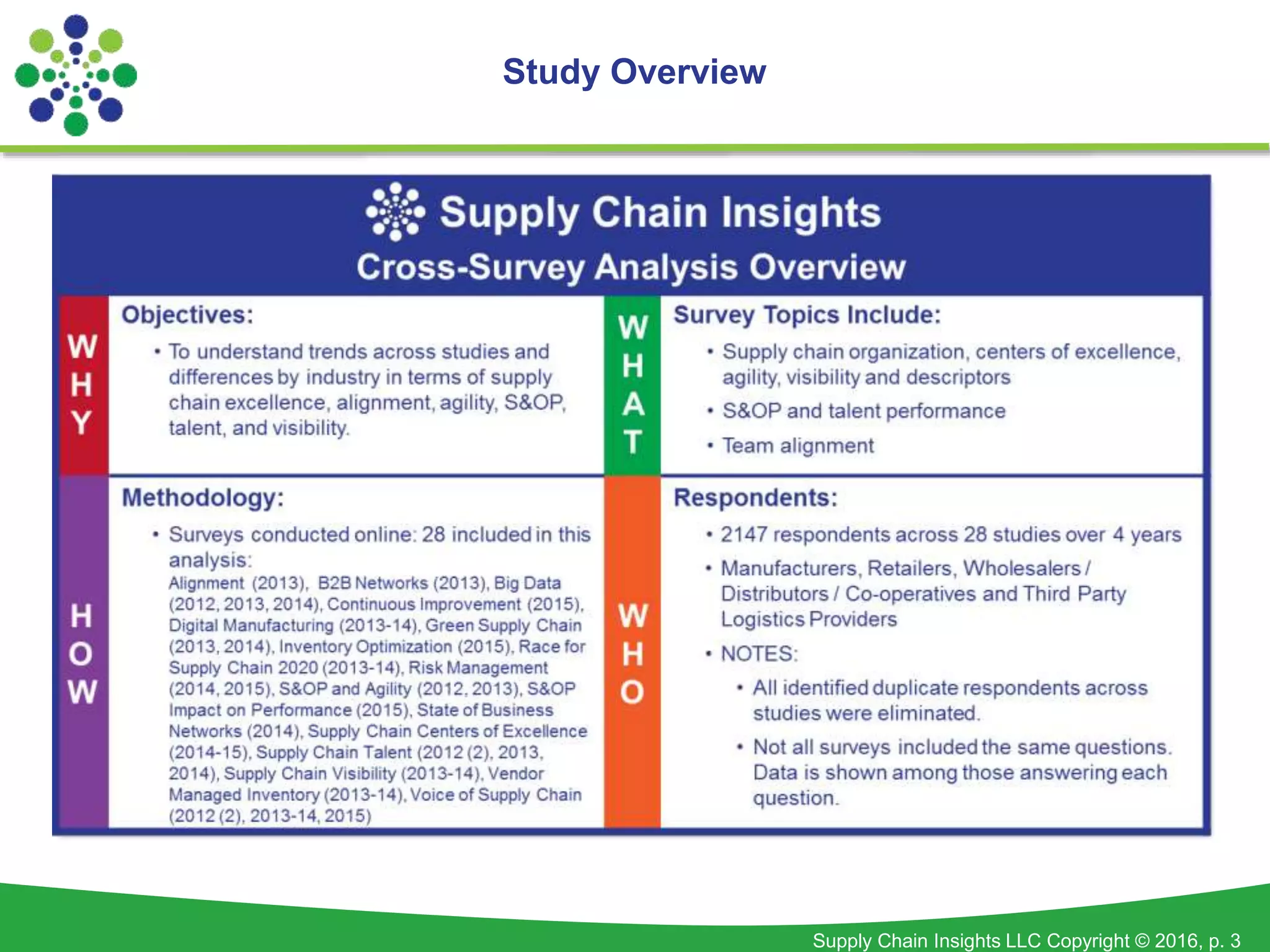

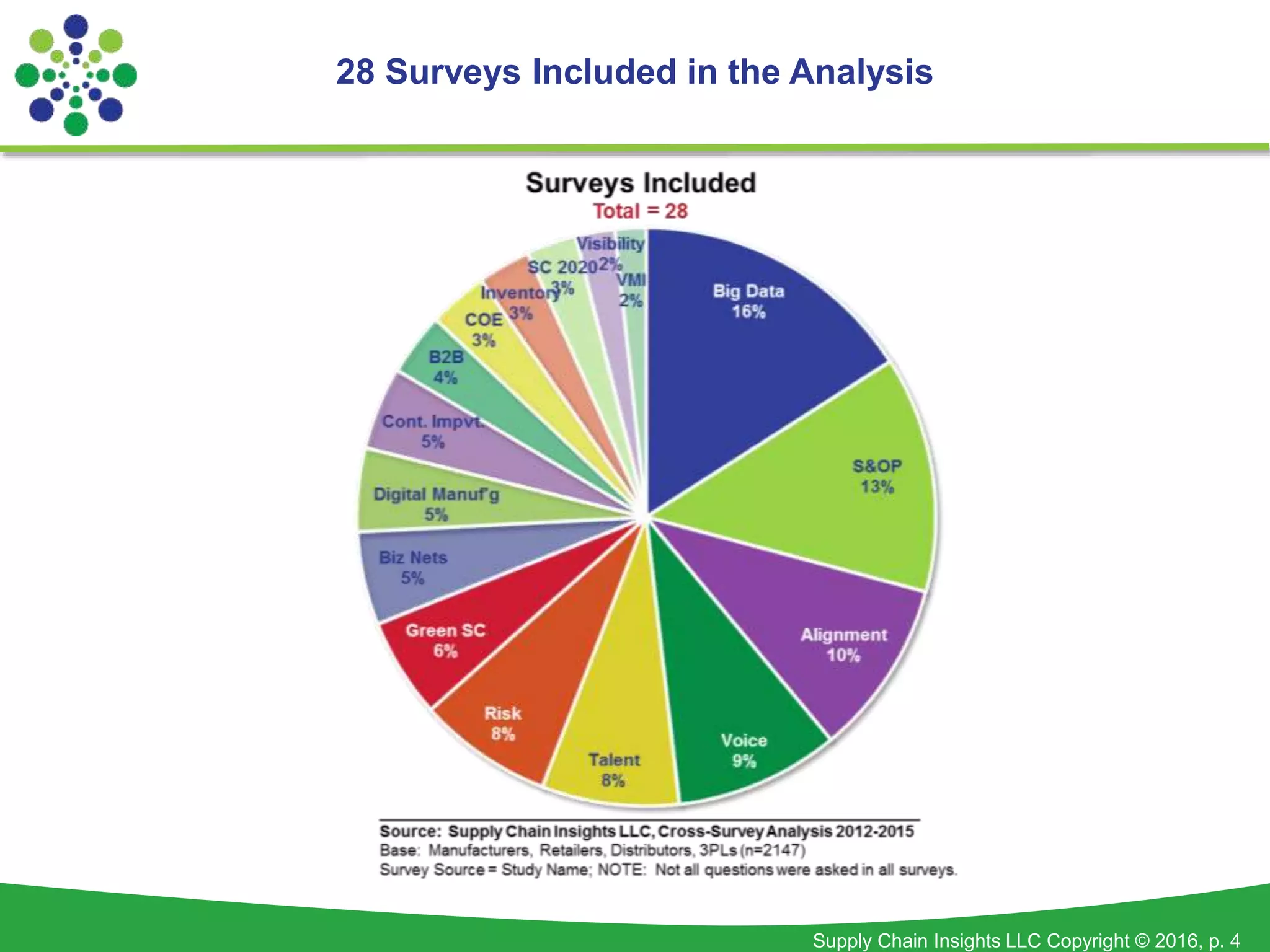

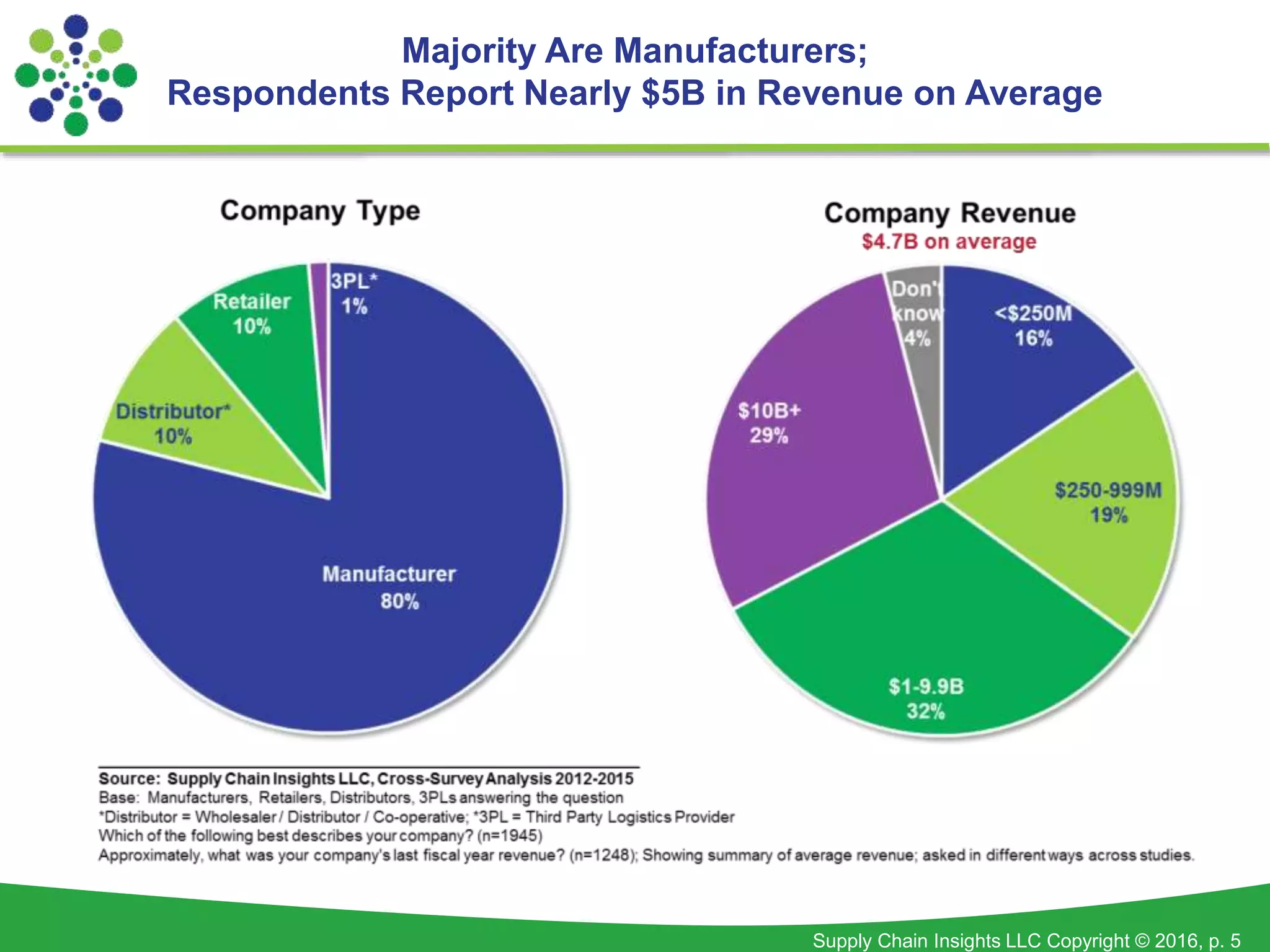

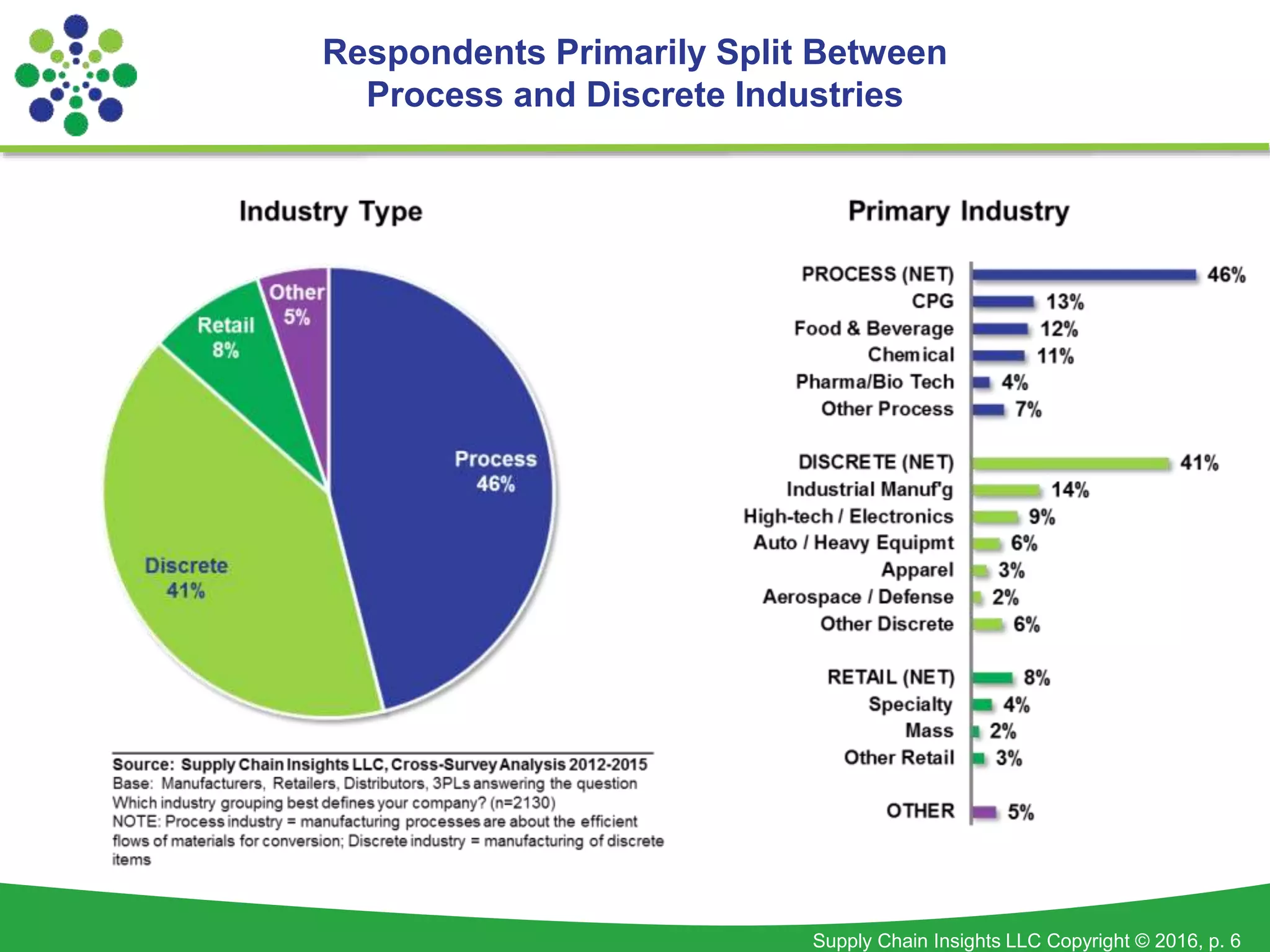

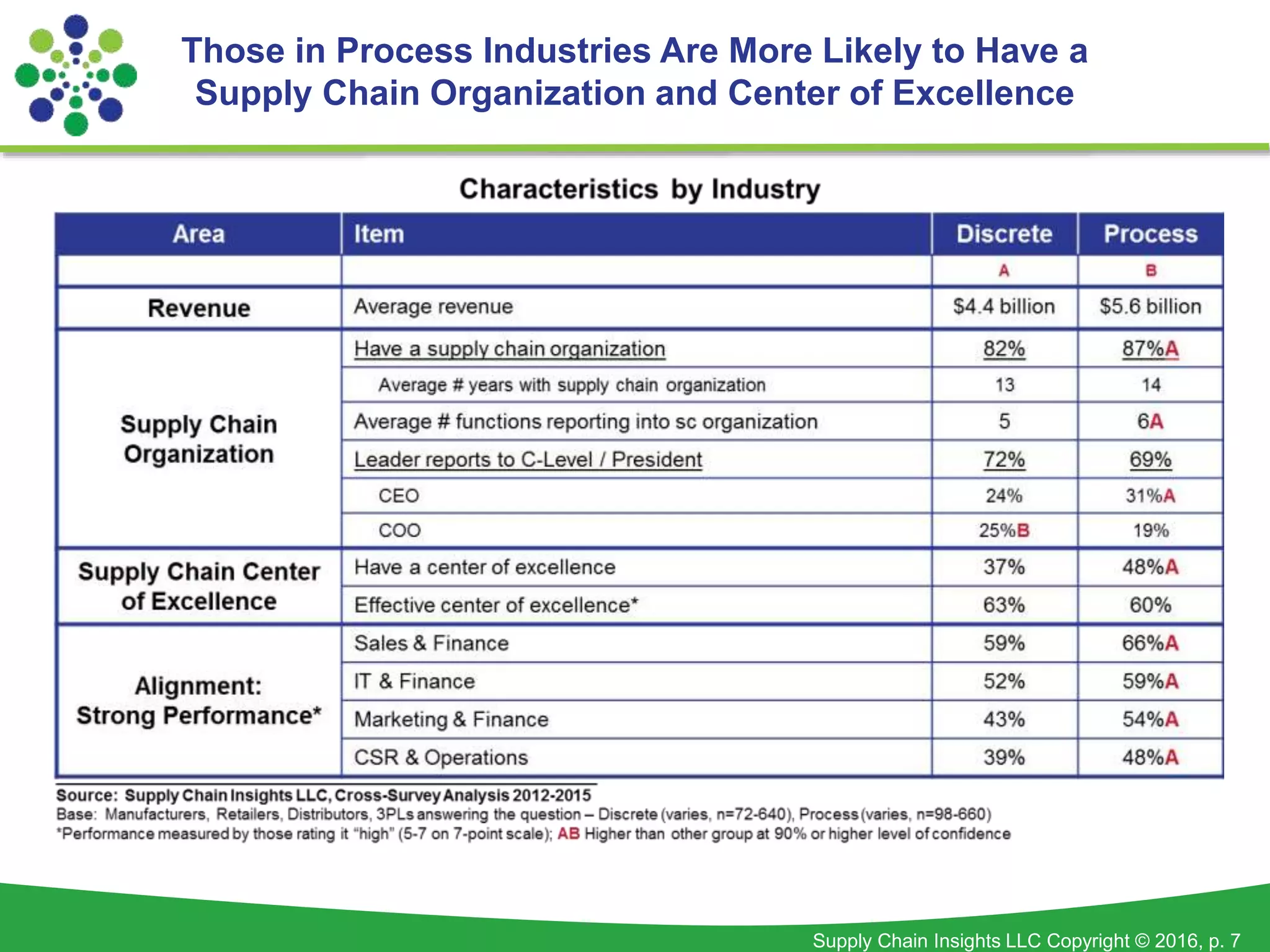

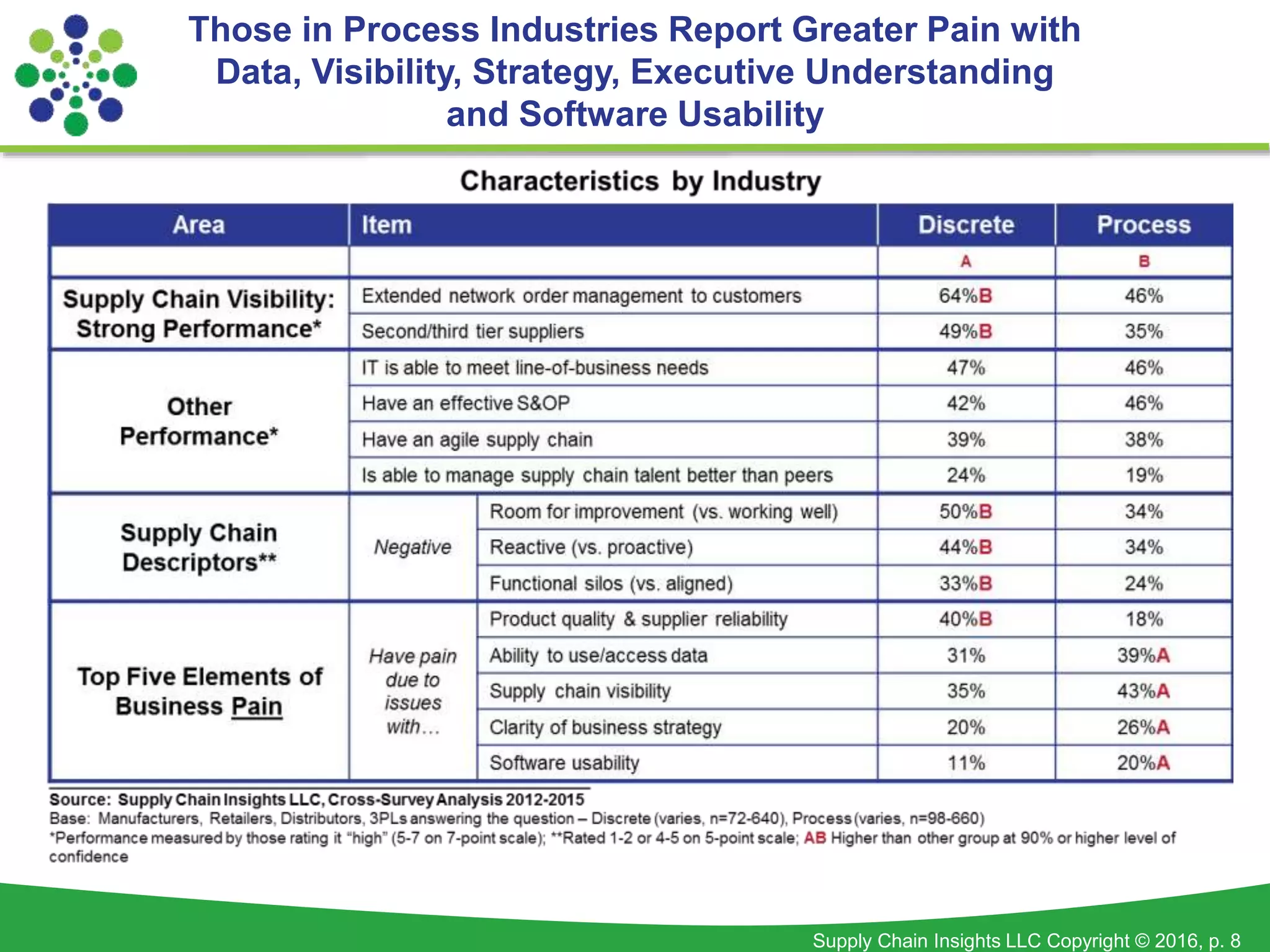

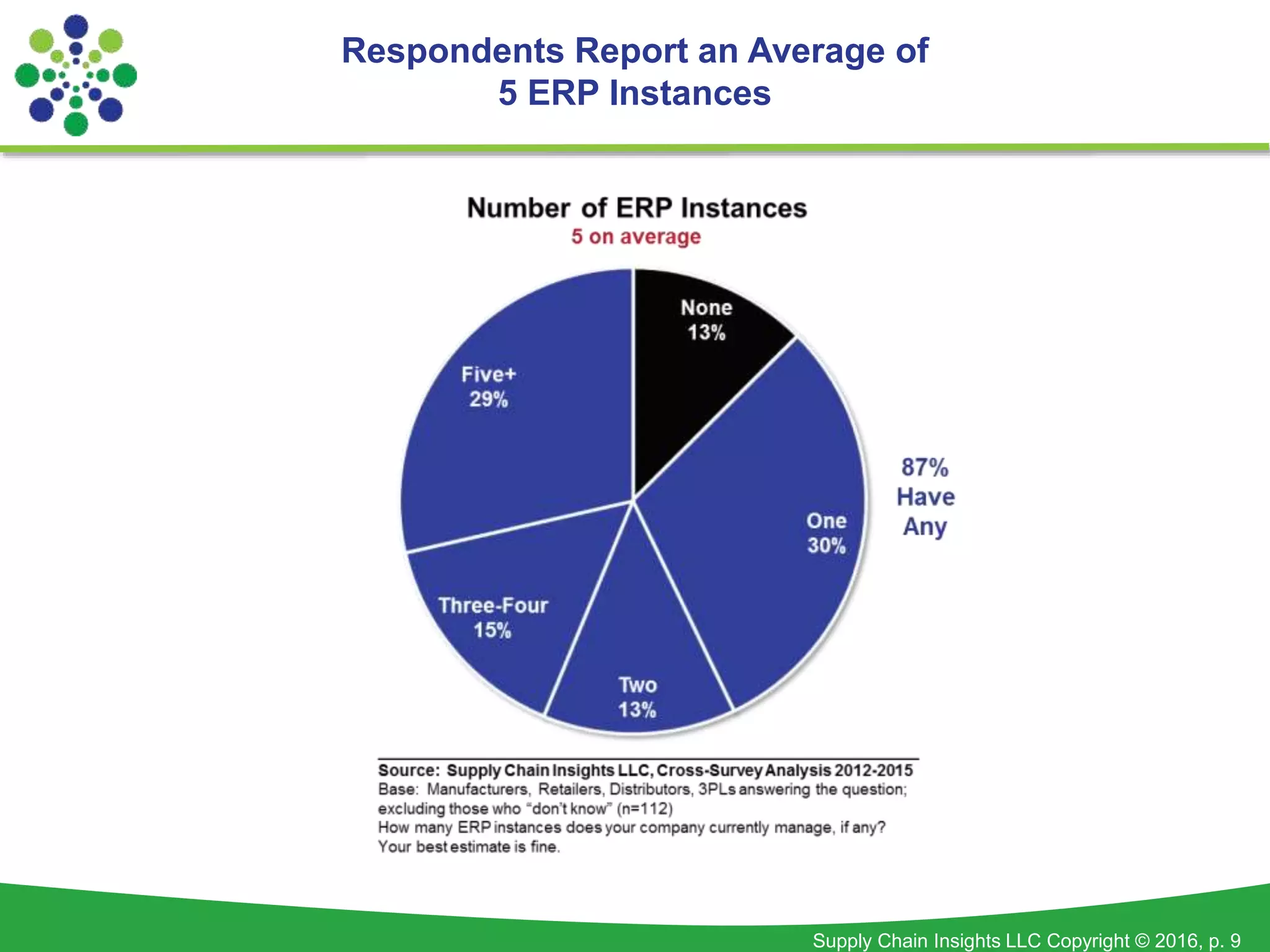

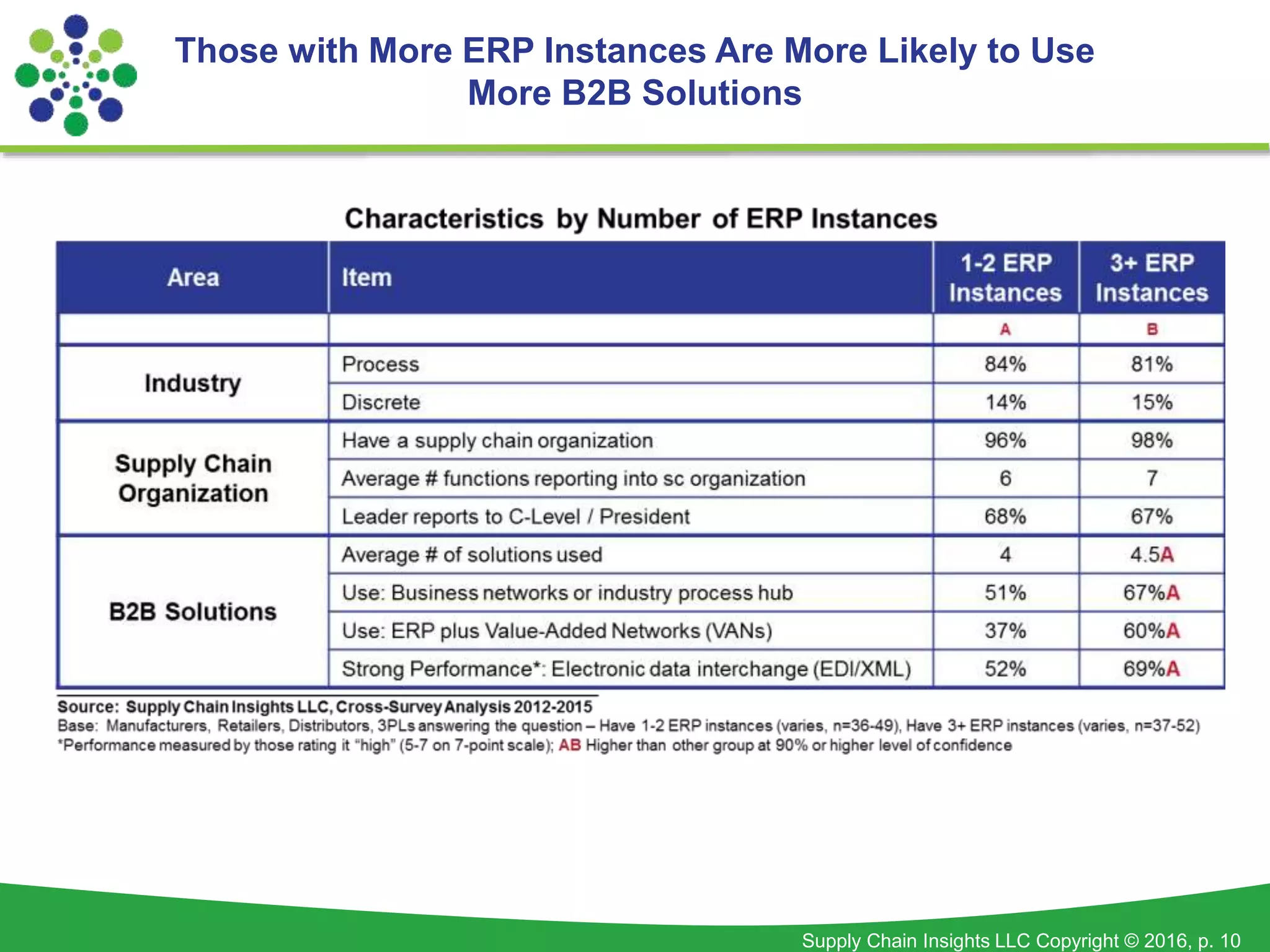

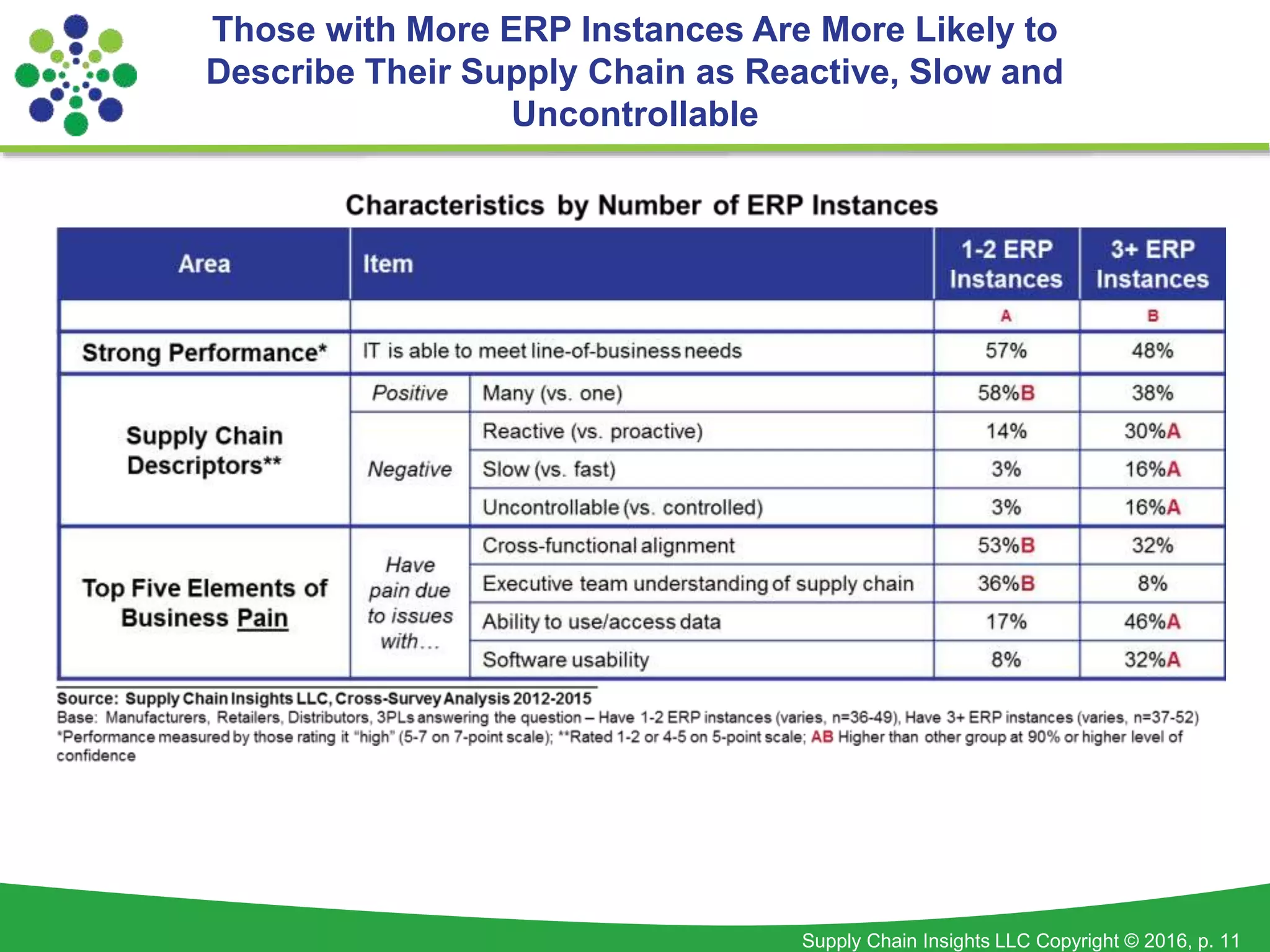

