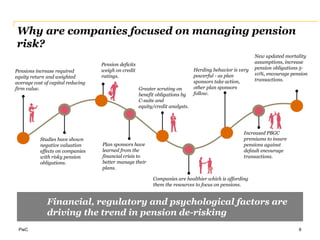

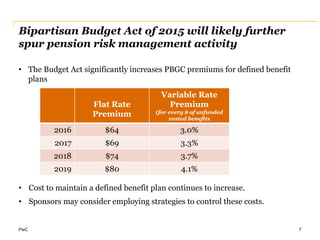

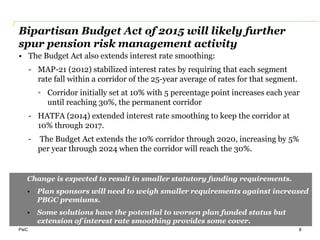

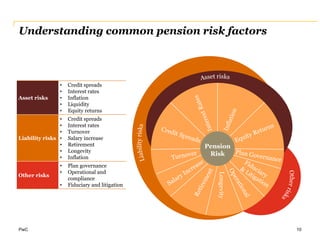

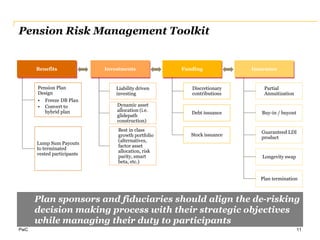

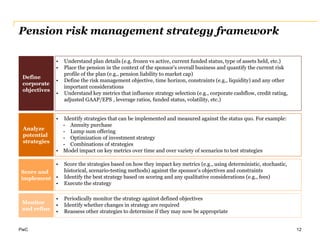

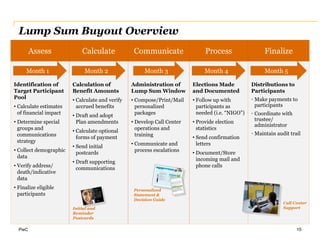

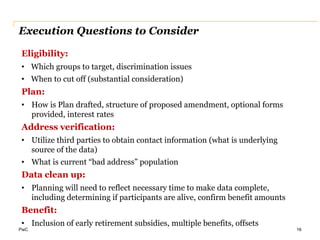

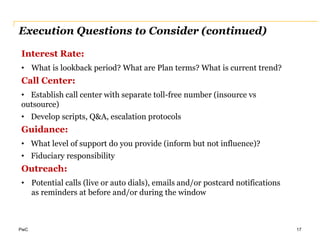

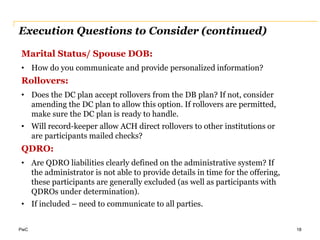

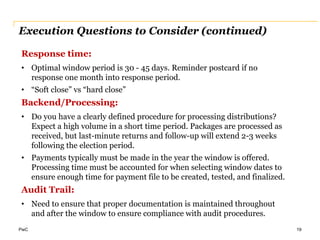

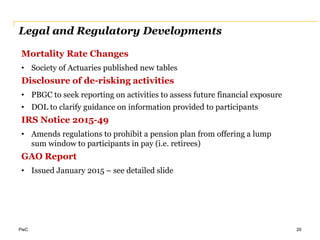

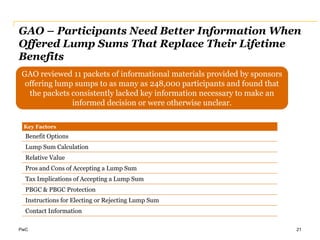

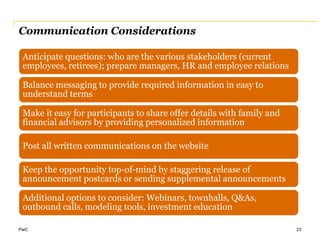

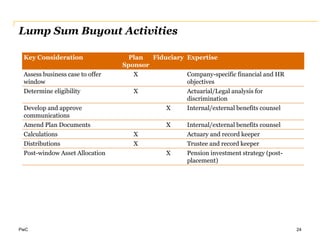

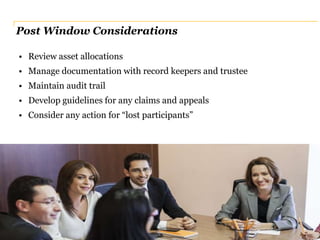

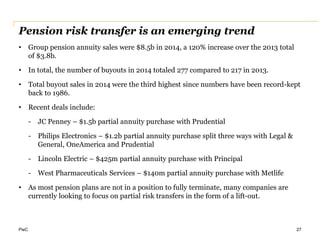

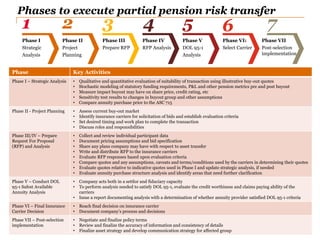

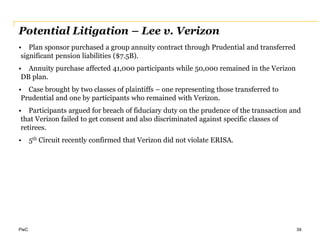

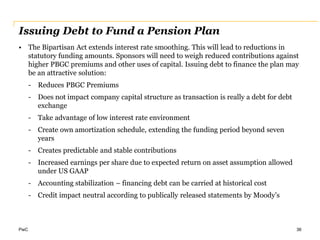

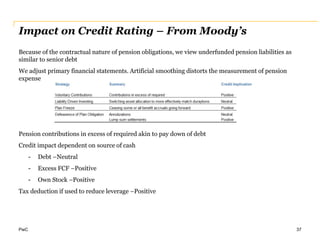

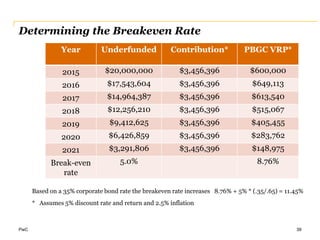

The document discusses current pension risk management strategies and trends, emphasizing the importance for companies to minimize the volatility and materiality associated with defined benefit pension plans. Key factors driving pension risk management include increased regulatory scrutiny, the need for cost control, and rising PBGC premiums, prompting companies to explore pension de-risking strategies such as lump sum buyouts and partial pension risk transfers. A discussion of the impact of recent legislative changes, particularly the Bipartisan Budget Act of 2015, highlights how these developments influence the decision-making process for plan sponsors.