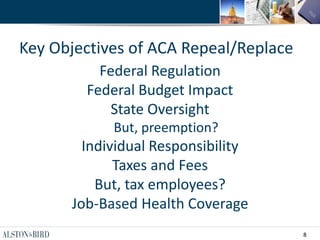

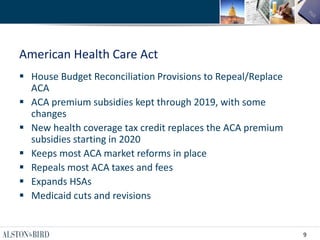

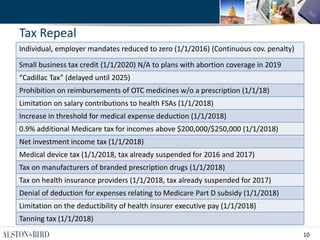

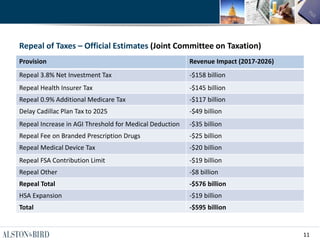

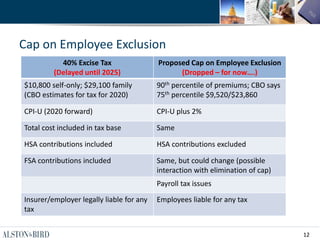

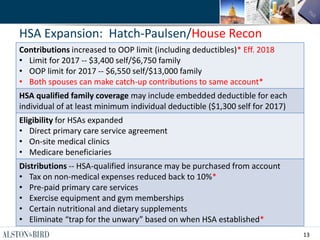

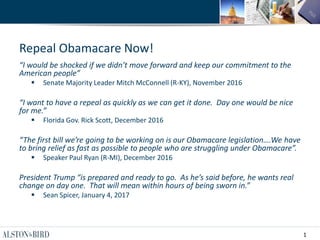

The document summarizes the new administration's plans and debates around repealing and replacing the Affordable Care Act (ACA). Key points include: Republicans want a quick repeal but some caution slowing the process to avoid harming Americans. There are disagreements around refundable tax credits and capping the employee health coverage exclusion. The proposed American Health Care Act would keep some ACA subsidies temporarily and introduce a new tax credit system starting in 2020. Repealing most ACA taxes would reduce revenues by around $600 billion over 10 years. The process of repeal and replace will involve House committees and floor votes before moving to the Senate.

![5

Medicaid

Under our proposal, Obamacare’s Medicaid expansion for able-bodied

adult enrollees would be repealed in its current form.

House Republican Obamacare Repeal and Replace Policy Brief and Resources

2017

“As long as Alaska wants to keep the [Medicaid] expansion it should have

the option. I will not vote to repeal it.”

Senator Lisa Murkowski (R-AL)](https://image.slidesharecdn.com/nywebpresentation11-170317192050/85/Ny-web-presentation-1-1-6-320.jpg)