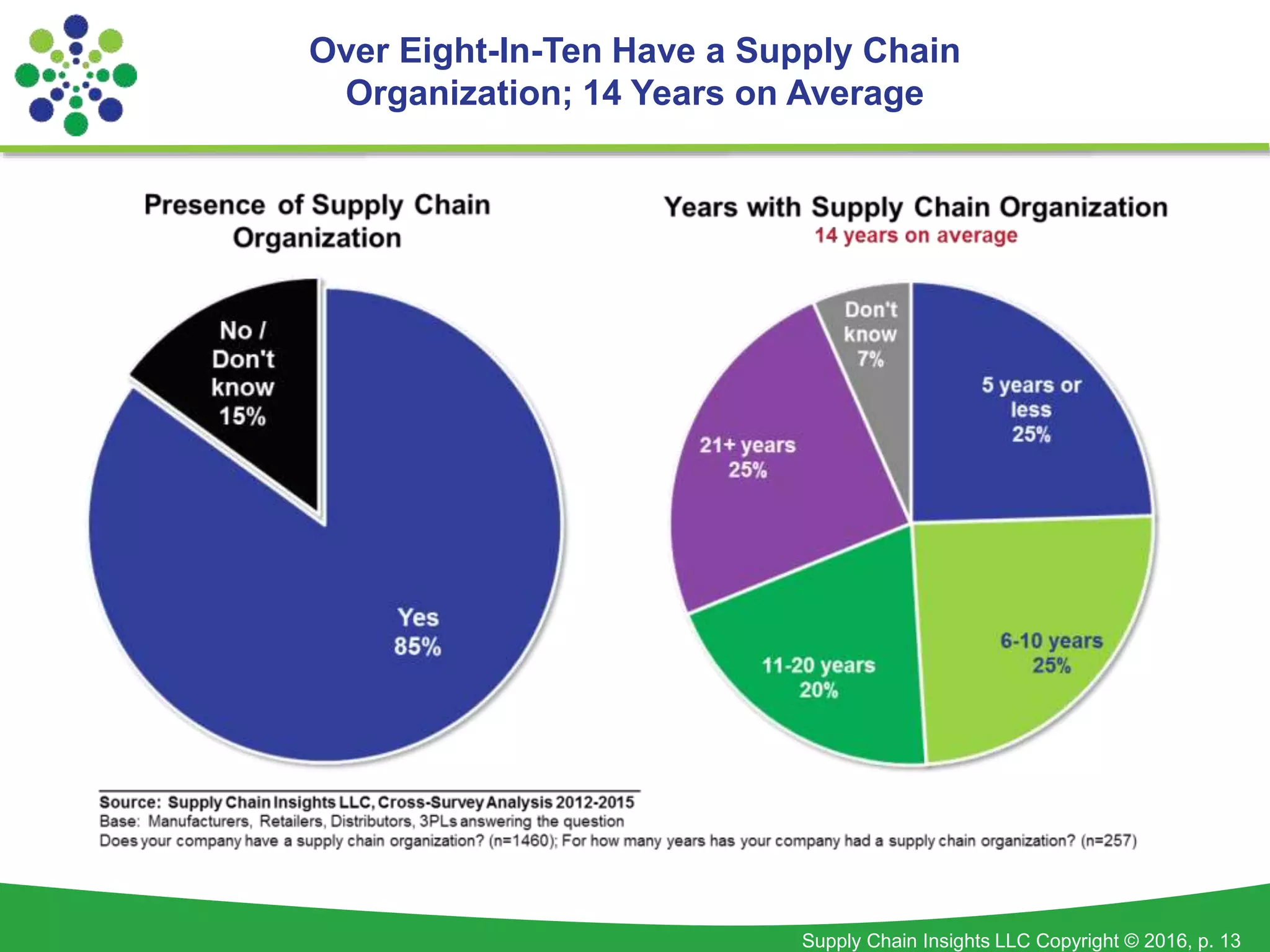

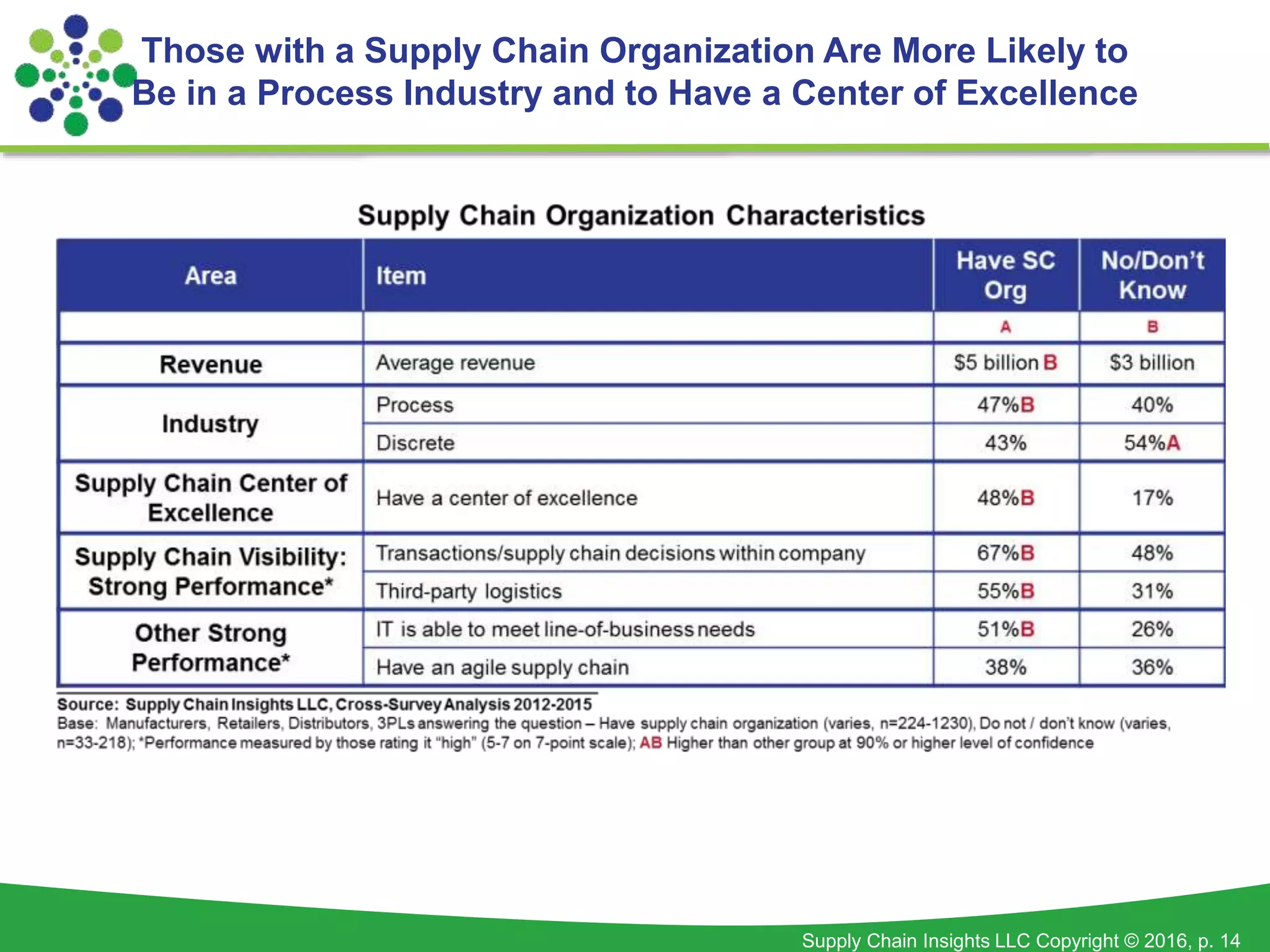

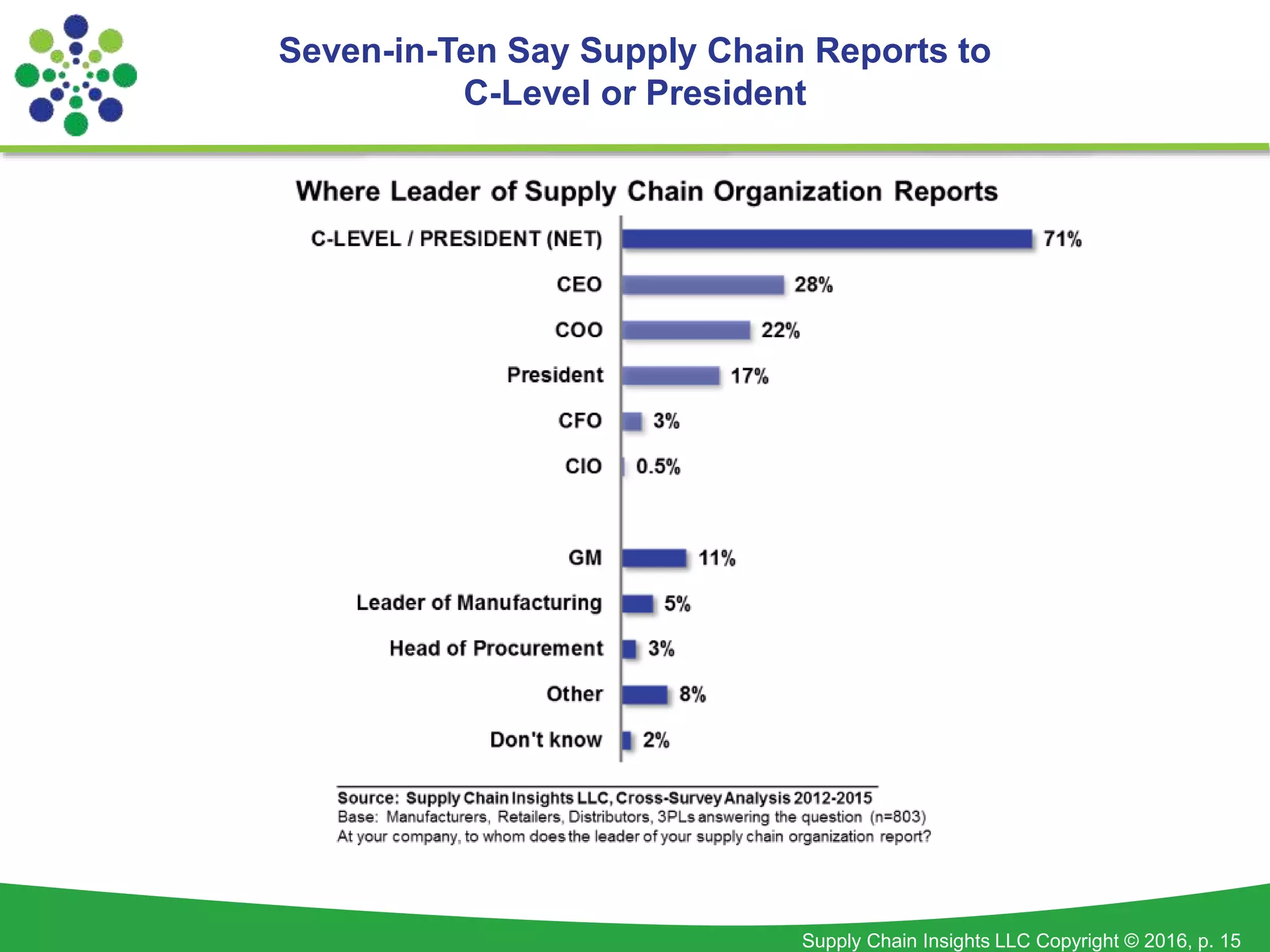

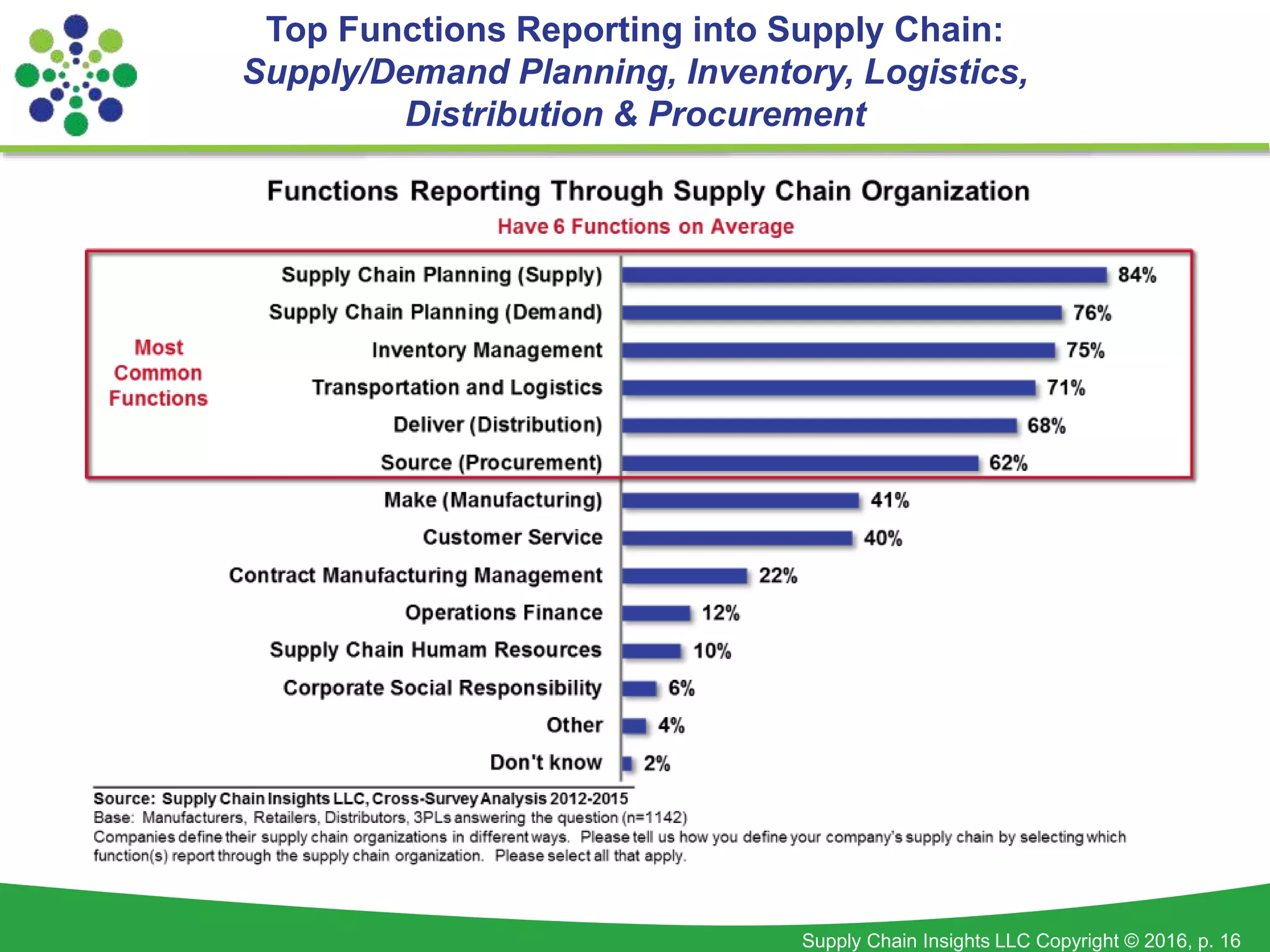

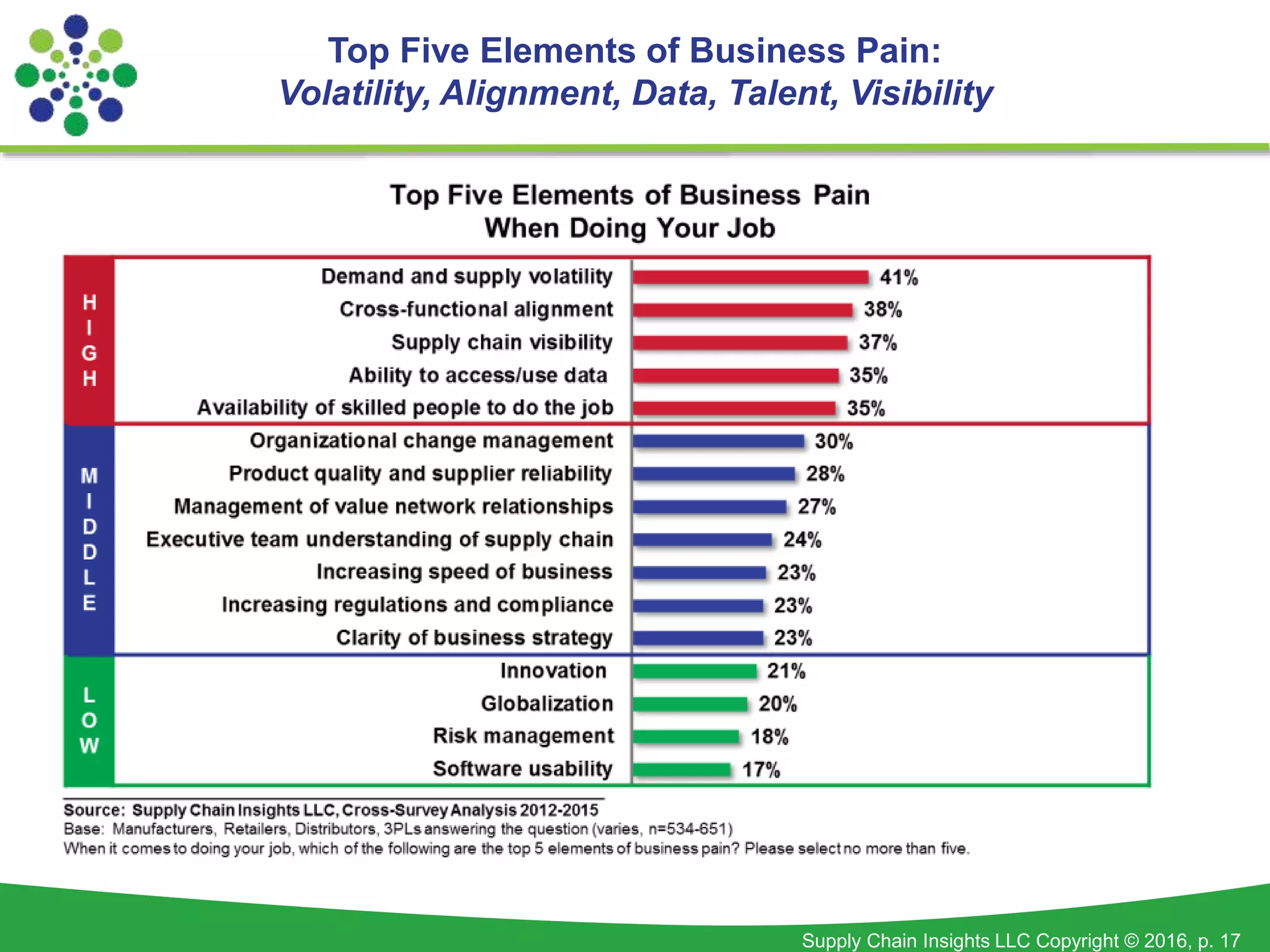

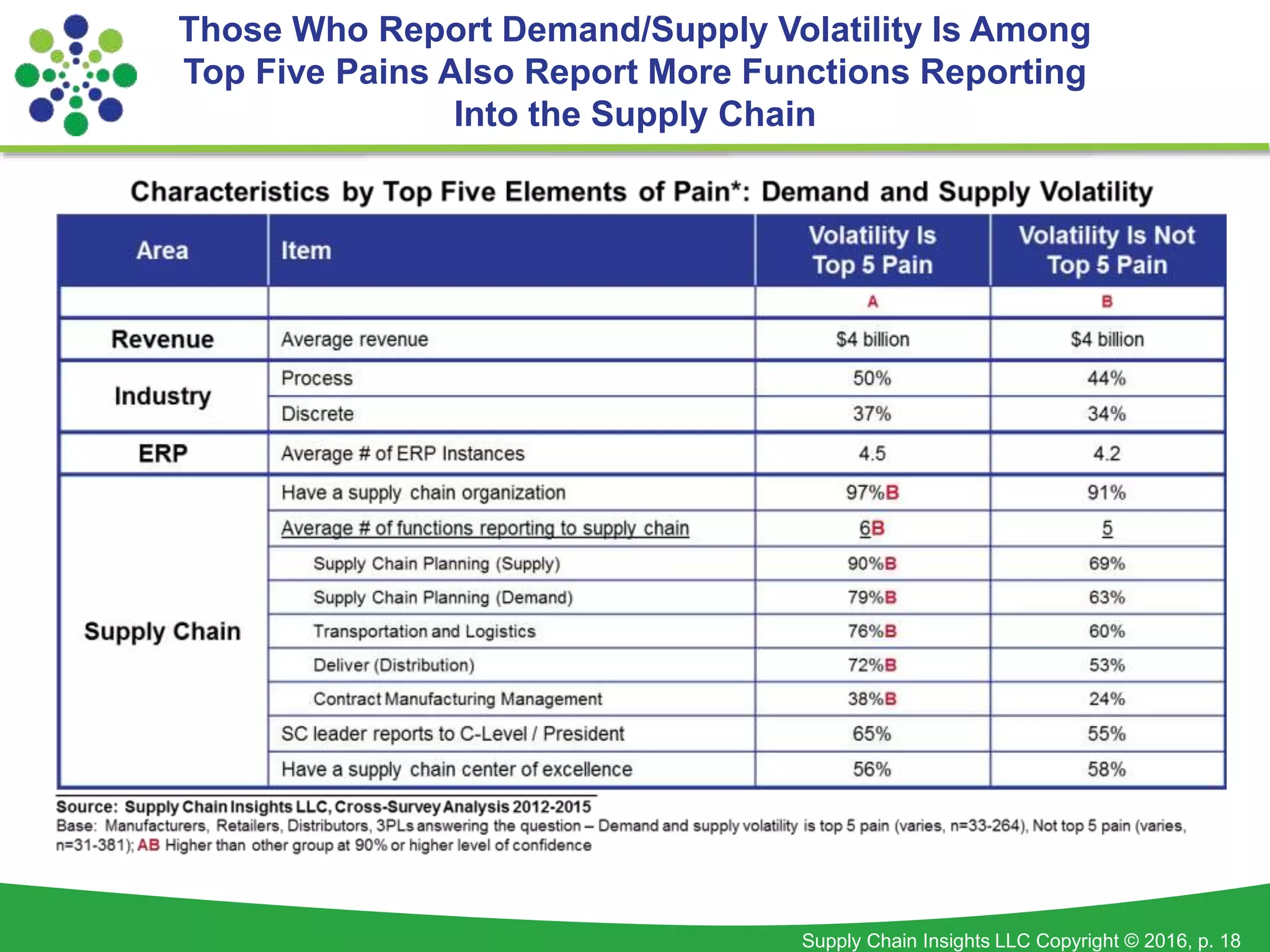

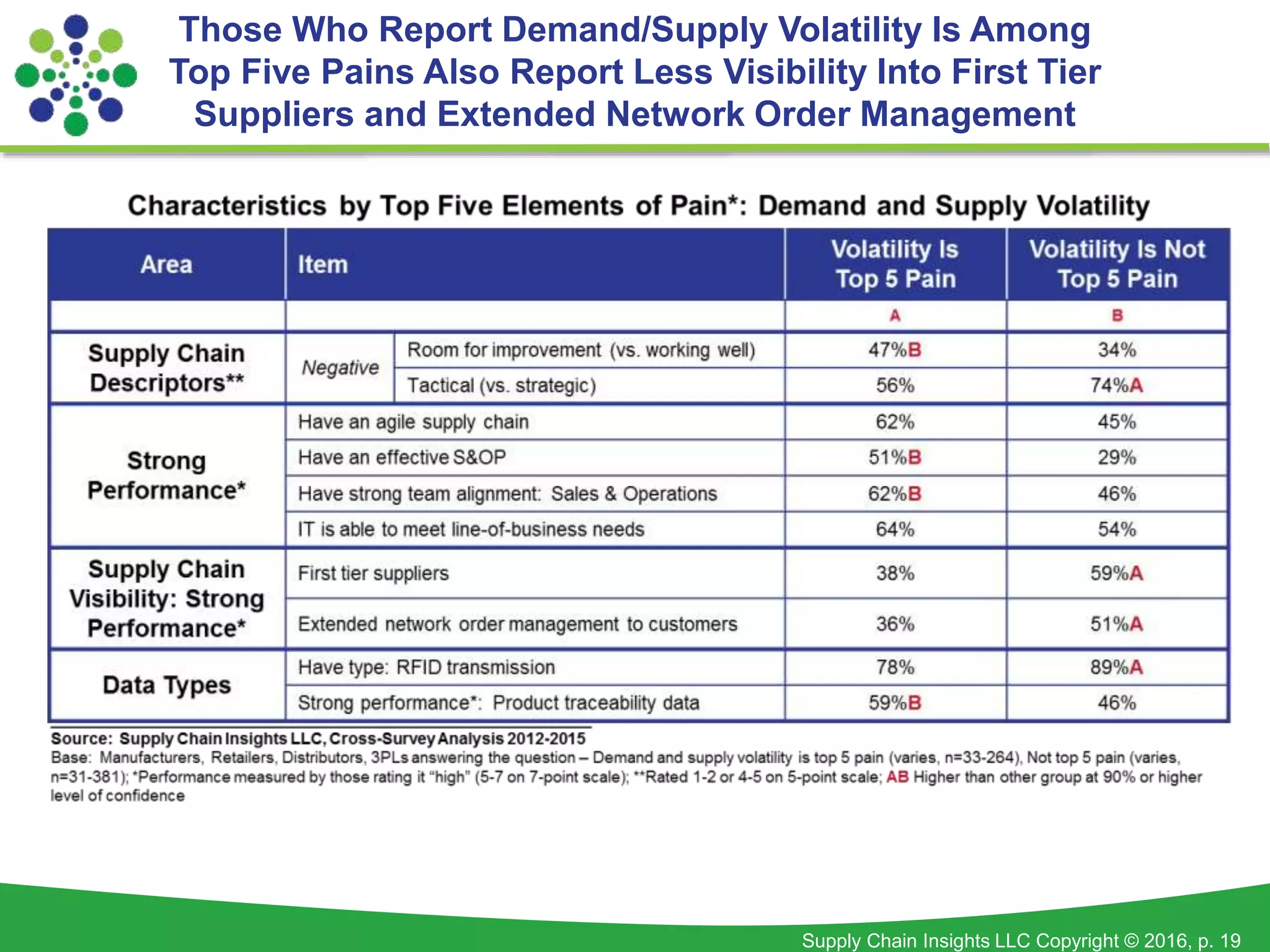

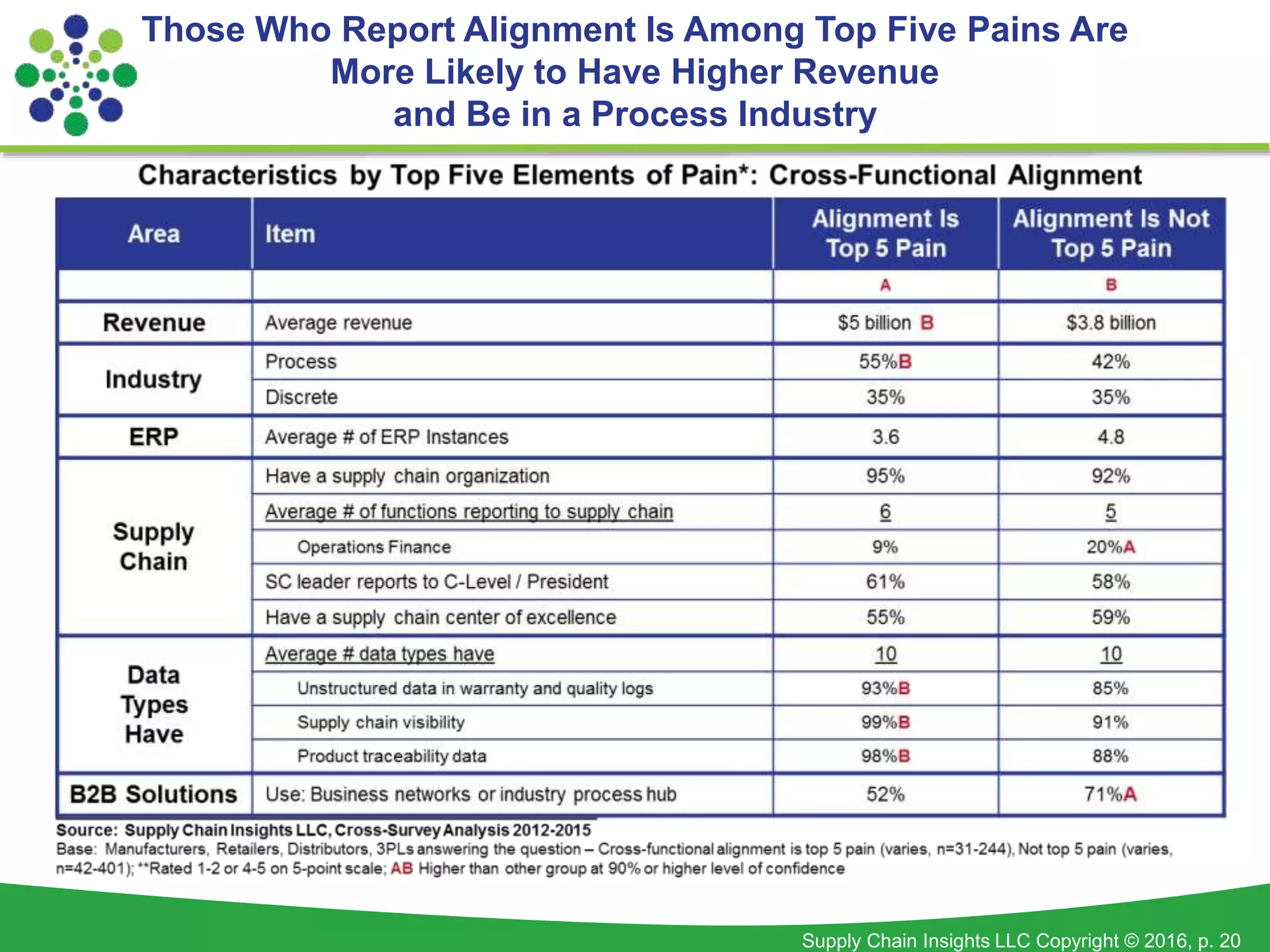

