The document provides details about an internship project conducted at Fullerton Securities & Wealth Advisors Limited. It includes an introduction describing the importance of practical experience. It then acknowledges and thanks the guidance and support received from supervisors and other staff members at Fullerton Securities. Finally, it outlines the objectives and structure of the project report, which focuses on understanding the current scenario and customer satisfaction levels of Fullerton Securities in the financial market.

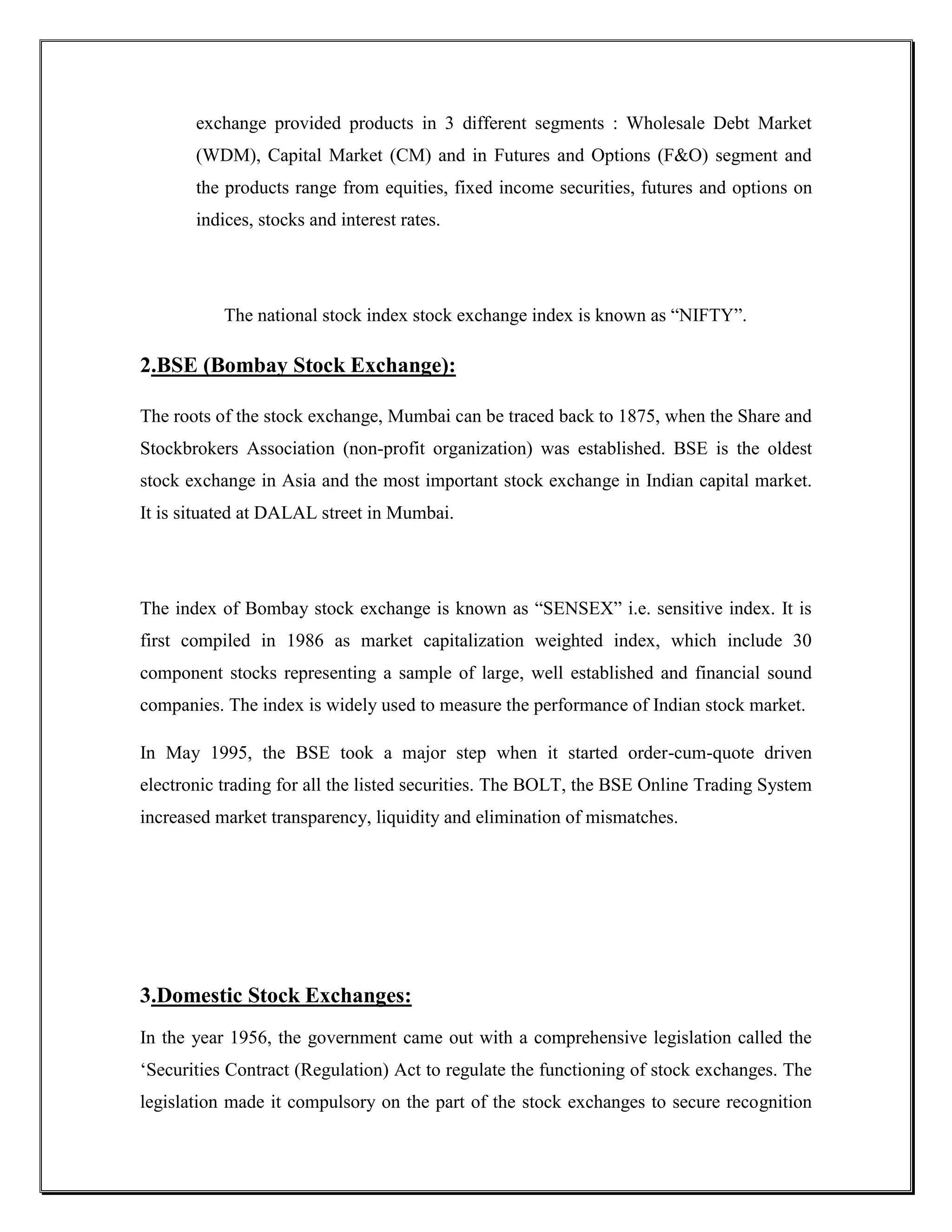

![[A] BROKING

FREEDOM ACCOUNT

It is also called „demate account‟ for which our company takes the charges

of Rs 1995/- and no ammount is refundable.after opening this account customer

gets the facility of free brokerage up to trading of 500,000/- in delivery or

50,00.000/- in intraday during 6 months.

