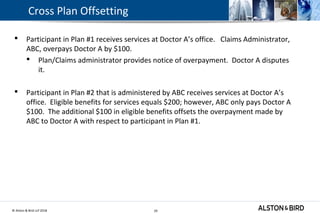

This document summarizes a presentation on health plan design and administration challenges. It discusses various hot topics in employee health benefits, including mental health parity requirements, emergency services coverage, treatment limitations, wellness program rules, out-of-network payments, document requests, and HIPAA compliance. For each topic, it outlines the applicable regulations and compliance risks plans may face. The presentation aims to help plans understand and navigate complex health benefit laws and regulations.

![© Alston & Bird LLP 2018 7

Financial and Quantitative Limitations

A plan may not apply any financial requirement or [quantitative]

treatment limitation to MH or SA benefits in any category that is:

More restrictive that the predominant financial requirement or treatment

limitation applied to substantially all medical/surgical benefits in the same

category

2 tests for measuring benefits:

predominant

substantially all

Special rule for prescription drugs

7](https://image.slidesharecdn.com/web051720181-180522204411/85/Web-05172018-Health-Plan-Hot-Spots-7-320.jpg)