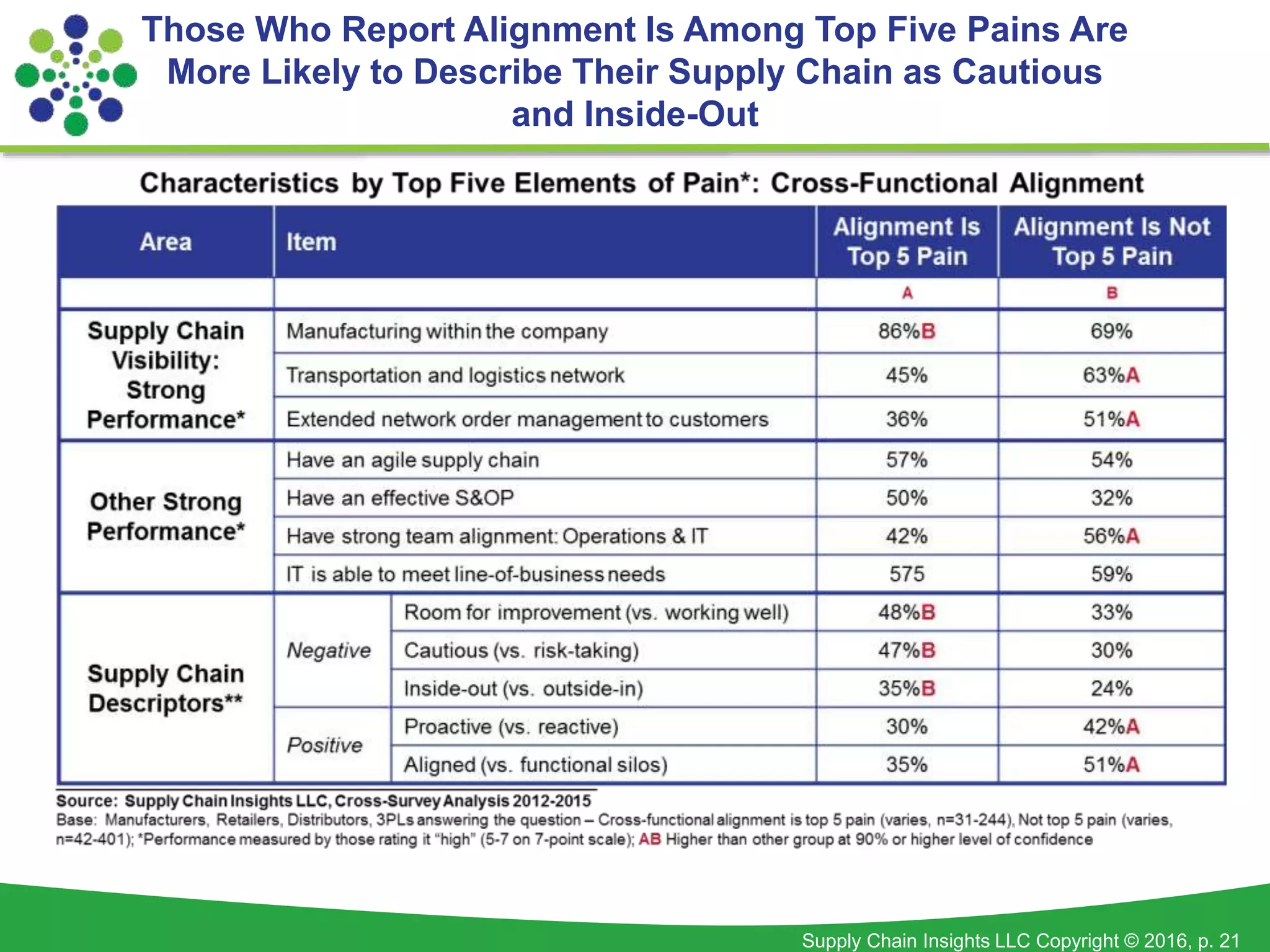

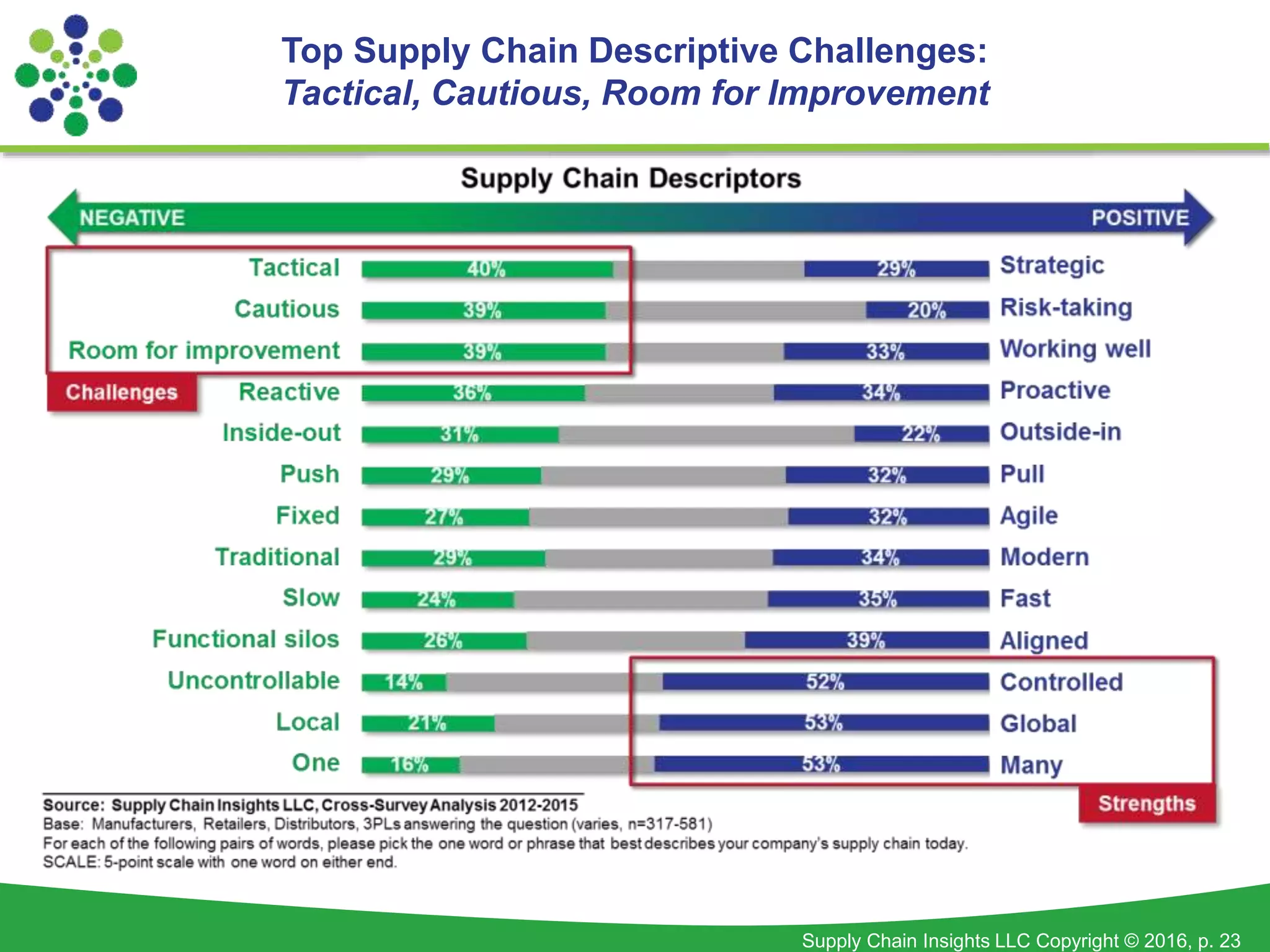

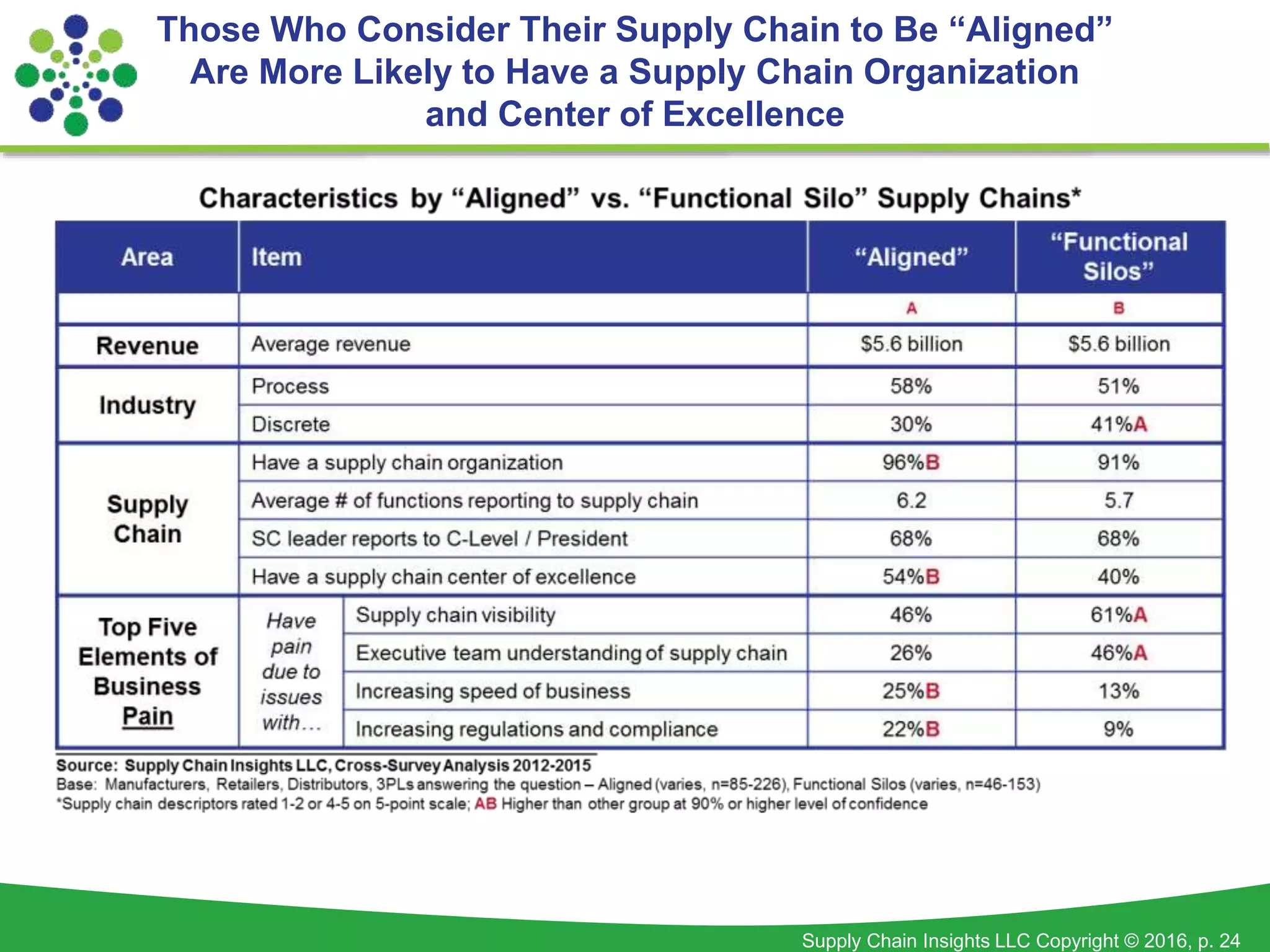

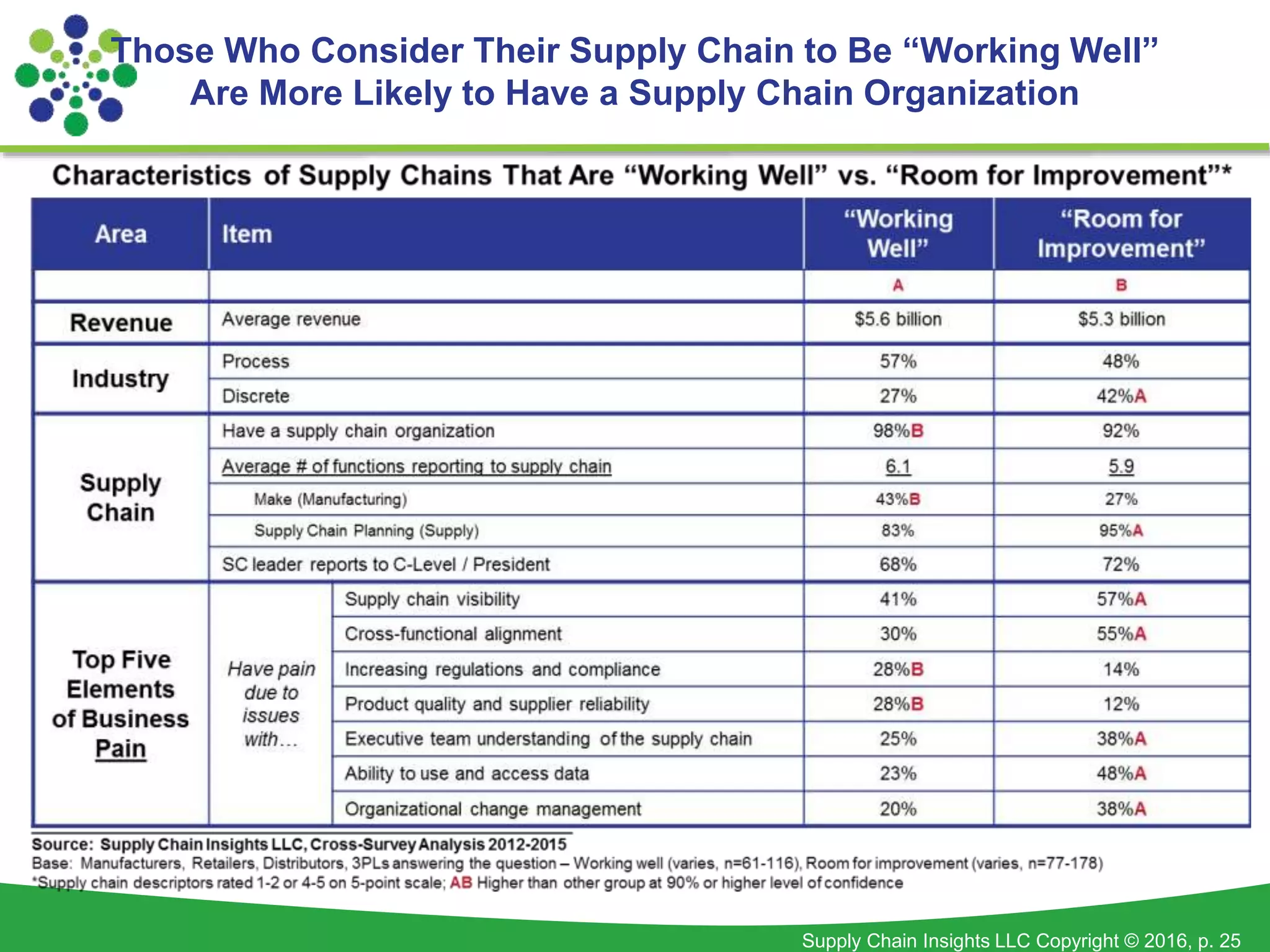

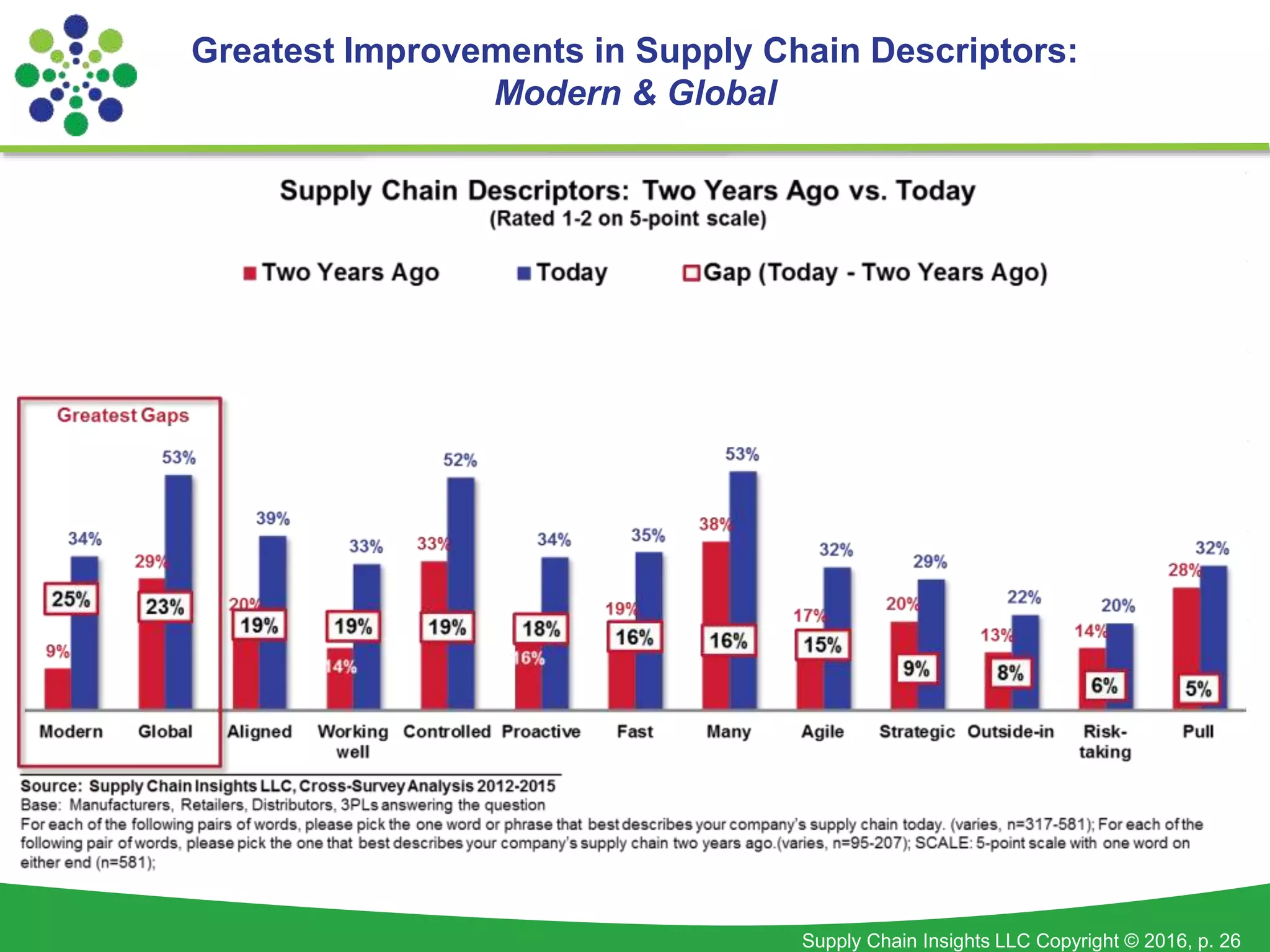

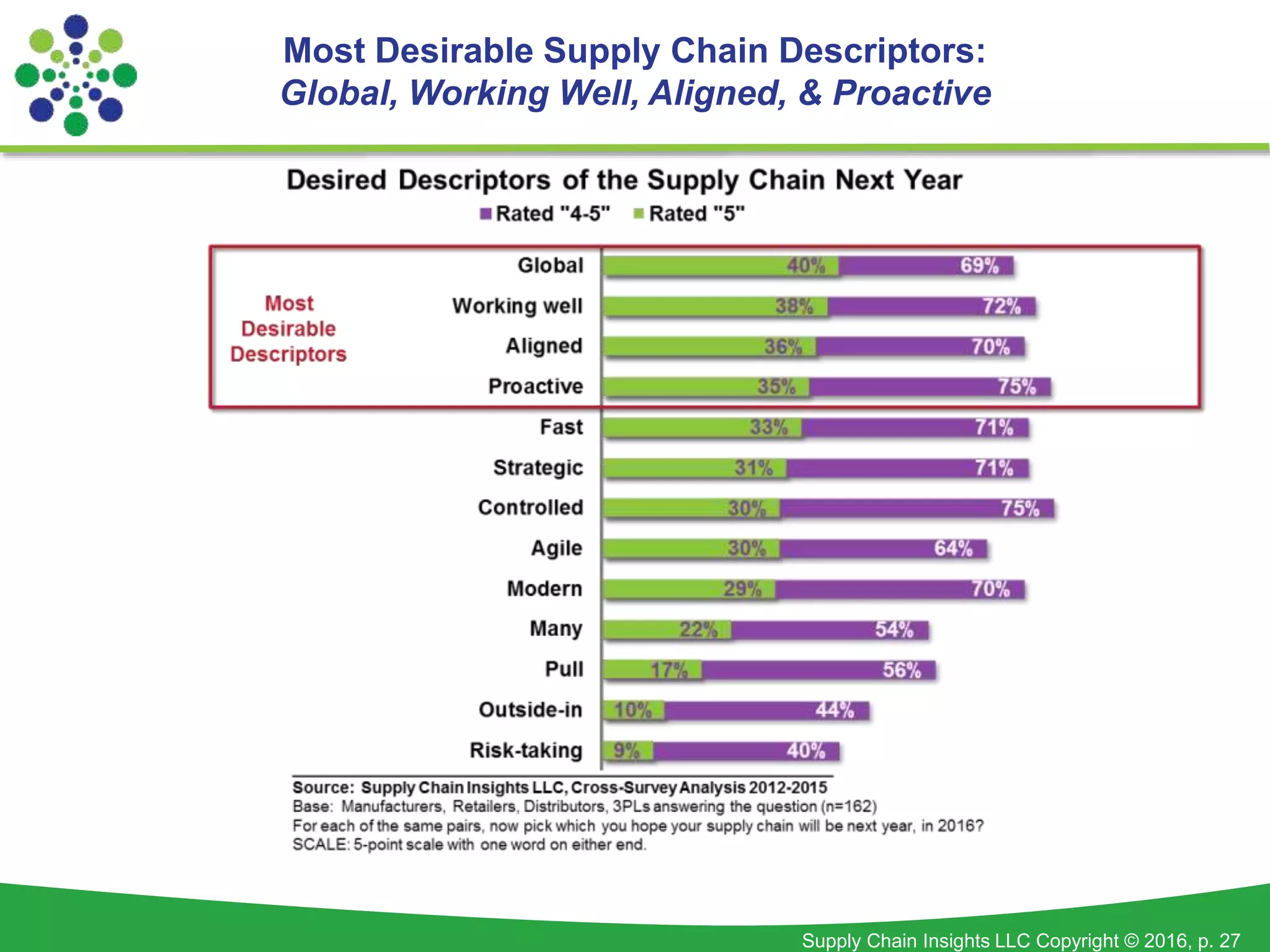

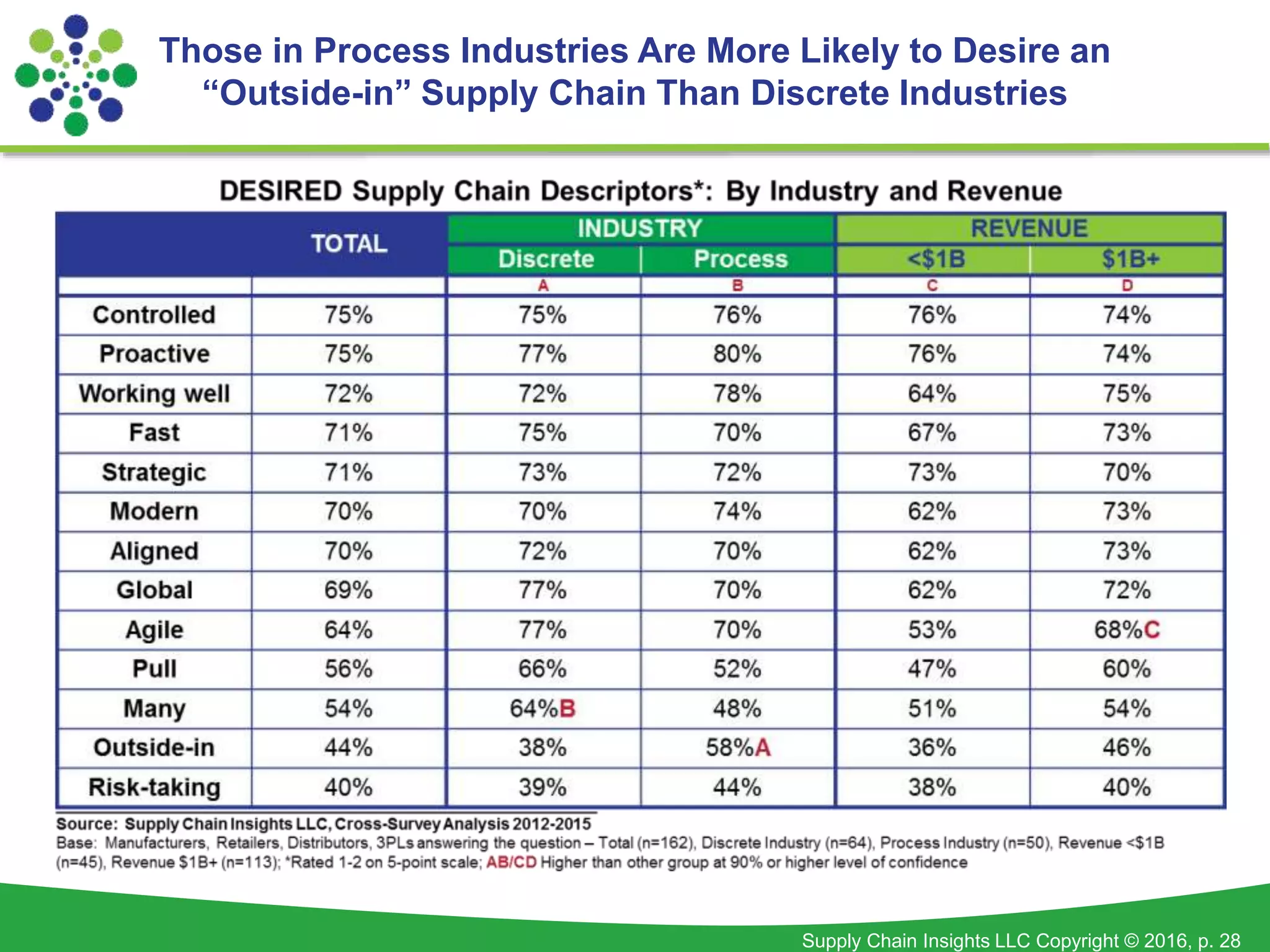

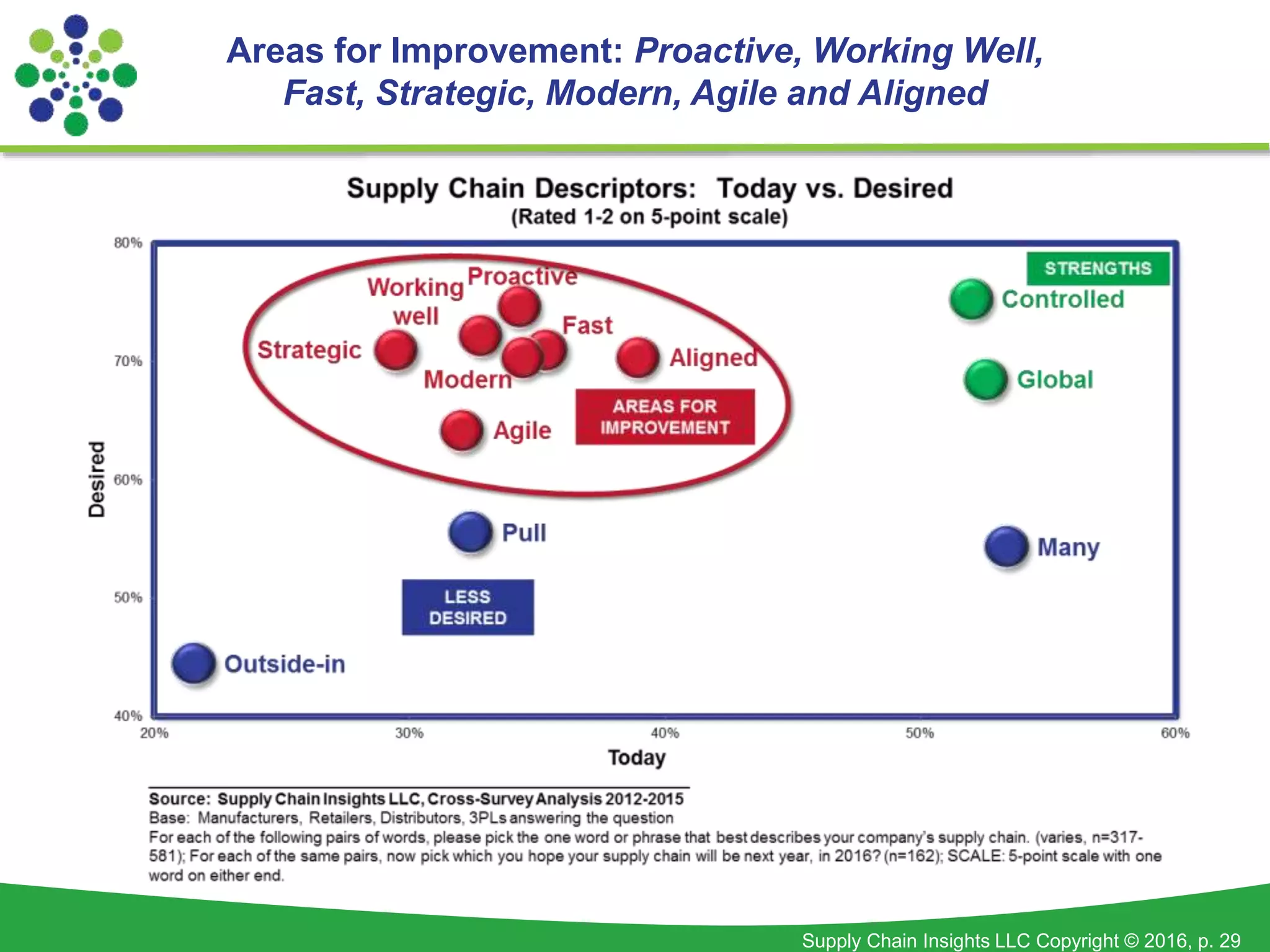

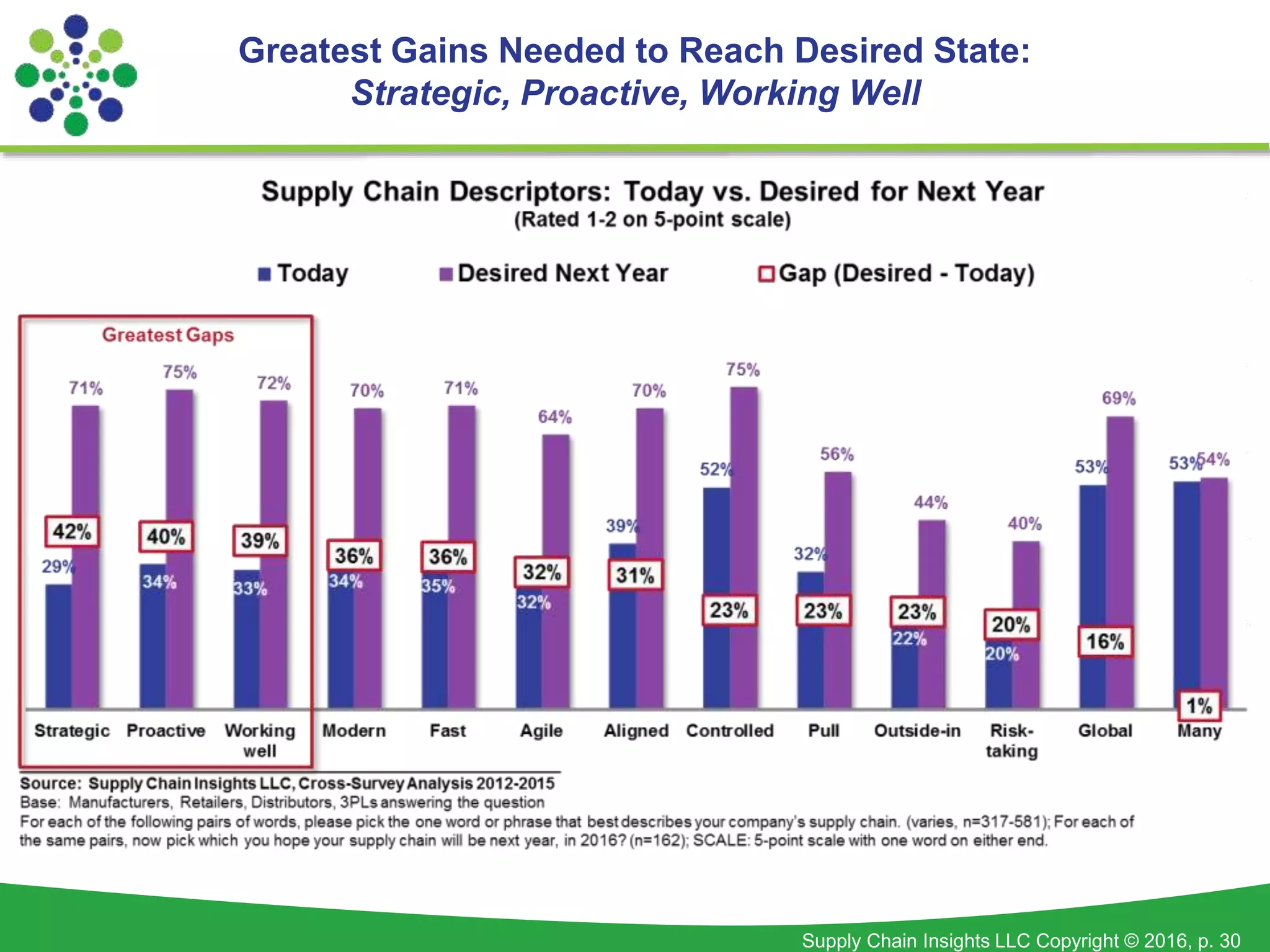