What Does Equity Market Mean?

The market in which shares are issued and traded, either through exchanges or

over-the-counter markets. It is also known as the stock market, it is one of the most

vital areas of a market economy because it gives companies access to capital and

investors a slice of ownership in a company with the potential to realize gains based

on its future performance.

What is Derivative Market Mean ?

The Derivatives Market is meant as the market where exchange of derivatives takes

place. Derivatives are one type of securities whose price is derived from the underlying

assets. And value of these derivatives is determined by the fluctuations in the underlying

assets. These underlying assets are most commonly stocks, bonds, currencies, interest

rates, commodities and market indices. As Derivatives are merely contracts between two

or more parties, anything like weather data or amount of raincan be used as underlying

assets. The Derivatives can be classified as Future Contracts, Forward Contracts,

Options, Swaps and Credit Derivatives.](https://image.slidesharecdn.com/jimjipart1-120321012104-phpapp02/75/current-scenario-of-stock-market-33-2048.jpg)

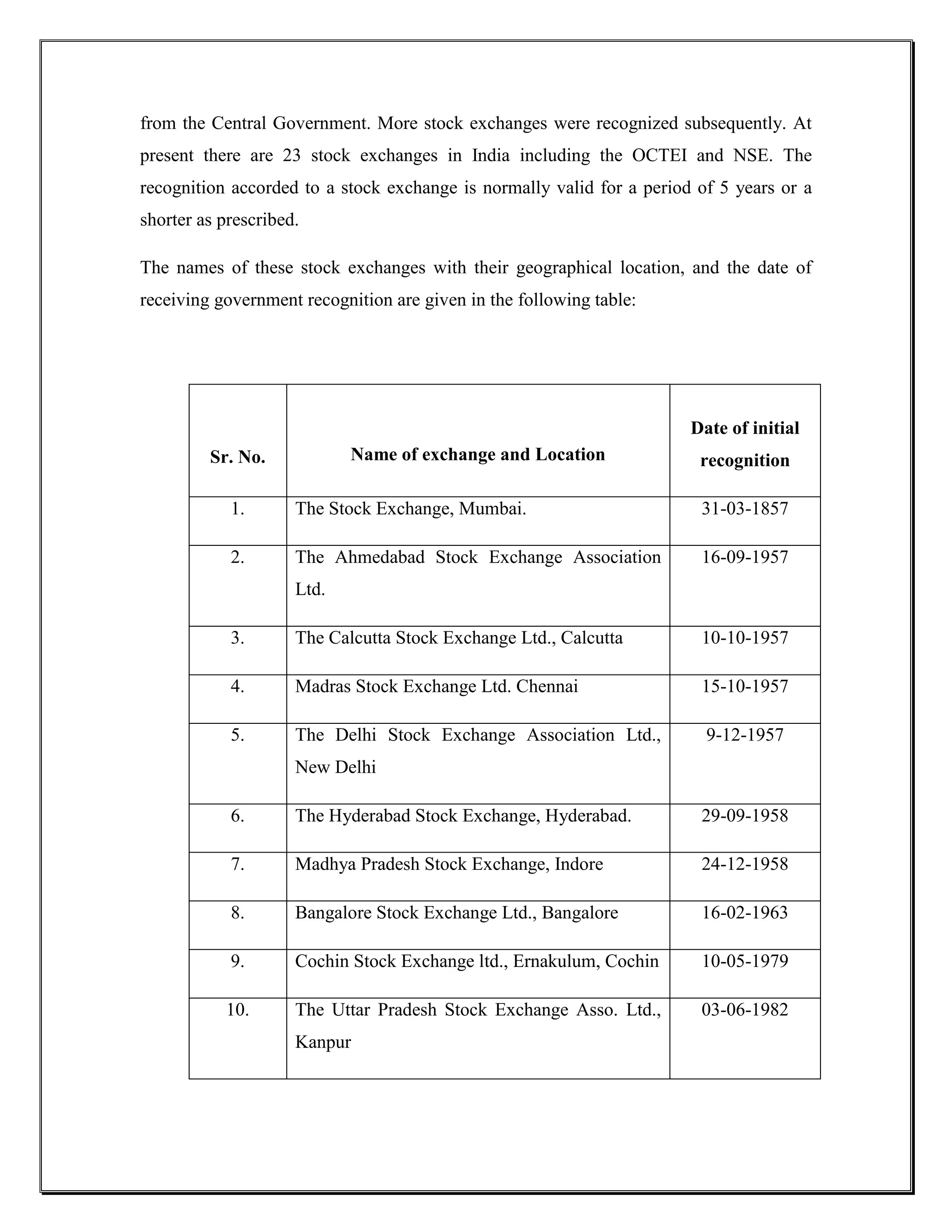

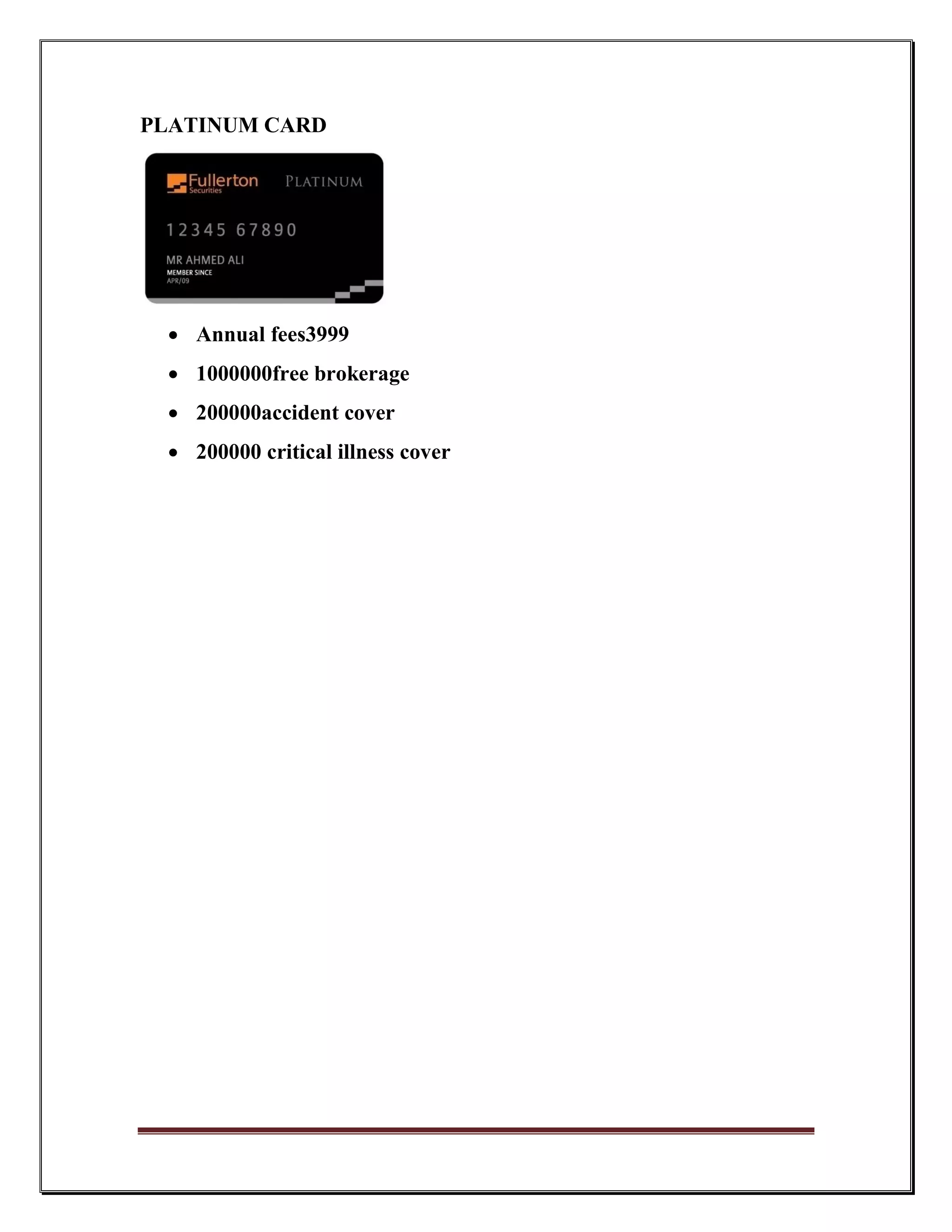

![[B] MUTUAL FUND

A Mutual Fund is a trust that pools the savings of a number of investors who share a

common financial goal. The money thus collected is then invested in shares, debentures

and other securities. The income earned through these investments and the capital

appreciations realized are shared by its unit holders in proportion to the number of units

owned by them.

The flow chart below describes broadly the working of a mutual fund. It simply shows

the cyclic flow of funds and how the mutual fund is working.

There are two approaches for investing in Mutual Fund i.e. Lump sum and SIP

(Systematic Investment Plan)](https://image.slidesharecdn.com/jimjipart1-120321012104-phpapp02/75/current-scenario-of-stock-market-37-2048.jpg)

