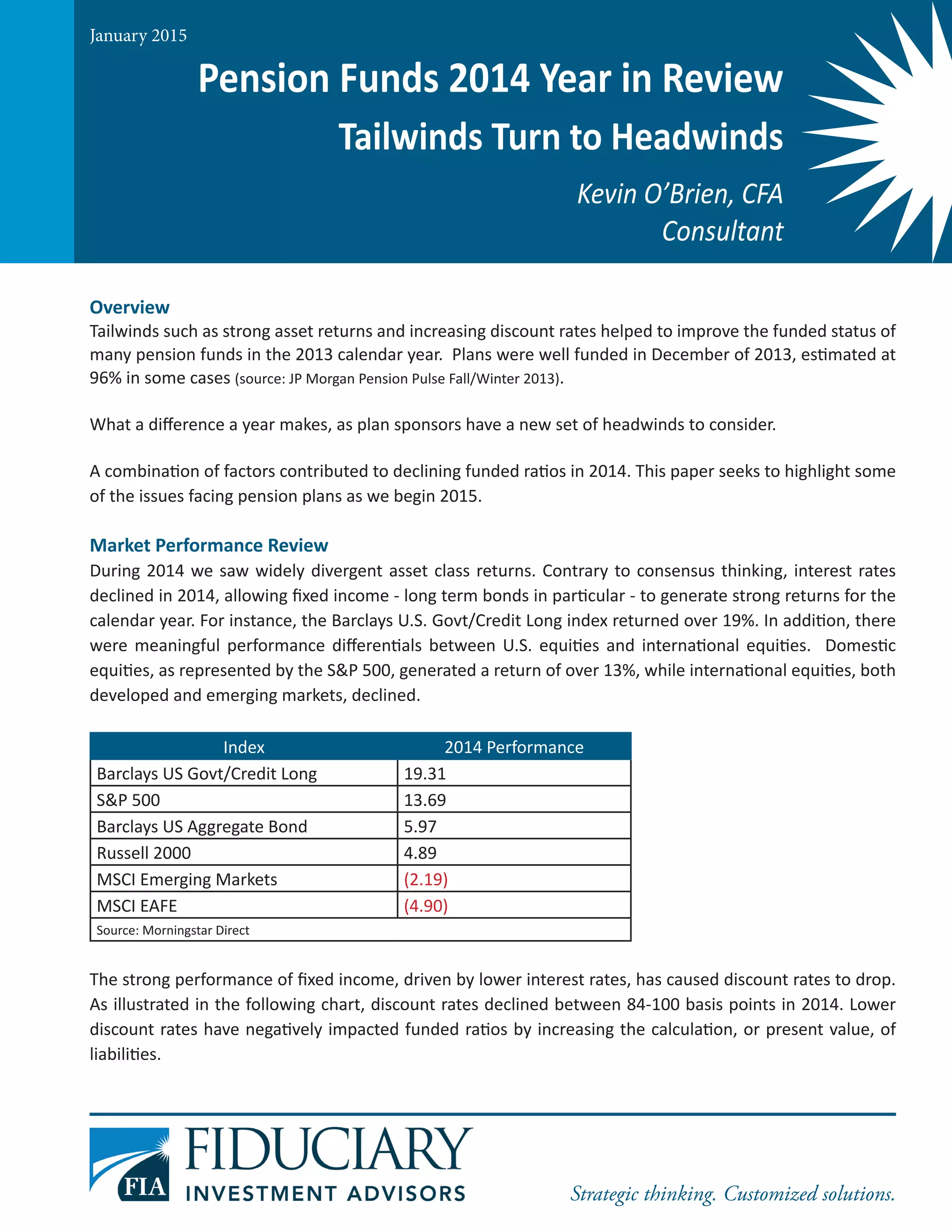

Lower discount rates and declining asset returns negatively impacted pension plan funding in 2014. Funded ratios declined roughly 9% on average as discount rates fell between 84-100 basis points. Longer life expectancies also increased liabilities, with estimates that plan obligations rose 5-10% based on updated mortality tables. Looking ahead, plan sponsors will need to evaluate the impact of lower funding levels on required contributions and PBGC premiums.