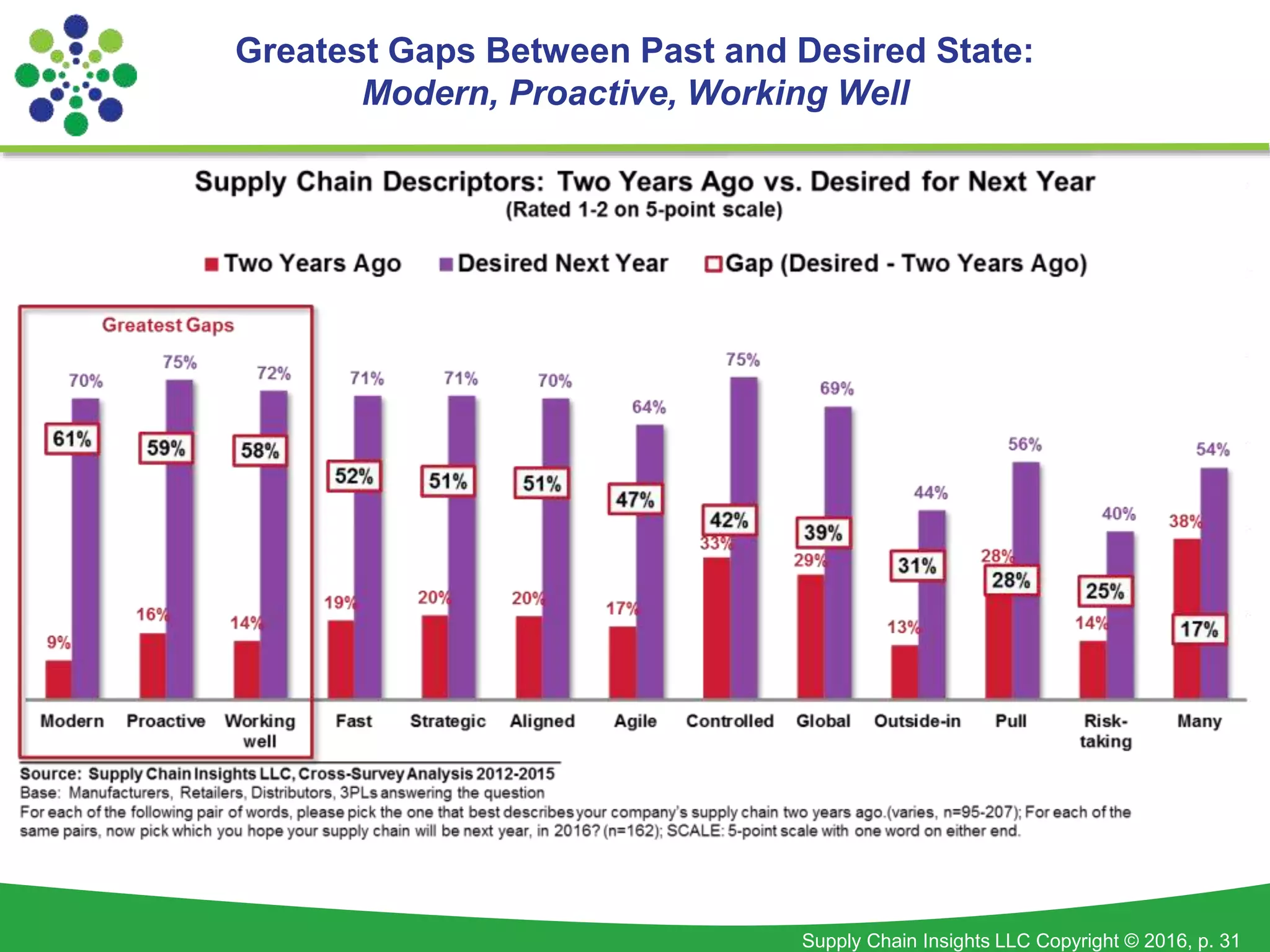

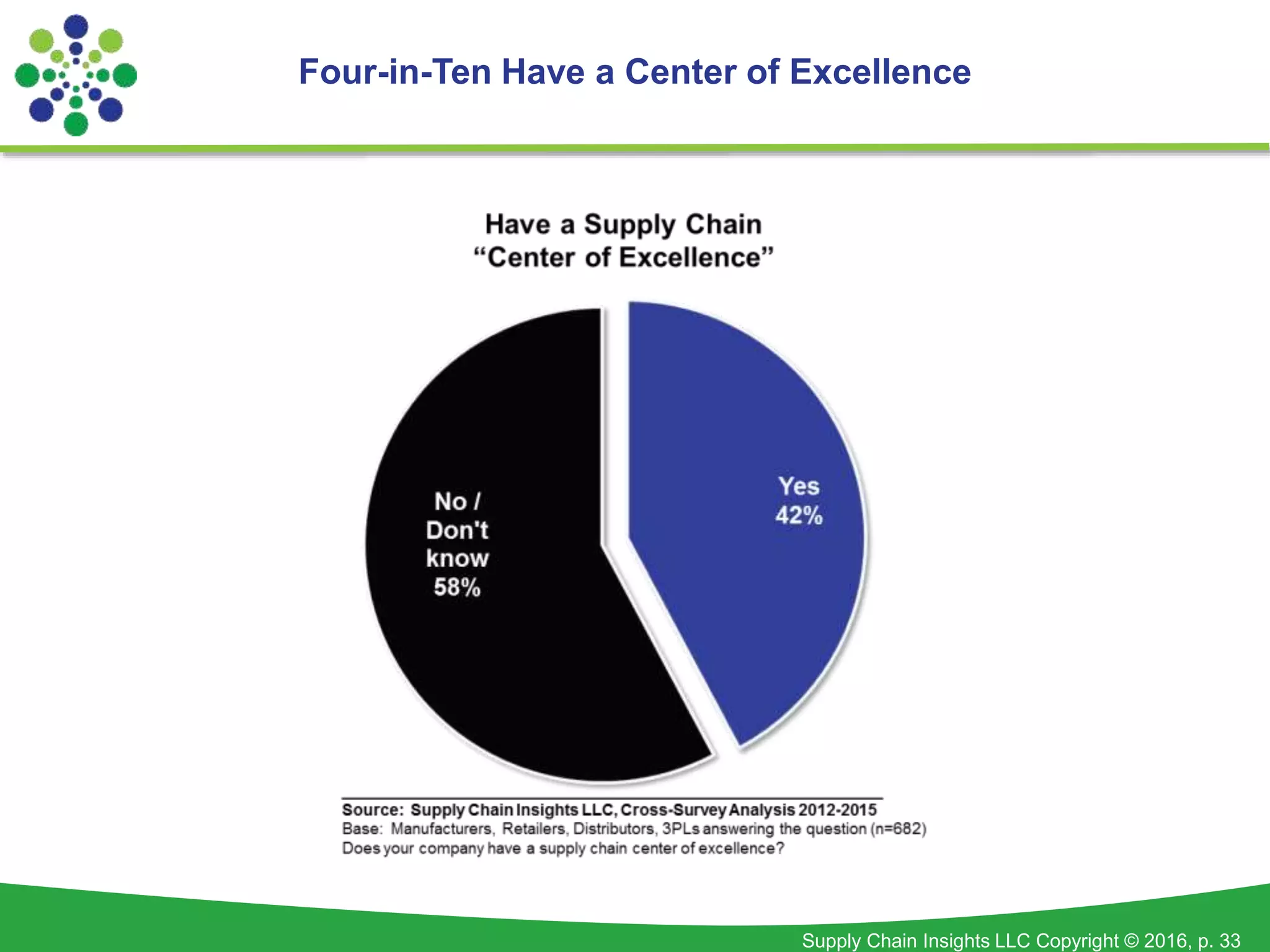

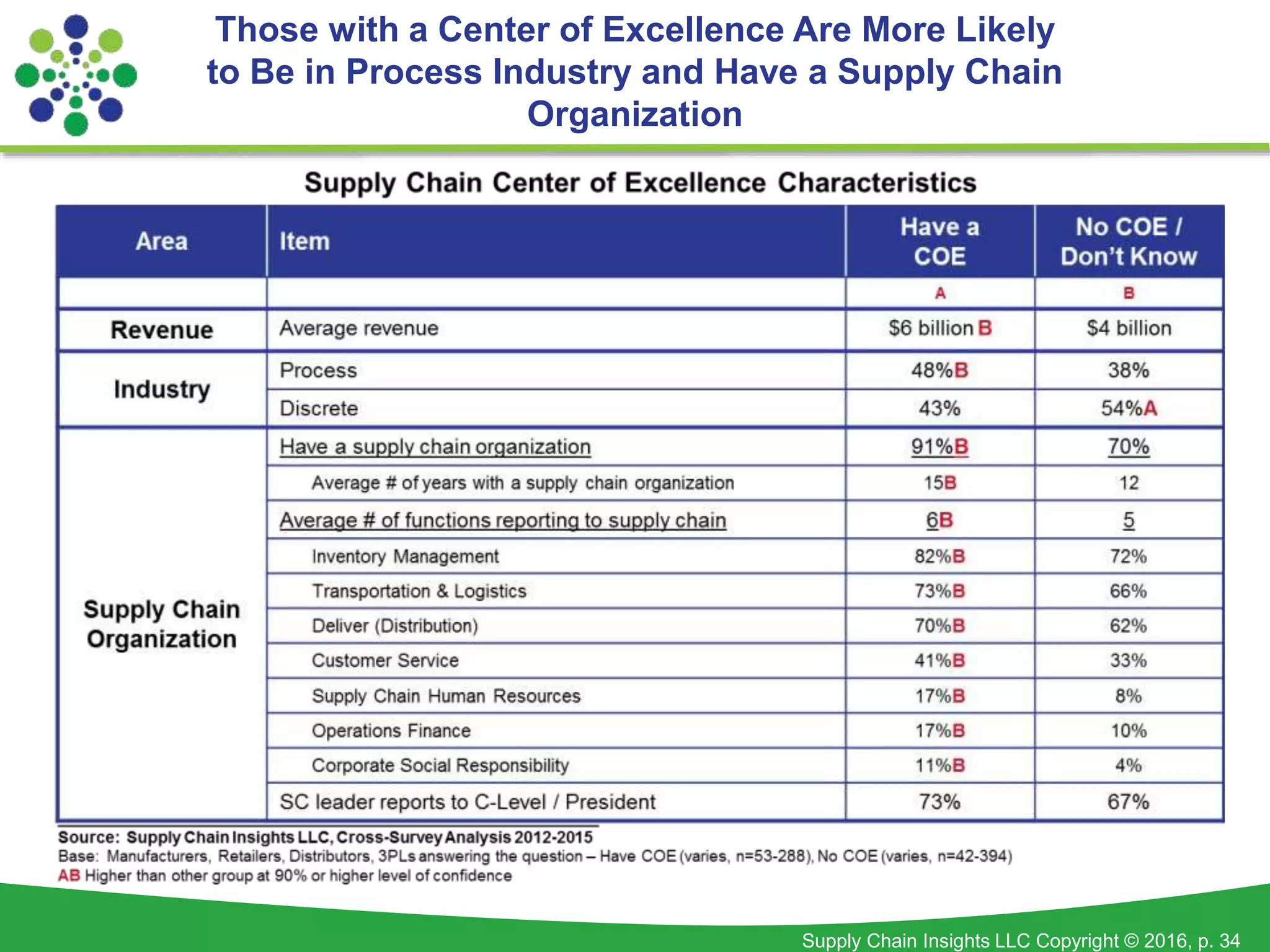

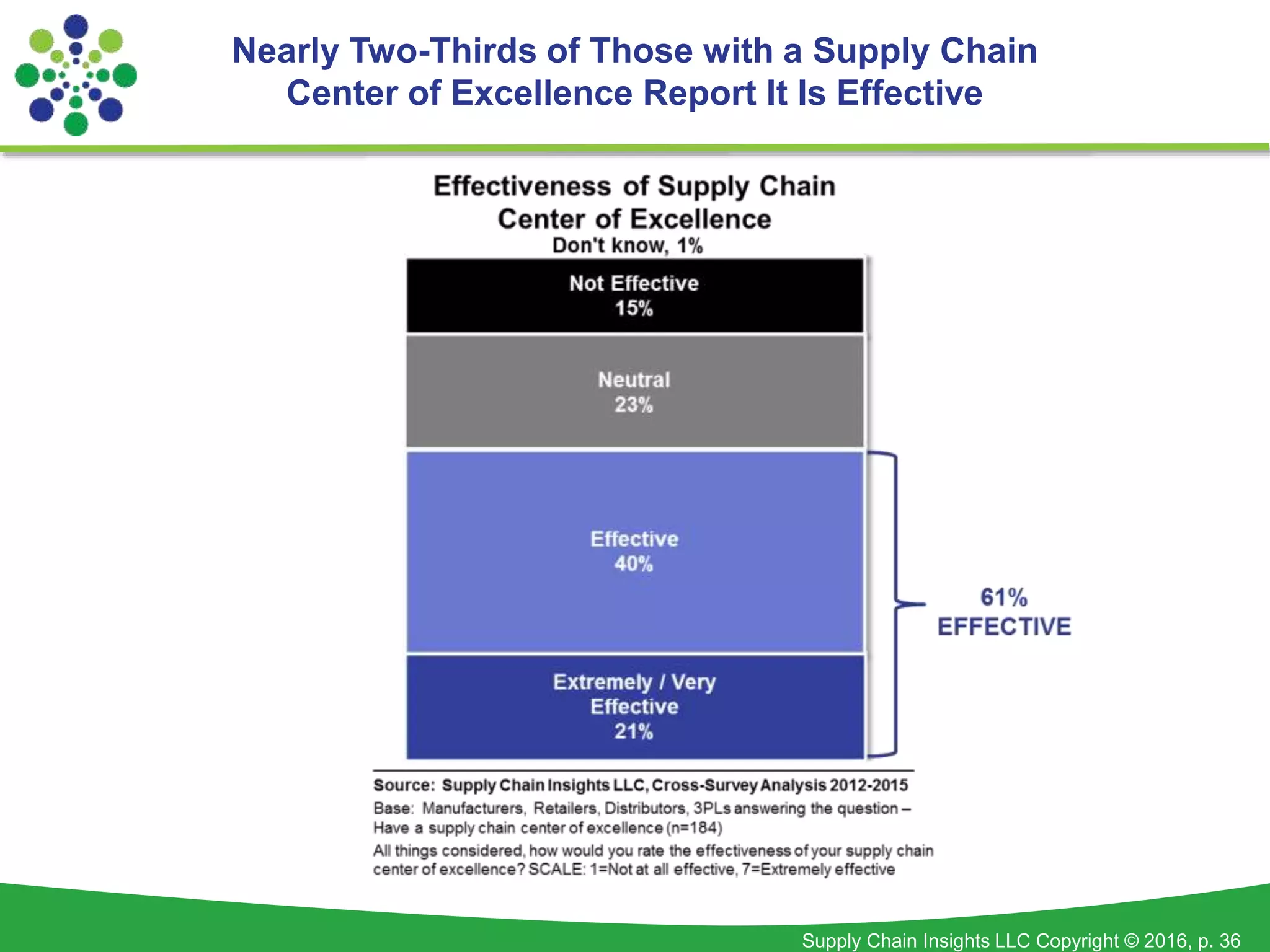

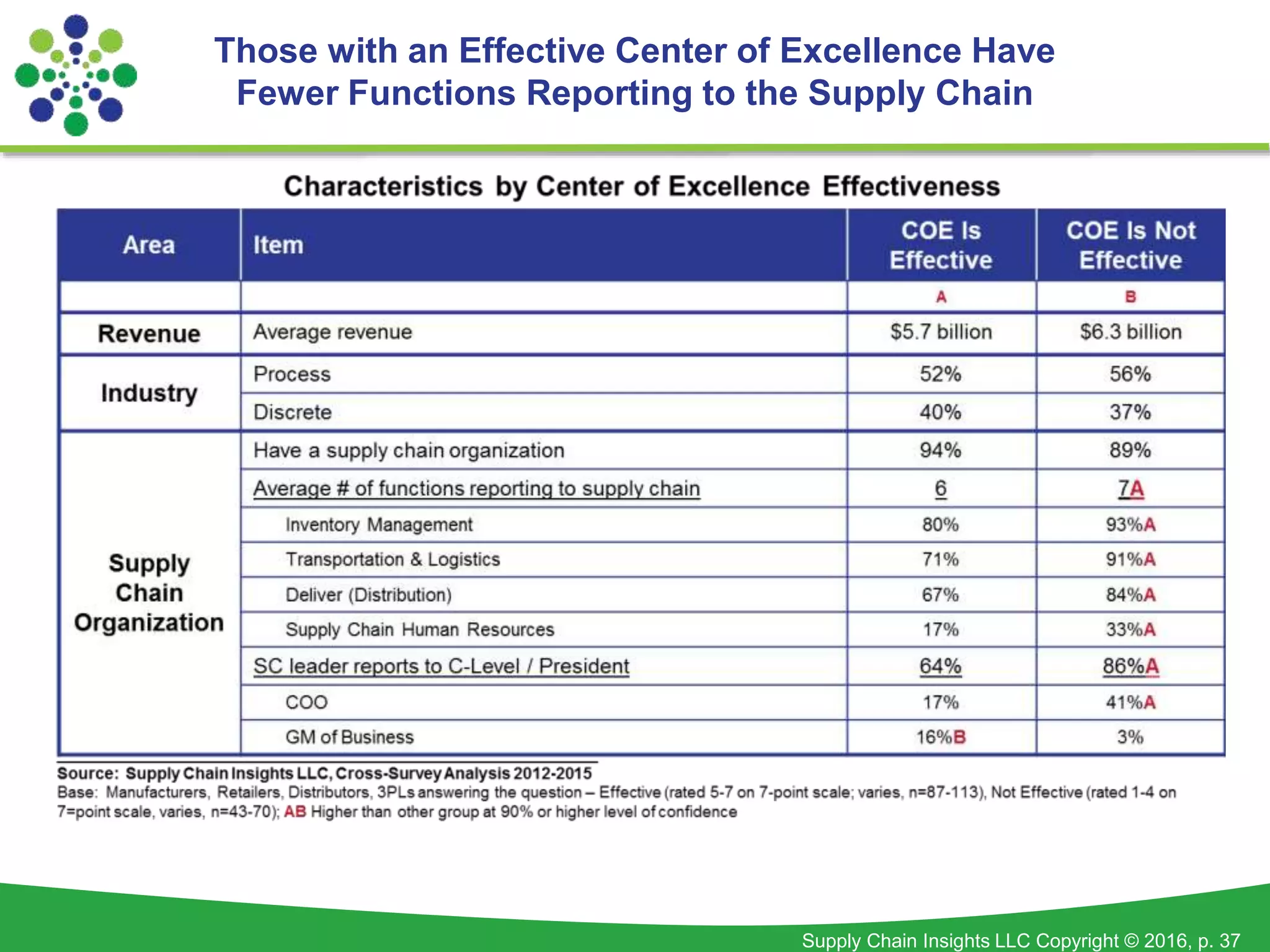

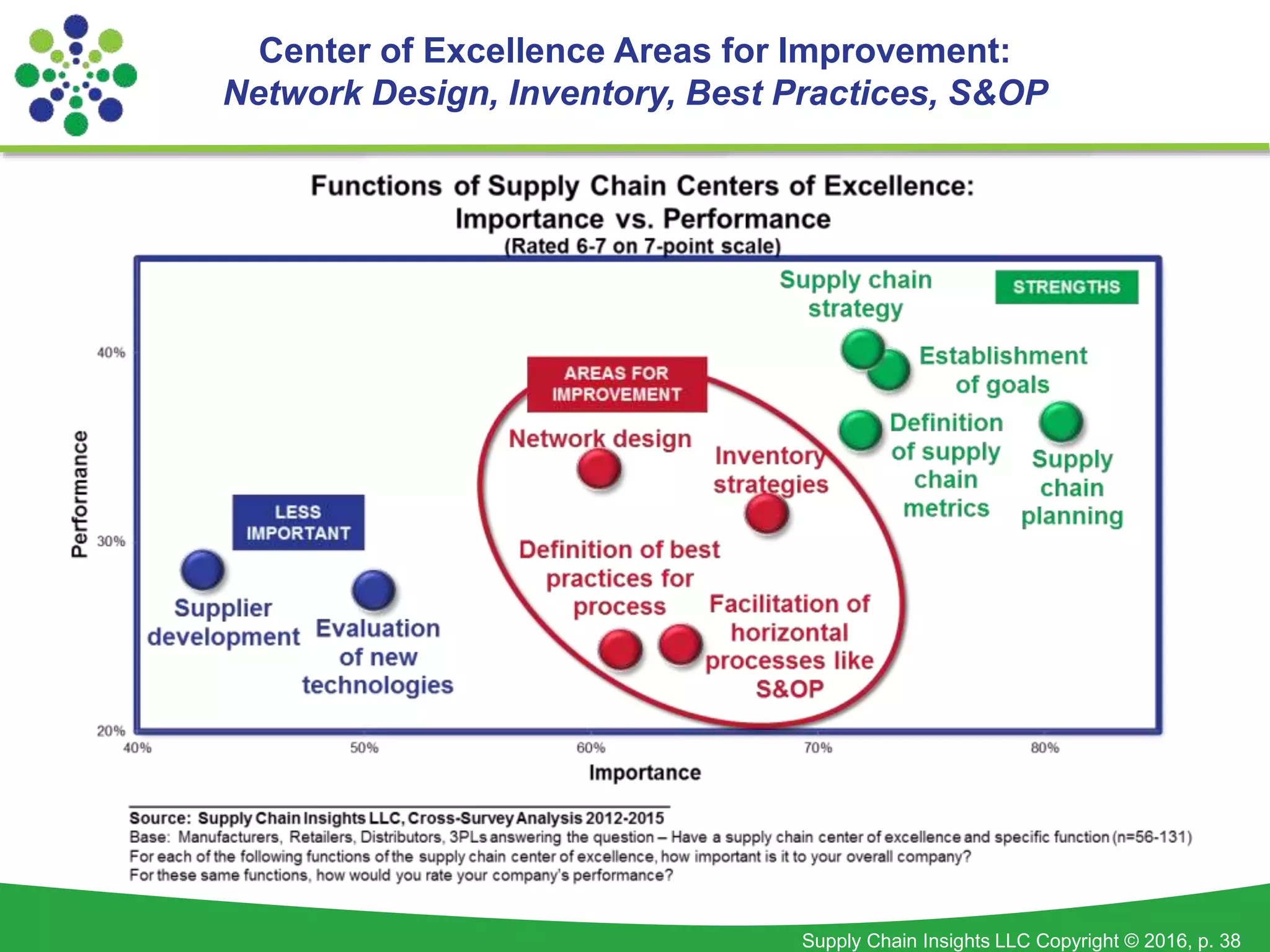

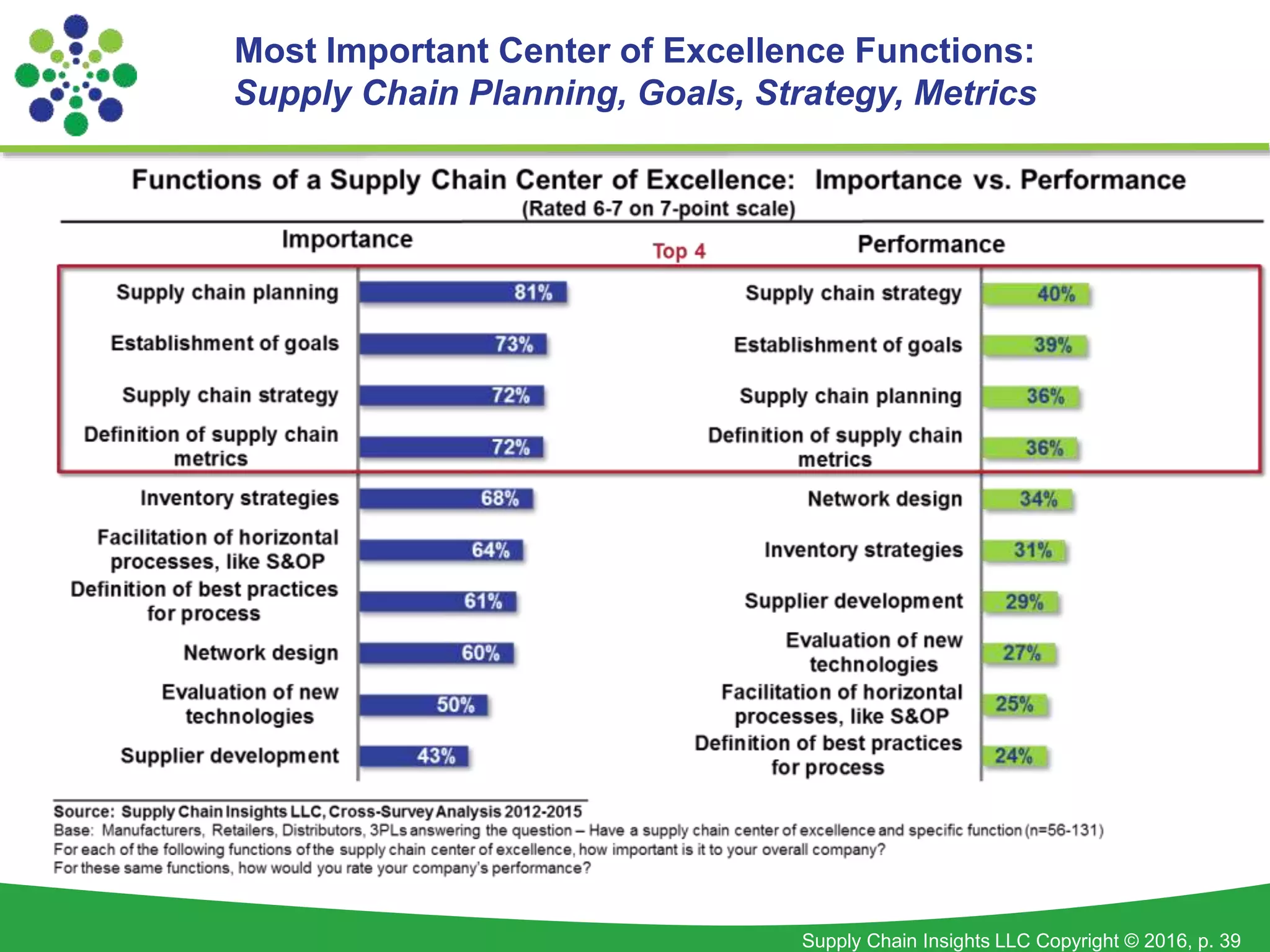

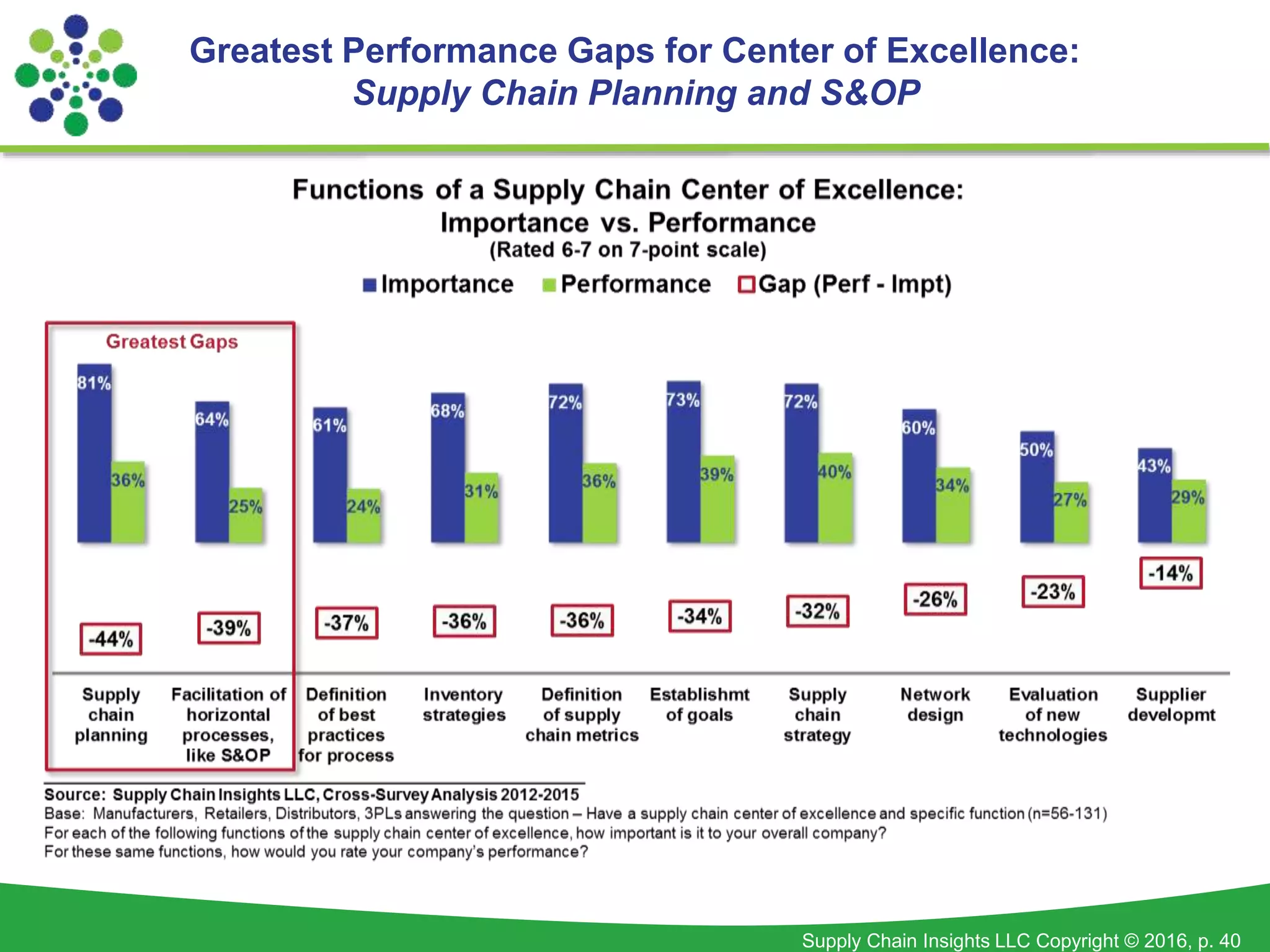