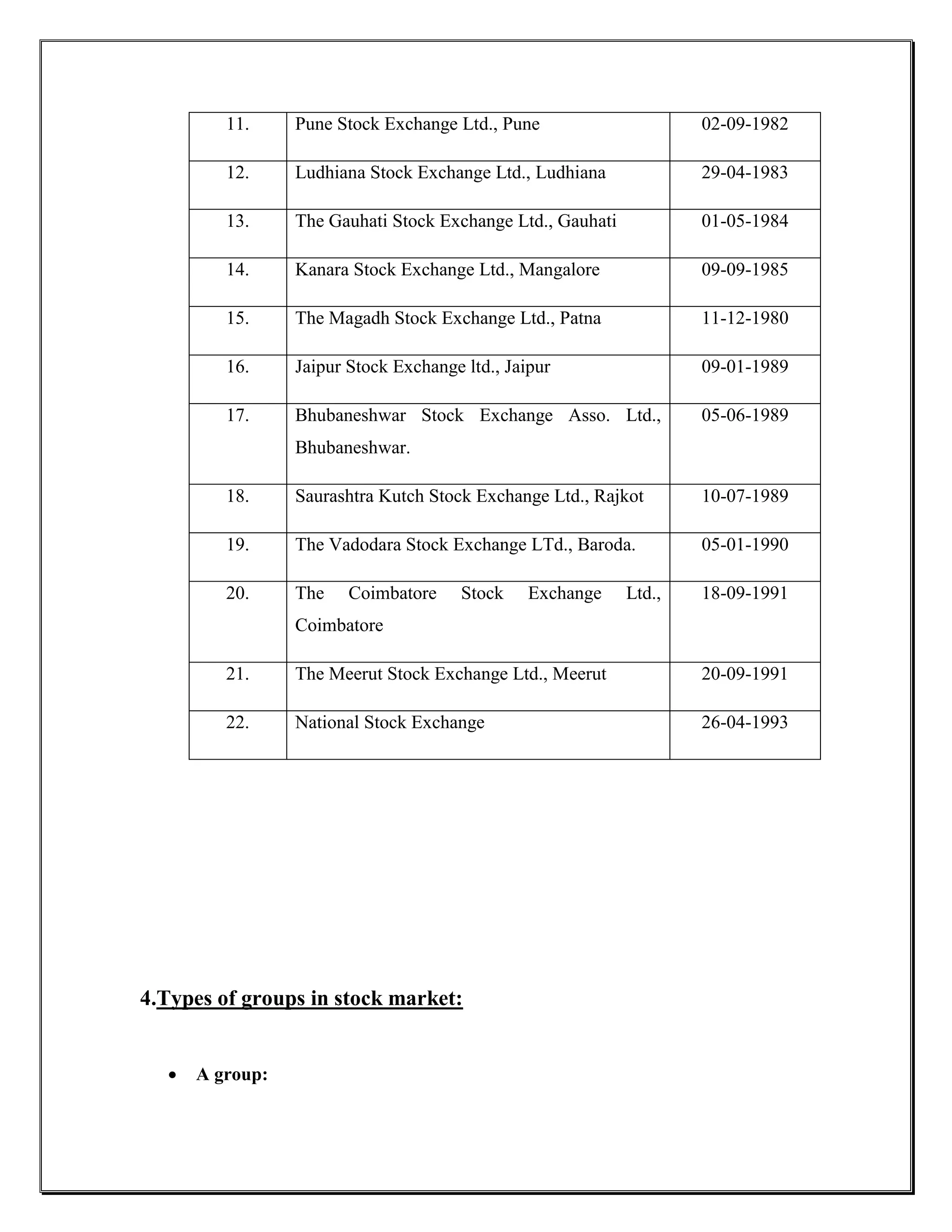

![[C] CORPORATE FDs-BONDS & DEBENTURES

The fixed deposit space in the industry is gaining some attention as top coporates are raising

funds for their companies through the FD window. Recently Tata Motors has introduced a fixed

deposit scheme where by an interest rate of 11% is offered for deposits parked for three years and

the firm has a sanction to raise up to Rs 1,931.5 crore from the public.

financial advisors say that investors must look at their tax brackets before investing

in such FDs. Director of Transcened Consulting, Kartik Jhaveri says, "It is advisable

for people with very low income. For example, it works out best for people with

income of below Rs 3 lakh or people earning below Rs 5 lakh where they are taxed

at 20%. But it is not at all suited for high net worth clients or people in the higher

tax bracket, as the interest income would be charged at a rate of 30%.".

Two types :-

1. Bank and NBFC FDs: Offered by banks or non-banking finance companies; the Reserve

Bank of India (RBI) regulates these institutions.

2. Corporate FDs: These are offered by companies that are looking to raise money from the

