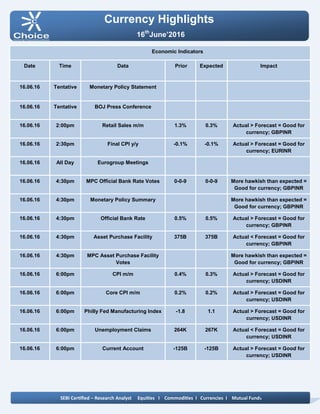

The Indian rupee snapped its 4 day losing streak, rising 12 paise against the US dollar on Wednesday due to selling of dollars by exporters and banks as well as upbeat domestic market sentiment, while other currencies like the euro, pound, and yen also rose against the dollar due to weakness in the US dollar index and positive economic data from Europe and the UK. The document also provides technical analysis of currency pairs and highlights upcoming economic indicators from various countries that could impact currencies.