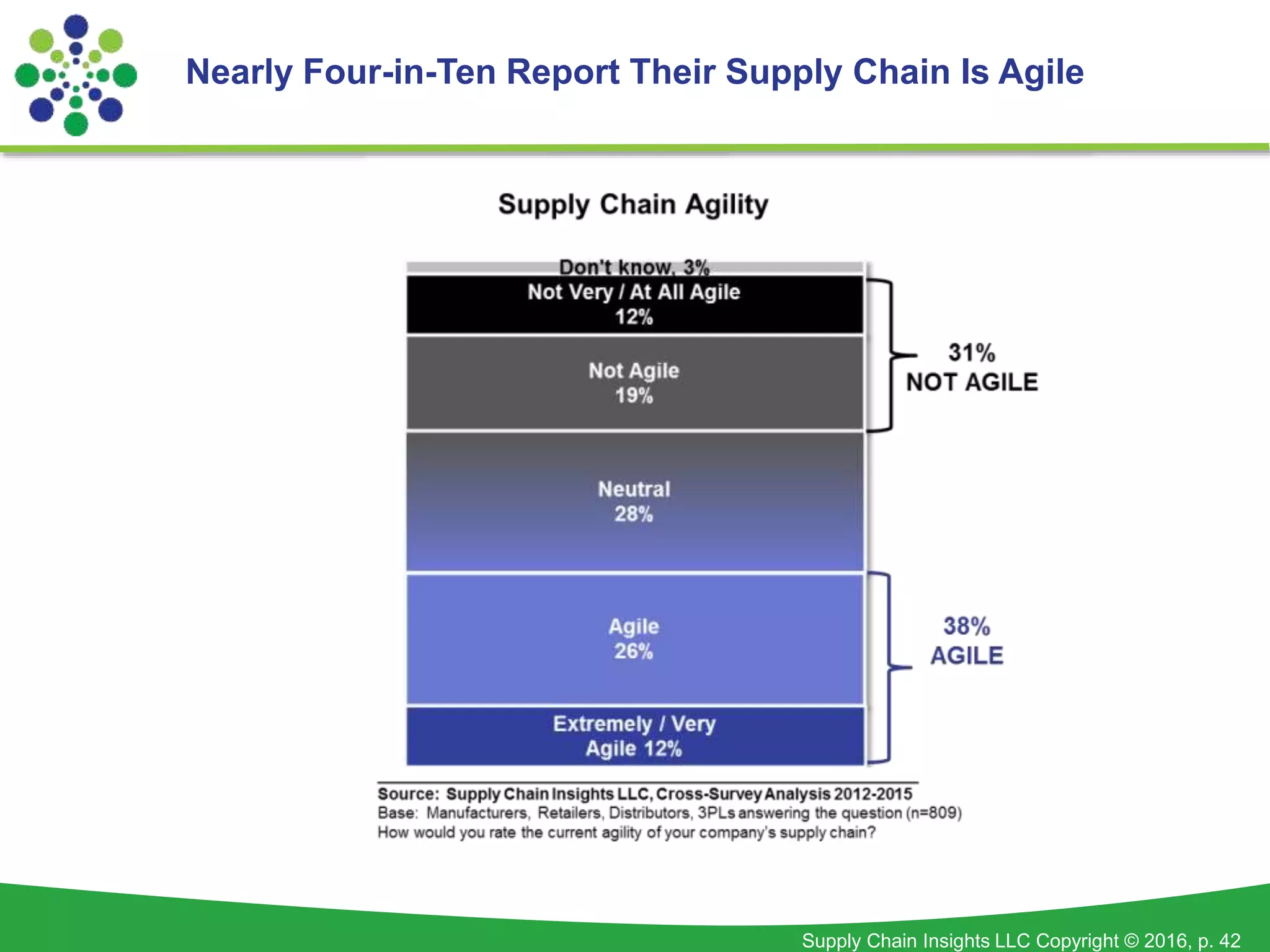

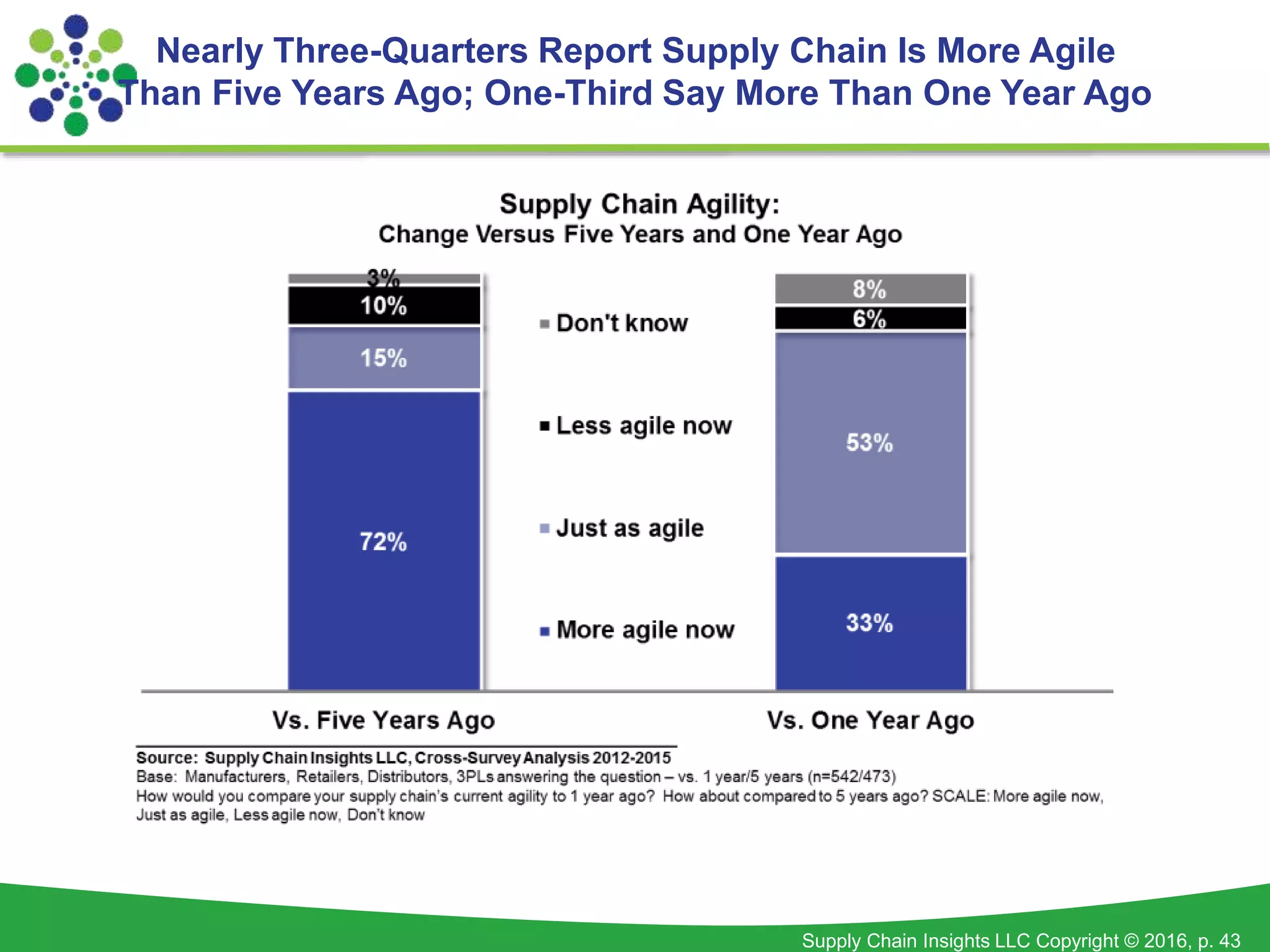

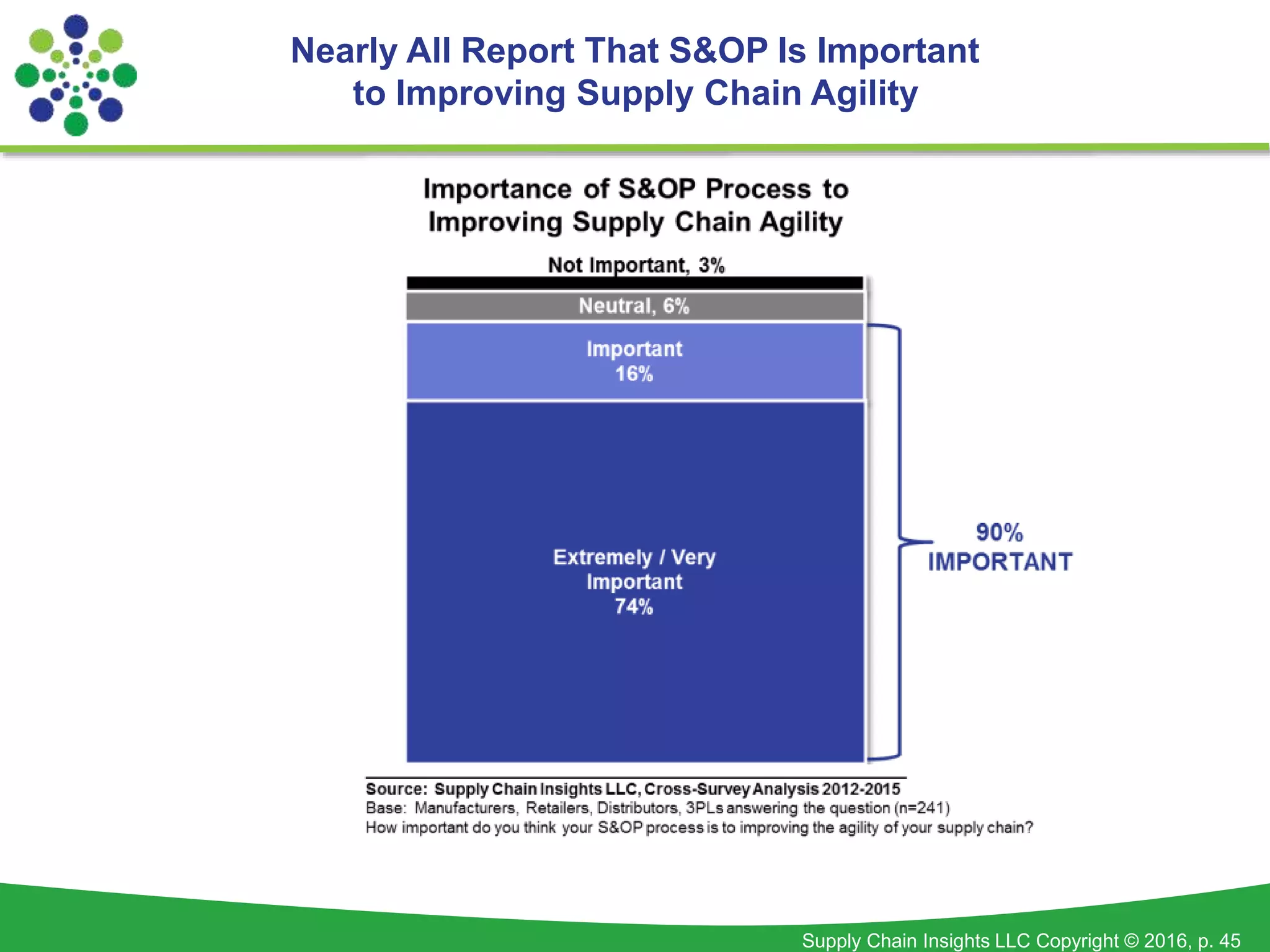

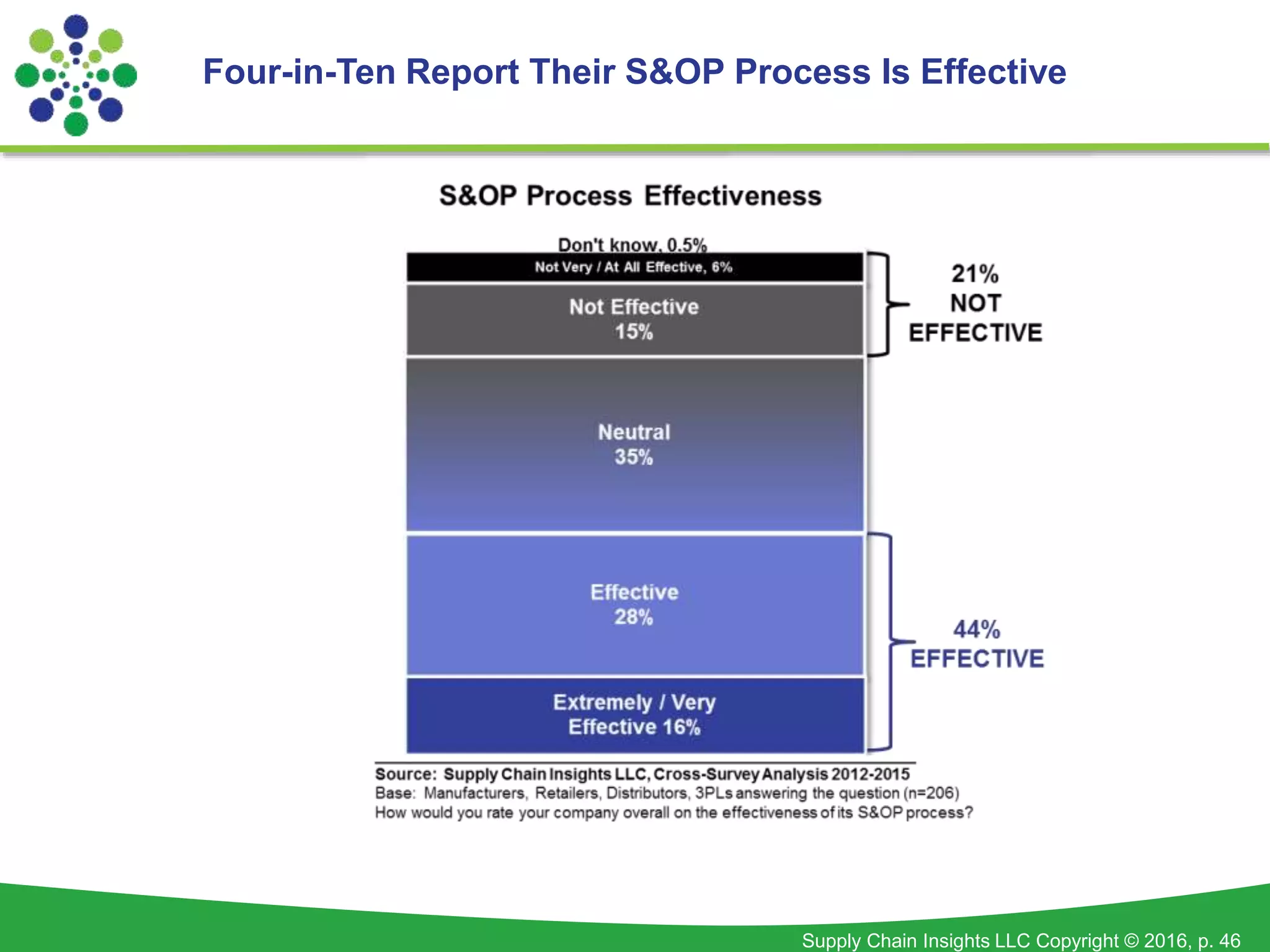

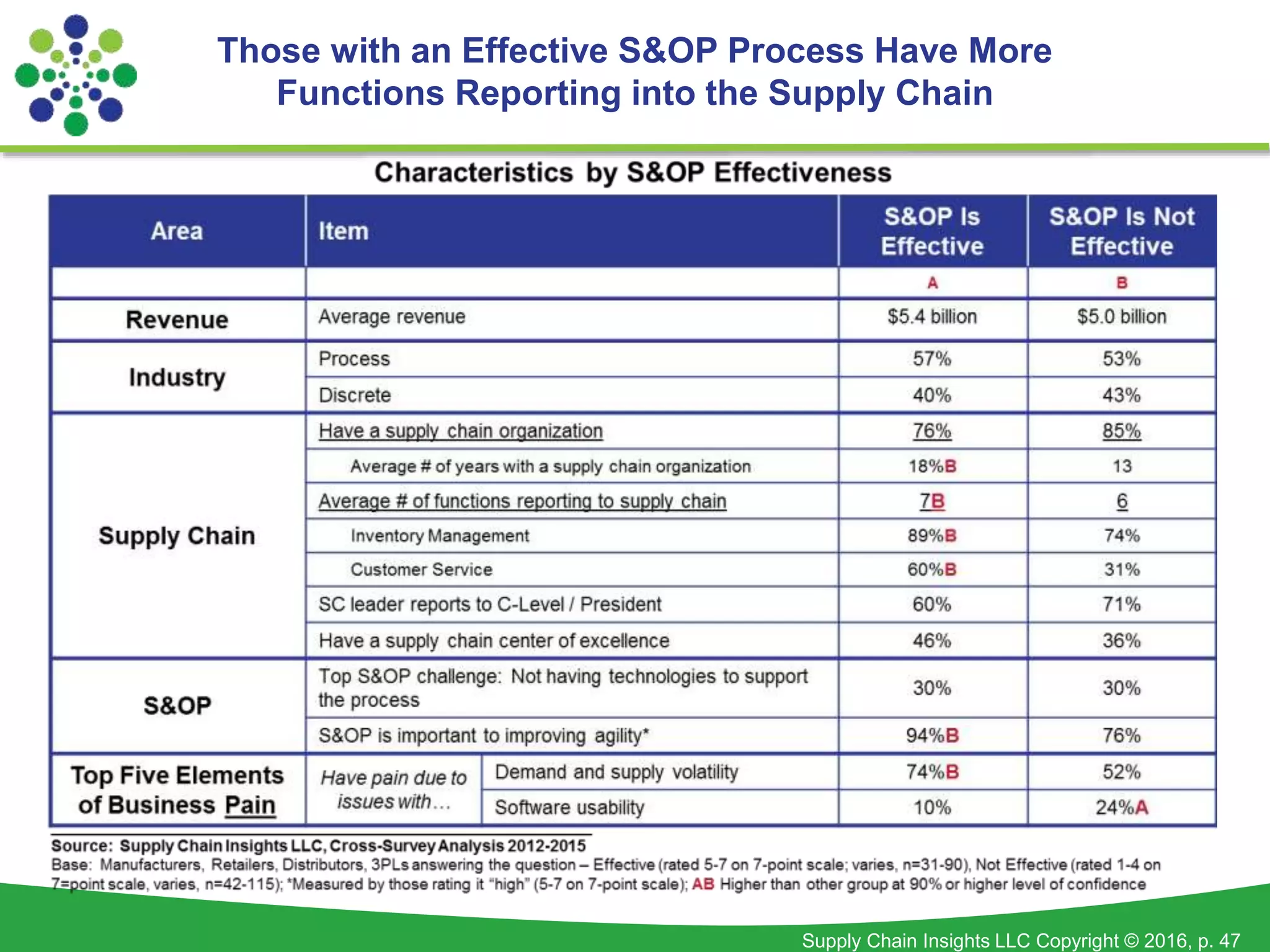

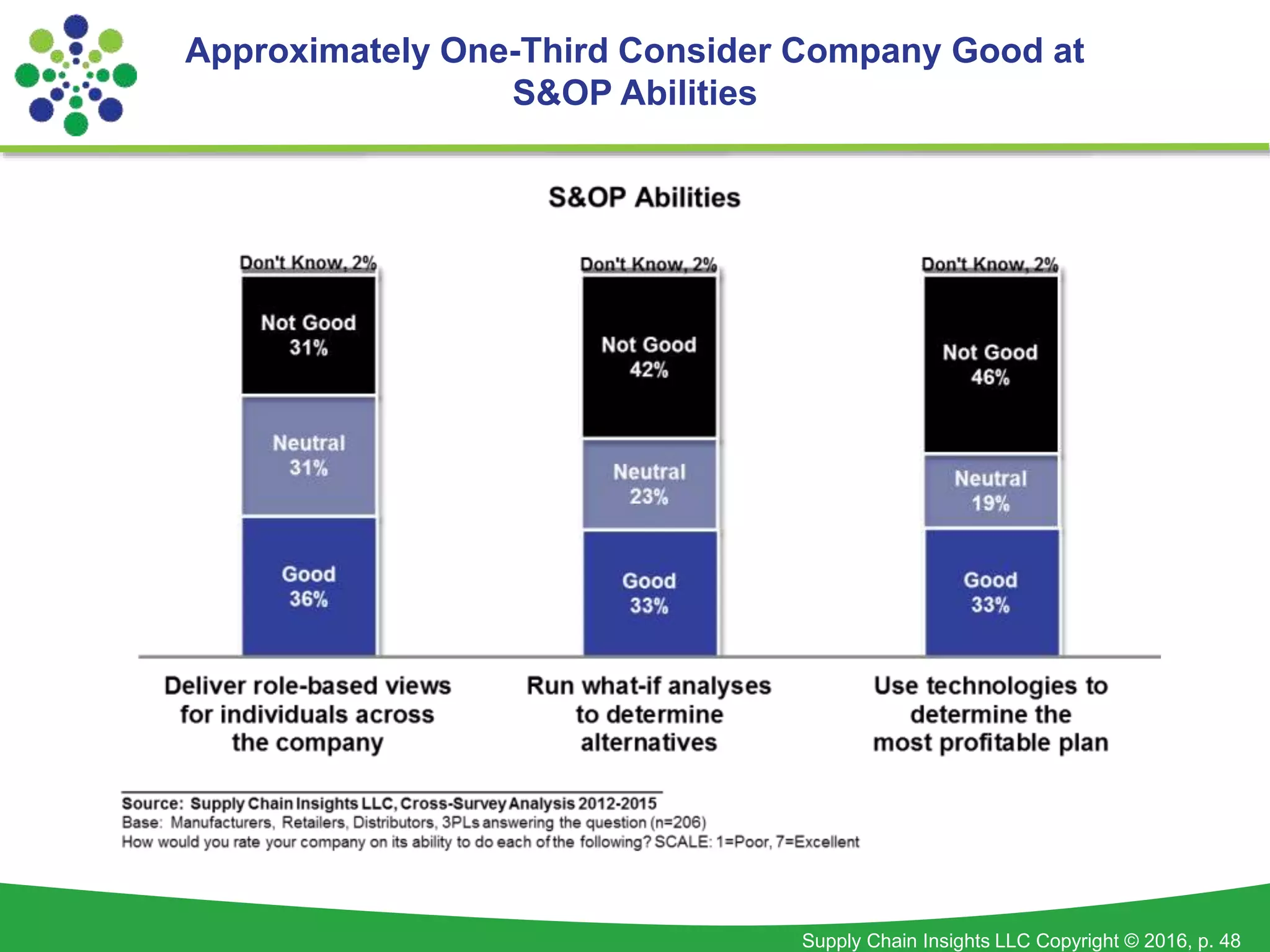

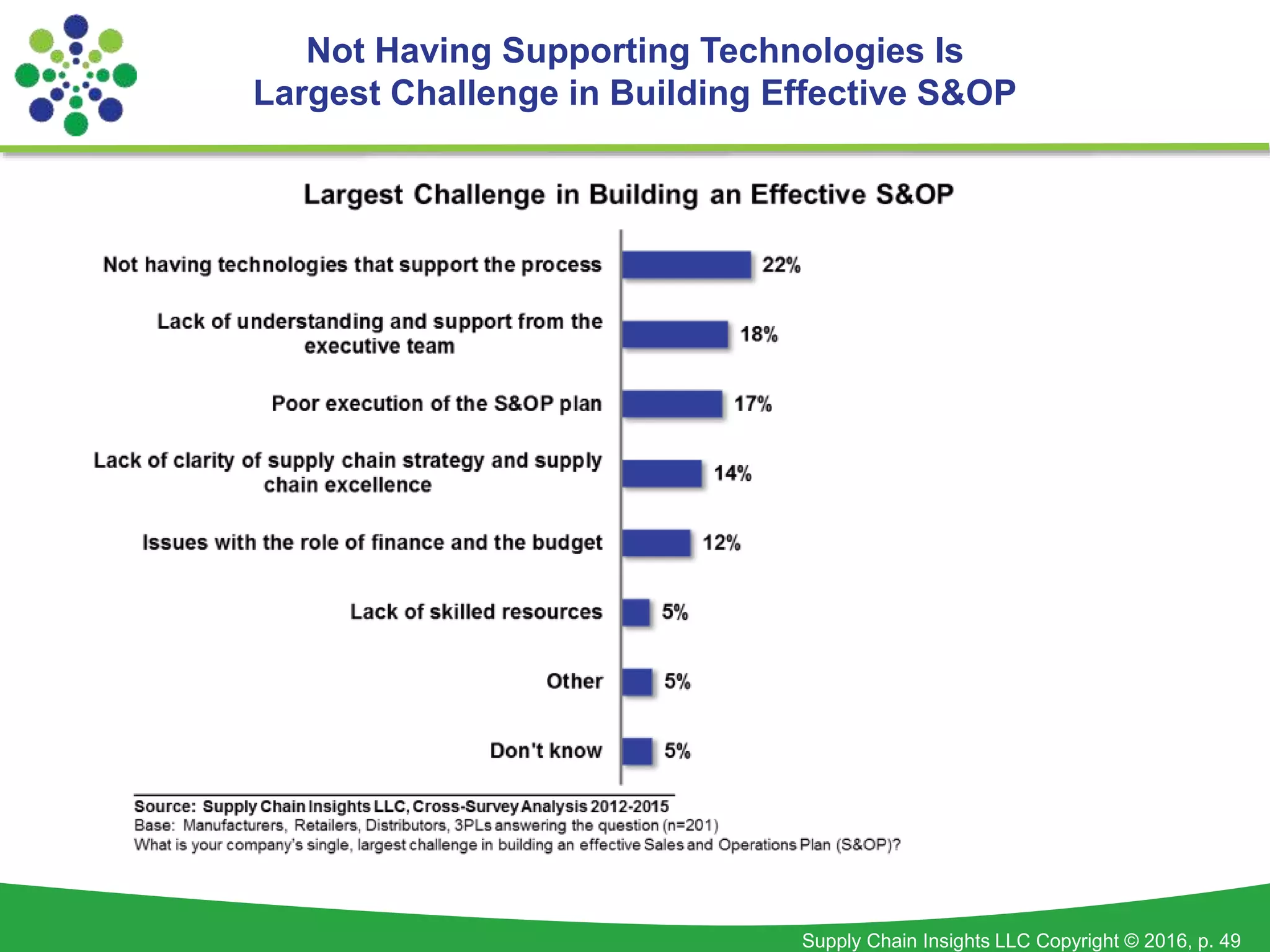

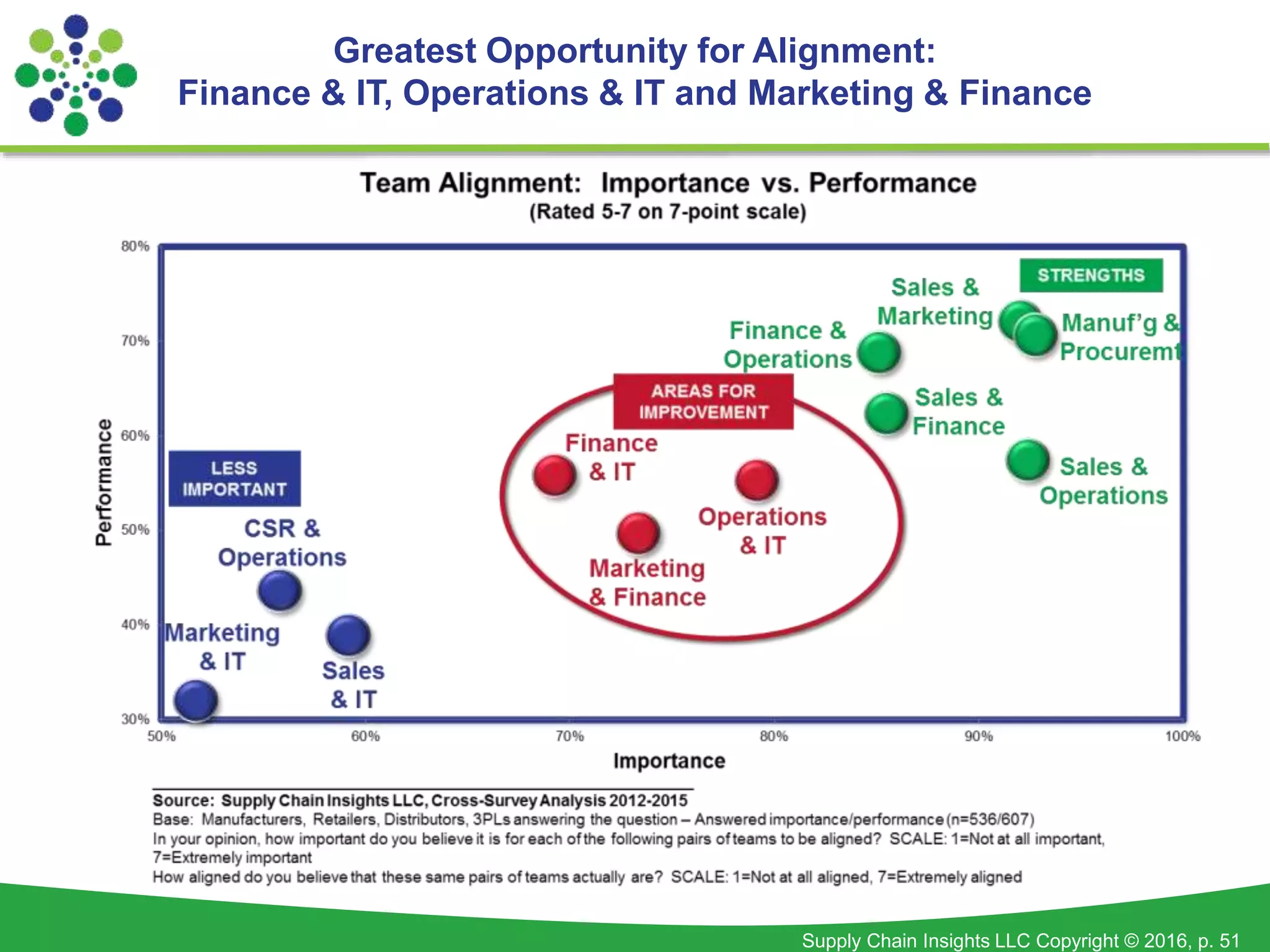

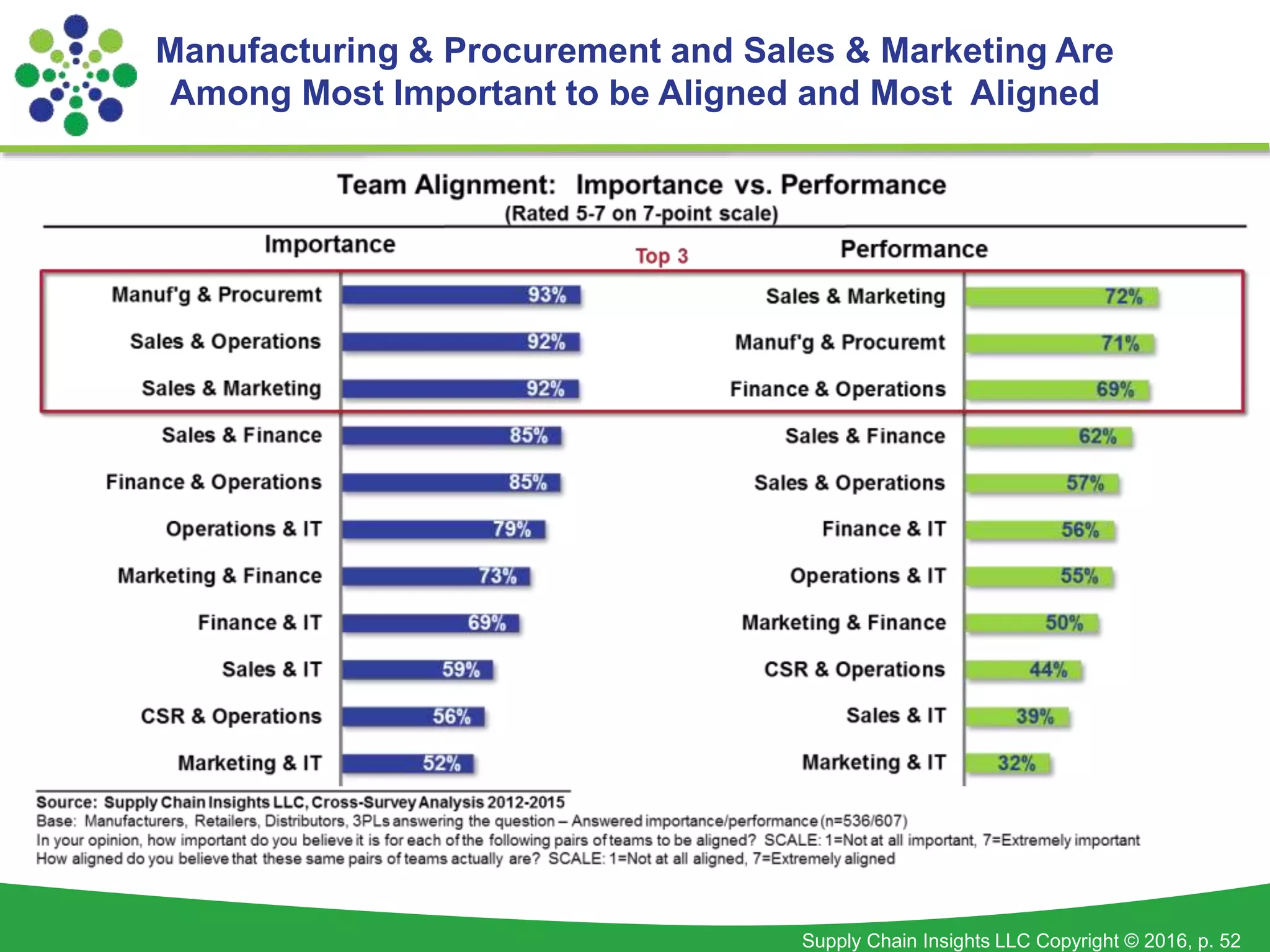

