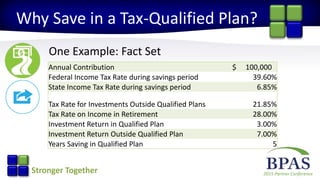

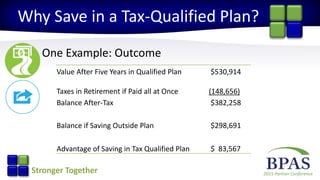

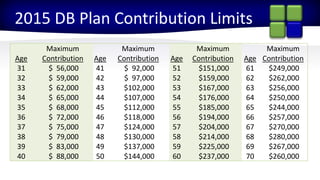

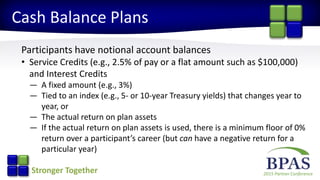

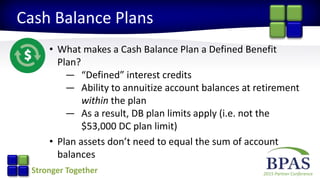

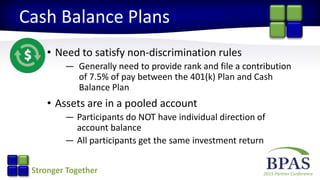

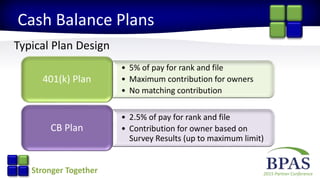

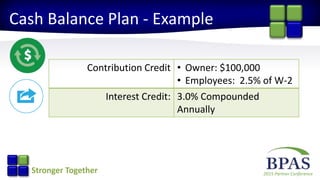

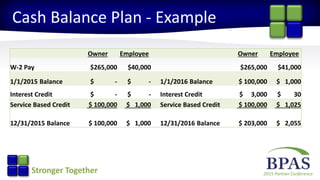

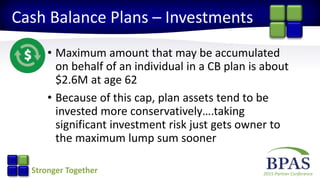

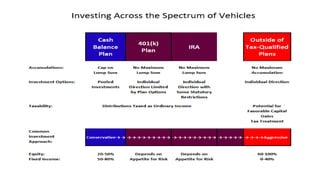

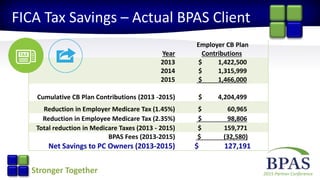

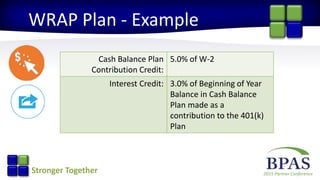

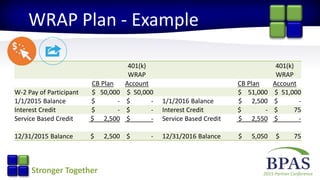

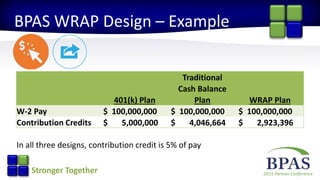

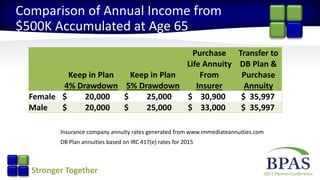

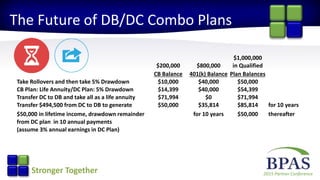

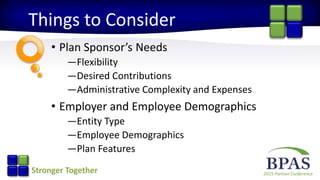

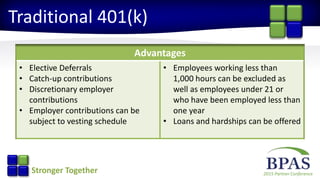

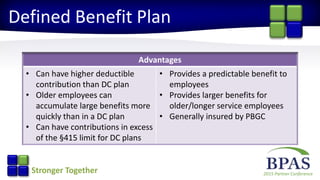

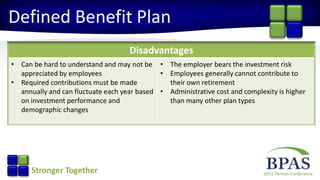

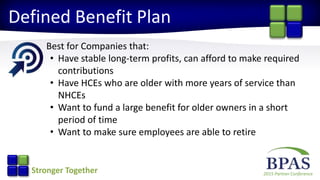

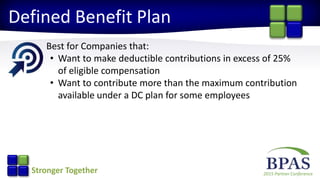

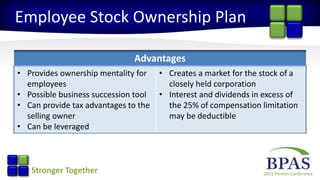

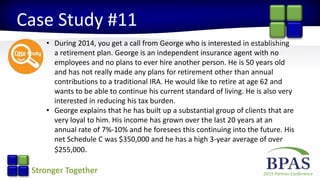

This document discusses various defined contribution and defined benefit plan designs, including their advantages and disadvantages. It begins with an overview of why saving in a tax-qualified retirement plan is beneficial compared to saving outside of a plan. It then discusses cash balance pension plans, including typical design features and examples. The document also covers the BPAS WRAP plan design, which combines features of a cash balance plan and 401(k) plan. Finally, it discusses potential future combinations of defined benefit and defined contribution plans that provide more flexible income options at retirement.