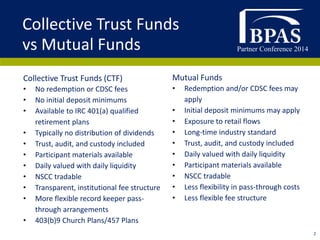

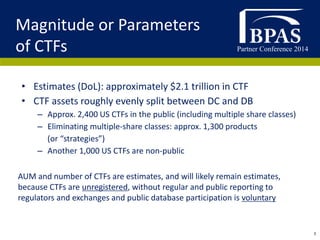

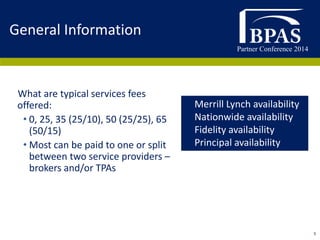

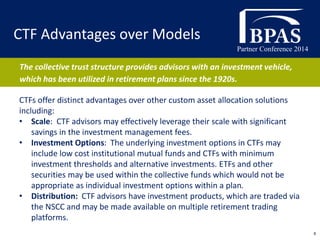

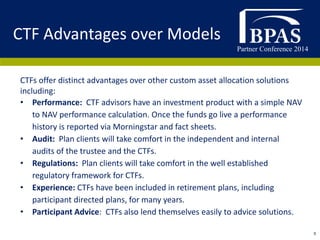

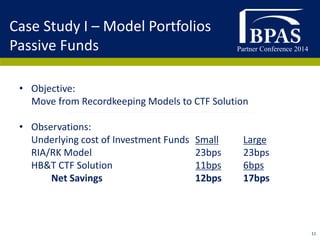

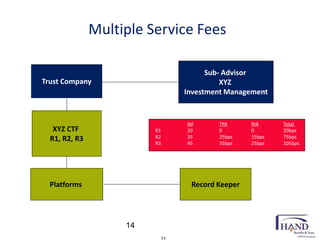

This document summarizes information presented at a partner conference about collective investment trusts (CTFs). It discusses the key advantages of CTFs compared to mutual funds and customized model portfolios, such as lower fees, greater flexibility, and the ability to include alternative assets. The document also presents two case studies showing how CTFs can lower costs compared to recordkeeping models. Finally, it outlines new business models for advisors using CTFs, such as acting as a solicitor to earn solicitation fees or providing multiple services with different fee structures.