The document discusses opportunities for growth and investment in developing economies beyond the BRIC countries. It notes that:

- Countries like Brazil, Russia, India and China have transformed rapidly in recent decades, reducing poverty and growing their economies.

- A new wave of countries is following a similar path of steady growth above 3% annually with improving business conditions.

- These emerging markets represent commercial opportunities in sectors like banking, agriculture, and renewable energy to serve their growing populations and economies.

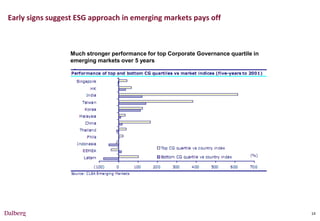

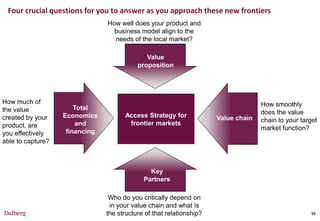

- Successfully capturing these opportunities requires understanding local needs and partnering with key local players, while navigating environmental, social and governance risks.