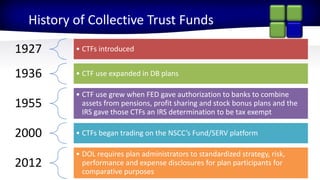

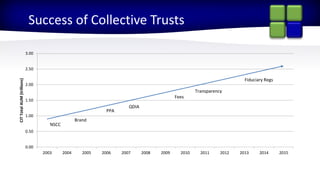

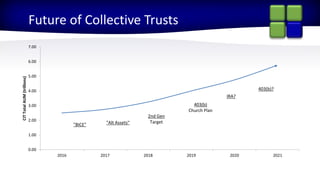

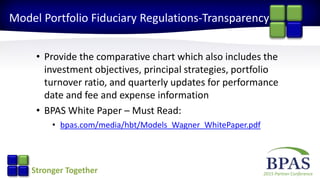

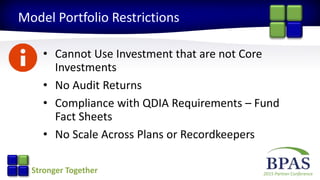

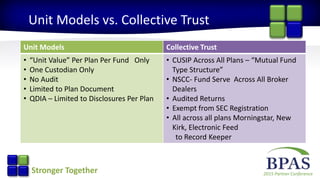

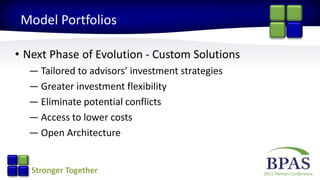

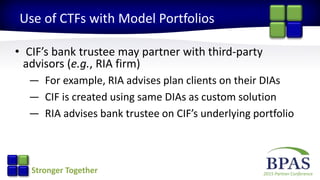

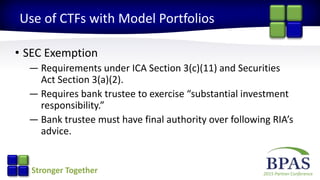

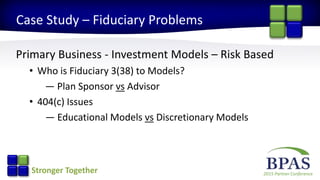

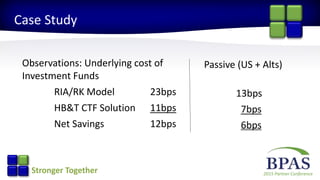

This document summarizes strategies for using collective investment trust funds (CITFs) to bring value to retirement plans and clients. It discusses the history and benefits of CITFs, opportunities in the CITF space including model portfolios and customized solutions, and how CITFs can be used in model portfolios and custom solutions. It also discusses the 2015 fiduciary regulations and their impact on transparency requirements for model portfolios.