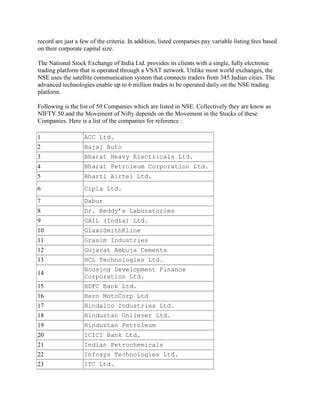

The National Stock Exchange of India (NSE) was established in 1992 as the second stock exchange in the country to accelerate reforms in the Indian capital markets. It is now the largest stock exchange in India with over 1,000 listed companies and 726 trading members. The NSE was set up with the goal of providing a modern, fully electronic trading platform and it uses advanced technology like a satellite network to connect traders across India. Some key developments include launching indices like Nifty 50, starting internet-based trading in 2000, and establishing different segments for trading various financial instruments.