open market. Corporate FDs typically pay a higher rate of interest, but also carry a relatively

higher risk than bank FDs.](https://image.slidesharecdn.com/jimjipart1-120321012104-phpapp02/75/current-scenario-of-stock-market-44-2048.jpg)

![• If you do not fall in a taxable slab, then furnish Form 15G or 15H to your bank to prevent TDS

on the interest income that is paid to you.

[D] INSURANCE:

Life Insurance:

Fullerton securities is tie up with the ICICI Prudencial life insurance.

1.Endowement plan(Traditional plan):

This plan contains:

Guaranteed maturity benefit

Insurance+investment+tax benefit

2.ULIPs(Unit linked plan):

This plan consists of:

Insurance+investment+tax benefit

Basis-NAV

Non-Life Insurance:

Fullerton securities is tie up with the ICICI LOMBARD life

insurance.

1-Health insurance(Mediclaim)

2-Home Insurance

3-Personal accident](https://image.slidesharecdn.com/jimjipart1-120321012104-phpapp02/75/current-scenario-of-stock-market-46-2048.jpg)

![4-Vehicle insurance

5-Travel insuranc

[E] OTHER PRODUCT

1. MARGIN FUNDING:

2. REAL ESTATE: 1.Residental

2.Commercial](https://image.slidesharecdn.com/jimjipart1-120321012104-phpapp02/75/current-scenario-of-stock-market-47-2048.jpg)