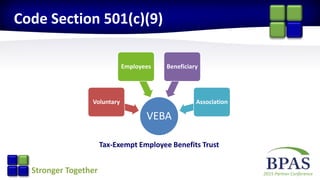

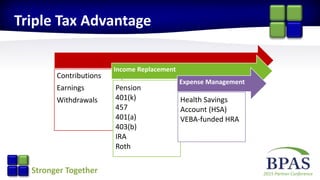

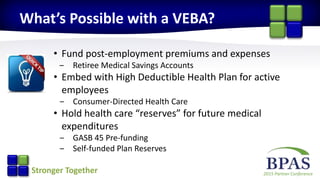

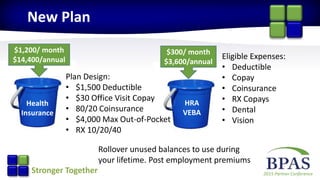

This document discusses strategies for adding VEBA plans to insurance product portfolios. It begins by defining a VEBA as a tax-exempt irrevocable trust that employers can fund on behalf of employees to pay for healthcare costs. It then explains that a VEBA can fund Health Reimbursement Arrangement (HRA) accounts for employees. HRAs along with VEBAs provide triple tax advantages for contributions, earnings, and withdrawals. The document gives examples of how VEBAs can be used to fund retiree healthcare, high deductible plans, and healthcare reserves. It also provides talking points for stakeholders and ends with a question section.