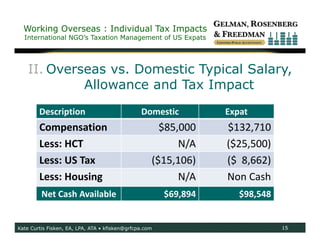

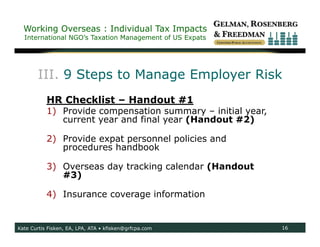

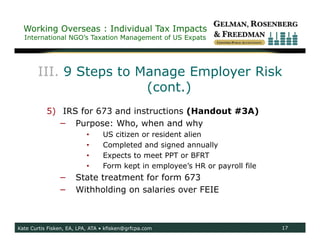

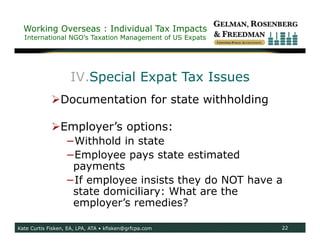

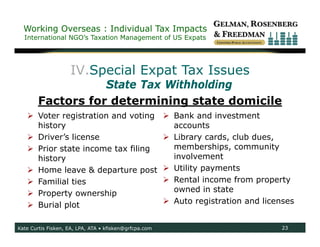

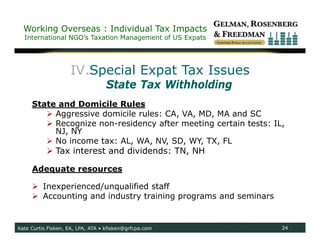

This document summarizes a session on working overseas and individual tax impacts. Kate Fisken, an international tax specialist, led the session. She discussed key definitions for long-term expatriates versus short-term business travelers. Fisken also covered qualifying for exclusions under the foreign earned income exclusion and foreign housing exclusion, and outlined the tax impacts of typical expatriate compensation packages compared to domestic salaries. The session provided steps for employers to manage tax risks and addressed special expatriate tax issues.