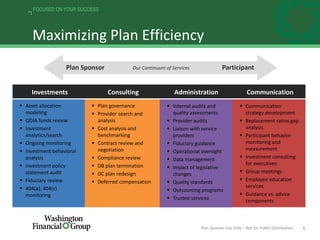

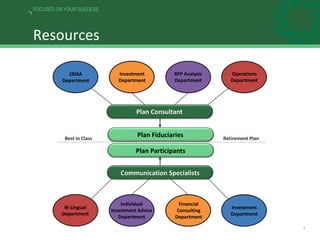

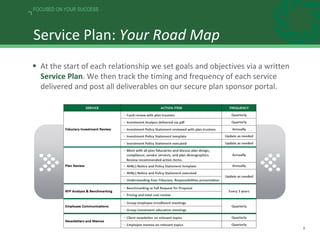

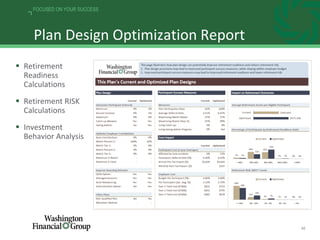

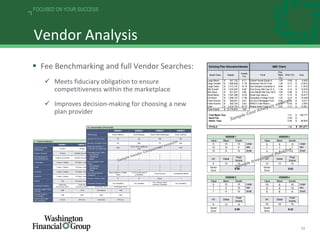

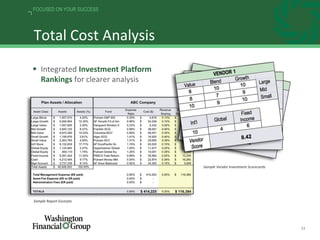

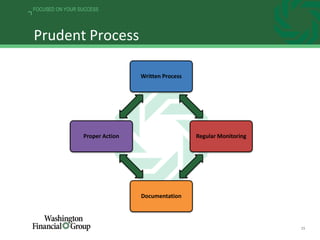

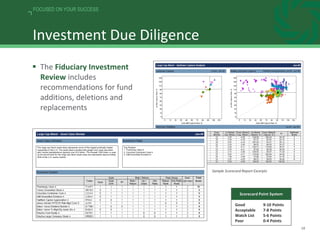

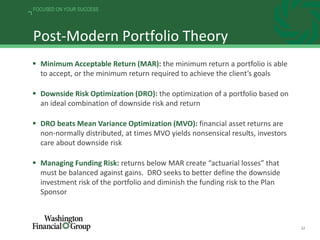

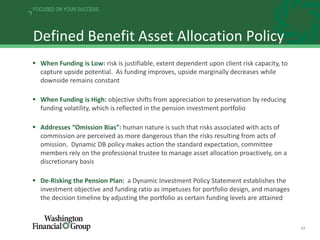

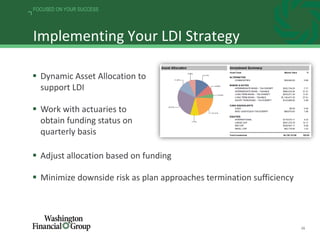

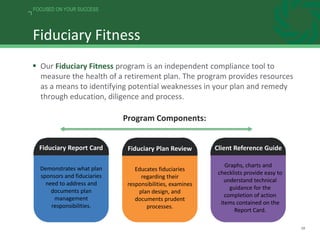

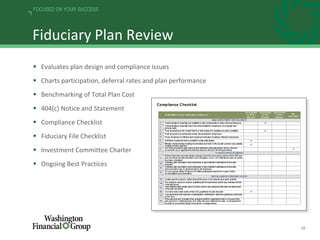

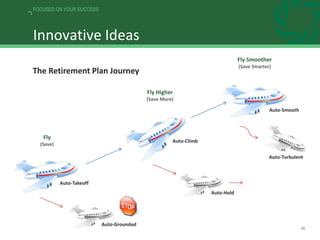

Washington Financial Group offers comprehensive retirement plan consulting and advisory services focusing on fiduciary investment review, vendor analysis, and participant education. Their team includes specialists in retirement planning and investment strategy, providing tools for plan efficiency and risk management. The firm emphasizes the importance of fiduciary responsibility and aims to enhance financial security for both plan sponsors and participants.