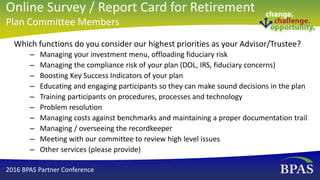

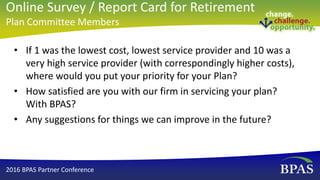

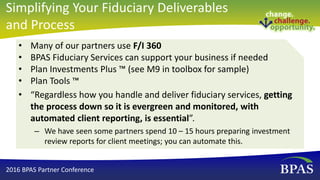

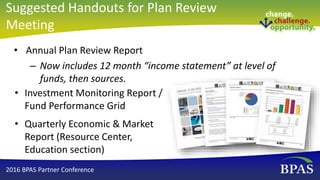

This document summarizes key points from a BPAS Partner Conference presentation on best practices for retirement plan advisors. The presentation covered topics like creating an online presence to attract prospects, using client relationship management software, surveying clients to define service models, automating fiduciary processes and reports, and making education meetings more engaging for retirement plan participants. The goal was to share insights that can help advisors strengthen their businesses and better serve clients.