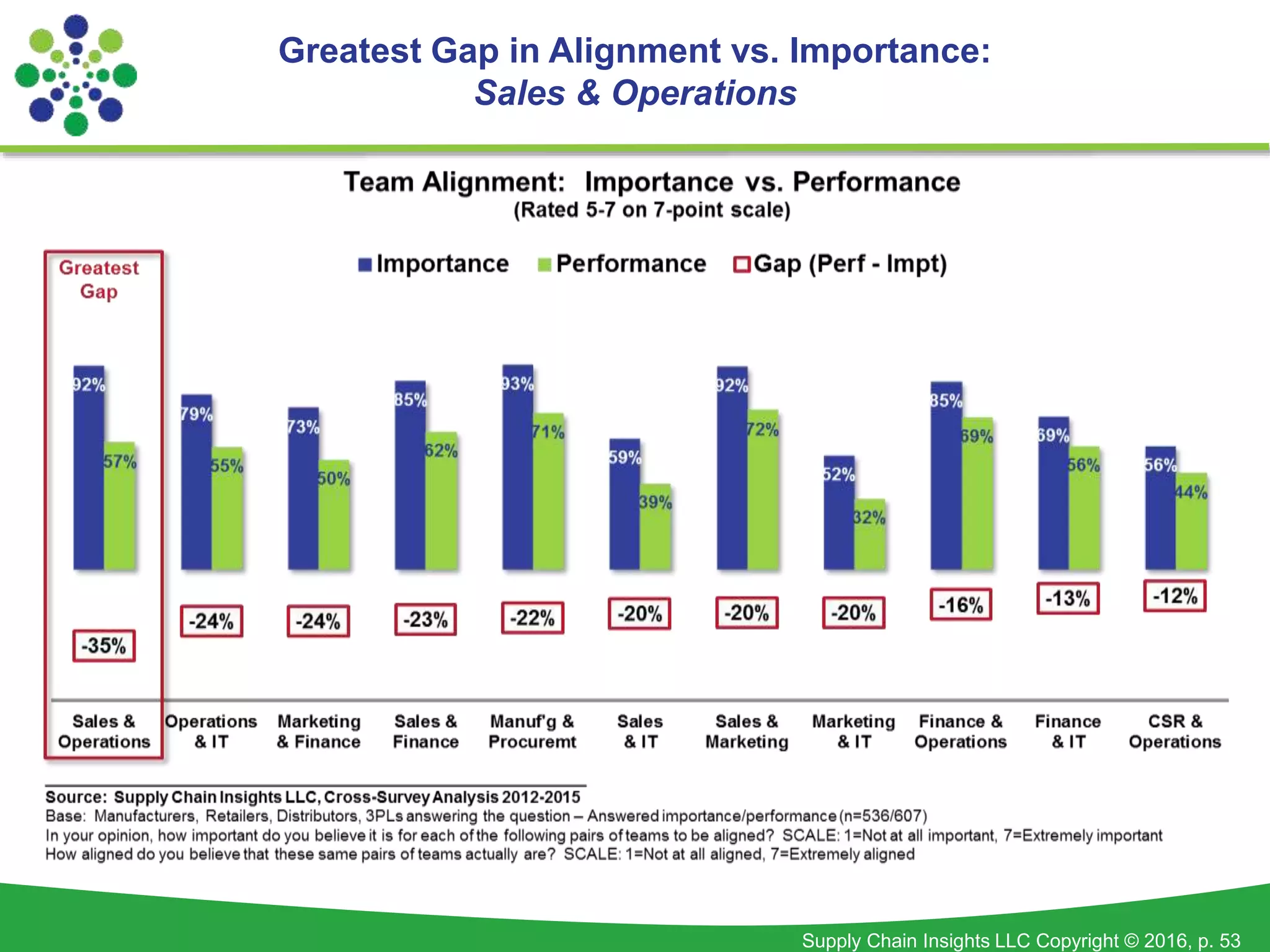

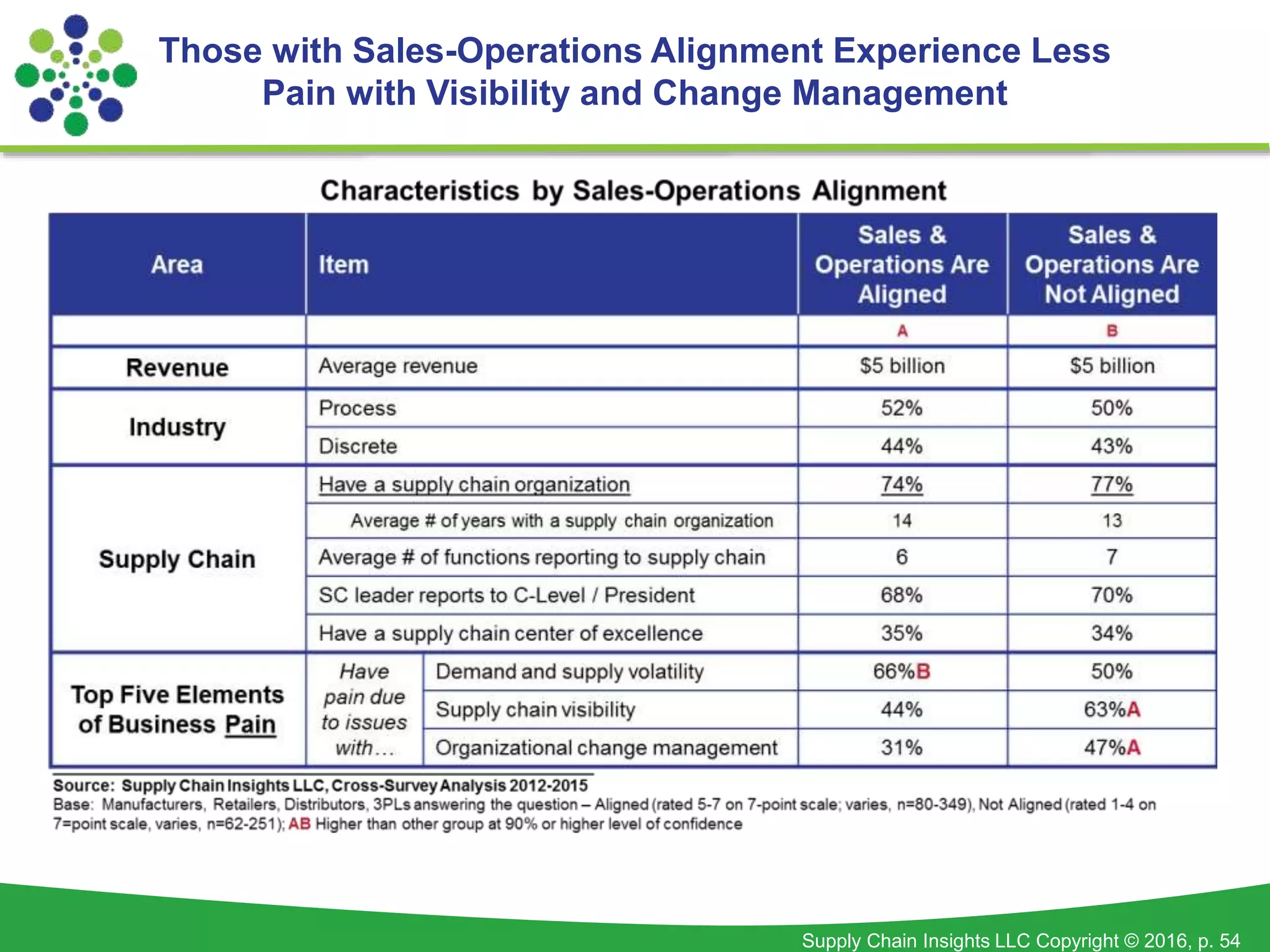

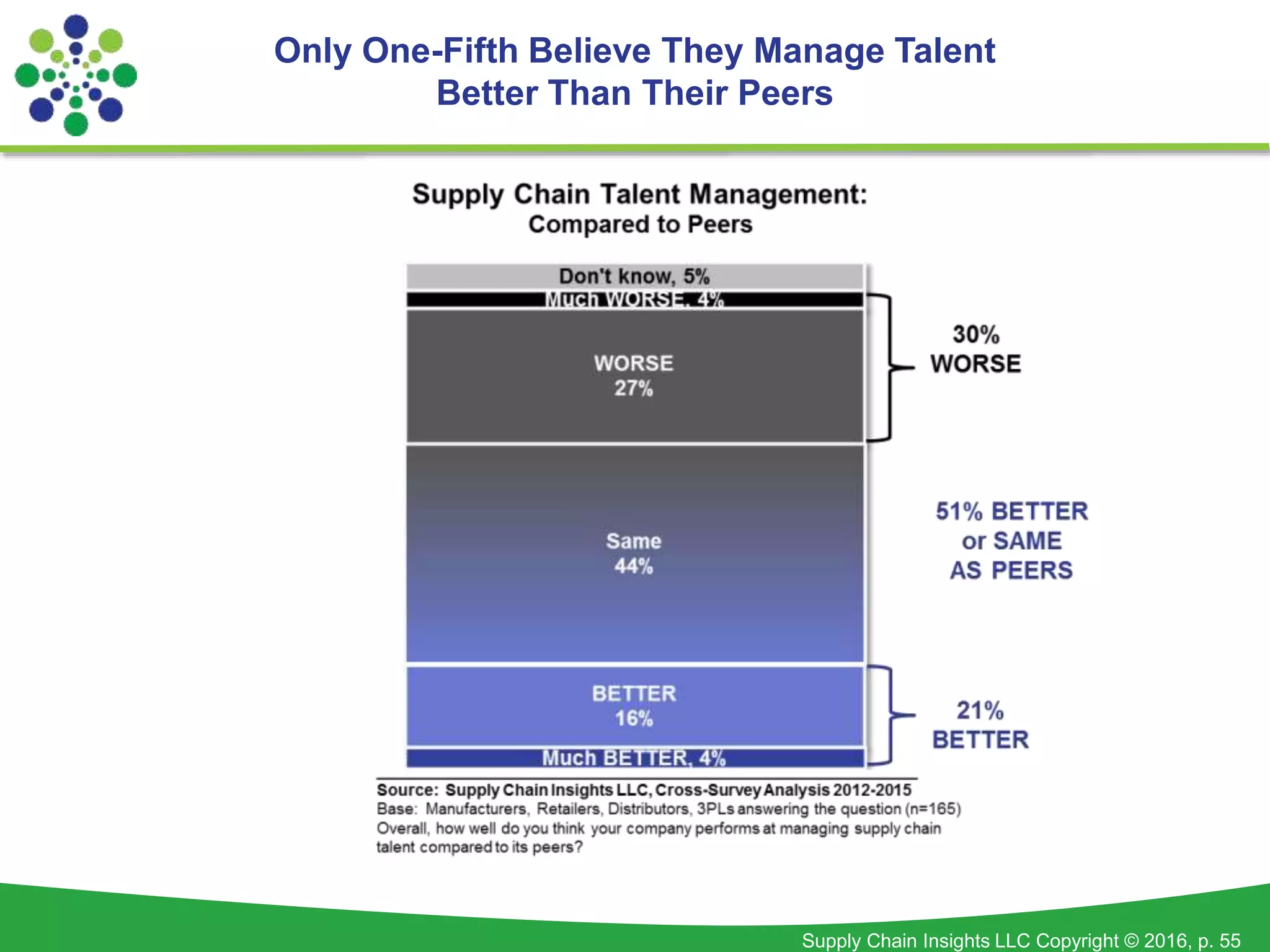

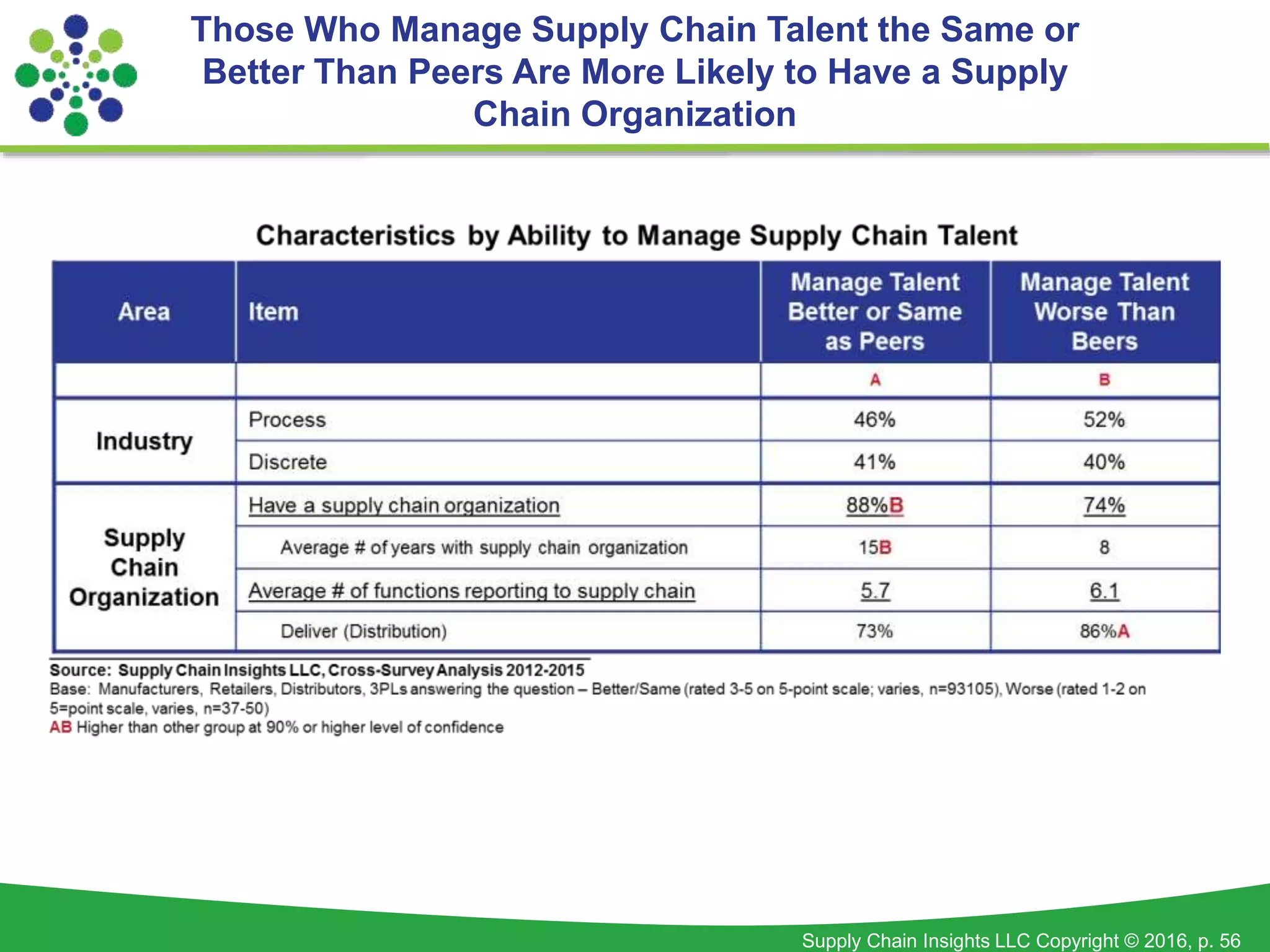

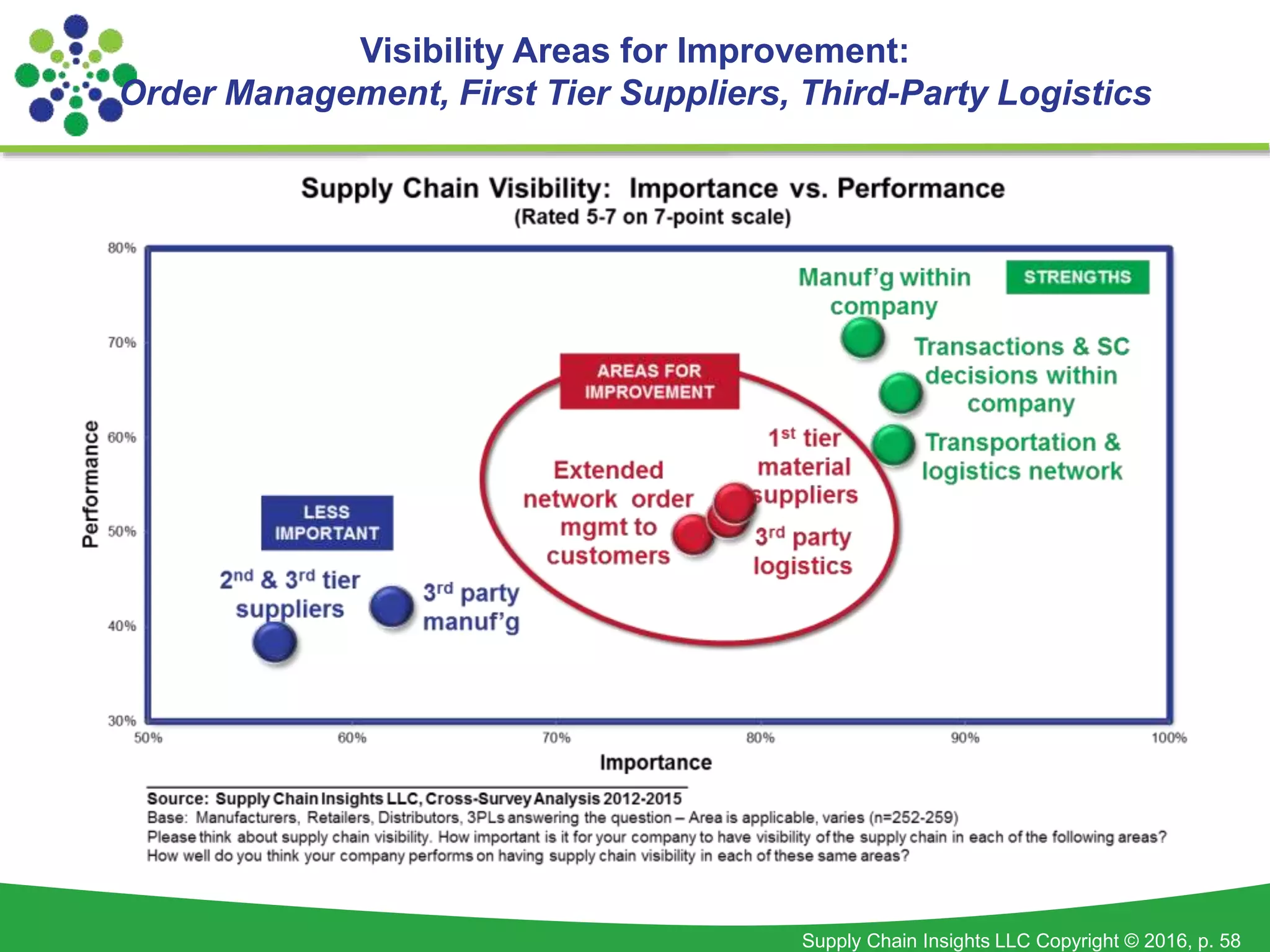

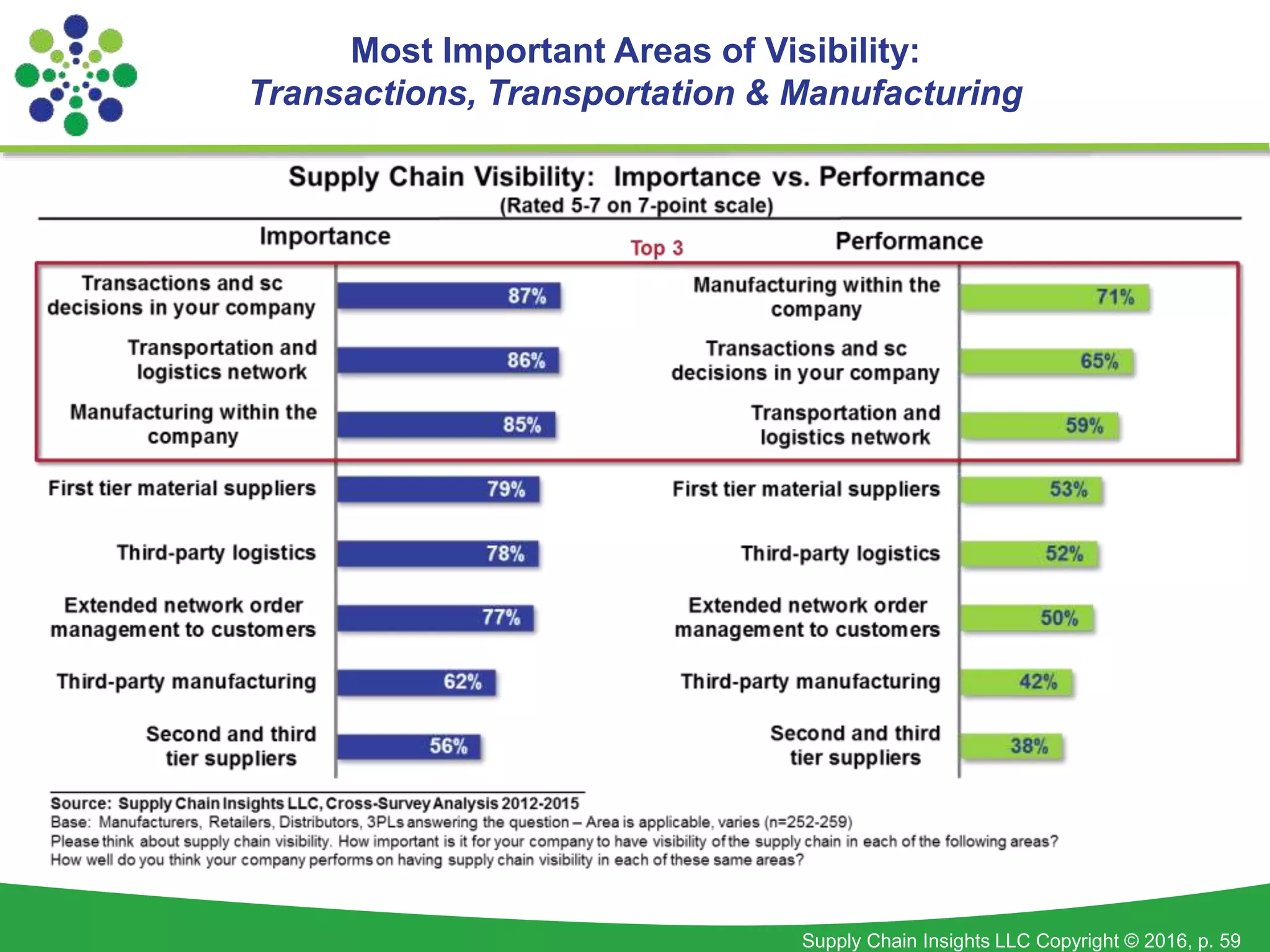

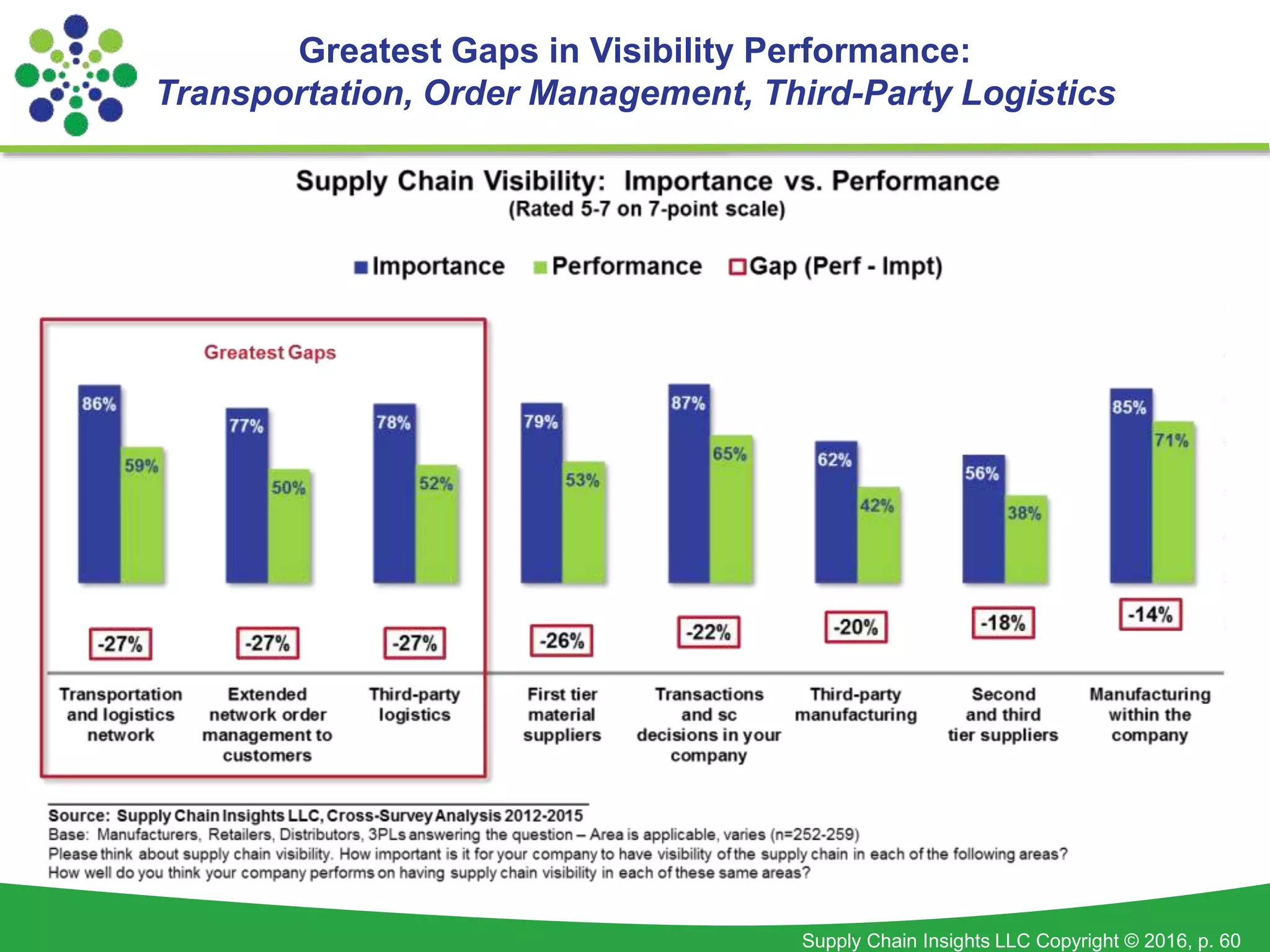

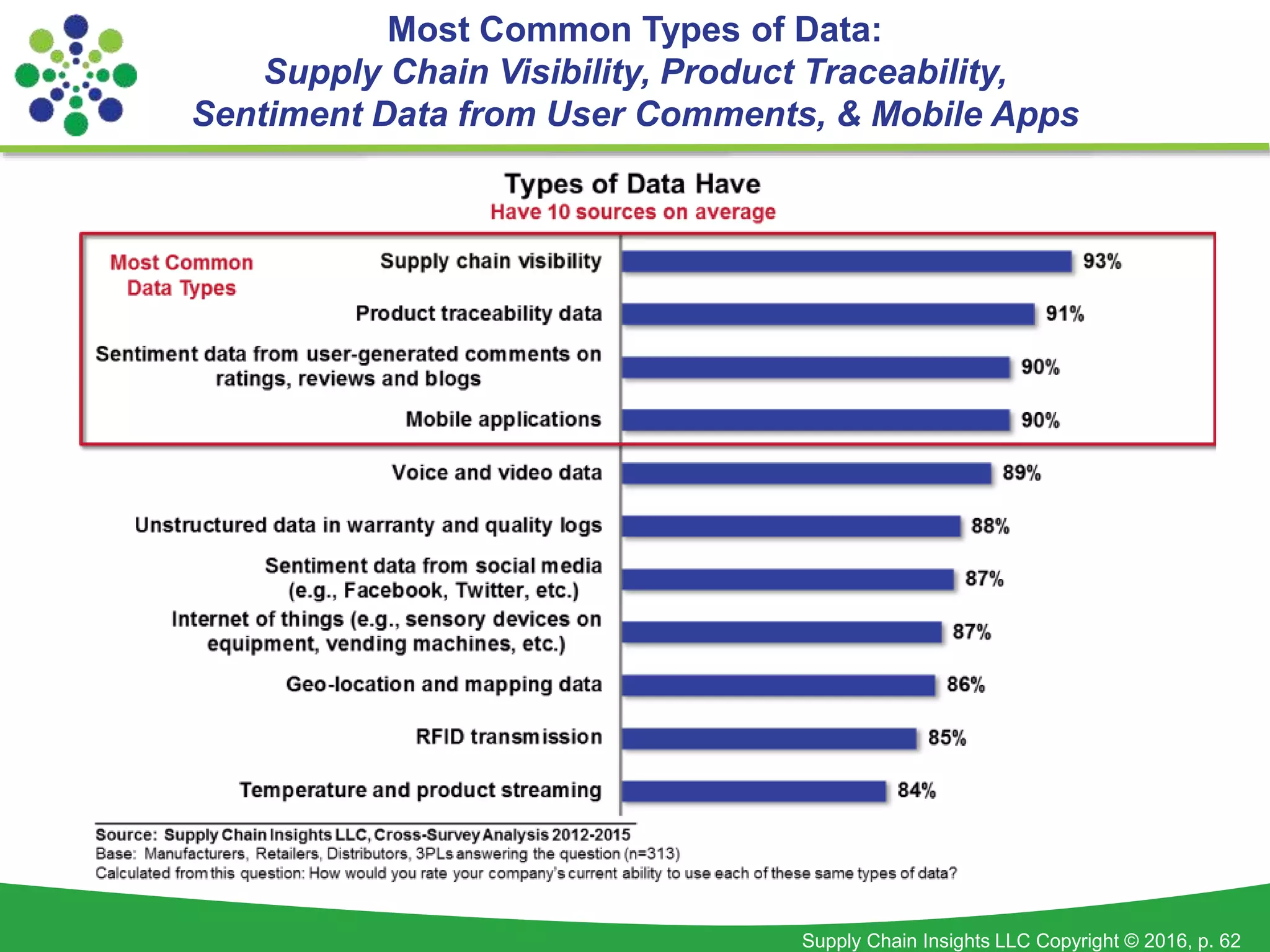

