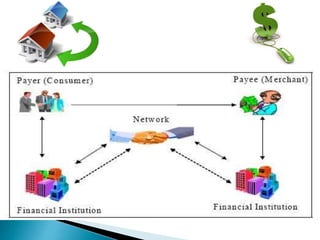

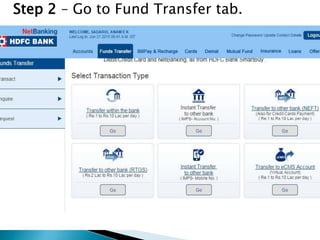

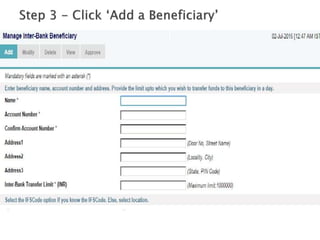

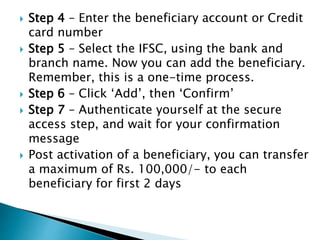

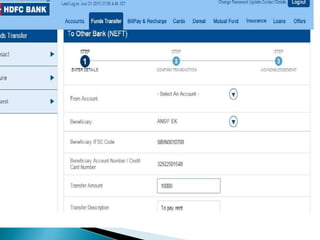

The document outlines various methods for transferring money electronically, including NEFT, RTGS, and IMPS, highlighting the ease of these transactions in India. NEFT, which launched in November 2005, allows transfers through 30,000 bank branches with no minimum or maximum limits. The document provides a step-by-step guide on how to add a beneficiary and complete the fund transfer process securely.