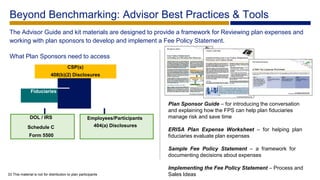

The document discusses the evolution of defined contribution plan governance from the 1970s to present day. It emphasizes the importance of fiduciary duties to pay only reasonable plan expenses and follow a prudent process. A fee policy statement is recommended as a tool to document how a plan will monitor and allocate costs. It explains concepts like revenue sharing, expense recapture accounts, and expense allocation methods to help fiduciaries meet regulatory requirements.