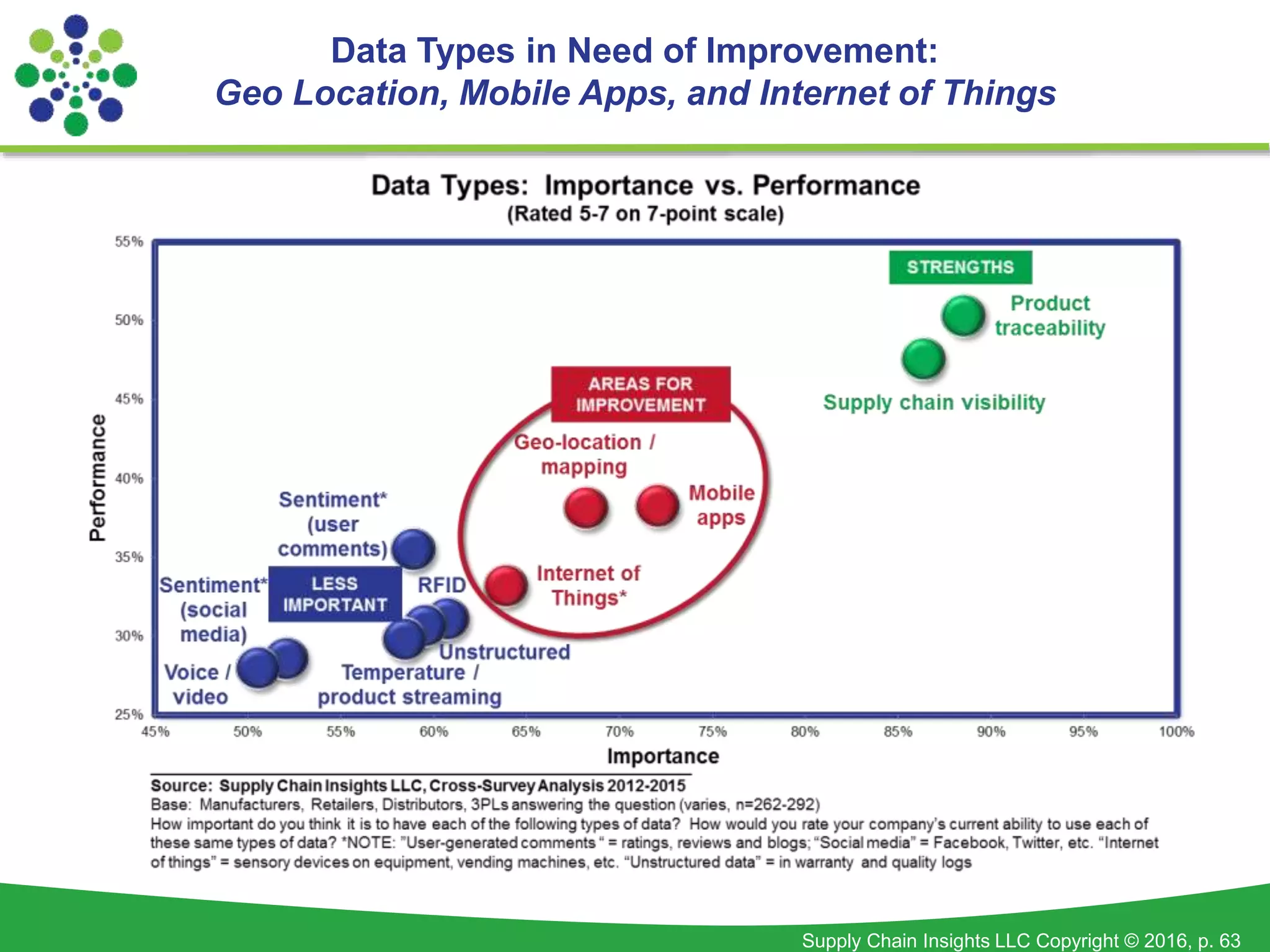

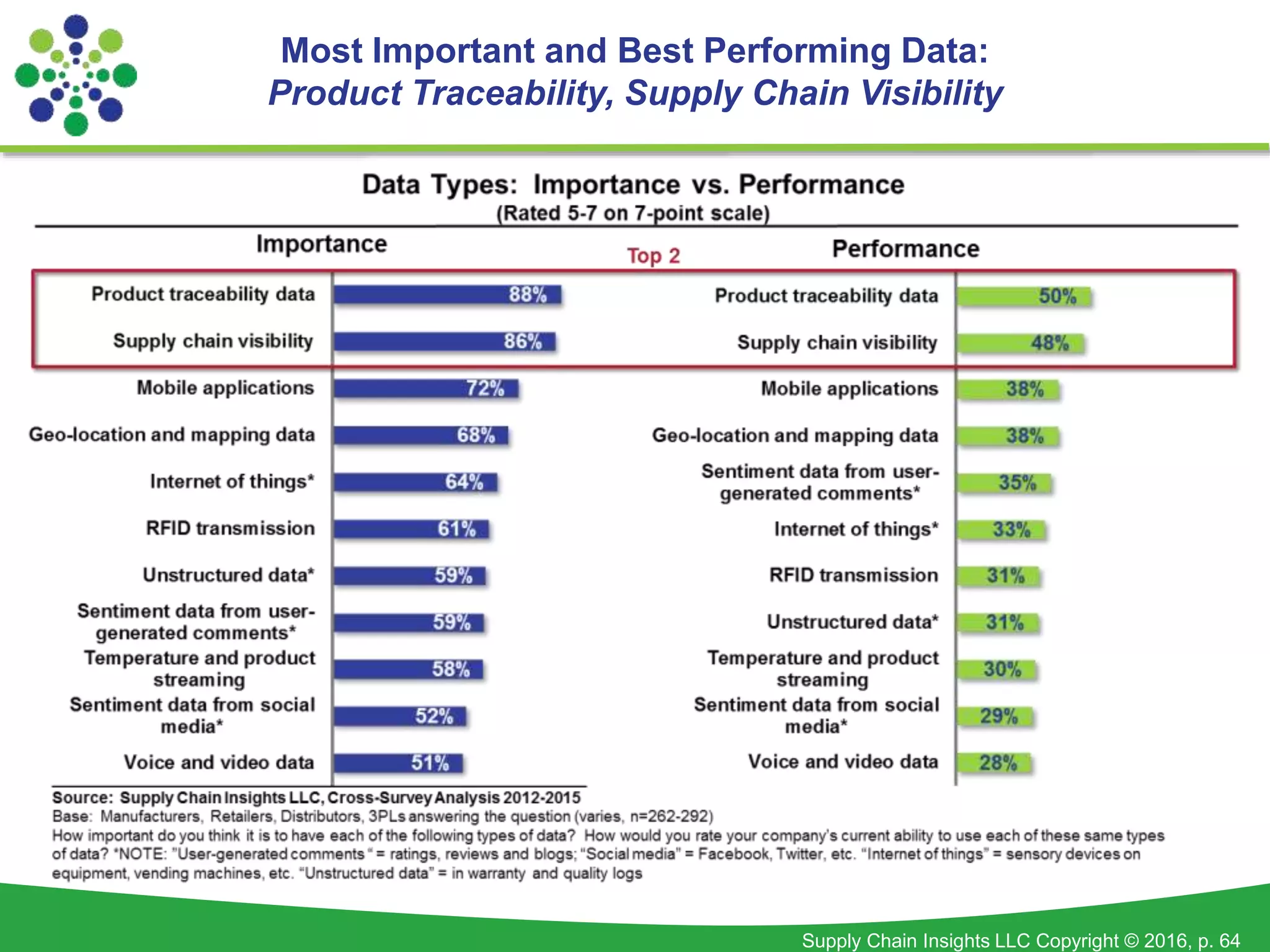

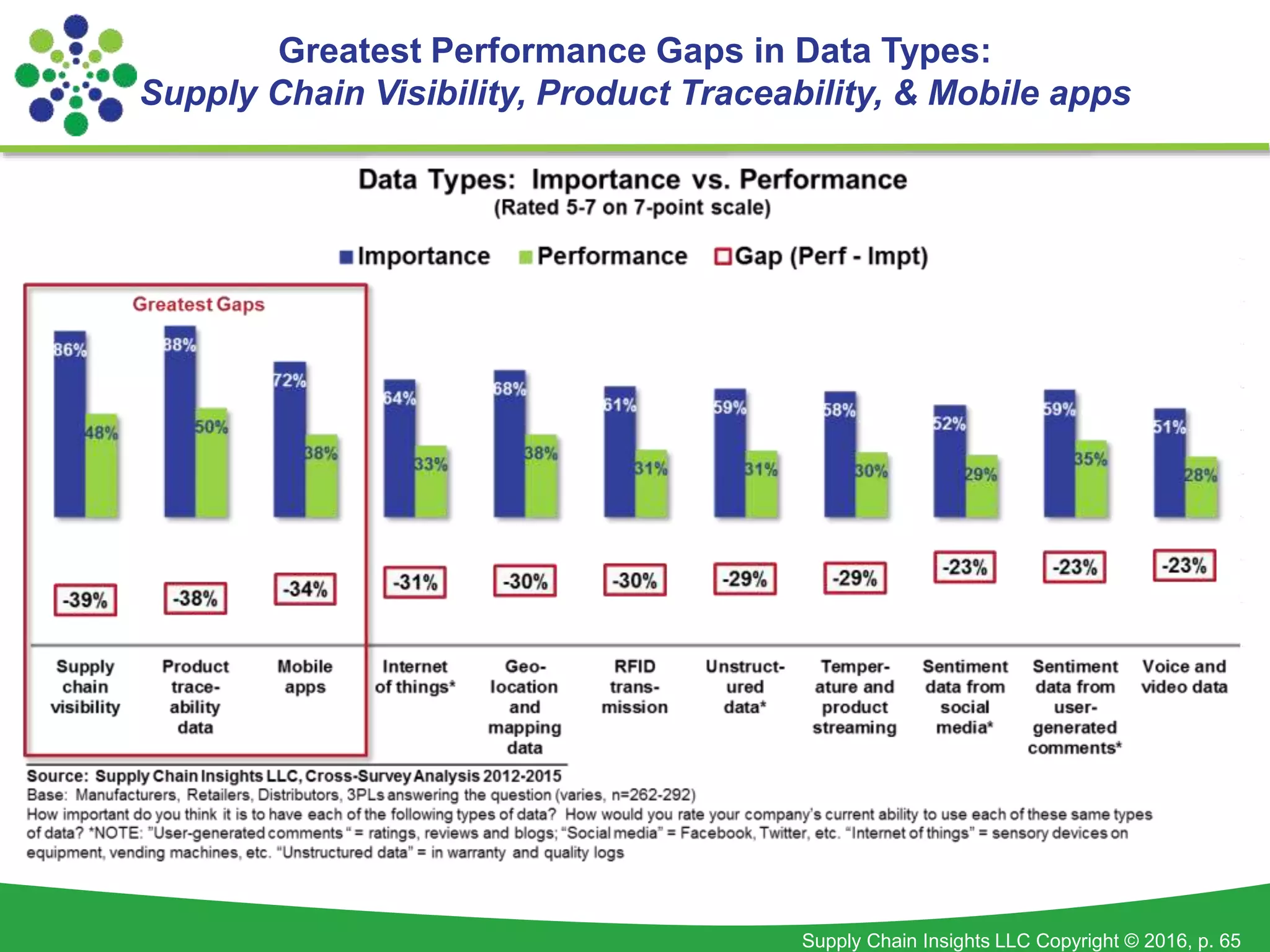

The document presents a cross-survey analysis covering supply chain organizations from 2012 to 2015, with insights from 28 surveys primarily involving manufacturers averaging nearly $5 billion in revenue. It highlights the importance of supply chain organization and alignment, particularly in process industries, and emphasizes challenges in visibility, data management, and overall supply chain performance. Additionally, findings indicate a need for improvement in strategic and proactive supply chain capabilities, as well as the effectiveness of centers of excellence and sales & operations planning processes.